Table of Contents

Part A

(Accounting for Partnership Firms and Companies)

1. Z is admitted to a firm for l/4th share in the profits for which he brings in Rs 10,000 towards premium for goodwill. It will be taken by old partners in which ratio?

2. As a director of a company, you had invited applications for 60,000 equity shares of Rs 10 each at a premium of Rs 2 each. The total application money received at Rs 2 per shares was 1,44,000.

3. In a partnership firm, partners desire to charge interest on drawings. However the partnership deed does not provide for charging interest on drawings. What actions may the partners take to allow the firm to charge interest on drawings?

4. The firm of A and B earned a profit of Rs 2,75,000 during the end of the year on 31st March, 2015. They have decided to donate around 10% of this profit to an NGO working for senior citizens. Pass necessary journal entry for the distribution of profits.

5. On admission of a new partner in a firm, an accountant is of the opinion that reserves and accumulated profits should not be distributed because there is no legal requirement and also he is of the opinion that if they are not distributed, they will remain in businesses. When a partner retires or the firm is dissolved, they can be distributed. Is the accountant correct or not?

6. A company forfeited 2,000 shares of Rs 10 held by Mr. Kartik for non-payment of allotment money of Rs 4 per share. The called-up value per share was Rs 9. On forfeiture, how much will the share capital account be debited?

7. How are debentures disclosed in the balance sheet of a company?

8. Vishvesh Ltd was formed with a Rs 10,00,000 capital and 20 share capital.It invited application for 50,000 shares. The amount is payable as Rs 5 on application, Rs 7 on allotment and Rs 8 on first and final call. The whole of above issue was applied for and amount was duly received. Provide journal entries for the above transactions

9. RM and N share profits in the ratio of 3 : 2 : The profits of the last three years were Rs 14,000, Rs 8,400 and Rs 10,600 respectively. N noticed that the profits were by mistake shared equally for all the three years. She informed P and M about this and now they decided to correct the error. Give necessary journal entry for the same. Identify the value shown by N?

10. XYZ Ltd was registered with the authorised share capital of Rs 1,00,00,000 divided into 8,00,000 equity shares of Rs 10 each and 20,000, 10% preference shares of Rs 100 each. The company offered 6,00,000 equity shares for subscription to public and also 20,000, 10% preference shares. Applications were received for 5,50,000 equity shares and 20,000, 10% preference shares. The directors had called the entire nominal value of equity and Rs 80 on 10% preference shares. The money called on both the equity shares and preference shares was duly received. Show the share capital in the balance sheet of the company.

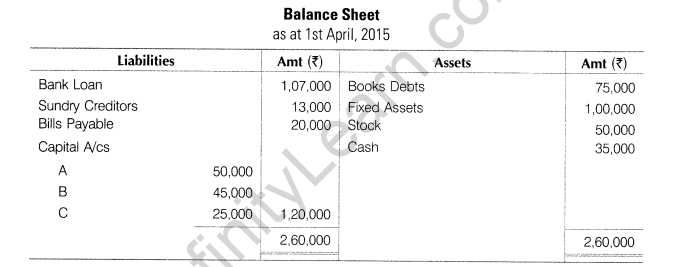

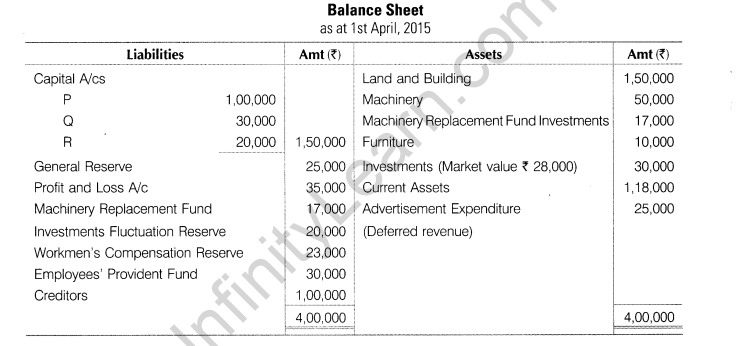

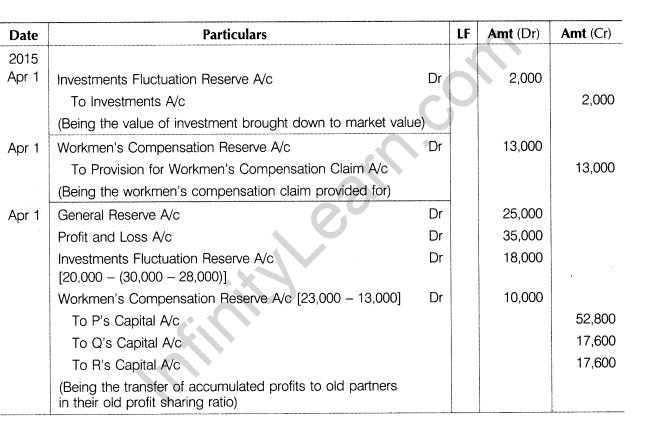

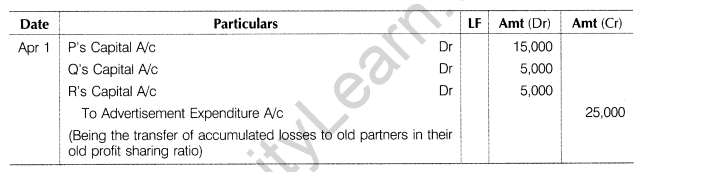

11. R, Q and R are partners in a business that shares profits and losses in a ratio of 3: 1: 1. On 1st April, 2015, their balance sheet stood as

They admitted S into partnership for l/5th share of profits on the above date. A claim on account of workmen’s compensation is estimated at Rs 13,000 only. Give the necessary journal entries to adjust the accumulated profits and losses.

12. W, X and Y were partners sharing profits and losses in the ratio of 1:2:2 as at 31st March, 2015. Mr Y died on 31st December, 2015. The firm closes its accounts on 31st March every year. Following adjustments were agreed upon:

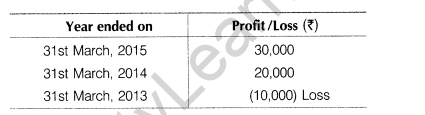

(i) Goodwill is to be calculated at the rate of two years’ purchase on the basis of average of last three years’ profit. The profits for the three years were as detailed I below

(ii) Profit for the period 1st April, 2015 onward shall be ascertained proportionately on the basis of average profits of the preceding three years.

(iii) During the year ending 31st March, 2015, a van costing Rs 40,000 was purchased on 1st April, 2014 and wrongly debited to travelling expenses account on which depreciation is to be calculated at 20% per annum. The asset is to be brought into account at depreciated value.

Pass necessary journal entries for the treatment of goodwill and Y’s share of profit at the time of his death assuming W and X share further profits and losses in the ratio of 3:2.

13. (i) Aakash and Vikash are partners sharing profits and losses in the ratio of 3:1. On 1st April, 2014, their capitals were Rs 50,000 and Rs 30,000 respectively. During the year ended 31st March, 2015, they earned a net profit of Rs 74,000. The terms of partnership are

(a) Interest on the capital is to be charged @ 6% per annum.

(b) Aakash will get commission @ 2% on turnover.

(c) Vikash will get a salary of Rs 500 per month.

(d) Vikash will get commission of 5% on profits after deduction of interest, salary and commission (including his own commission).

(e) Aakash is entitled to a rent of Rs 2,000 per month for the use of his premises by the firm. It is paid to him by cheque at the end of every month.Partners’ drawings for the year were Aakash Rs 8,000 and vikash Rs 6,000. Turnover for the year was Rs 3,00,000.

After considering the above factors, you are required to prepare the profit and loss appropriation account.

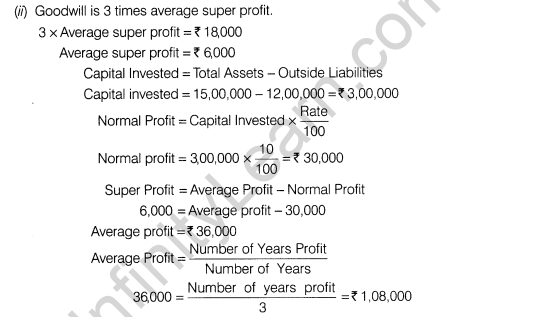

(ii) Ajit and Baljit were sharing profits in the ratio of 3:2. They decided to admit Chaman into the partnership for 1/6th share in the future profits. Goodwill, valued at 3 times the average super profits of the firm, was Rs 18,000, the firm had assets worth Rs 15 lakhs and liabilities of Rs 12 lakhs. The normal earning Capacity of such firm is expected to be 10% per annum. Find the average profits and actual profits earned by the firm during the last 3 years.

