Courses

Q.

How to Use the Xmaster (XHMaster) Formula Indicator in Forex?

see full answer

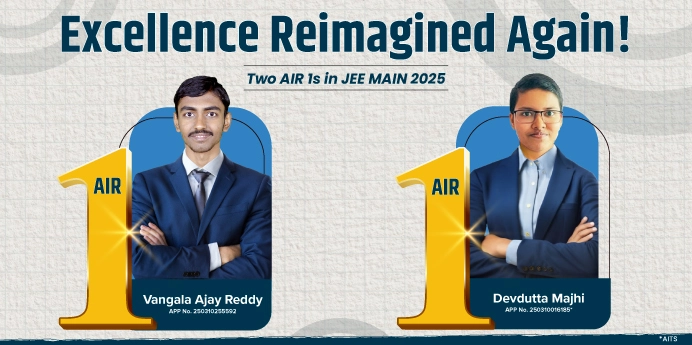

High-Paying Jobs That Even AI Can’t Replace — Through JEE/NEET

(Unlock A.I Detailed Solution for FREE)

Best Courses for You

JEE

NEET

Foundation JEE

Foundation NEET

CBSE

Detailed Solution

The XHmaster (Xmaster) Formula Indicator is a comprehensive technical analysis tool that combines signals from popular indicators like MACD, RSI, Bollinger Bands, and Stochastic to provide clear, color-coded signals directly on the chart. Originally launched in the early 2010s, the indicator has evolved into various versions, including the more responsive 2023 release often referred to as XHMaster.

Features:

- No-Repaint Design: Once a signal appears on the chart, it doesn't change after the fact

- Multi-Indicator Fusion: Combines 5+ technical indicators into one visual system

- Platform Compatibility: Available for MT4, MT5, and TradingView

- Accuracy Rate: Backtesting shared by users indicated accuracy rates of around 70% to 75% in trending conditions

1. Exponential Moving Average (EMA) Calculations

Purpose: EMAs or exponential moving averages are a type of moving average that pay more attention to the most recent price changes. Because of this, the indicator reacts faster than a simple moving average when the price moves.

Standard EMA Formula:

EMA(t) = (Price(t) × K) + (EMA(t-1) × (1 - K))

Where:

K = 2 ÷ (Period + 1)

t = Current period

EMA(t-1) = Previous period's EMA

XHmaster EMA Settings:

| EMA Type | Default Period | Purpose |

| Short-term EMA | 10 periods | The period for the short-term EMA (default is 10) |

| Medium-term EMA | 20 periods | The period for the medium-term EMA (default is 20) |

| Long-term EMA | 38 periods | The period for the long-term EMA (default is 38) |

Standard Mode EMA Calculation:

In Standard Mode, the indicator calculates the difference between the 10-period short-term EMA and the 38-period long-term EMA and normalizes it to a 0-100 scale.

EMA_Difference = EMA(10) - EMA(38)

Normalized_Value = (EMA_Difference / Price) × 100

2. MACD (Moving Average Convergence Divergence) Formulas

Purpose: MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages of the price.

MACD Calculation Components:

MACD Line = EMA(12) - EMA(26)

Signal Line = EMA(9) of MACD Line

Histogram = MACD Line - Signal Line

XHmaster MACD Settings:

| Component | Default Value | Formula Application |

| Fast Length | 12 periods | The period for the fast EMA in the MACD calculation (default is 12) |

| Slow Length | 26 periods | The period for the slow EMA in the MACD calculation (default is 26) |

| Signal Line | 9 periods | The signal line period for MACD (default is 9) |

MACD Signal Conditions:

- Buy Signal: When MACD histogram bars are positive

- Enhanced Strategy: MACD line above the signal line and histogram rising or above zero

3. RSI (Relative Strength Index) Formula

Purpose: RSI is one of the most commonly used indicators to determine overbought (price is too high) and oversold level (price is too low). It shows how quickly and by how much the price is changing over time.

