Table of Contents

CBSE Sample Papers for Class 12 Economics Foreign-2011

Time allowed : 3 hours Maximum marks 100

GENERAL INSTRUCTIONS

- All questions in both the sections are compulsory.

- Marks for questions are indicated against each.

- Questions No. 1-5 and 17-21 are very short-answer questions carrying 1 nick each. They are required to be answered in one sentence each.

- Questions No. 6-10 and 22-26 are? short-answer questions carrying 3 marks each. Answers to them should normally not exceed 60 words each.

- Questions No. 11-13 and 27-29 are also short-answer questions carrying 4 marks each. Answers to them should normally not exceed 70 words each.

- Questions No. 14-16 and 30-32 are long-answers questions carrying 6 marks each. Answers to them should normally not exceed 100 words each.

- Answers should be brief and to the point and the above word limit should be adhered to as far as possible.

SET I

SECTION A

Question.1. Define microeconomics.

Answer. Microeconomics may be defined as the study of individual decision making units of an economy such,as consumers, firms, etc.’ ” ,

Question.2. What is market equilibrium?

Answer. Market equilibrium refers to the situation where price of a commodity is fixed at a point when quantities demanded and supplied are equal.

Question.3. Define market demand.

Answer. The total demand of a commodity of all consumers at a price during a period of time is market demand.

Question.4. Give meaning of “Change in quantity supplied”.

Answer. The change that takes place in supply of a commodity due to change in the price only is called change in quantity supplied. :

Question.5. Define ‘Revenue’.

Answer. The money obtained by a firm from the sale of its products is called revenue.

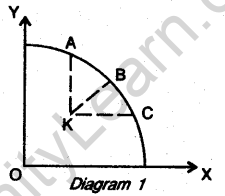

Question.6. Explain how a production possibility curve is affected when resources are inefficiently employed in an economy.

Answer. If resources are inefficiently employed, in that case the bundle of two goods which can be produced with the full use of resources will not be possible. In a way, inefficient use of resources is similar to a situation when resources are not fully utilized or are underemployed with the result as shown in Diagram 1. The bundles of two goods produced inside the production area (such as K) signifies that either we have less of one commodity or less of both the commodities.

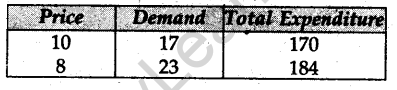

Question.7. A consumer buys 17 units of a good at a price of Rs 10 per unit When price falls to Rs 8 per unit the consumer buys 23 units. Using the expenditure approach, what will you say about price elasticity of demand of the good?

Answer.

If a fall in the price leads to an increase in total expenditure, or when price and total expenditure move in opposite directions, the elasticity of demand is more than 1, i.e. \({ E }_{ d }>1\).

Question.8. Giving examples, distinguish between fixed cost and variable cost.

Answer. Fixed cost It is that cost which does not change when level of output changes, such as rent of the building. Fixed cost remains fixed whether we produce or do not produce at all. Variable cost These are the costs which vary directly with the change in the level of output. The cost incurred on variable factors /inputs is variable cost such as cost of raw material. Variable cost is zero at zero level of production and changes when level of output changes.

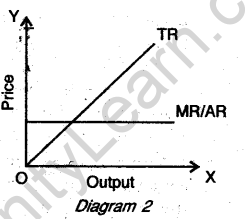

Question.9. Draw Total Revenue Curve and Marginal Revenue Curve of a firm which is free to sell any quantity of the good at a given price. Explain.

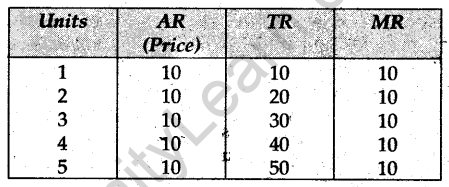

Answer. Under perfect competition a firm is free to sell any quantity of its product at a given price which is fixed by the supply and demand of the whole industry. As such AR (price) remains the same all through and because of that AR and MR are equal. Since MR is constant, TR increases at a constant rate.