14. Arihant Ltd on 1st April, 2012 acquired assets of the value of Rs 12,00,000 and liabilities worth Rs 1,40,000 from Sultan Ltd at an agreed value of Rs 11,00,000. Arihant Ltd issued 12% debentures of Rs 100 each at a premium of 10% in full satisfaction of purchase consideration. The debentures were redeemable 3 years later at a premium of 5%. Pass entries to record the above, including redemption of debentures.

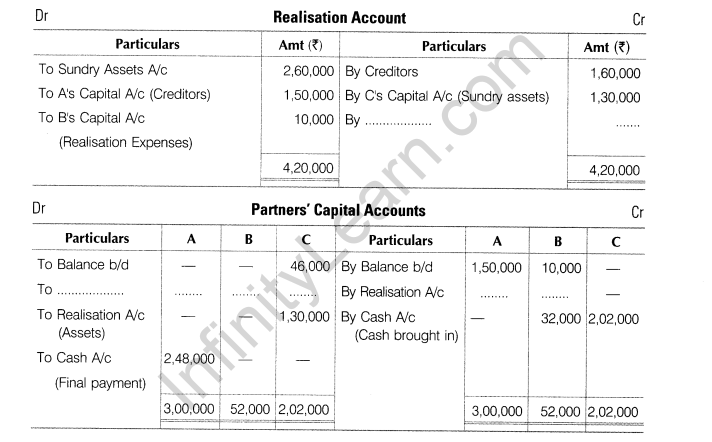

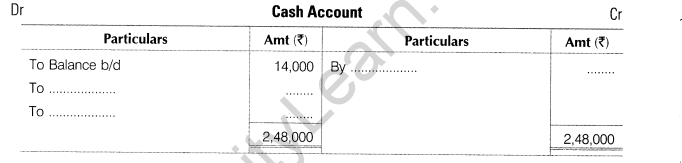

15.A, B and C were partners in a firm sharing profits in the ratio of 2 : 2: 1. On 28th February, 2015, their firm was dissolved.From the following information complete realization account, partners’ capital account and cash account.

16. Radha Ltd issued for public subscription 40,000 equity shares of Rs 10 each at a premium of Rs 2 per share payable as under

On application Rs 4 per share; on allotment Rs 5 per share (including premium) and on call Rs 3 per share.

Applications were received for 60,000 shares. Allotment was made, pro-rata to the applications for 48,000 shares, the remaining being rejected. Money overpaid on applications was applied towards sum due on allotment.

C, to whom 1,600 shares were allotted , failed to pay the allotment money and J, to whom 2,000 shares were allotted, failed to pay the call money. These shares were subsequently forfeited. Record journal entries in the books of the company. Identify the value being violated by the company and the shareholder.

or

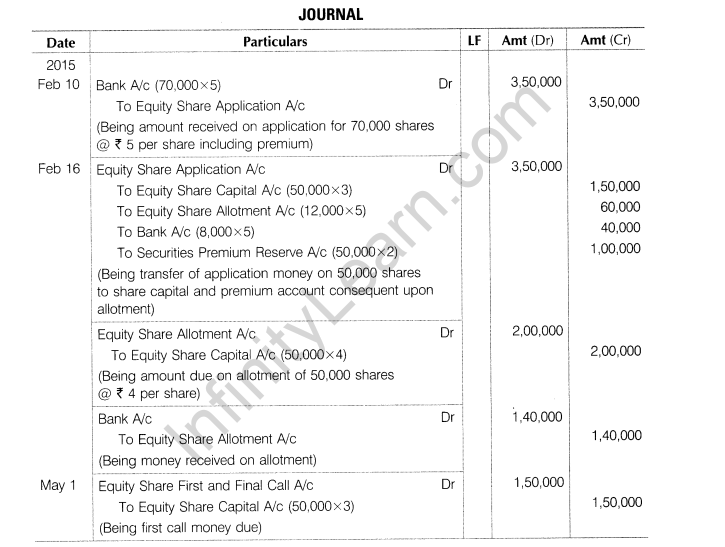

On 1st January, 2015, the director of Geeta Ltd issued for public subscription 50,000 equity shares of Rs 10 each at Rs 12 per share payable as to Rs 5 on application (including premium), Rs 4 on allotment and balance on call in on Ist , May, 2015.

The lists were closed on 10th February, 2015. By that date, applications for 70,000 were received. Out of the cash received, Rs 40,000 was returned and Rs 60,000 was applied to wards the amount due on allotment, the balance of which was paid on 16th February, 2015.

All the shareholders paid the call due on 1st May, 2015 with the exception of an allotted of 500 shares.

These shares were forfeited on 29th September, 2015 and reissued as fully paid at Rs 8 per share on 1st November, 2015.

The company, as a matter of policy, does not maintain a calls-in-arrears account. Give journal entries to record these share capital transactions in the books of Geeta Ltd.

Identify the value being violated by the company and the shareholder

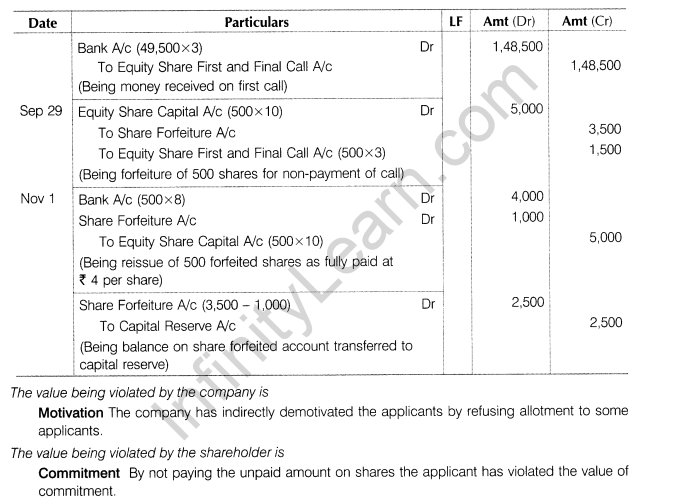

17.A and B are partners with 3 : 2 ratio. Their balance is given below

Adjustments

(i) C comes as a new partner.

(ii) New profit sharing ratio is 5 : 3 : 2.

(iii) C brings capital Rs 80,000 and premium Rs 20,000 out of his share of Rs 30,000.

(iv) Make 10% provision for doubtful debts on debtors.

(v) Patents are valueless.

(vi) Worker compensation liabilities fixed at Rs 20,000.

(vii) Building undervalued by Rs 40,000.

(viii) Machine overvalued by Rs 10,000.

Prepare necessary accounts and balance sheet of the newly constituted firm.

or

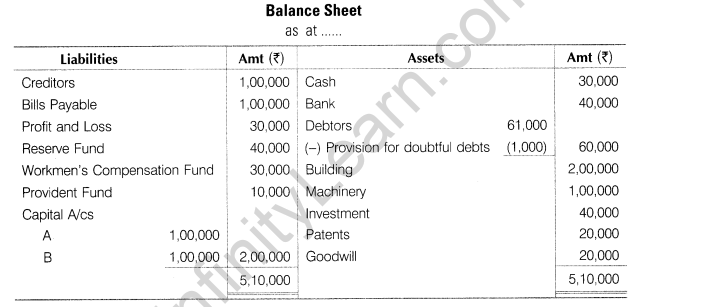

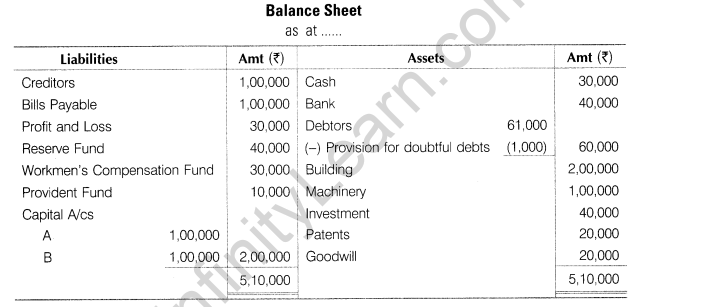

A, B and C were partners sharing profits and losses in the ratio of 5 : 3 : 2. Their balance sheet was as follows

C retired on the same date and the following adjustments were made

(i) Fixed assets were overvalued by 20%.

(ii) Make provision for outstanding expenses Rs 10,000.

(iii) Goodwill was valued at Rs 50,000.

