Table of Contents

CBSE Sample Papers for Class 12 Accountancy Solved 2016 Set 6

Part A

(Accounting for Partnership Firms and Companies)

1.When shares are forfeited, share capital account is debited with what amount?

2.X, Y and Z are partners sharing profits in the ratio of 4 : 3 : 2. Y retires and the goodwill of the firm is valued at Rs 36,000. Pass journal entry for the treatment of goodwill on Y’s retirement.

3.Advise M/S PQR & Co whether to debit salary and commission of partners to the profit and loss appropriation account or profit and loss account?

4.As per AS-26, goodwill is to be recorded in the books of accounts only when money or money’s worth has been paid for it. If the new partner is unable to bring his share of goodwill, how will it be dealt?

5.The company issued shares of Rs 10 each at a premium of Rs 2 payable as:

On application Rs 3

On allotment Rs 4 (including premium)

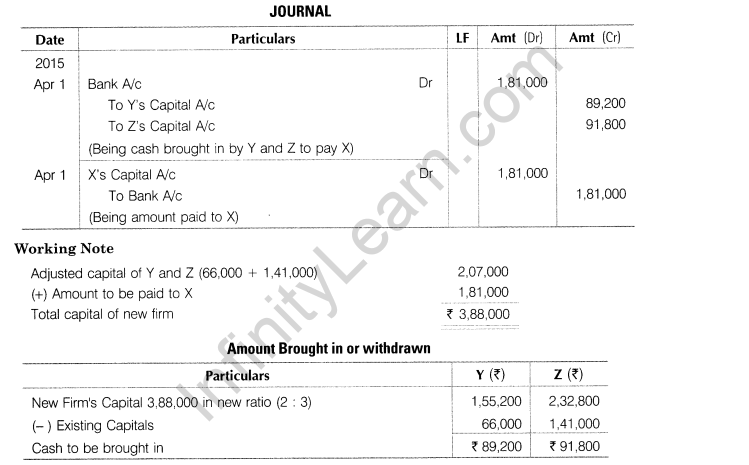

On first Call Rs 3

On second and final Call Rs 2

Mr X who holds 100 shares failed to pay the first call money. The company has forfeited the 100 shares after the first call. On forfeiture, the amount debited to share capital account would be?

6.Ram and Shyam are partners sharing profits is the ratio of 3 : Mrs Ram has given a loan of Rs 4,00,000 to the firm and the firm also obtained a loan of 12,00,000 from Shyam. The firm was dissolved and its assets were realised for Rs 5,00,000. State the order of payment of Mrs Ram’s loan and Shyam’s loan with reason, if there were no other creditors of the firm.

7.Define right issue and buy back of shares?

8.R Q and R are partners sharing profits in the ratio of 2 : 2 : 1. On 1st April, 2015, they decided to share profits in the ratio of 5 : 3 : 2. On that date, following balances appearing in the balance sheet Profit and loss (debit balance t 20,000); general reserve Rs 70,000; deferred revenue expenditure Rs 10,000.Pass adjusting journal entry without affecting the book values.

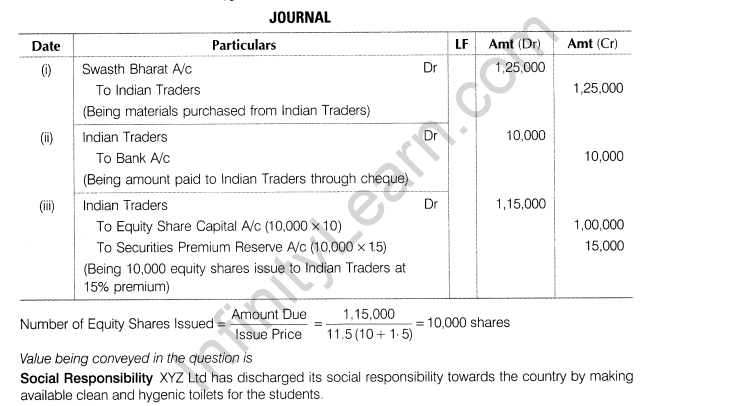

9.XYZ Ltd is in garment business. As its corporate social responsibility. It decided to install 100 toilets in schools. The project was named “Swasth Bharat”. It purchased materials worth 11,25,000 from Indian Traders Ltd. Payment made as Rs 10,000 by a cross cheque and remaining by issuing equity shares of Rs 10 each at 15% premium. Pass journal entry for the same. Identify the value being conveyed in the question.

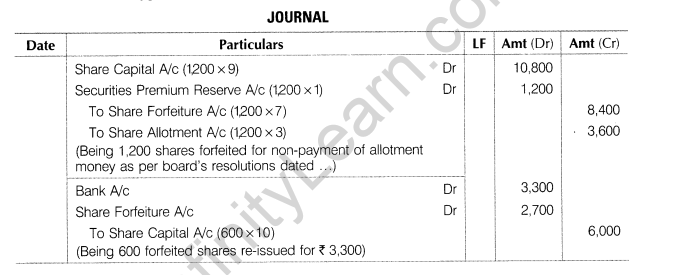

10.1,200 shares of Rs 10 each issued at premium of Rs 2 per share were forfeited for non-payment of allotment money of 13 per share (including Rs 1 premium). The first and final call of Rs 2 (including t 1 premium) was not yet made. 600 of the forfeited shares were re-issued for Rs 3,300 credited as fully paid.

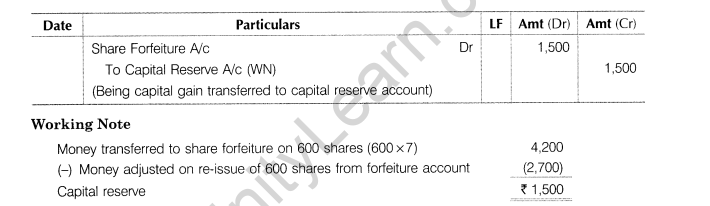

11.X, Y and Z are partners sharing profits in the ratio of 5 : 3: 7. On 1st April, 2015, X gave a notice to retire from the firm. Y and Z decided to share future profits in the ratio of 2 : 3. The adjusted capital accounts of Y and Z showed a balance of Rs 66,000 and Rs 1,41,000 respectively. The total amount to be paid to X is 11,81,000. This amount is to be paid by Y and Z in such a way that their capitals become proportionate to their new profit sharing ratio. Pass necessary journal entries for the above transactions in the books of the firm. Show your working clearly.

12.Pass journal entries in the following cases at the time of dissolution

(i)B’s loan paid off Rs 10,000.

(ii)Rs 3,000 dissolution expenses paid by firm.

(iii)Stock was taken over by B, a partner at Rs 10,000.

(iv)Rs 10,000 unrecorded creditors settled at Rs 6,000.