This is dear from Diagram 2.

For Blind Candidates only, in lieu of Q. No. 9. Explain the relation between Total Revenue and Marginal Revenue of a firm which is free to sell any quantity it likes at a given price.

Answer. This is a case of perfect competition. Under this market it is a given condition that on the prevailing market price a firm can sell as such as it wants. By implication this means AR (Price) remains constant throughout. As such, AR and MR will be equal and TR will increase at a constant rate. This becomes evident Jacking at the table given below.

Question.10. Explain the implications of the feature ‘freedom of entry and exit to firms’ under perfect competition.

Answer. An important feature of perfect competition is ‘freedom of entry and exit to firms’. This implies that the firms are free to enter the competition as well as leave the competition. As a consequence of that, firms earn only normal profit (AR = AC) in the long-run. If firms are earning abnormal profit (AR > AC), new firms enter the competition with the result output of the industry increases and this reduces the extra profit, Chi the. other hand, if firms are having losses, few firms leave the competition, output of the industry falls, market price increases and losses are eliminated.

Or

Explain the implications of the feature large number of sellers’ under perfect competition.

Answer. Under perfect competition, the number of sellers is very large. It is so large that sellers in individual capacity cannot influence the market prices. They have to accept the price which is fixed by the supply and demand of the whole industry. Therefore each seller (or firm) is a price taker contributing an insignificant proportion of the total industry output.

Question.11. Derive the inverse relation between price of a good and its demand from the single commodity equilibrium condition: ‘Marginal utility = Price’.

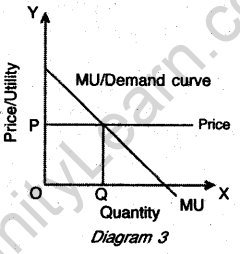

Answer. The price and quantity demanded of a good are usually inversely related. This means when price is more, demand is less and vice-versa. This inverse relationship between price and demand can be exhibited using single commodity equilibrium condition.

Marginal Utility (MU) = Price

The law . of diminishing marginal utility states that if we successively go on consuming more units of the same commodity, the utility which we derive from such successive units (i.e., its MU) declines. Knowing this, one will have (or demand) more of a good when its price is less and vice-versa, because now, he is having units yielding less satisfaction. The reverse of it will be true in opposite direction. Thus given the law of diminishing marginal utility, we have downward sloping MU curve and given the equilibrium condition, MU = Price, for a single commodity. The demand curve of the commodity coincides with the MU curve (in the positive quadrant only). As shown in Diagram 3, the equilibrium quantity will be OQ because at this level MU and price of the commodity are equal.

Question.12. Explain how a fall in prices of the related goods affects the demand for the given good.Give example.

Answer. Related goods are of two types—(i) Substitute goods and (ii) Complementary goods. Substitute goods are those which can be used in place of one another, such as tea and coffee. Complementary goods are those which cannot be used without one another, such as pen and ink.

When price of substitute good (say, coffee) falls, it becomes cheaper in comparison to tea and hence its demand increases and the demand for tea falls. Thus, decline in the price of substitute good leads to decline in the, demand of related good, i.e. tea.

When price of complementary good (say, ink) falls, its demand increases and this will lead to an increase in the demand for pen. The fall in the price of complementary good leads to an increase in the demand for its related good.

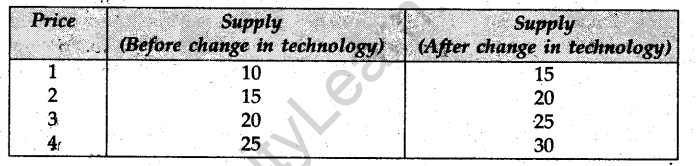

Question.13. What is a supply schedule? Explain how does change in technology of producing a good affect the supply of that good.

Answer. Supply schedule is a two column table which shows quantities supplied corresponding to prevailing prices. When technology of producing a good changes (improves), supply increases implying that more quantity can be supplied at the given price. This becomes clear looking at the supply schedule given below.