C was to be paid immediately by cash brought in by A and B so as to make their capital in new profit sharing ratio which was 3:2. Goodwill was not be raised in the books. Prepare revaluation account, partners’ capital account and the balance sheet of the firm.

Part B

(Financial Statements Analysis)

18. Depreciation charged by a company will result into inflow, outflow or no flow of cash. Give reason.

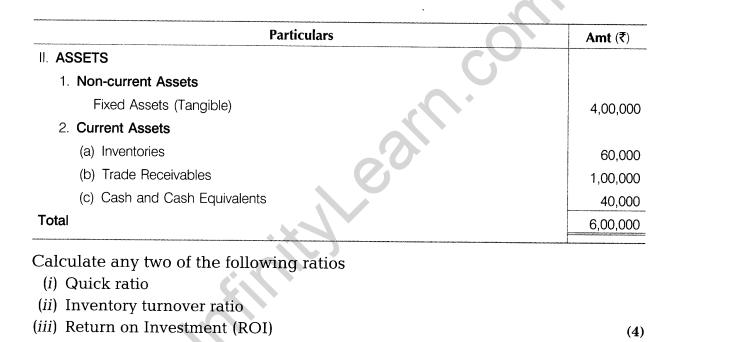

19. Rakshak Ltd made an operating profit of Rs 1,85,500 after charging depreciation of Rs 31,200. During that year, trade payables increased by Rs 26,600 and inventory increased by Rs 40,300. There was no change to trade receivables. Assuming that no other factors affected it, what would be the cash generated from operations.

20.Mention any four items under the sub-heading ‘current assets’ and any four items under the sub-heading ‘current liabilities’ as per the provisions of Schedule III, Part I of the Companies Act, 2013.

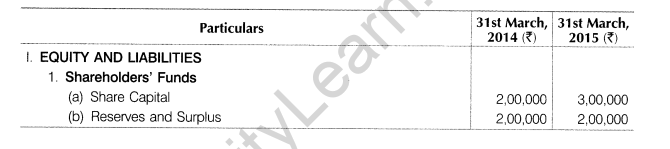

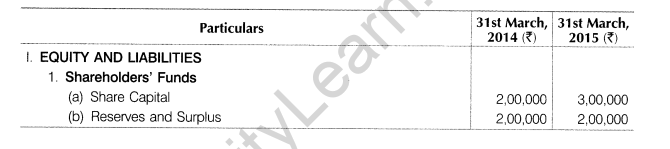

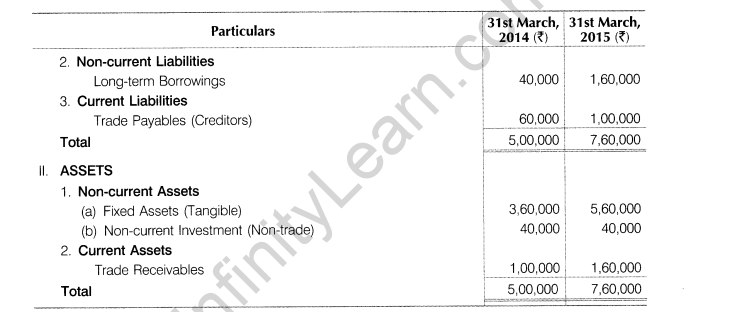

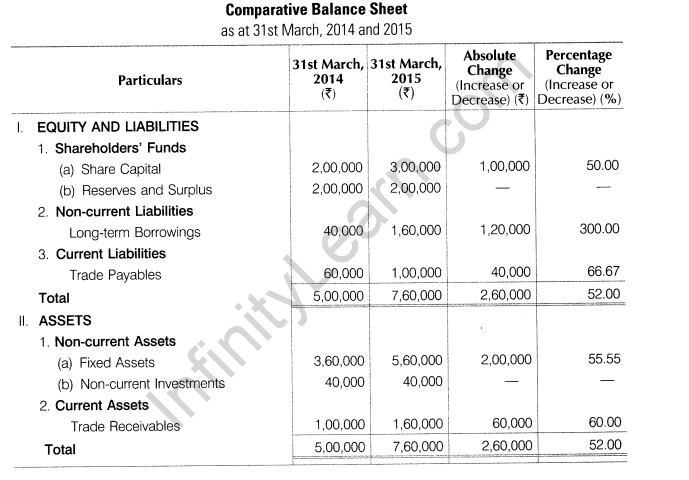

21.From the following balance sheet, prepare the comparative balance sheet of Z Ltd.

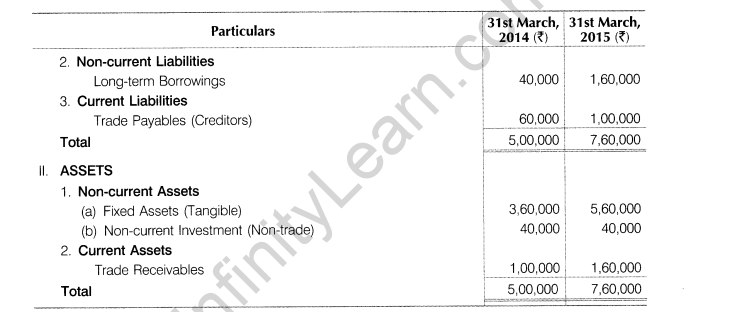

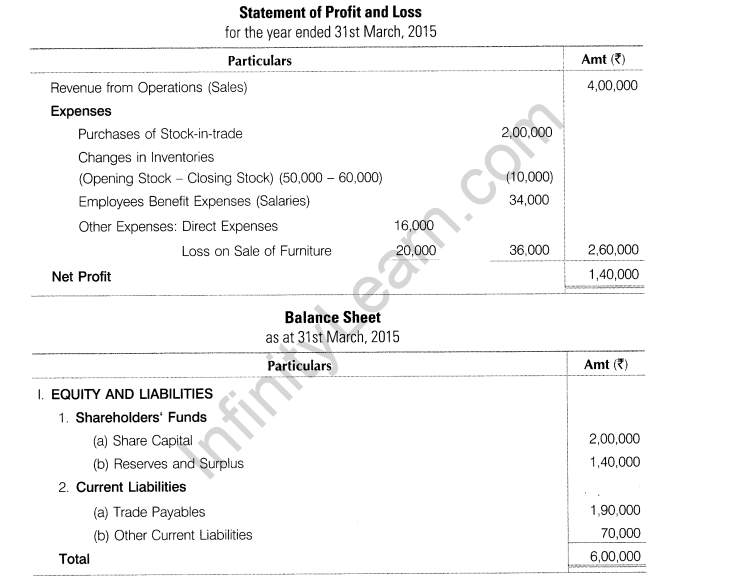

22. Following is the statement of profit and loss of Goldy Ltd for the year ended 31st March, 2013 and the balance sheet of the company as at that date.