RSI Calculation:

RS = Average Gain / Average Loss

RSI = 100 - (100 / (1 + RS))

Where:

Average Gain = Sum of Gains over Period / Period

Average Loss = Sum of Losses over Period / Period

XHmaster RSI Settings:

| Parameter | Default Value | Signal Conditions |

| RSI Length | 14 periods | The period for the Relative Strength Index (default is 14) |

| Oversold Level | Below 30 | When RSI is below 30 (oversold) |

| Overbought Level | Above 70 | Indicates potential sell signal |

4. Stochastic Oscillator Formula

Purpose: The Stochastic Oscillator compares the current price to recent price levels to show how strong a price move is. It helps traders see if the price might be too high or too low.

Stochastic Calculation:

%K = ((Current Close - Lowest Low) / (Highest High - Lowest Low)) × 100

%D = Simple Moving Average of %K over specified period

Where:

Lowest Low = Lowest low over the specified period

Highest High = Highest high over the specified period

XHmaster Stochastic Settings:

| Component | Default Value | Signal Condition |

| Stochastic Length | 14 periods | The period for the Stochastic Oscillator (default is 14) |

| Buy Signal | Below 20 | When Stochastic value falls below 20 |

| Alternative Setting | (5,3,3) | Stochastic Oscillator (5, 3, 3) |

5. Bollinger Bands Formula

Purpose: This indicator is all about the lines around the price that show how much the market is moving. Bollinger Bands help traders see when the market is very active and when the price might jump up or down.

Bollinger Bands Calculation:

Middle Band = Simple Moving Average (20 periods)

Upper Band = Middle Band + (2 × Standard Deviation)

Lower Band = Middle Band - (2 × Standard Deviation)

Standard Deviation = √(Σ(Price - SMA)² / Period)

XHmaster Bollinger Bands Application:

The Bollinger Bands is calculated by subtracting the 20-period EMA from the 38-period EMA and then multiplying the result by 2. This indicator is used to indicate extreme price movements or volatility.

Modified BB = (EMA(20) - EMA(38)) × 2

6. Parabolic SAR Formula

Purpose: The Parabolic SAR indicator is used to identify a potential price reversal. When SAR points are below the price it indicates a buy signal.

Parabolic SAR Calculation:

SAR(t) = SAR(t-1) + AF × (EP - SAR(t-1))

Where:

SAR(t) = Current SAR value

SAR(t-1) = Previous SAR value

AF = Acceleration Factor (starts at 0.02, increases by 0.02, max 0.20)

EP = Extreme Point (highest high in uptrend, lowest low in downtrend)

XHmaster Signal Generation Logic

Advanced Mode Signal Conditions

In Advanced Mode, the indicator combines multiple technical indicators to provide more accurate and robust signals.

Buy Signal Requirements (ALL must be true):

- MACD: Histogram bars are positive

- RSI: Below 30 (oversold condition)

- Stochastic: Value falls below 20

- Parabolic SAR: Points are below the price

- EMA: Price above short-term EMA

Sell Signal Requirements (ALL must be true):

- MACD: Histogram bars are negative

- RSI: Above 70 (overbought condition)

- Stochastic: Value rises above 80

- Parabolic SAR: Points are above the price

- EMA: Price below short-term EMA

XHmaster Indicator Versions & Settings

MT4 Indicator Settings

The XMASTER forex indicator is a formula-based system that uses a combination of technical indicators to identify the price movements of assets. The indicator calculates the 10-period exponential moving average (EMA), 20-period EMA, 38-period EMA, Bollinger Bands (20, 2), MACD (12, 26, 9) and Stochastic Oscillator (5, 3, 3).

| Parameter | Default Setting | Description |

| Period | Variable | Averaging period |

| Sensitivity | Variable | Market dynamics determination |

| MA Method | SMMA | Moving average calculation method |

| Applied Price | PRICE_LOW | Type of price used for indicator calculation |

| Fast Period | 40 | Fast period setting |

| Arrow Gap | 200 | Visual arrow positioning |

2023 Enhanced Version Features

The Xmaster Formula 2023 Version indicator for Metatrader 4, also known as the "xhmaster", is an improved version of the old Xmaster formula indicator, originally launched in 2013. The buy/sell trading algorithm has been enhanced, and trading signals should be more accurate as a result.

Key Improvements:

- Enhanced signal accuracy

- Better visual alerts

- Adjustable sensitivity settings

- Reduced false signals in choppy markets

courses

No courses found

Ready to Test Your Skills?

Check your Performance Today with our Free Mock Test used by Toppers!

Take Free Test