Or

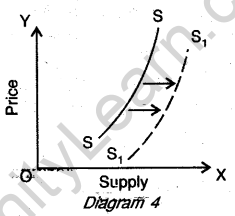

Define supply curve. How does fall in price of an input affect the supply of the good using that input?

Answer. Supply curve graphically represents the supply schedule. Since price and supply change in the same direction, therefore, supply curve rises upwards to the right. In Diagram 4, SS is supply curve. When the price of an input falls, it leads to reduction in cost as a result of which more quantity can be supplied at the same price. In such a case a shift towards right takes place in supply curve as shown in the diagram 4.

Question.14. Giving reason, explain the behaviour of total product under the Law of Variable Proportions. Use diagram.

Answer. See Q.15, 2008 (I Delhi).

For Blind Candidates only, in lieu of Q. No. 14.

Giving reason, explain the behaviour of total product under the’ law of variable proportions. Use a schedule.

Answer. See Q.15, 2008 (I Delhi).

Question.15. Explain the conditions of consumer’s equilibrium with the help of The indifference curve analysis.

Answer. See Q.14, 2010 (I Delhi).

Question.16. Market for a good is in equilibrium. There is an ‘increase’ in the demand for this good. Explain the chain of effects of this change. Use diagram.

Answer. See Q. 16, 2011 (I Delhi).

Or

Distinguish between ‘cooperative’ and ‘non-cooperative’ oligopoly. Explain the following features of oligopoly:

(i) Barriers to the entry of firms

(ii) Non-price competition

Answer. Cooperative oligopoly is one in which the firms cooperate with each other in deciding on output and price. On the other hand, non-cooperative oligopoly is one in which the firms compete with each other. Cartel is an example of cooperative oligopoly. In India, most of the oligopolistic firms are the examples of non-cooperative oligopoly, such as Hindustan Lever, Bajaj Electricals, etc.

(i) Barriers to the entry of firms: In Oligopoly, there are a few firms and they are dominant because of which new firms do not think of entering The market. For them it is very difficult to compete with^he existing firms which are dominant in nature.

(ii) Non-price competition: In oligopoly, firms try to avoid price competition for the fear of price war. Firms are free to pursue their price policy independently but because of the fear of retaliation they do not change the price. They adopt, other methods to promote their sales, such as, better services to their customers.

For Blind Candidates only, in lieu of Q. No. 16 Market for a good is in equilibrium. Supply of the good decreases. Explain the chain of effects of this change. Use numerical example.

Answer. When the market of a good is in equilibrium, quantity demanded and Quantity supplied will be equal. However, when supply decreases, demand remaining unchanged, equilibrium price will increase and quantity will decrease. This becomes clear by looking at the following table. According to the table, initially, the equilibrium price is Rs 7 and equilibrium quantity is 35. When supply decreases, equilibrium price increases to Rs 8 and equilibrium quantity decreases to 30 units. Thus, when supply decreases, demand remaining unchanged, price increases and quantity falls.

SECTION B

Question.17. Define ‘capital goods’.

Answer. Capital Goods are those final goods which form the capital stock of a country at the end of an accounting year and are used into the production process.

Question.18. Define ‘real’ gross-domestic product.

Answer. Real GDP is the, gross money value at constant prices of the final goods and services .

produced within the domestic territory of country in an accounting year.

Question.19. Define Legal-Reserve Ratio.

Answer. Legal Reserve Ratio is the percentage of the total deposits which the commercial banks are legally required to keep in reserve with the central bank of the country. LRR has two components:

Cash Reserve Ratio: It refers to the minimum amount of funds that a commercial bank has to maintain with the central bank in the form of deposits.

Statutory Liquidity Ratio: It is concerned with the reserve of assets with the central bank.

Question.20. What are demand deposits?

Answer. These are the deposits which depositors can withdraw from the bank whenever they demand. These deposits are as good as cash.