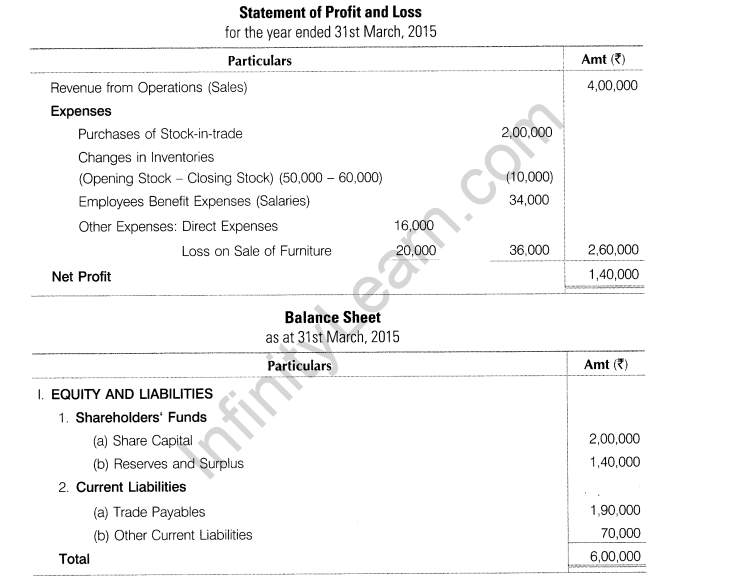

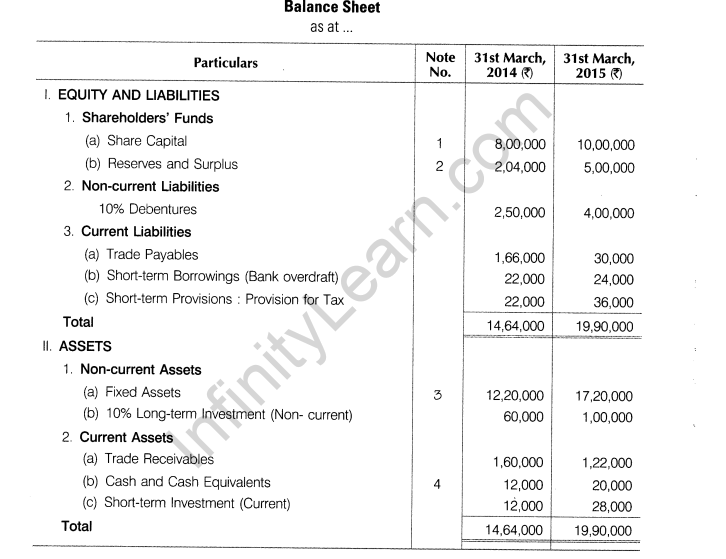

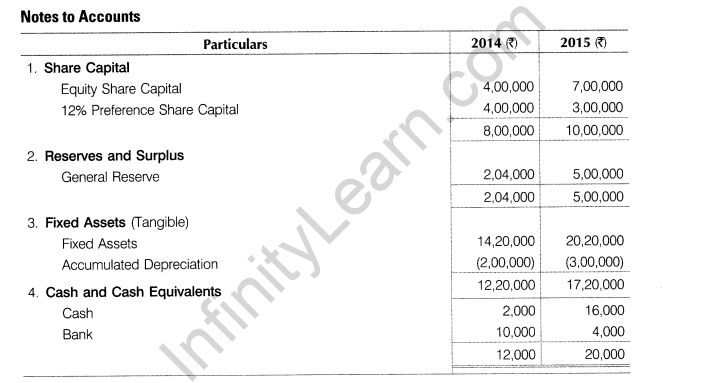

23. From the following balance sheet of Ravi Ltd, prepare cash flow statement as per AS-3 (Revised)

Additional Information

(i) Preference shares were redeemed on 31st March, 2015 at a premium of 10%.

(ii) Dividend at 12% was paid to equity shareholders for the year 2013-14.

(iii) Fresh debentures were issued on 1st April, 2014.

Answers

Part A

(Accounting for Partnership Firms and Companies)

1. Z is admitted to a firm for l/4th share in the profits for which he brings in Rs 10,000 towards premium for goodwill. It will be taken by old partners in which ratio?

Ans. Sacrificing ratio

2. As a director of a company, you had invited applications for 60,000 equity shares of Rs 10 each at a premium of Rs 2 each. The total application money received @ Rs 2 per shares was 1,44,000. Name the kind of subscription.

Ans. Oversubscribed, as applications are received for 72,000 shares

3. In a partnership firm, partners desire to charge interest on drawings. However the partnership deed does not provide for charging interest on drawings. Suggest what steps can be taken by the partners so that firm can charge interest on drawings?

Ans. The partnership deed should be amended to incorporate the clause to charge interest on drawings. It is only then that the interest on drawings can be charged.

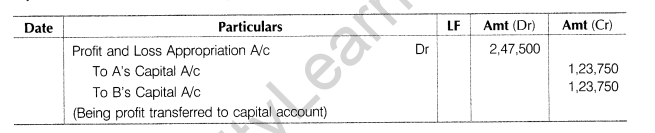

4. The firm of A and B earned a profit of Rs 2,75,000 during the year ending on 31st March, 2015. They have decided to donate 10% of this profit to an NGO working for senior citizens. Pass necessary journal entry for the distribution of profits.

Ans.

5. On admission of a new partner in a firm, an accountant is of the opinion that reserves and accumulated profits should not be distributed as there is no legal requirement and also he is of the opinion that if they are not distributed, they will remain in business and they can be distributed when a partner retires or when the firm is dissolved. Is the accountant correct?

Ans. No, the accountant is not correct because if the reserves and accumulated profits are distributed at the time of retirement or dissolution, they will have to be distributed among all the partners including the new partner in the profit sharing ratio at the time of distribution. It will mean that the new partner will also be given a share out of reserves and accumulated profits. It will not be correct because it puts the new partner to advantage and old partners to disadvantage.

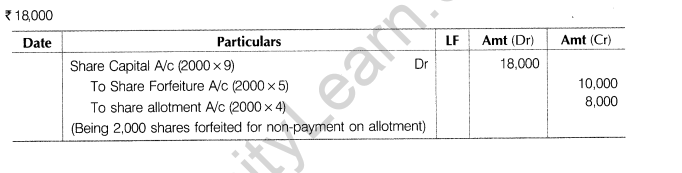

6. A company forfeited 2,000 shares of Rs 10 each (which were issued at par) held by Mr. Kartik for non-payment of allotment money of Rs 4 per share. The called-up value per share was Rs 9. With what amount the share capital account would be debited on forfeiture.

Ans.

7. How are debentures disclosed in the balance sheet of a company?

Ans. Debentures being borrowings (liability) of a company are shown in the equity and liabilities part of the balance sheet. Debentures may be either non-current liability or a current liability. Debentures are shown in the balance sheet under the head non-current liabilities and sub-head long-term borrowings, when they are due for redemption after 12 months from the date of issue or after the period of operating cycle. These debentures will be shown (classified) under current liabilities as current maturities of long-term debts under other current liabilities, when they are due for redemption in the current year. Debentures issued to be redeemed within 12 months of the date of issue are shown (classified) as short-term borrowings under current liabilities.

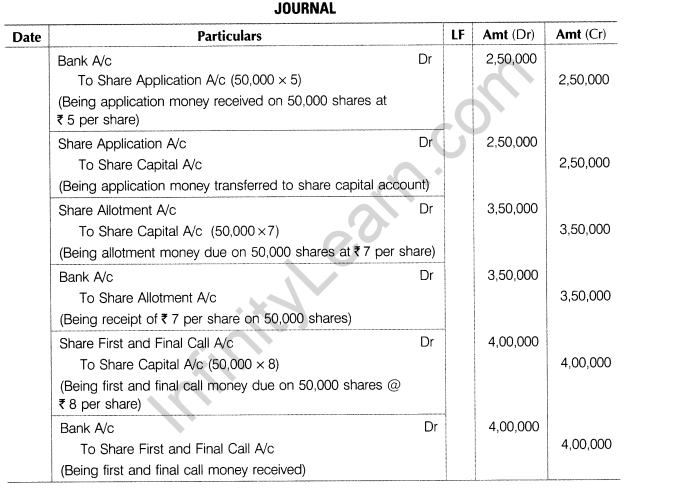

8. Vishvesh Ltd was registered with a capital of Rs 10,00,000 in shares of Rs 20 each.It invited application for 50,000 shares. The amount is payable as Rs 5 on application, Rs 7 on allotment and Rs 8 on first and final call. The whole of above issue was applied for and amount was duly received. Give the journal entries for the above transactions.

Ans.

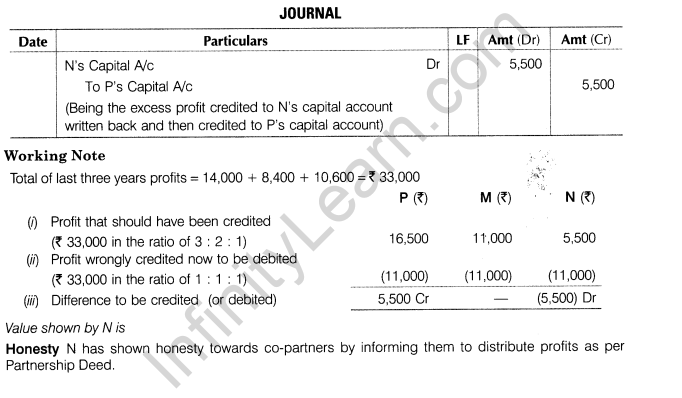

9. RM and N share profits in the ratio of 3 : 2 : The profits of the last three years were Rs 14,000, Rs 8,400 and Rs 10,600 respectively. N noticed that the profits were by mistake shared equally for all the three years. She informed P and M about this and now they decided to correct the error. Give necessary journal entry for the same. Identify the value shown by N?

Ans.