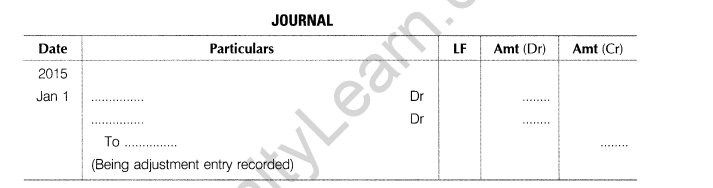

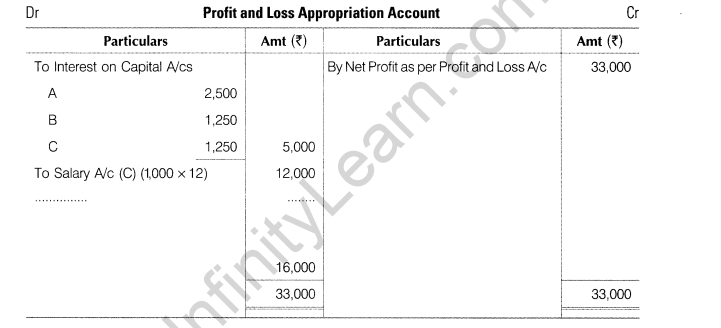

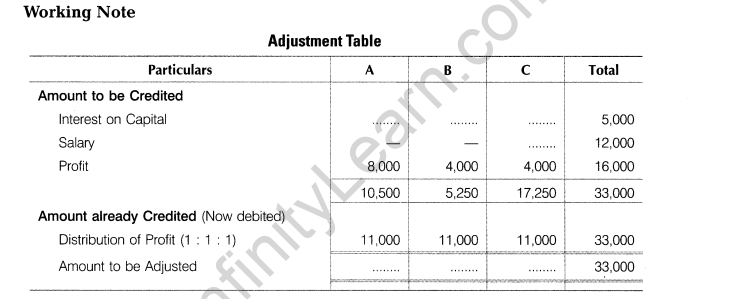

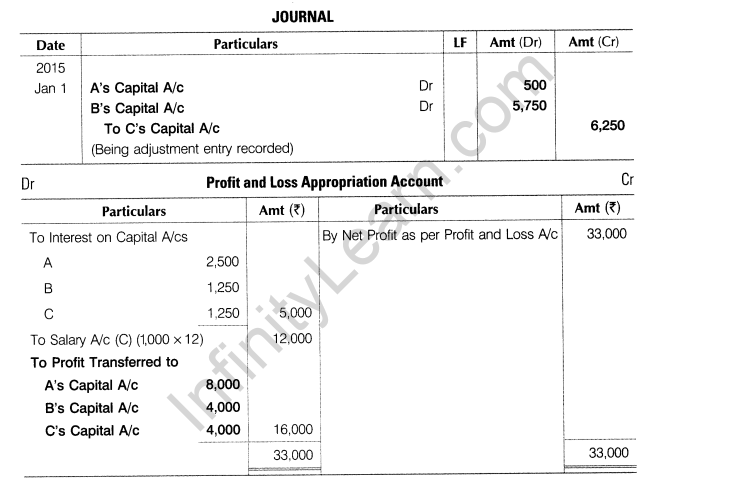

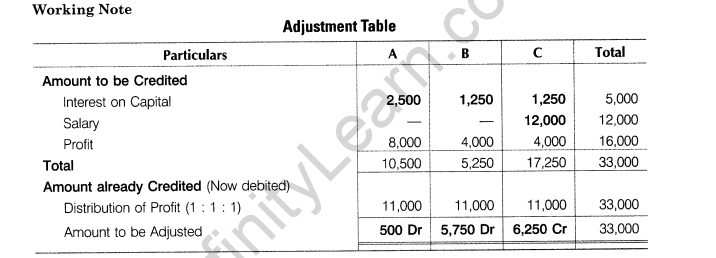

13.A, B and C are the partners in a firm sharing profits in the ratio of their capitals. On 1st January, 2015, their capital stood at Rs 50,000, Rs 25,000 and Rs 25,000 respectively. Complete the missing figures.

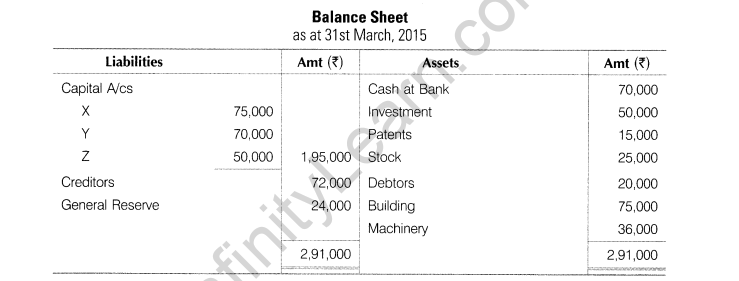

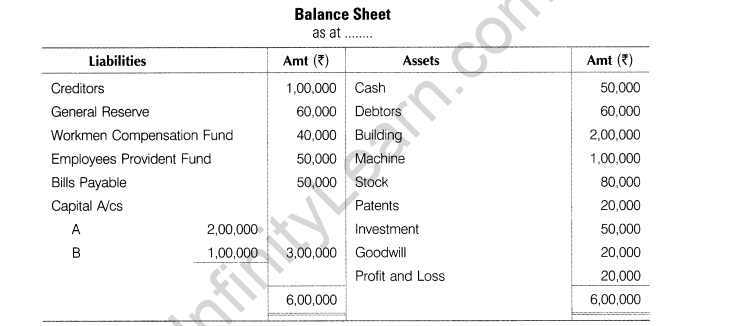

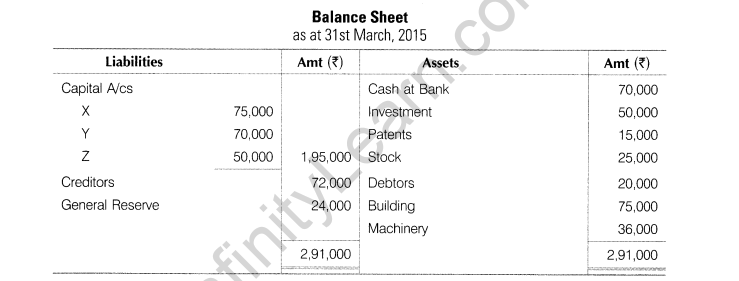

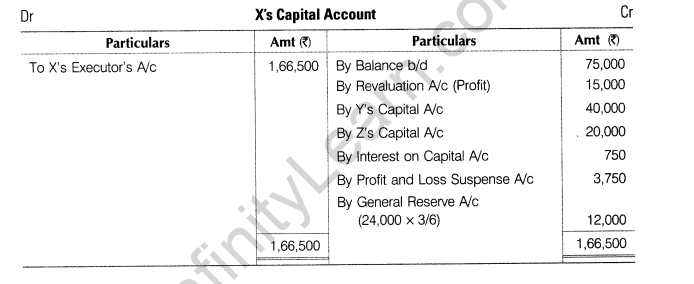

14.X, Y and Z were partners sharing profits in the ratio of 3 : 2 : 1. On 31st March, 2015, their balance sheet stood as under

X died on 31st May, 2015. It was agreed that

(i)Goodwill was valued at 3 years’ purchase of the average profits of the last five years which were, 2010-Rs 40,000, 2011-Rs 40,000, 2012-Rs 30,000,2013-Rs 40,000 and 2014 -Rs 50,000.

(ii)Interest on capital @ 6% per annum.

(iii)Machinery was valued at Rs 70,000, patents at Rs 20,000 and building at ? 66,000.

(iv)For the purpose of calculating X’s share of profits till the date of his death. It was agreed that the same be calculated based on the average profits for the last 2 years.

(v)The executor of the deceased partner is to be paid the entire amount due by means of a cheque.

Prepare X’s capital account to be rendered to his executor and also X’s executor account.

15.(i)Sultan Ltd has issued 20,000, 9% debentures of Rs 100 each of which half the amount is due for redemption on 31st March, 2015. The company has in its debenture redemption reserve account a balance of ? 5,00,000. Record the necessary journal entries at the time of redemption of debentures.

(ii)On 1st January, 2015, Sultan Ltd purchased 5,000, 15% own debentures of Rs 100 each for immediate cancellation Rs 98, the brokerage being 1%.Pass the necessary journal entries.