Question.21. What is balance of payments?

Answer. Balance of payments of a country is a systematic record of its receipts and payments in international transactions in a given year.

Question.22. What are the components of the current account of the balance of payments account?

Answer. The components of current account of balance of payments account are:

- Export and import of goods.

- Export and import of services.

- Unilateral receipts and payments.

Question.23. Explain how ‘externalities’ are a limitation on taking gross domestic product as an index of welfare.

Answer. Externalities refer to the benefits (or harms) a firm or an individual causes to another for which they are not paid (penalised). Externalities do not.have any market wherein they can be bought arid sold- Externalities having positive effects are positive externalities and externalities having negative effects are negative externalities.

Positive externalities occur when a beautiful garden maintained by Mr. X raises welfare of Mr. Y even when Mr. Y is not paying for it. There is no valuation of it in the estimation of GDP. Negative externalities occur when smoke emitted by factories causes air pollution, or the industrial waste is driven into rivers causing water pollution.

Environmental pollution causes a loss of social welfare. But nobody is penalised for it and there is no valuation of it in the estimation of GDP.

Impact of externalities (positive or negative) not accounted in the index of social welfare in terms of GDP. To that extent, GDP as an index of welfare is not a price index, it either underestimates or overestimates the level of welfare.

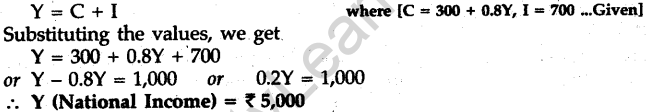

Question.24. An economy is in equilibrium. Its consumption function is C = 300 + 0.8 Y where C is consumption expenditure and Y is income and investment is Rs 700. Find National Income.

Answer.

Question.25. Explain with the help of examples, the distinction between direct tax and indirect tax.

Answer. Direct taxes are those taxes whose real burden is borne by those upon whom these are levied. Income-tax is a direct tax. Its burden cannot be shifted.

On the other hand, indirect taxes are those whose real burden is riot fm in real frame by those upon whom these are levied. Excise duty and sales tax are the examples of indirect taxes. These taxes are levied upon traders and manufacturers but their burden is passed oh to the users of these goods, who ultimately use the goods which are taxed.

Question.26. When price of a foreign currency rises its supply also rises. Explain, why.

Answer. When price of a foreign currency rises, this means for obtaining a given amount of foreign currency (say, one dollar) more domestic currency (say, Indian rupee) will have to be paid.

In that case the demand for foreign goods will fall for now because they are costlier. In such a situation the supply of foreign currency will increase. Since foreign goods are not economically viable, so the supply of foreign currency will increase.

Or

When price of a foreign currency falls, its demand rises. Explain, why.

Answer. See Q. 23, 2008 (I Outside Delhi).

Question.27. Explain the ‘economic stability’ objective of a government budget.

Answer. Government can bring in economic stability, i.e., It can control fluctuation in general price level, through taxes, subsidies and expenditure. Inflation and deflation both are not good front economic point of view. Therefore, whenever a country suffers from inflation or deflation, besides other corrective measures, appropriate budgetary steps are taken to remedy the situation.

When there is inflation, government .can reduce its own expenditure. When there is deflation, government can reduce taxes and give subsidies to encourage spending by the people.

Or

Explain the ‘allocation of resources’ objective of a government budget.

Answer. Allocation of resources. Government has to provide for public goods. Public goods such as national defence, government administration etc. are different from private goods. These goods cannot be provided through market mechanism but are essential for consumers arid, therefore, government has to provide diem. Because of that government has to allocate resources between private goods and public goods.

Private goods are limited to some individuals but public goods are available to all. Secondly, private goods are available to those only who can buy them but this is riot the case with regard to public goods. These are available to those also who can not afford them financially.