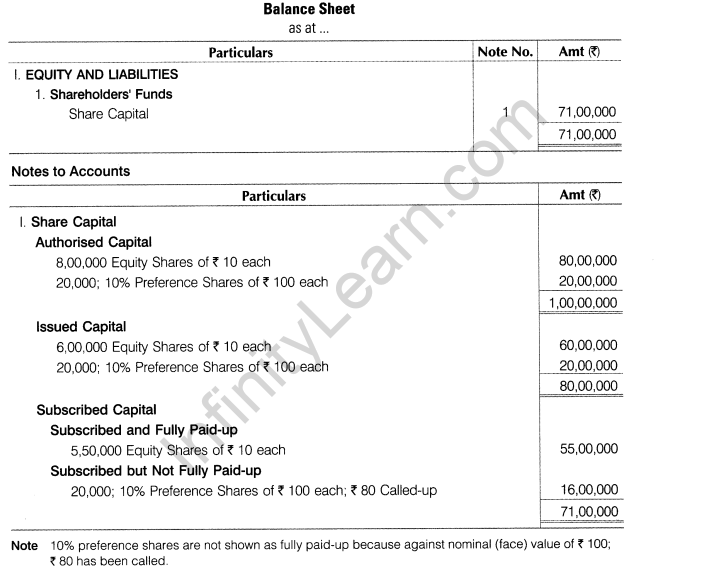

10. XYZ Ltd was registered with the authorised share capital of Rs 1,00,00,000 divided into 8,00,000 equity shares of Rs 10 each and 20,000, 10% preference shares of Rs 100 each. The company offered 6,00,000 equity shares for subscription to public and also 20,000, 10% preference shares. Applications were received for 5,50,000 equity shares and 20,000, 10% preference shares. The directors had called the entire nominal value of equity shares and Rs 80 on 10% preference shares. The money called on both the equity shares and preference shares was duly received. Show the share capital in the balance sheet of the company.

Ans.

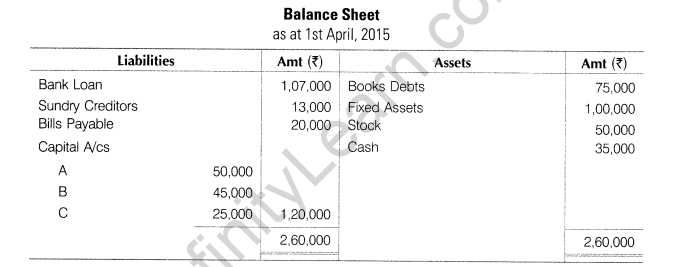

11. R Q and R were partners in a firm sharing profits and losses in the ratio of 3 : 1 : 1. On 1st April, 2015, their balance sheet stood as

They admitted S into partnership for l/5th share of profits on the above date. A claim on account of workmen’s compensation is estimated at Rs 13,000 only. Give the necessary journal entries to adjust the accumulated profits and losses.

Ans.

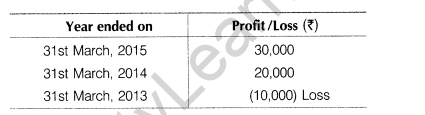

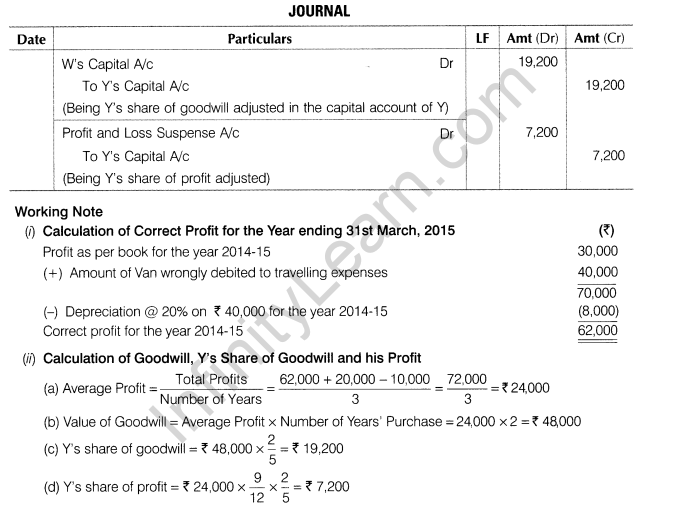

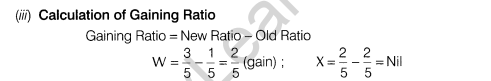

12. W, X and Y were partners sharing profits and losses in the ratio of 1:2:2 as at 31st March, 2015. Mr Y died on 31st December, 2015. The firm closes its accounts on 31st March every year. Following adjustments were agreed upon:

(i) Goodwill is to be calculated at the rate of two years’ purchase on the basis of average of last three years’ profit. The profits for the three years were as detailed I below

(ii) Profit for the period 1st April, 2015 onward shall be ascertained proportionately on the basis of average profits of the preceding three years.

(iii) During the year ending 31st March, 2015, a van costing Rs 40,000 was purchased on 1st April, 2014 and wrongly debited to travelling expenses account on which depreciation is to be calculated at 20% per annum. The asset is to be brought into account at depreciated value.

Pass necessary journal entries for the treatment of goodwill and Y’s share of profit at the time of his death assuming W and X share further profits and losses in the ratio of 3:2.

Ans.

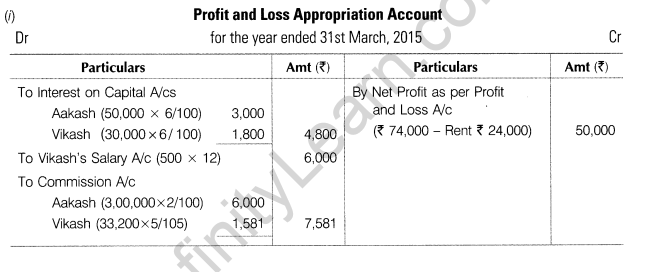

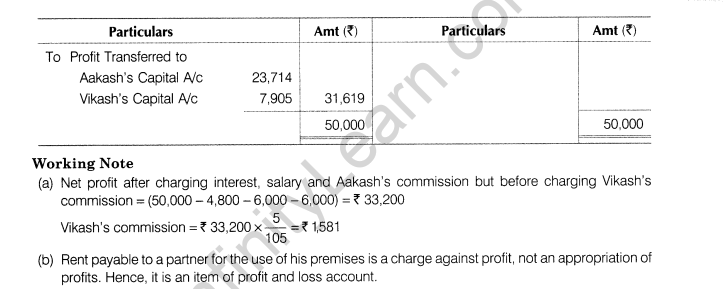

13.(i) Aakash and Vikash are partners sharing profits and losses in the ratio of 3:1. On 1st April, 2014, their capitals were Rs 50,000 and Rs 30,000 respectively. During the year ended 31st March, 2015, they earned a net profit of Rs 74,000. The terms of partnership are

(a) Interest on the capital is to be charged @ 6% per annum.

(b) Aakash will get commission @ 2% on turnover.

(c) Vikash will get a salary of Rs 500 per month.

(d) Vikash will get commission of 5% on profits after deduction of interest, salary and commission (including his own commission).

(e) Aakash is entitled to a rent of Rs 2,000 per month for the use of his premises by the firm. It is paid to him by cheque at the end of every month.Partners’ drawings for the year were AakashRs 8,000 and vikash Rs 6,000. Turnover for the year was Rs 3,00,000.

After considering the above factors, you are required to prepare the profit and loss appropriation account.

(ii) Ajit and Baljit were sharing profits in the ratio of 3:2. They decided to admit Chaman into the partnership for 1/6th share in the future profits. Goodwill, valued at 3 times the average super profits of the firm, was Rs 18,000, the firm had assets worth Rs 15 lakhs and liabilities of Rs 12 lakhs. The normal earning Capacity of such firm is expected to be 10% per annum. Find the average profits and actual profits earned by the firm during the last 3 years.

Ans.