16.Sonia Ltd invited applications for 2,00,000 equity shares of ? 10 each. The amount was payable as follows

On application Rs 3 per share, on allotment Rs 5 per share and on first and final call Rs 2 per share.

Applications for 3,00,000 shares were received and pro-rata allotment was made to all the applicants.

Vihaan, who was allotted 3,000 shares failed to pay the allotment and call money. His shares were forfeited. Out of the forfeited shares, 2,500 shares were re-issued as fully paid-up @ Rs 8 per share.Pass the necessary journal entries to record the above transactions.

or

Ram Ltd invited applications for 8,00,000 equity shares of Rs 10 each at a premium of Rs 40 per share. The amount was payable as follows

On application — Rs 35 per share (including Rs 30 premium)

On allotment — Rs 8 per share (including Rs 4 premium)

On first and final call — Balance

Applications for 7,70,000 shares were received. Shares were allotted to all the applicants. Sumit to whom 70,000 shares were allotted failed to pay the allotment money. His shares were forfeited immediately after allotment.

Afterwards the first and final call was made. Sohail, the holder of 5,000 shares failed to pay the first and final call. His shares were also forfeited. Out of the forfeited shares 10,000 shares were re-issued at Rs 50 per share fully paid-up. The re-issued shares included all the shares of Sohail. Pass necessary journal entries for the above transactions in the books of Ram Ltd.

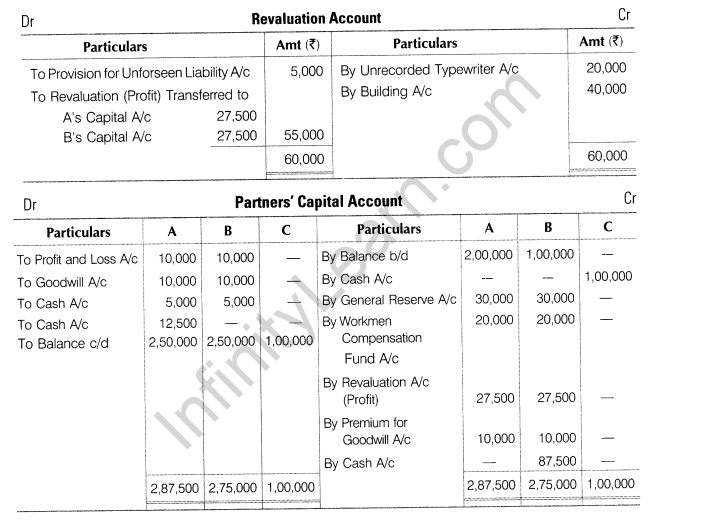

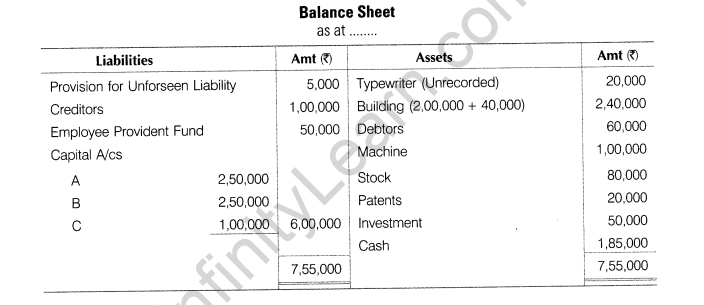

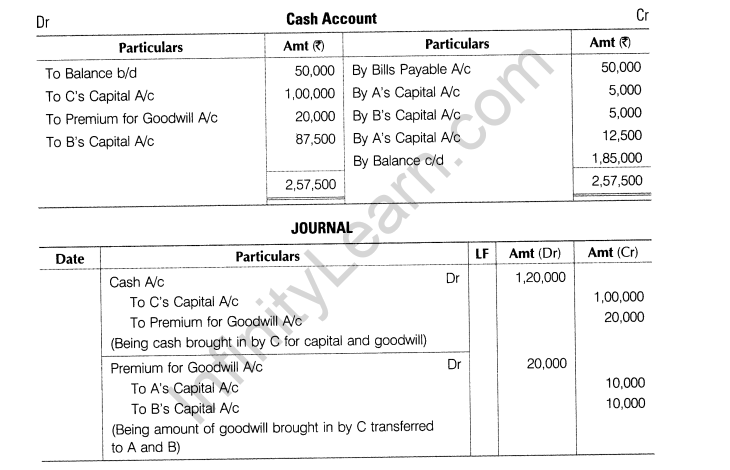

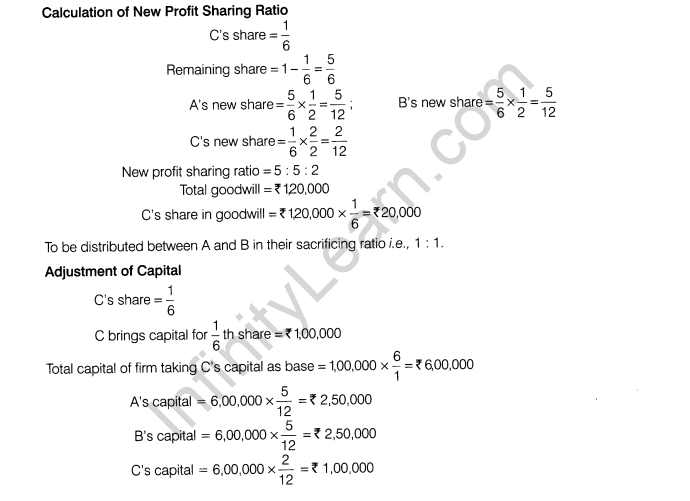

17.A and B are partners sharing profits and losses in the ratio of 1:1. Following in their balance sheet:

Adjustments

(i)C comes for l/6th share and brings capital of Rs 1,00,000 and proportionate share in goodwill.

(ii)Goodwill of the firm valued at Rs 1,20,000.

(iii)Half premium withdrawn by old partners.

(iv)Rs 20,000 unrecorded typewriter brought into books.

(v)Make Rs 5,000 provision for unforseen liabilities.

(vi)Bills payable paid off.

(vii) Building founded undervalued by Rs 40,000.

(viii) Capital of A and B adjusted in new profit sharing ratio on the basis of C’s capital, f The difference is adjusted in cash. Prepare revaluation account, partners’ capital account, cash account and balance sheet of the new firm.