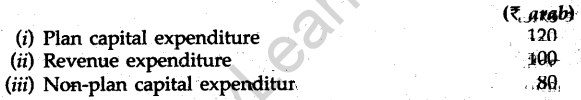

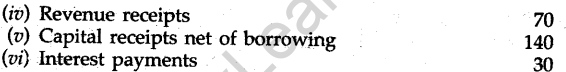

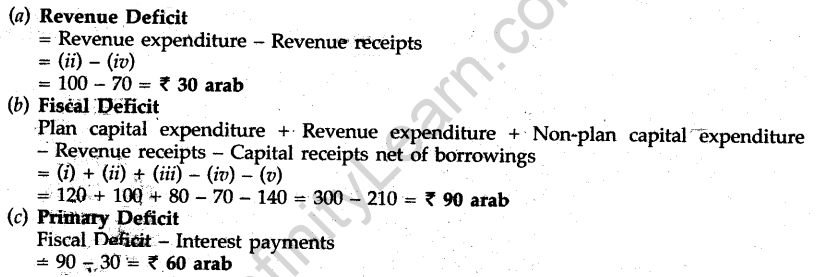

Question.28. From the following data about a government budget, find out (a) revenue deficit, (b) fiscal deficit and (c) primary deficit.

Answer.

Question.29. Giving reasons, explain the treatment assigned to the following while estimating National Income

(i) Payment ‘of income tax by a firm.

(ii) Festival gift to employees.

Answer. (i) Payment of income tax by a firm is already included in corporate tax and hence is not separately included in the National Income.

(ii) Festival gifts to employees become a part of compensation of employees which is included in National Income.

Question.30. Explain the role of the following in correcting deficient demand in an economy:

(i) Government expenditure (ii) Legal reserve

Answer. (i) Government expenditure. Deficient demand refers to a situation when at the equilibrium level aggregate demand is less than aggregate supply at the full employment level of an economy creating the problem of involuntary unemployment. For increasing the level of aggregate demand government expenditure should be increased. This wiJJ reduce or eliminate deflationary gap.

(ii) Legal reserve. Legal reserve ratio should be reduced. This will improve the liquidity position of commercial banks enabling them to create more credit. The availability of more credit in the economy will generate more aggregate demand and thereby correct the deflationary gap or the deficient- demand situation.

Or

Explain the role of the following in correcting the inflationary gap in an economy:

(i) Open market operations (ii) Government expenditure

Answer. Excess of aggregate demand over aggregate supply at the full employment level is inflationary gap. In this situation, level of employment cannot be increased and hence prices increase. Therefore, level of aggregate demand needs to be reduced.

(i) See Q.30 (Or) (ii), 2011 (I Delhi)

(ii) Government expenditure. Government should cut down its expenditure on public works such as roads, buildings, rural electrification etc. thereby reducing the money income of the people and their demand for goods and services, so that inflationary gap may be reduced or eliminated.

Question.31. How do commercial banks create credit?

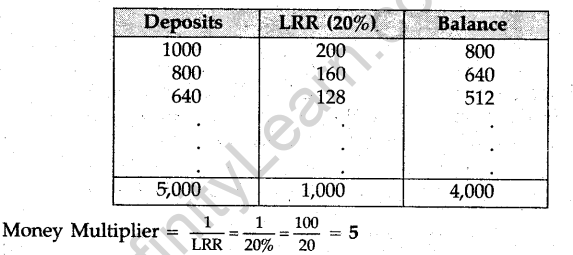

Answer. Commercial banks accept deposits from the general public known as primary deposits and keeping a percentage of these deposits in reserve (known as Legal Reserve Ratio), advance the balance of the deposits to other customers. While advancing them loans banks deposit the amount in their accounts and again keeping a percentage of the deposits (Legal Reserve Ratio), further advance the balance amount to others. This process continues and is known as credit creation by banks. In this way banks create credit many times more than the primary deposits. The phenomenon of credit creation can be explained by taking a hypothetical example, where primary deposit is Rs 1000 and legal reserve ratio (LRR) is 20%. Say, Mr A deposits Rs 1000. Keeping Rs 200 (20%) in reserve, the balance of Rs 800 is advanced as loan to B. Keeping Rs 160 (20% of Rs 800) in reserve, the balance of Rs 640 is advanced as loan to C. This process continues and finally total deposits created are Rs 5,000, i.e. 5 times more. So money multiplier is 5. This process becomes clear, looking at the schedule given below:

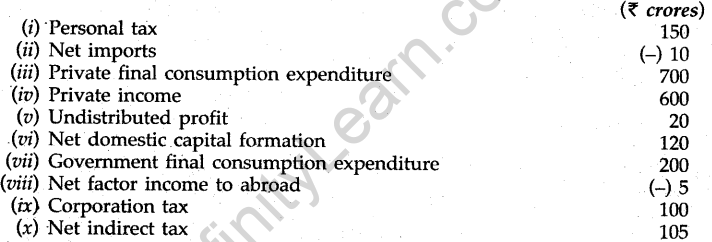

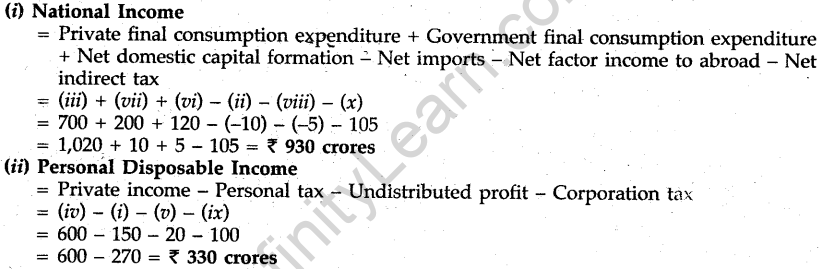

Question.32. Calculate National Income and Personal Disposable Income from the following:

Answer.

SET II

Note : Except for the following questions, all the remaining questions have been asked in .Set I.

SECTION A

Question.1. What is a market economy?

Answer. A market economy is one in which central problems are solved through the free forces of demand and supply.

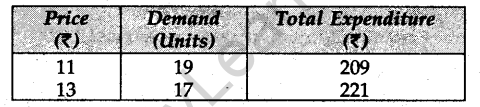

Question.7. A consumer buys 19 units of a good at a price of Rs 11 per unit. When price rises to Rs 13 per unit the consumer buys 17 units. Using the expenditure approach, what will you say about price elasticity of demand of a good?

Answer.

According to expenditure method, when price and total expenditure move in the same direction, elasticity of demand is less than unity, i.e., \({ E }_{ d }>1\). Here, price and total expenditure both are increasing, therefore elasticity of demand is less than unity.

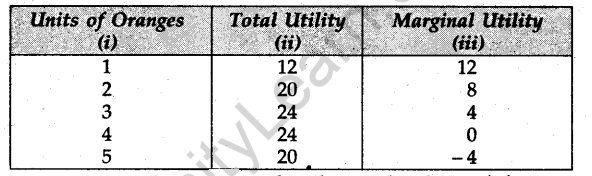

Question.11. Explain the relation between total utility and marginal utility.

Answer. Marginal utility (MU) is the utility derived by consuming an additional unit of a commodity. According to law of diminishing marginal utility, MU declines when we consume successive units of a commodity. In the beginning MC declines but is positive, later on it becomes zero, and finally it becomes negative.

There is a definite relationship between total utility and marginal utility which can be studied with the help of the following table:

In the table, column (ii) indicates total utility and column (iii) marginal utility. The relationship between TU and MU, which emerges after analyzing the table, is the following:

(i) In the beginning as a consumer consumes more and more units of oranges, its total utility increases but marginal utility declines. In other words, total utility increases at a decreasing rate.

(ii) Total utility is maximum when marginal utility is zero. In this situation a consumer gets maximum satisfaction. This is the stage where the consumer stops consuming any more units of oranges.

(iii) If the consumer consumes units of the commodity beyond this point, marginal utility becomes negative and total utility starts declining.