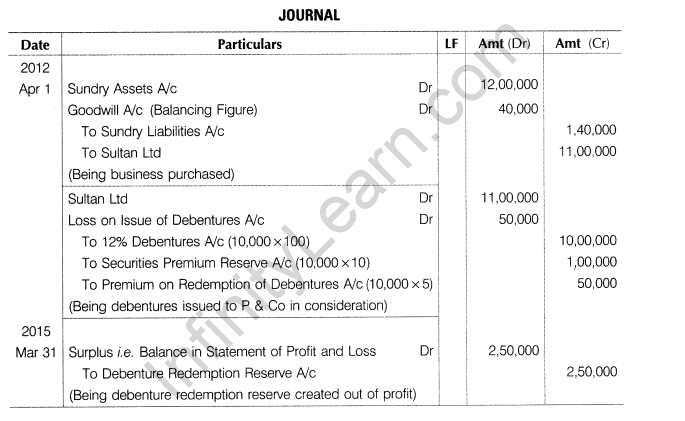

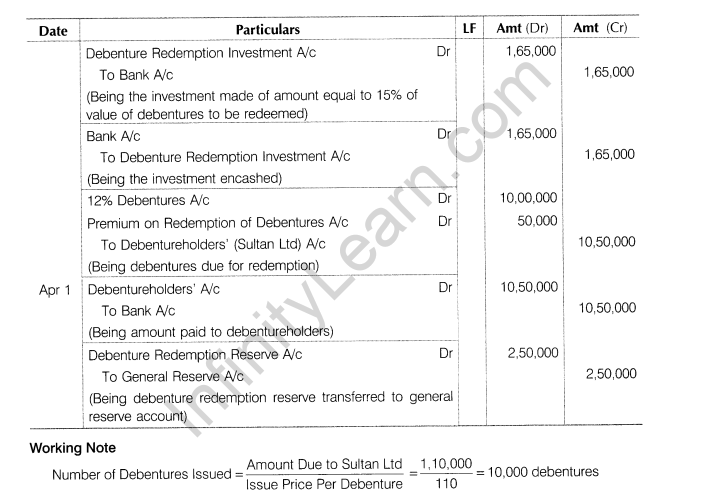

14. Arihant Ltd on 1st April, 2012 acquired assets of the value of Rs 12,00,000 and liabilities worth Rs 1,40,000 from Sultan Ltd at an agreed value of Rs 11,00,000. Arihant Ltd issued 12% debentures of Rs 100 each at a premium of 10% in full satisfaction of purchase consideration. The debentures were redeemable 3 years later at a premium of 5%. Pass entries to record the above, including redemption of debentures.

Ans.

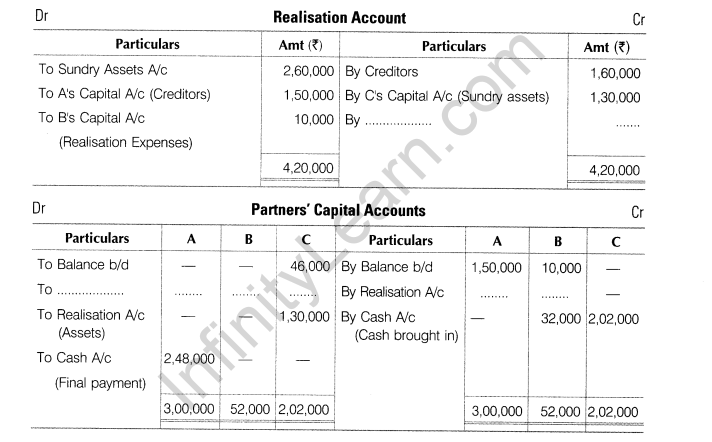

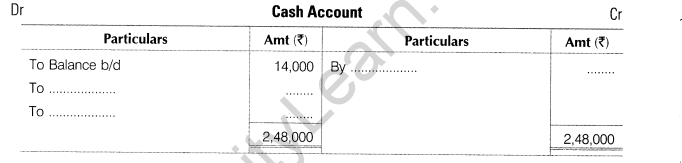

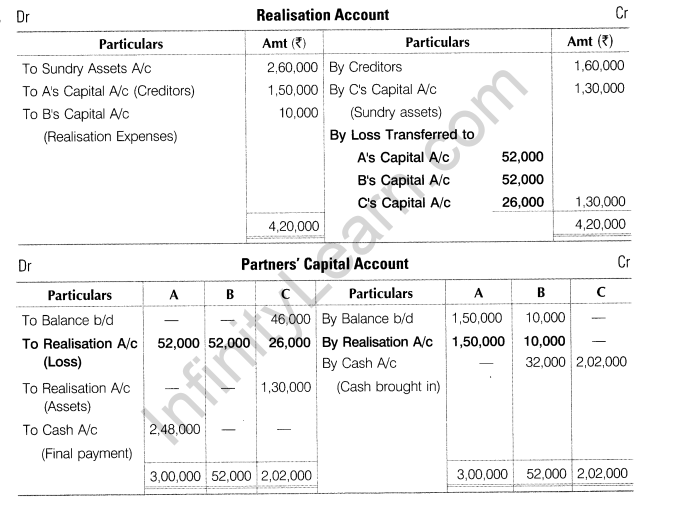

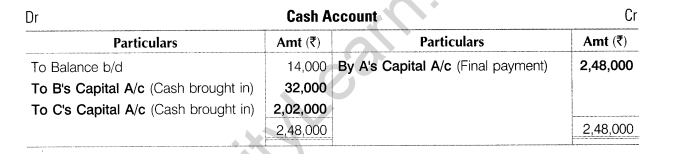

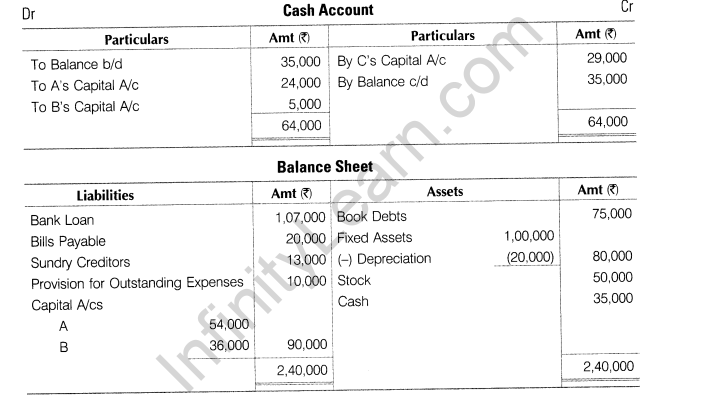

15. A, B and C were partners in a firm sharing profits in the ratio of 2 : 2: 1. On 28th February, 2015, their firm was dissolved.From the following information complete realisation account, partners’ capital account and cash account.

Ans.

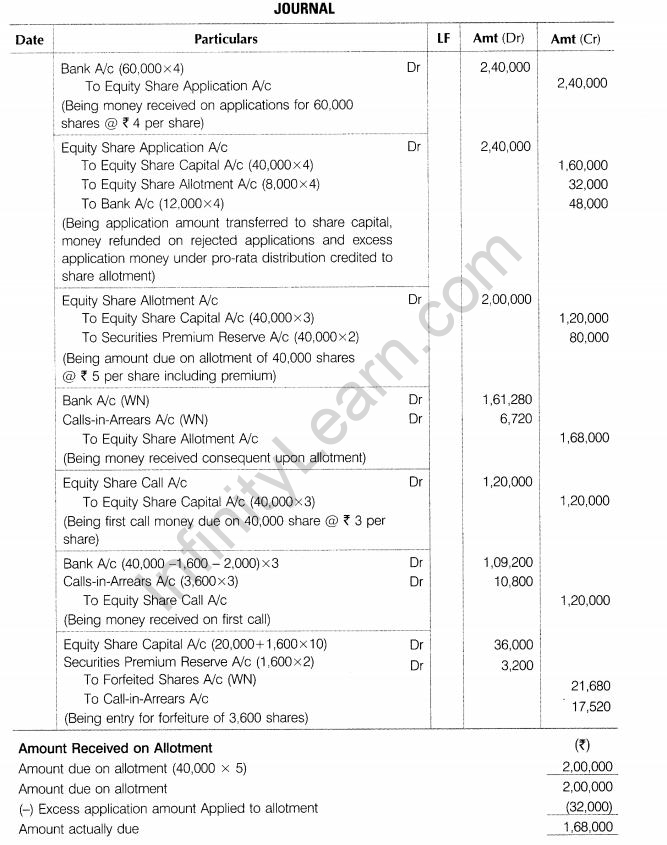

16. Radha Ltd issued for public subscription 40,000 equity shares of Rs 10 each at a premium of Rs 2 per share payable as under

On application Rs 4 per share; on allotment Rs 5 per share (including premium) and on call Rs 3 per share.

Applications were received for 60,000 shares. Allotment was made, pro-rata to the applications for 48,000 shares, the remaining being rejected. Money overpaid on applications was applied towards sum due on allotment.

C, to whom 1,600 shares were allotted, failed to pay the allotment money and J, to whom 2,000 shares were allotted, failed to pay the call money. These shares were subsequently forfeited. Record journal entries in the books of the company. Identify the value being violated by the company and the shareholder.

or

On 1st January, 2015, the director of Geeta Ltd issued for public subscription 50,000 equity shares of Rs 10 each at Rs 12 per share payable as to Rs 5 on application (including premium), Rs 4on allotment and balance on call in on Ist , May, 2015.