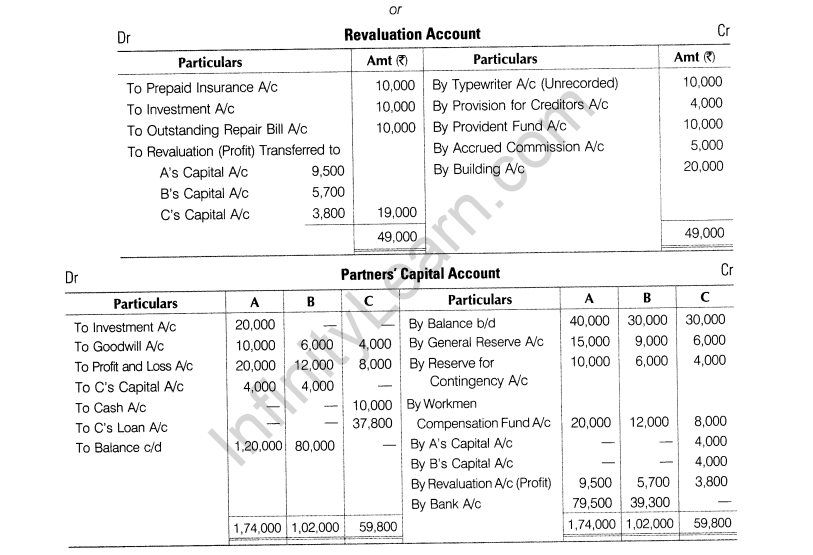

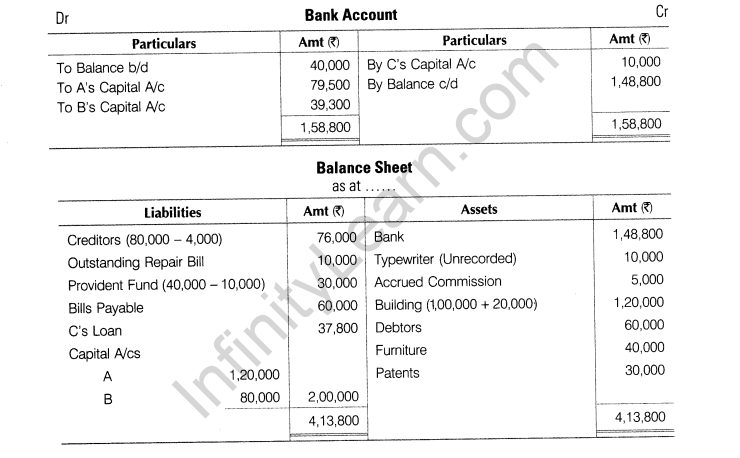

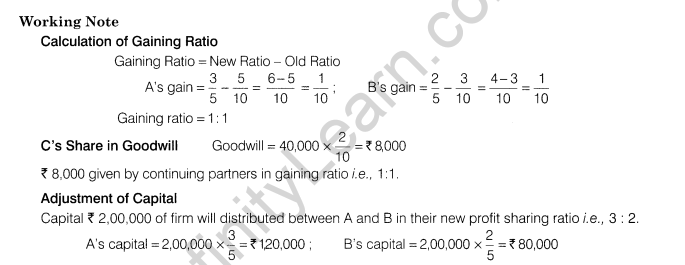

or

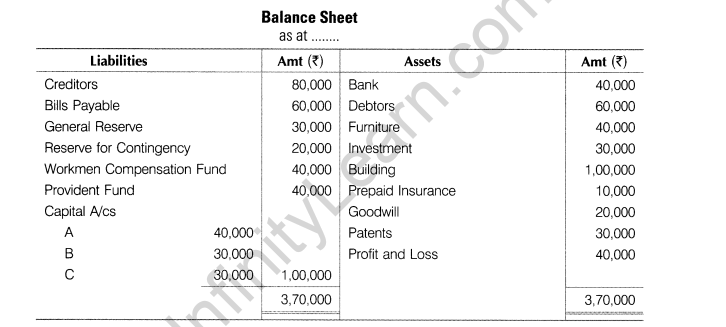

A, B and C are partners with profit sharing ratio 5:3:2. Their balance sheet is as follows

Adjustments

(i)C takes retirement, new ratio of A and B is 3:2.

(ii) Rs 10,000 given to C in cash and balance transferred to C’s loan account.

(iii)Capital of new firm fixed at Rs 2,00,000 and difference adjusted in cash.

(iv)Prepaid insurance is no more required.

(v)Rs 10,000 unrecorded typewriter has to be shown in the balance sheet.

(vi)Investment is valued at Rs 20,000 and is taken over by A at this value.

(vii)Make 5% provision for discount on creditors.

(viii) Outstanding repair bills due Rs 10,000.

(ix)Provident fund decreased by 10,000.

(x)Accrued commission Rs 5,000.

(xi)Building increased by 20%.

(xii)Goodwill of the firm valued at Rs 40,000.

Prepare necessary ledgers

Part B

(Financial Statements Analysis)

18.Under which type of activity will you classify cash receipt from debtors while preparing cash flow statement?

19.State with reason whether deposit of cash into bank will result into inflow, outflow or no flow of cash?

20.(i) Under what main headings and sub-headings will you classify the following

items in the balance sheet of a company?

(a)Bills payable

(b) Debentures

(c)Interest accrued on investment

(d)Shares of XYZ Ltd

(e)Share options outstanding account

(f)Short-term loans

(ii)What is the importance of analysis of financial statements from the point of view of taxation authorities?

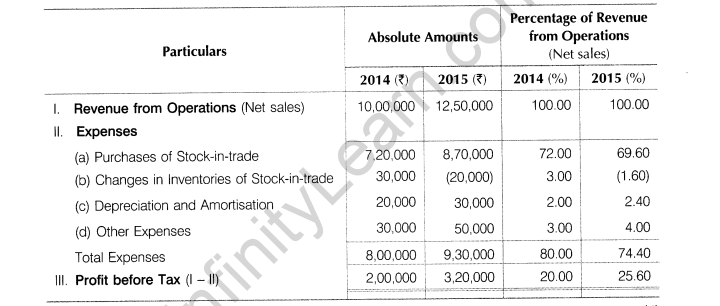

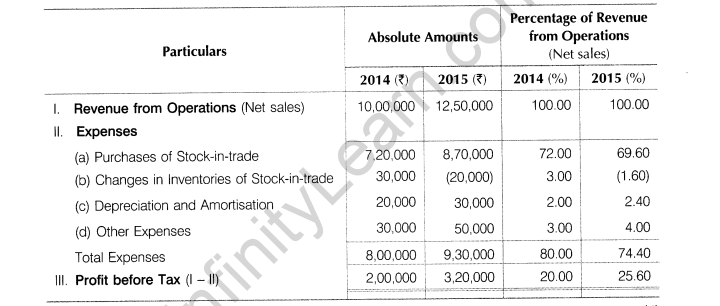

21.From the following common size statement of profit and loss, compute gross profit ratio and net profit ratio.

Common size statement for the year ended 2014 and 2015

22.Current ratio of a company is 2.5 : 1. State giving reasons, which of the following would improve, decline or not change the ratio?

