Courses

Q.

How can I confirm my identity?

see full answer

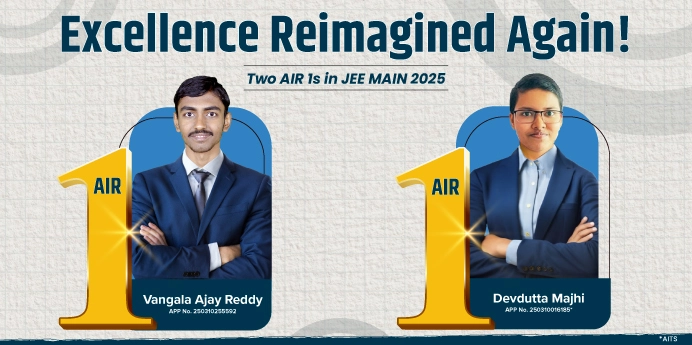

Talk to JEE/NEET 2025 Toppers - Learn What Actually Works!

(Unlock A.I Detailed Solution for FREE)

Ready to Test Your Skills?

Check your Performance Today with our Free Mock Test used by Toppers!

Take Free Test

Detailed Solution

Confirming your identity can happen in physical contexts (e.g., government offices, banks) or digital contexts (e.g., online accounts, e-commerce). Although details vary by jurisdiction or platform, the underlying principles revolve around verifying “Something you are,” “Something you have,” and/or “Something you know.” Below is a roadmap to confirm identity in both contexts:

- Physical Identity Confirmation (In-Person).

- Primary Documents (Government-Issued IDs).

- Passport: Globally accepted; contains name, photograph, date of birth, nationality.

- Driver’s License/National ID Card: Contains photo, signature, and unique ID number.

- Birth Certificate (sometimes insufficient alone).

- Voter ID & Aadhaar (in India). These contain demographic and biometric data (fingerprints, iris scans).

- Secondary Documents (Supporting Proof).

- Utility Bills: To verify address.

- Bank Statements: As supplemental proof of residence.

- Educational Certificates: Often used for youth identity confirmation in school admissions.

- Biometric Verification.

- Fingerprint Scanner: Many governmental services (passport offices, tax offices) require fingerprint scans.

- Iris/Retina Scan: Used in high-security facilities.

- Facial Recognition: Automated gates at airports match live faces to passport photos.

- Process Workflow (Government Office Example).

- Pre-Registration: Fill out online form, upload a selfie, and a scanned copy of your ID.

- Appointment: Visit the local office with original documents (passport, Aadhaar, utility bill).

- Biometric Capture: Fingerprint and/or iris scan captured on-site.

- Document Verification: Official inspects IDs for holograms, watermarks—ensures they are not forged.

- Confirmation & Receipt: If all checks pass, your identity is confirmed and linked to your application (e.g., passport application or e-KYC).

- Digital Identity Confirmation (Online).

- Knowledge Factor (Passwords & Security Questions).

- Typically the first step: Log in with a username/email and password.

- If you forget your password, answer a set of preselected security questions (e.g., “What is your mother’s maiden name?”).

- Possession Factor (Email/SMS OTP).

- Email-Based Verification: Upon signup or login from a new device, you receive a one-time link or code to your registered email. Clicking the link or entering the code proves possession of that email account.

- SMS OTP (One-Time Password): A 6- to 8-digit code sent to your phone number. You must enter it on the website/app.

- Authenticator Apps: e.g., Google Authenticator or Authy generate time-based codes that refresh every 30 seconds.

- Biometric Factor (Device-Based).

- Smartphone Fingerprint/Face ID: Many banking or payment apps use your phone’s built-in biometric for instant login.

- Voiceprint Recognition: Some call-center systems analyze voice patterns to verify identity.

- Identity Verification Services (KYC Platforms).

- Services such as Jumio, Onfido, or ID.me offer identity verification via:

- Document Scan: You take a photo of your ID (passport, driver’s license).

- Liveness Check: You take a brief video or follow on-screen prompts (“turn your head,” “smile”) to prove you’re a real person.

- AI/Manual Review: The platform’s AI scans document security features (holograms, microprinting) and compares your live selfie to the ID photo for a match score.

- Result: Within seconds or minutes, you receive a “Verified” or “Flagged” status.

- Multi-Factor & Risk-Based Authentication.

- Adaptive Authentication: If you log in from a known device and location, the system may ask only for a password. If from a new location or device, it may trigger a biometric check or extra security questions.

- Transaction Verification: For high-risk online banking transactions, the system might require a fresh SMS OTP plus a fingerprint scan on your mobile banking app.

- Best Practices to Confirm Identity.

- Maintain Updated Documents: Always keep your government IDs current.

- Secure Your Digital Channels: Use a strong, unique password (or passphrase) for each account; enable MFA.

- Be Aware of Phishing & Scams: Legitimate services will not ask for your password and OTP together or pressure you to share biometric data.

- Regularly Review Account Activity: Check login history and linked devices to ensure no unauthorized access.

By leveraging appropriate factors—government IDs and biometrics for in-person verification, and layered MFA methods (password + OTP + biometric) for online services—you can robustly confirm identity while minimizing fraud or impersonation risk.

Best Courses for You

JEE

NEET

Foundation JEE

Foundation NEET

CBSE