The lists were closed on 10th February, 2015. By that date, applications for 70,000 were received. Out of the cash received, Rs 40,000 was returned and Rs 60,000 was applied to wards the amount due on allotment, the balance of which was paid on 16th February, 2015.

All the shareholders paid the call due on 1st May, 2015 with the exception of an allotted of 500 shares.

These shares were forfeited on 29th September, 2015 and reissued as fully paid at Rs 8 per share on 1st November, 2015.

The company, as a matter of policy, does not maintain a calls-in-arrears account. Give journal entries to record these share capital transactions in the books of Geeta Ltd.

Identify the value being violated by the company and the shareholder.

Ans.

==============================

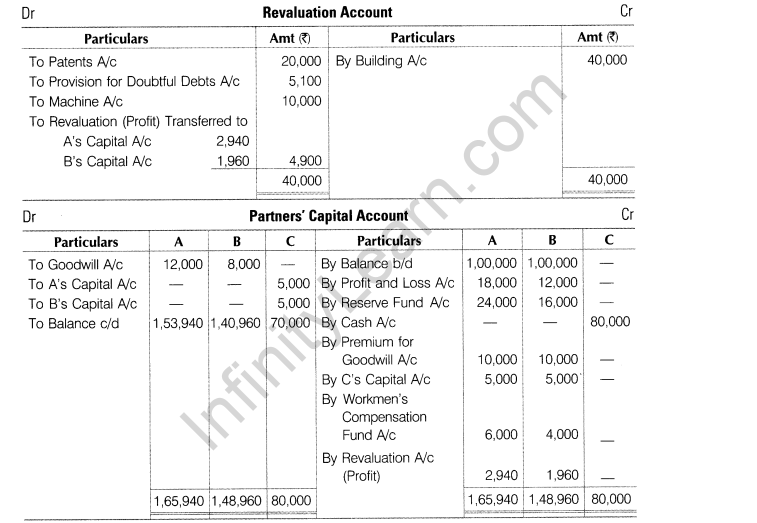

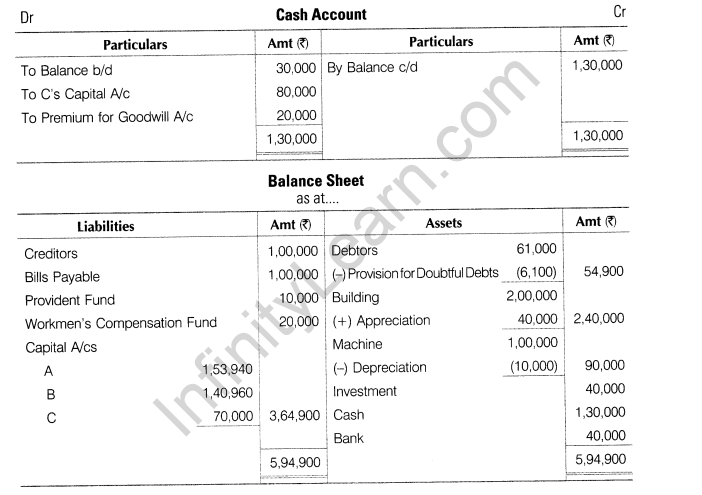

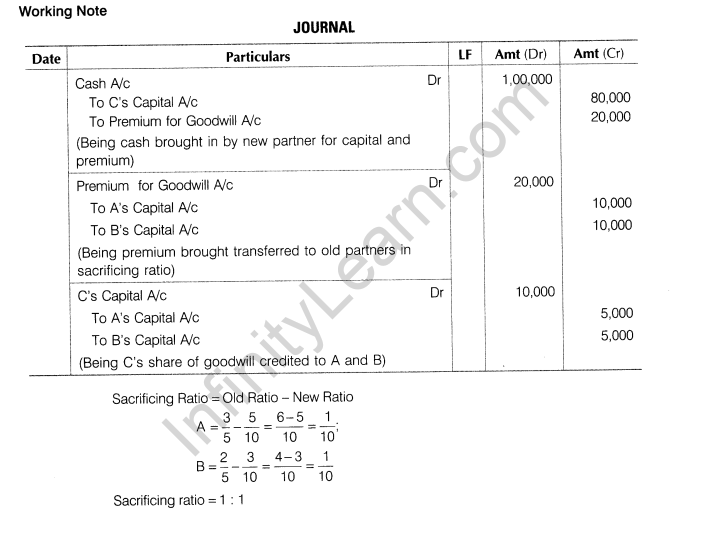

17. A and B are partners with 3 : 2 ratio. Their balance is given below

Adjustments

(i) C comes as a new partner.

(ii) New profit sharing ratio is 5 : 3 : 2.

(iii) C brings capital Rs 80,000 and premium Rs 20,000 out of his share of Rs 30,000.

(iv) Make 10% provision for doubtful debts on debtors.

(v) Patents are valueless.

(vi) Worker compensation liabilities fixed at Rs 20,000.

(vii) Building undervalued by Rs 40,000.

(viii) Machine overvalued by Rs 10,000.

Prepare necessary accounts and balance sheet of the newly constituted firm.

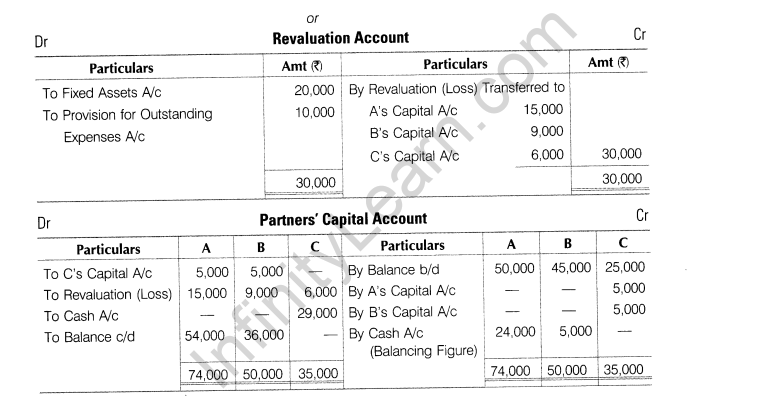

or

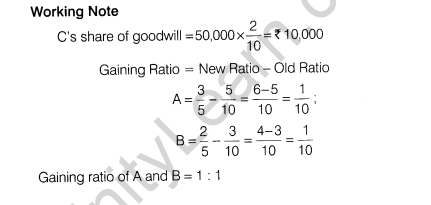

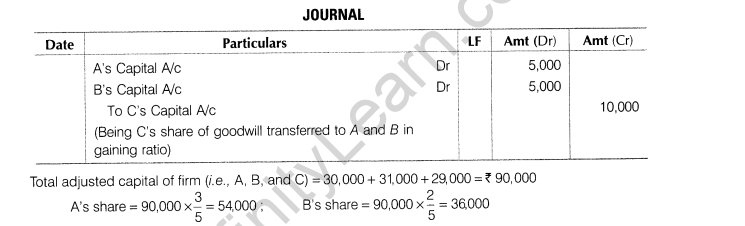

A, B and C were partners sharing profits and losses in the ratio of 5 : 3 : 2. Their balance sheet was as follows

C retired on the same date and the following adjustments were made

(i) Fixed assets were overvalued by 20%.

(ii) Make provision for outstanding expenses Rs 10,000.

(iii) Goodwill was valued at Rs 50,000.

C was to be paid immediately by cash brought in by A and B so as to make their capital in new profit sharing ratio which was 3:2. Goodwill was not be raised in the books. Prepare revaluation account, partners’ capital account and the balance sheet of the firm.

Ans.

==========================

Part B

(Financial Statements Analysis)

18. Depreciation charged by a company will result into inflow, outflow or no flow of cash. Give reason.

Ans.There will be no flow of cash because depreciation is a non-cash expense.

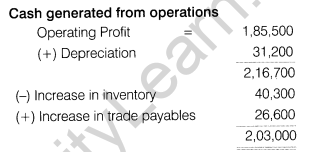

19. Rakshak Ltd made an operating profit of Rs 1,85,500 after charging depreciation of Rs 31,200. During that year, trade payables increased by Rs 26,600 and inventory increased by Rs 40,300. There was no change to trade receivables. Assuming that no other factors affected it, what would be the cash generated from operations.

Ans.

20. Mention any four items under the sub-heading ‘current assets’ and any four items under the sub-heading ‘current liabilities’ as per the provisions of Schedule III, Part I of the Companies Act, 2013.