(i)Purchase of building by issuing debentures

(ii)Repayments of long-term loans

(iii)Cash paid to creditors

(iv)Payment of outstanding liabilities

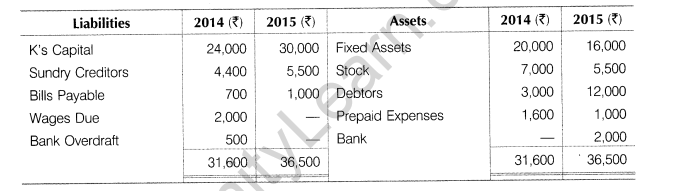

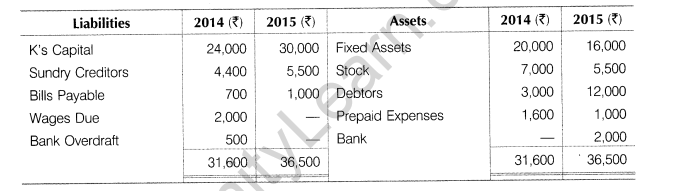

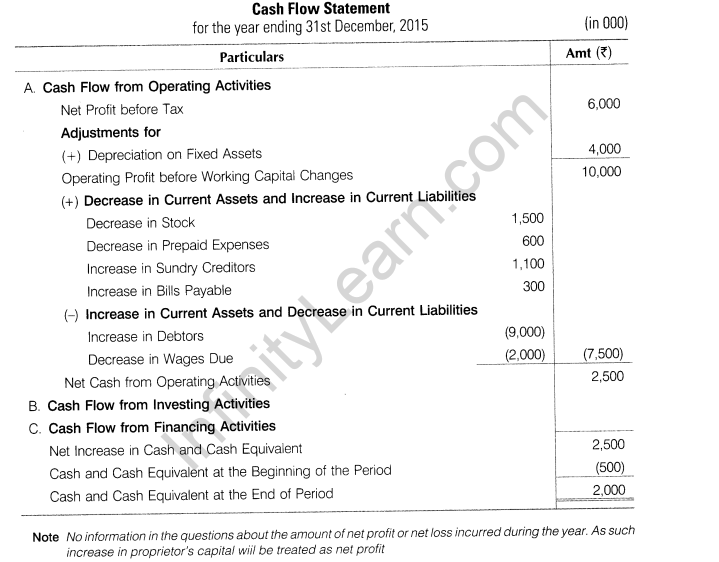

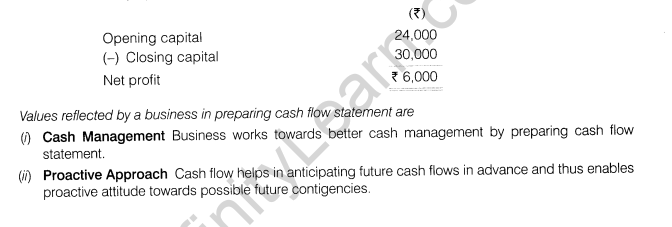

23.Prepare cash flow statement from the following balance sheet of Mr K as at 31st March 2015

Additional Information

(i)There was neither any drawings nor any capital addition during the year.

(ii)There was no purchase/sale of fixed assets.

Identify the values shown by the business in preparing cash flow statement.

Answers

Part A

(Accounting for Partnership Firms and Companies)

1.When shares are forfeited, share capital account is debited with what amount?

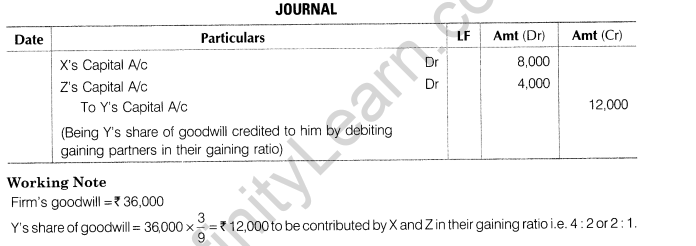

Ans.Called-up value of shares

2.X, Y and Z are partners sharing profits in the ratio of 4 : 3 : 2. Y retires and the goodwill of the firm is valued at Rs 36,000. Pass journal entry for the treatment of goodwill on Y’s retirement.

Ans.

3.Advise M/S PQR & Co whether to debit salary and commission of partners to the profit and loss appropriation account or profit and loss account?

Ans.Salary and commission to partners is an appropriation of profits. Therefore, it should be debited to profit and loss appropriation account

4.As per AS-26, goodwill is to be recorded in the books of accounts only when money or money’s worth has been paid for it. If the new partner is unable to bring his share of goodwill, how will it be dealt?

Ans.In such a situation, new partner’s capital account will be debited with his share of goodwill while sacrificing partners’ capital account will be credited with their respective shares. In case of fixed capital accounts, their current accounts will be debited and credited.

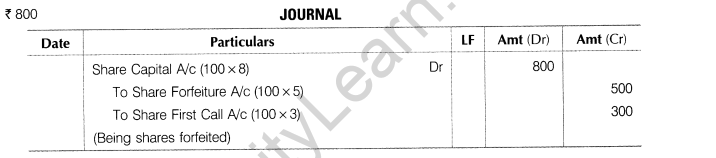

5.The company issued shares of Rs 10 each at a premium of Rs 2 payable as:

On application Rs 3

On allotment Rs 4 (including premium)

On first Call Rs 3

On second and final Call Rs 2

Mr X who holds 100 shares failed to pay the first call money. The company has forfeited the 100 shares after the first call. On forfeiture, the amount debited to share capital account would be?

Ans.

6.Ram and Shyam are partners sharing profits is the ratio of 3 : Mrs Ram has given a loan of Rs 4,00,000 to the firm and the firm also obtained a loan of 12,00,000 from Shyam. The firm was dissolved and its assets were realised for Rs 5,00,000. State the order of payment of Mrs Ram’s loan and Shyam’s loan with reason, if there were no other creditors of the firm.

Ans.According to Section 48 of the Indian Partnership Act 1932, first of all, the payment ofRs 4,00,000 will be made for Mrs Ram’s loan (as it is an external liability), then remaining? 1,00,000 will be paid to Shyam against his loan ofRs 2,00,000

7.Define right issue and buy back of shares?

Ans.(i)Right Issue The existing shareholders, under Section 62 of the Companies Act, 2013 have a right to

subscribe to fresh issue of share capital made by the comapny in proportion to their existing shareholdings. They may subscribe to the offer in full or in part or may reject it or may renounce the right. Alternatively, the company may seek their approval, through passing a special resolution, to offer the fresh issue to the public in general.

(ii) Buy-back of shares The term ‘buy-back’ of shares implies the act of purchasing its own shares by the company.

Sources of funds for buy-back are [Section 52(2)]

(a)Free reserve or

(b)The securities premium reserve account or

(c)The proceeds of any shares or other specified securities

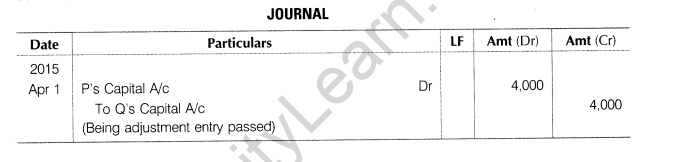

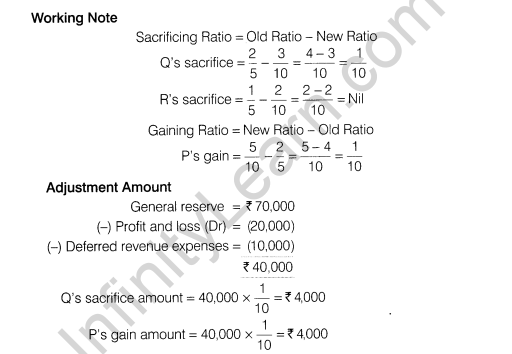

8.R Q and R are partners sharing profits in the ratio of 2 : 2 : 1. On 1st April, 2015, they decided to share profits in the ratio of 5 : 3 : 2. On that date, following balances appearing in the balance sheet Profit and loss (debit balance t 20,000); general reserve Rs 70,000; deferred revenue expenditure Rs 10,000.Pass adjusting journal entry without affecting the book values.

Ans.

9.XYZ Ltd is in garment business. As its corporate social responsibility. It decided to install 100 toilets in schools. The project was named “Swasth Bharat”. It purchased materials worth 11,25,000 from Indian Traders Ltd. Payment made as Rs 10,000 by a cross cheque and remaining by issuing equity shares of Rs 10 each at 15% premium. Pass journal entry for the same. Identify the value being conveyed in the question.

Ans.

10.1,200 shares of Rs 10 each issued at premium of Rs 2 per share were forfeited for non-payment of allotment money of 13 per share (including Rs 1 premium). The first and final call of Rs 2 (including t 1 premium) was not yet made. 600 of the forfeited shares were re-issued for Rs 3,300 credited as fully paid.

Ans.