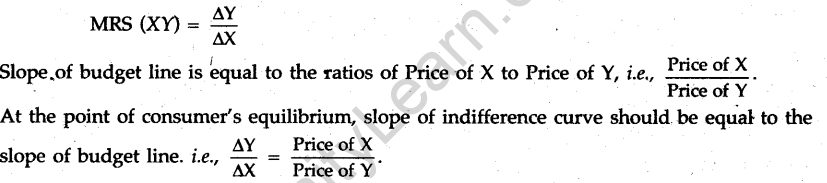

Question.15. Explain the concept of Marginal Rate of Substitution. Explain the reaction of the consumer when Marginal Rate of Substitution is higher than the ratio of prices.

Answer. Marginal rate of substitution (MRS) may be defined as the quantity of Y that a consumer is willing to substitute for an additional unit of X. MRS is always declining. MRS is the slope of indifference curve:

Any position deviating from this position, cannot be sustained economically. If MRS is higher than the ratio of price of commodities X and Y, this cannot be possible because of the given constraint of income.

SECTION B

Question.22. Distinguish between ‘balance on current account’ and ‘balance of trade’.

Answer. The current account balance of a country includes payments and receipts relating to visible trade (export and import of goods), invisibles (services) and unilateral transfers. On the other hand, balance of trade is confined only to the payments of invisibles (imports and exports of goods) only. Thus, balance of trade is a restricted term in comparison to current account balance.

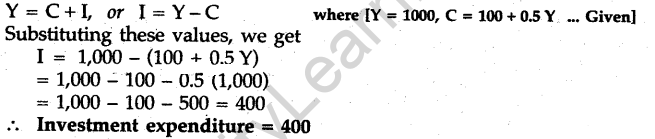

Question.24. An economy is in equilibrium. The economy’s consumption function is C = 100 + 0.5 Y where C is consumption expenditure and Y is National Income. National Income is 1,000. Find out investment expenditure in the economy.

Answer.

Question.29. Giving reasons, explain the treatment assigned to the following while estimating National Income:

(i) Subsidy on the output produced

(ii) Contribution to provident fund by the employees

Answer. (i) Subsidy on the output produced is not included as it is a unilateral (transfer payment by the government to firms).

(ii) Contribution to provident fund by the employees is not included separately because it is a part of wages and salaries.