Ans.Current Assets

(i) Current investments (ii) Inventories

(iii) Trade receivables (iv) Cash and Cash Equivalents

Current Liabilities

(i) Short-term borrowings (ii) Trade payables

(iii) Other current liabilities (iv) Short-term provisions

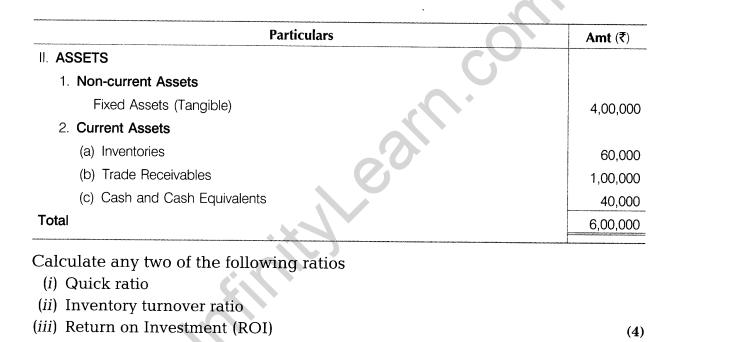

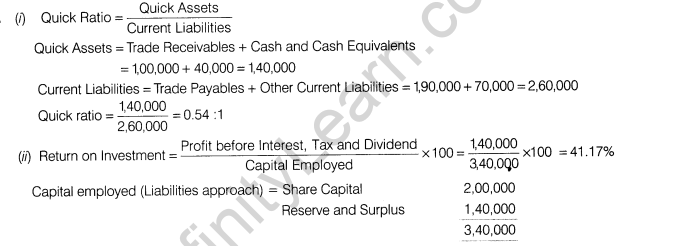

21.From the following balance sheet, prepare the comparative balance sheet of Z Ltd.

Ans.

22. Following is the statement of profit and loss of Goldy Ltd for the year ended 31st March, 2013 and the balance sheet of the company as at that date.

Ans.

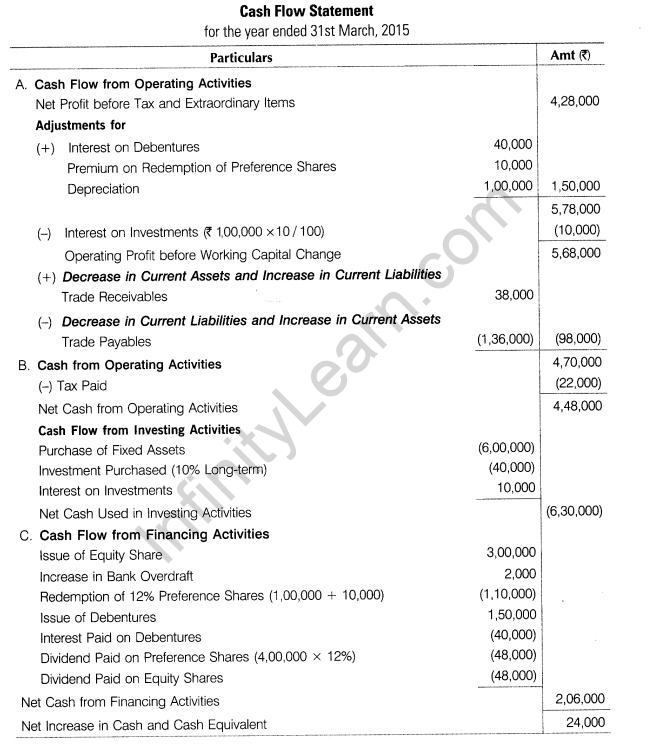

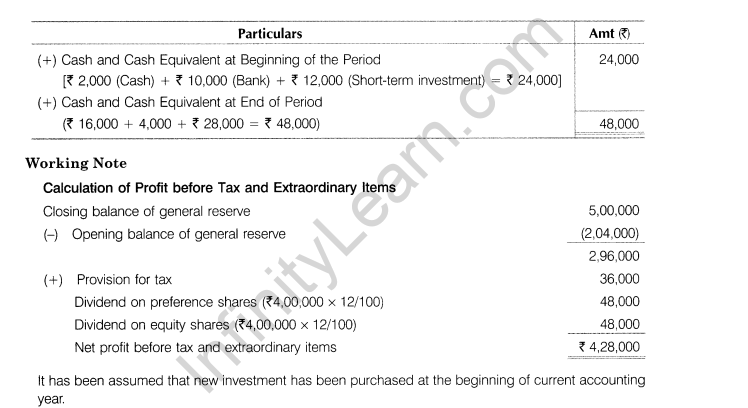

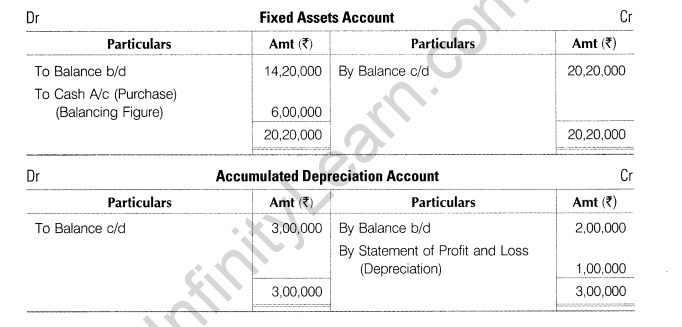

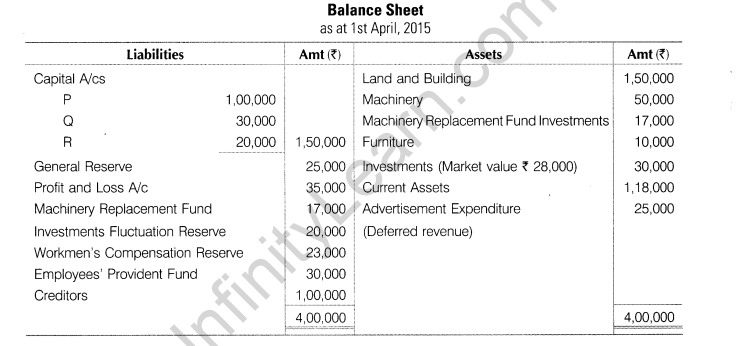

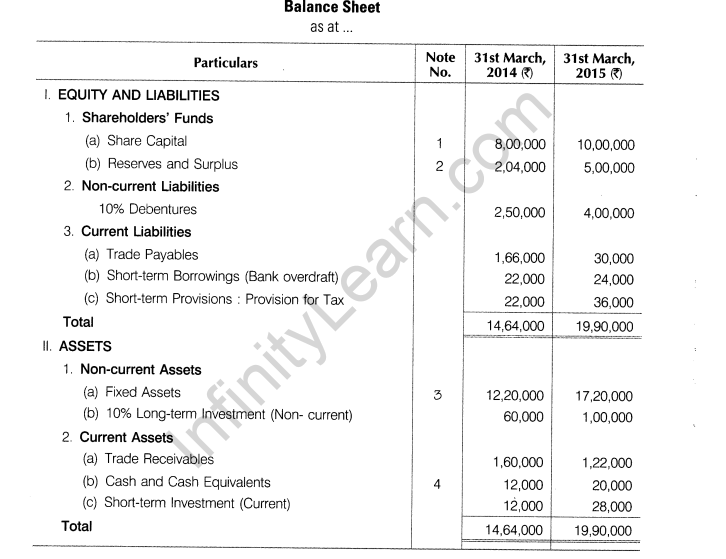

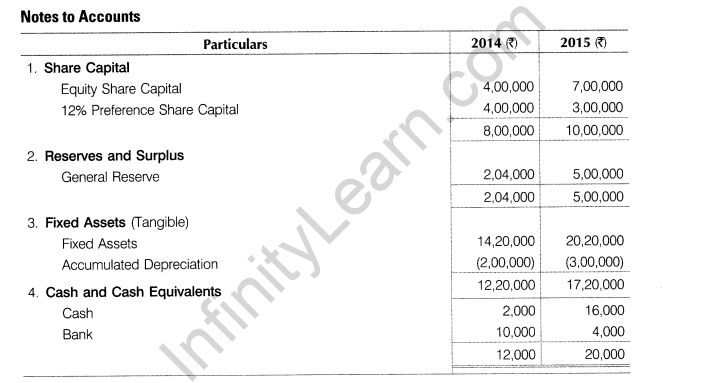

23. From the following balance sheet of Ravi Ltd, prepare cash flow statement as per AS-3 (Revised)

Additional Information

(i) Preference shares were redeemed on 31st March, 2015 at a premium of 10%.

(ii) Dividend at 12% was paid to equity shareholders for the year 2013-14.

(iii) Fresh debentures were issued on 1st April, 2014.

Ans.