11.X, Y and Z are partners sharing profits in the ratio of 5 : 3: 7. On 1st April, 2015, X gave a notice to retire from the firm. Y and Z decided to share future profits in the ratio of 2 : 3. The adjusted capital accounts of Y and Z showed a balance of Rs 66,000 and Rs 1,41,000 respectively. The total amount to be paid to X is 11,81,000. This amount is to be paid by Y and Z in such a way that their capitals become proportionate to their new profit sharing ratio. Pass necessary journal entries for the above transactions in the books of the firm. Show your working clearly.

Ans.

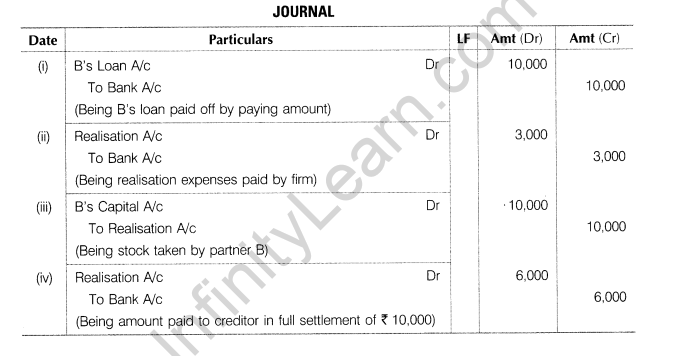

12.Pass journal entries in the following cases at the time of dissolution

(i)B’s loan paid off Rs 10,000.

(ii)Rs 3,000 dissolution expenses paid by firm.

(iii)Stock was taken over by B, a partner at Rs 10,000.

(iv)Rs 10,000 unrecorded creditors settled at Rs 6,000.

Ans.

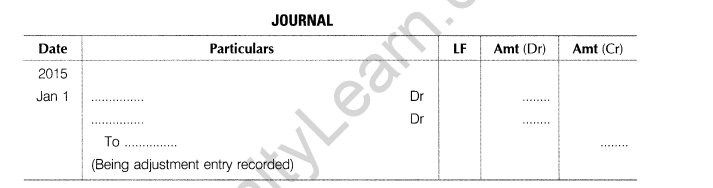

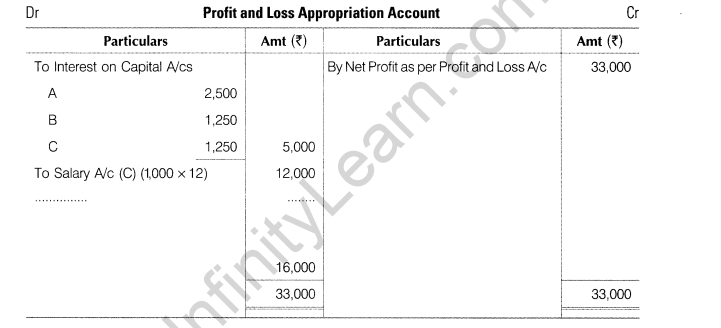

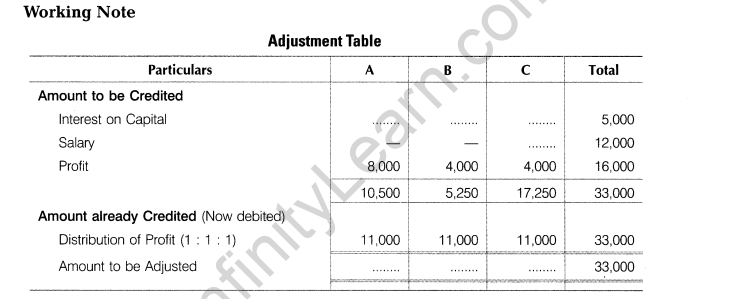

13.A, B and C are the partners in a firm sharing profits in the ratio of their capitals. On 1st January, 2015, their capital stood at Rs 50,000, Rs 25,000 and Rs 25,000 respectively. Complete the missing figures.

Ans.

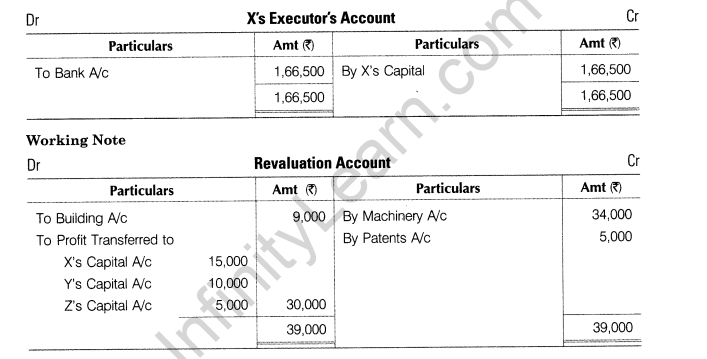

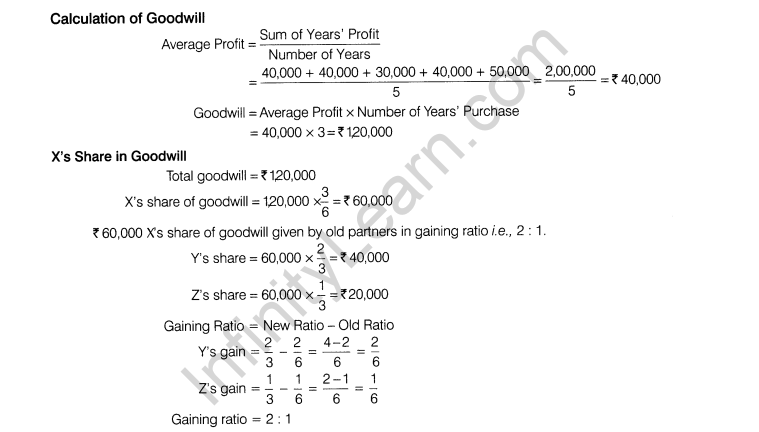

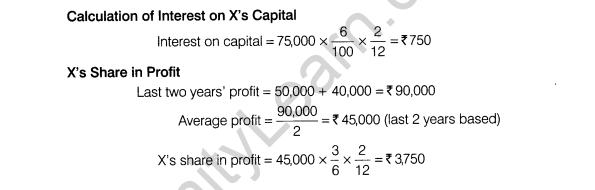

14.X, Y and Z were partners sharing profits in the ratio of 3 : 2 : 1. On 31st March, 2015, their balance sheet stood as under

X died on 31st May, 2015. It was agreed that

(i)Goodwill was valued at 3 years’ purchase of the average profits of the last five years which were, 2010-Rs 40,000, 2011-Rs 40,000, 2012-Rs 30,000,2013-Rs 40,000 and 2014 -Rs 50,000.

(ii)Interest on capital @ 6% per annum.

(iii)Machinery was valued at Rs 70,000, patents at Rs 20,000 and building at ? 66,000.

(iv)For the purpose of calculating X’s share of profits till the date of his death. It was agreed that the same be calculated based on the average profits for the last 2 years.

(v)The executor of the deceased partner is to be paid the entire amount due by means of a cheque.

Prepare X’s capital account to be rendered to his executor and also X’s executor account.

Ans.