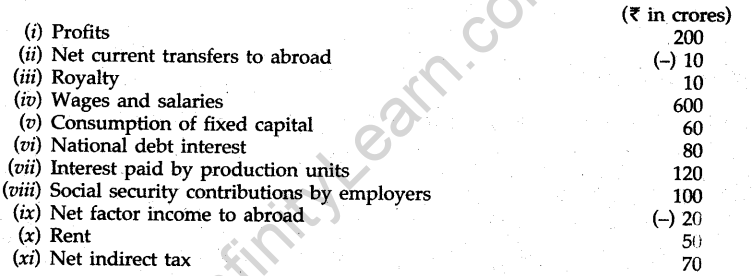

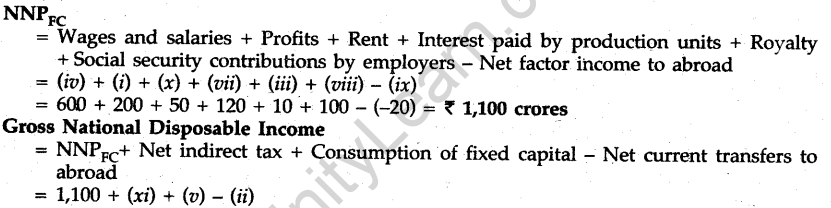

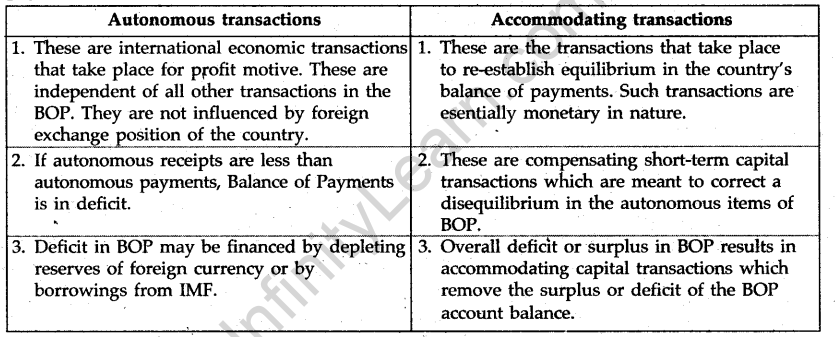

Question.32. Calculate ‘Net National Product at Factor Cost’ and ‘Gross National Disposable Income’ from the following:

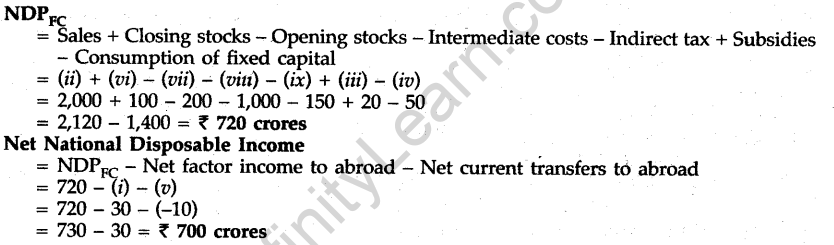

Answer.

SET III

Note: Except for the following questions, all the remaining questions have been asked in Set I and Set II.

SECTION A

Question.1. What is ‘opportunity cost’?

Answer. Opportunity cost is defined as the value of the benefit that is foregone by choosing one alternative rather than the other.

Or, Opportunity cost of using a given resource is defined as the value of the next best use to which the resource could be put.

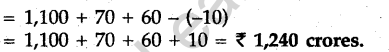

Question.7. A consumer buys 9 units of a good at a price of Rs 11 per unit. When price falls to Rs 9 per unit the consumer buys 11 units. Using the expenditure approach, what will you say about price elasticity of demand of the good?

Answer.

If total expenditure remains the same, whether price increases or decreases, elasticity of demand is is said to be equal to unity, i.e. equal to one. In the given situation, elasticity of demand is equal to one because total expenditure remains the same.

Question.11. What is ‘marginal utility’? Explain the law of diminishing marginal utility with the help of a utility schedule.

Answer. Marginal utility: It is the additional utility derived from consumption of an additional unit of a commodity.

haw of diminishing marginal utility: See Q. 11, 2011 (III Outside Delhi)

Question.15. Explain three properties of indifference curves.

Answer. See Q. 15, 2011 (I Delhi)

SECTION B

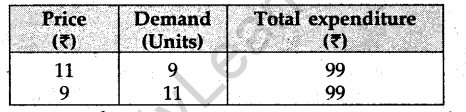

Question.22. Distinguish between autonomous and accommodating transactions in the balance! of payments.

Answer.

Question.24. An economy is in equilibrium. Its National Income is Rs 5000 and autonomous consumption expenditure is Rs 500. What is the total consumption expenditure if marginal propensity to consume is 0.7?

Answer. Consumption (C) = a (autonomous consumption) + MPC (Y)

C = a + 0.7 Y

Substituting the values:

C = 500 + 0.7 (5000) where [Y = 5,000, a = 500]

= 500 + 3500 = 4,000

Consumption expenditure = Rs 4,000

Question.29. Giving reasons, explain the treatment assigned to the following while estimating National Income:

(i) Contribution to provident fund by the employers.

(ii) Free dress provided to nurses by the hospital.

Answer. (i) Contribution to the provident find by the employers will be included. It is a part of the compensation of employees.

(ii) Free dress provided to nurses by the hospital will be included. It is also a part of the compensation of employees.

Question.32. Calculate ‘Net Domestic Product at Factor Cost’ and ‘Net National Disposable Income’:

Answer.