CBSE Class 7 Maths Notes Chapter 8 Comparing Quantities

To compare quantities, there are multiple methods, such as ratio and proportion, percentage, profit and loss, and simple interest.

The ratio of two quantities of the same kind and in the same unit is the fraction that one quantity is of the other.

The ratio a is to b as is the fraction \(\frac { a }{ b }\), and it is written as a : b.

In the ratio a : b, we call a as the first term or antecedent and b the second term or consequent.

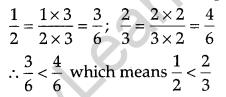

To compare different ratios, firstly convert fractions into like fractions. If like fractions are equal, then the given ratios are said to be equivalent.

e.g. To check 1 : 2 and 2 : 3 are equivalent.

Therefore, the ratio 1 : 2 is not equivalent to the ratio 2 : 3.

To compare two quantities, units must be the same.

If the two ratios are equal, the four quantities are called in proportion.

a : b = c : d ⇒ a : b :: c : d.

Fractions are converted to percentages by multiply the fraction by 100 and write % sign

e.g. \(\frac { 1 }{ 4 }\) = \(\frac { 1 }{ 4 }\) × 100 = 25%

Decimals are converted to percentages by multiply the decimal number by 100 and shift the decimal point two places to the right side and write % sign.

e.g. 2.42 × 100 = 242 %

Profit = SP – CP [∵ SP > CP]

SP = Selling Price

CP = Cost Price

Loss = CP – SP [∵ CP > SP]

CP = Cost Price

SP = Selling Price

Profit % = \(\frac { Profit }{ CP }\) × 100

Loss % = \(\frac { Loss }{ CP }\) × 100

Equivalent Ratios

Different ratios are compared with each other to know whether they are equivalent or not. For this, we write the ratios in the form of fractions and then compare them by converting them into like fractions. If these like fractions are equal, we say that the given ratios are equivalent. Equivalent ratios are very important. Two ratios are said to be equivalent if when converted into like fractions, they are equal.

Unitary Method

In the unitary method, we first find the value of one unit and then the value of the required number of units.

Percentage-Another way of Comparing Quantities

Percentages are numerators of fractions with denominator 100. They are used for comparisons.

Meaning of Percentage

Percent means ‘per hundred’. It is represented by the symbol % and means hundredths too.

Thus, 1% means 1 out of hundred or one-hundredths. It can be written as:

1% = \(\frac { 1 }{ 100 }\) = 0.01

Converting Fractional Numbers to Percentage

Fractional numbers can have different denominators. To compare fractional numbers we need a common denominator and it is more convenient to compare if the denominator is 100. So, we convert the fraction to percentages.

Percentages related to proper fractions are less than 100 whereas percentages related to improper fractions are more than 100.

Converting Decimals to Percentage

We multiply the decimal by 100 and affix percentage symbol.

Ratios to Percents

Sometimes, parts are given to us in the form of ratios and we need to convert those to percentage.

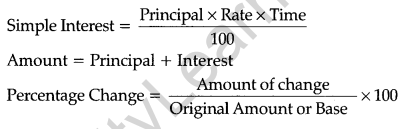

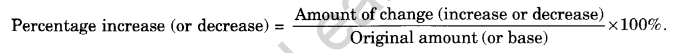

Increase or Decrease as Percent

There are times when we need to know what the increase in a certain quantity or decrease in it is as percent.

For example, if the population of a state is increased from 5,50,000 to 6,05,000, this could more clearly be understood if written as:

The population is increased by 10%.

Prices Related to an Item on Buying and Selling

The buying price of an item is known as its Cost Price (CP).

The price at which we sell an item is known as its Selling Price (SP).

Profit or Loss as a Percentage

Cost Price: The buying price of an item is known as its cost price written in short as CP.

Selling Price: The price at which we sell an item is known as the selling price or in short SP.

Naturally, it is better if we sell the item at a higher price than our buying price.

Profit or Loss: We can decide whether the sale was profitable or not depending on the CP and SP.

If CP < SP then we have gained some amount, that is, we made a profit, profit = SP – CP

If CP = SP then we are in a no profit no loss situation

If CP > SP then we have lost some amount, Loss = CP – SP.

The profit or loss we find can be converted to a percentage. It is always calculated on the CP.

Note. If we are given any two of the three quantities related to price, that is, CP, SP, and Profit or Loss percent, we can find the third.

Charge has given on Borrowed Money or Simple Interest

Principal: The money borrowed is known as sum borrowed or principal.

Interest: We have to pay some extra money (or charge) to the bank for the money being used by us for some time. This is known as interest.

Amount: We can find the amount we have to pay at the end of the year by adding the above two. That is.

Amount = Principal + Interest.

Note: Interest is generally given in per cents for a period of one year. It is written as x percent per year or per annum or in short as x% p.a. (say 10 percent per year)

10% p.a. means on every ₹ 100 borrowed, ₹ 10 is the interest we have to pay for one year.

We hope the given CBSE Class 7 Maths Notes Chapter 8 Comparing Quantities Pdf free download will help you. If you have any query regarding NCERT Class 7 Maths Notes Chapter 8 Comparing Quantities, drop a comment below and we will get back to you at the earliest.