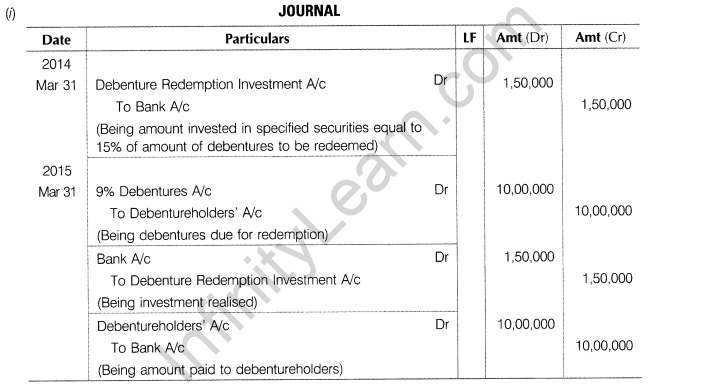

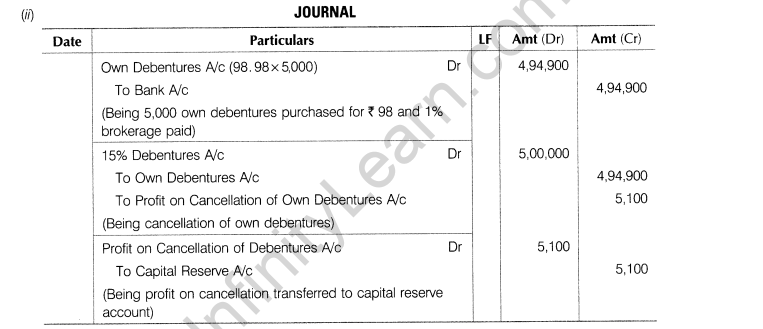

15.(i)Sultan Ltd has issued 20,000, 9% debentures of Rs 100 each of which half the amount is due for redemption on 31st March, 2015. The company has in its debenture redemption reserve account a balance of ? 5,00,000. Record the necessary journal entries at the time of redemption of debentures.

(ii)On 1st January, 2015, Sultan Ltd purchased 5,000, 15% own debentures of Rs 100 each for immediate cancellation Rs 98, the brokerage being 1%.Pass the necessary journal entries.

Ans.

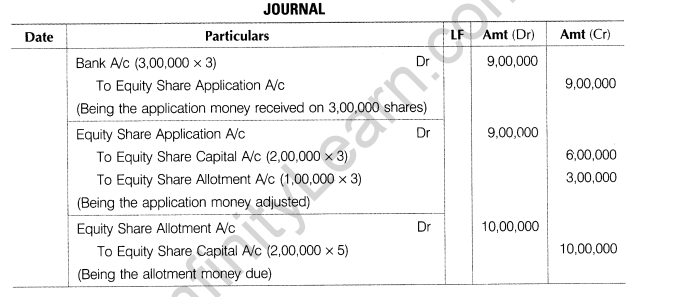

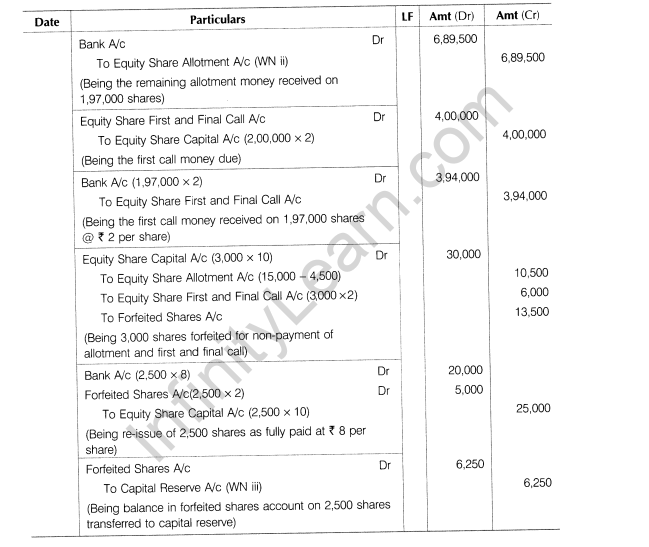

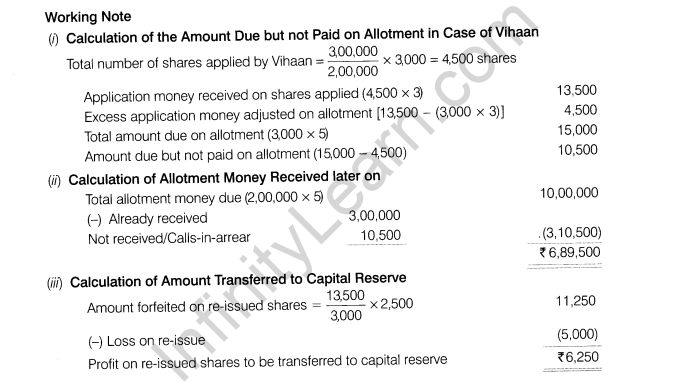

16.Sonia Ltd invited applications for 2,00,000 equity shares of Rs 10 each. The amount was payable as follows

On application Rs 3 per share, on allotment Rs 5 per share and on first and final call Rs 2 per share.

Applications for 3,00,000 shares were received and pro-rata allotment was made to all the applicants.

Vihaan, who was allotted 3,000 shares failed to pay the allotment and call money. His shares were forfeited. Out of the forfeited shares, 2,500 shares were re-issued as fully paid-up @ Rs 8 per share.Pass the necessary journal entries to record the above transactions.

or

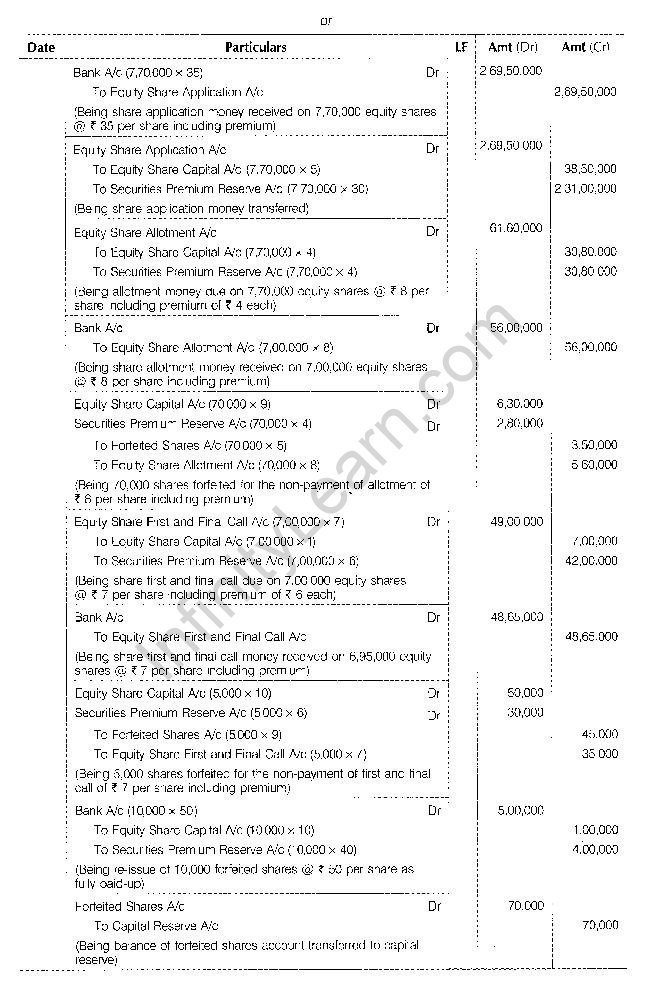

Ram Ltd invited applications for 8,00,000 equity shares of Rs 10 each at a premium of Rs 40 per share. The amount was payable as follows

On application — Rs 35 per share (including Rs 30 premium)

On allotment — Rs 8 per share (including Rs 4 premium)

On first and final call — Balance

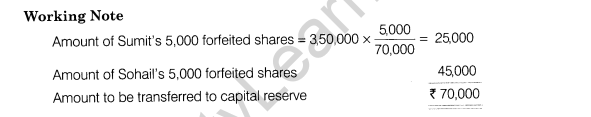

Applications for 7,70,000 shares were received. Shares were allotted to all the applicants. Sumit to whom 70,000 shares were allotted failed to pay the allotment money. His shares were forfeited immediately after allotment.

Afterwards the first and final call was made. Sohail, the holder of 5,000 shares failed to pay the first and final call. His shares were also forfeited. Out of the forfeited shares 10,000 shares were re-issued at Rs 50 per share fully paid-up. The re-issued shares included all the shares of Sohail. Pass necessary journal entries for the above transactions in the books of Ram Ltd.

Ans.

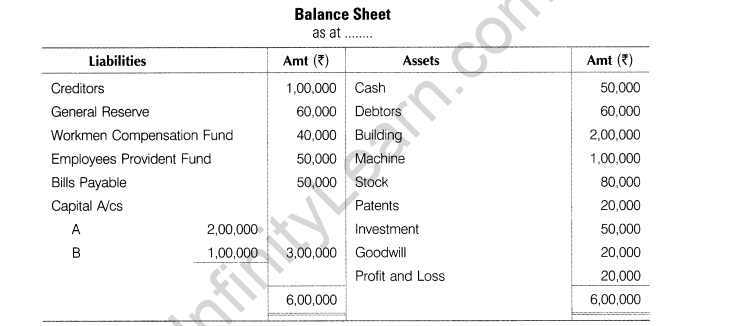

17.A and B are partners sharing profits and losses in the ratio of 1:1. Following in their balance sheet:

Adjustments

(i)C comes for l/6th share and brings capital of Rs 1,00,000 and proportionate share in goodwill.

(ii)Goodwill of the firm valued at Rs 1,20,000.

(iii)Half premium withdrawn by old partners.

(iv)Rs 20,000 unrecorded typewriter brought into books.

(v)Make Rs 5,000 provision for unforseen liabilities.

(vi)Bills payable paid off.

(vii) Building founded undervalued by Rs 40,000.

(viii) Capital of A and B adjusted in new profit sharing ratio on the basis of C’s capital, f The difference is adjusted in cash. Prepare revaluation account, partners’ capital account, cash account and balance sheet of the new firm.

or

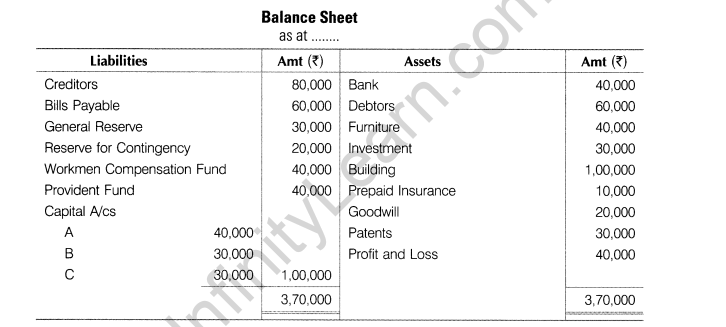

A, B and C are partners with profit sharing ratio 5:3:2. Their balance sheet is as follows

Adjustments

(i)C takes retirement, new ratio of A and B is 3:2.

(ii) Rs 10,000 given to C in cash and balance transferred to C’s loan account.

(iii)Capital of new firm fixed at Rs 2,00,000 and difference adjusted in cash.

(iv)Prepaid insurance is no more required.

(v)Rs 10,000 unrecorded typewriter has to be shown in the balance sheet.

(vi)Investment is valued at Rs 20,000 and is taken over by A at this value.

(vii)Make 5% provision for discount on creditors.

(viii) Outstanding repair bills due Rs 10,000.

(ix)Provident fund decreased by 10,000.

(x)Accrued commission Rs 5,000.

(xi)Building increased by 20%.

(xii)Goodwill of the firm valued at Rs 40,000.

Prepare necessary ledgers

Ans.

Part B

(Financial Statements Analysis)

18.Under which type of activity will you classify cash receipt from debtors while preparing cash flow statement?

Ans.Operating activity

19.State with reason whether deposit of cash into bank will result into inflow, outflow or no flow of cash?

Ans.Deposit of cash into bank does not result in cash flow. It is simply a movement between two components of cash and cash equivalents.

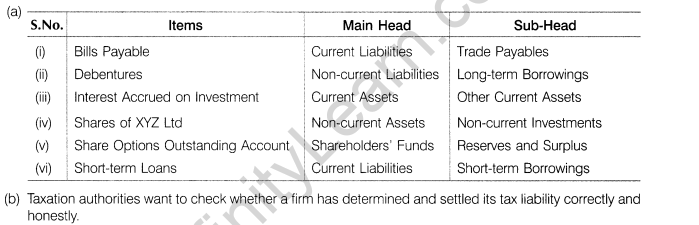

20.(i) Under what main headings and sub-headings will you classify the following

items in the balance sheet of a company?

(a)Bills payable

(b) Debentures

(c)Interest accrued on investment

(d)Shares of XYZ Ltd

(e)Share options outstanding account

(f)Short-term loans

(ii)What is the importance of analysis of financial statements from the point of view of taxation authorities?

Ans.

21.From the following common size statement of profit and loss, compute gross profit ratio and net profit ratio.

Common size statement for the year ended 2014 and 2015

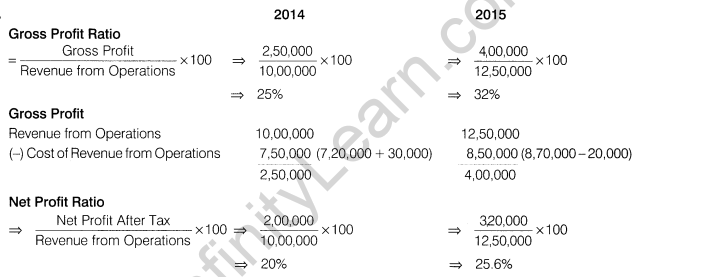

Ans.

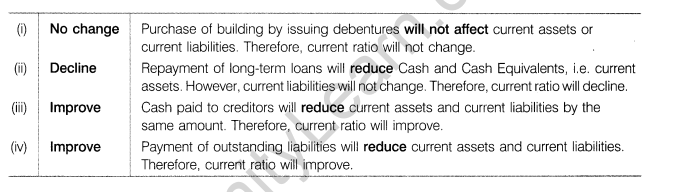

22.Current ratio of a company is 2.5 : 1. State giving reasons, which of the following would improve, decline or not change the ratio?

(i)Purchase of building by issuing debentures

(ii)Repayments of long-term loans

(iii)Cash paid to creditors

(iv)Payment of outstanding liabilities

Ans.

23.Prepare cash flow statement from the following balance sheet of Mr K as at 31st March 2015

Additional Information

(i)There was neither any drawings nor any capital addition during the year.

(ii)There was no purchase/sale of fixed assets.

Identify the values shown by the business in preparing cash flow statement.

Ans.

(Download Questions PDF)

[gview file=”https://resultscareer.files.wordpress.com/2016/01/cbse-sample-papers-for-class-12-accountancy-solved-2016-set-6-questions.pdf”]

(Download Solutions PDF)

[gview file=”https://resultscareer.files.wordpress.com/2016/01/cbse-sample-papers-for-class-12-accountancy-solved-2016-set-6-solutions.pdf”]