National Income and Related Aggregates – CBSE Notes for Class 12 Macro Economics

Introduction:

This is a numerical based chapter to calculate national income by different methods (Income, expenditure and value added method, their steps and precautions). Numerically to determine private income, personal income, personal disposable income, National disposable income (net and gross) and their differences.

Gross And Net:

1. Gross means the value of product including depreciation. Net means the value of product excluding depreciation.

2. The difference between these two terms is depreciation.

3. Where depreciation is the expected decrease in the value of fixed capital assets due to its general use.

4. It is the result of production process.

Gross = Net + Depreciation Net = Gross – Depreciation

Note: Other names of depreciation are:

(a) Consumption of fixed capital (b) Capital consumption allowance

(c) Current replacement cost.

National Income And Domestic Income:

1. National Income refers to net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

2. Domestic Income refers to a total factor incomes earned by the factor of production within the domestic territory of a country during an accounting year.

3. The difference between these two incomes is Net Factor Income from abroad (NFIA), which is included in National Income (NY) and excluded from Domestic Income (DY).

4. Where NFIA is the difference between income earned by normal residents from rest of the world and similar payments made to Non residents within the domestic territory. NFIA = Income earned by Residents from rest of the world (ROW) – Payments to

Non-Residents within Domestic territory.

NY = DY + NFIA DY = NY – NFIA

Note:

Case I: Income paid to abroad is given, then to make NFIA inverse the sign. For this put income from abroad 0.

Example, Income paid to abroad =100

NFIA = Income from Abroad – Income paid to abroad

= 0 – 100 = -100 and vice versa.

Case II: Income from abroad is given, then NFIA = Income from abroad. For this put income paid to abroad 0.

Example, Income from abroad =100

NFIA = Income from Abroad- Income paid to abroad = 100 – 0 = 100 and vice versa Case III: If income from abroad and income paid to abroad both are given, then NFIA is the difference between them,

Example, Income from abroad =100 Income paid to abroad =120

NFIA = Income from Abroad- Income paid to abroad = 100 – 120 = (-) 20 and vice versa Case IV: Net factor income to abroad be given, then to make NFIA inverse the sign.

Net factor income paid to abroad (NFPA) = income to abroad – income from abroad.

Example,

(i) Net Factor Income to abroad (NFPA = 100). In this NFPA is positive, which means that income to abroad is greater than income from abroad, which makes,

NFIA = (-)100

(ii) Net Factor Income to abroad [NFPA = (-)100]. In this NFPA is negative, which

means that income to abroad is less than income from abroad, which makes,

NFIA = (+) 100

Factor Cost And Market Price:

1. Factor Cost (FC): It refers to amount paid to factors of production for their contribution in the production process.

2. Market Price (MP): It refers to the price at which product is actually sold in the market. The difference between these two is Net Indirect Taxes (NIT) which is included in MP and excluded from FC. Where NIT is the difference between indirect taxes and subsidies.

NIT = IT – Subsidies

Where, Indirect Taxes are the taxes which are levied by the government on production and sale of commodity. Sales tax, excise duty, custom duty, etc. are some of the indirect taxes, and subsidies are the cash grants given by the government to the enterprises to encourage production of certain commodities, to promote exports or to sell goods at prices lower than the free market Price. In India, LPG cylinder is sold at subsidized rates.

MP = FC + NIT (Indirect Taxes – Subsidies)

FC = MP – NIT (Indirect Taxes – Subsidies)

Note:

Case I: Subsidy is given, then to make NIT inverse the sign. For this put Indirect tax = 0.

Example, Subsidy = 100

NIT = Indirect Tax – subsidies = 0-100 = (-) 100 and vice versa

Case II: IT is given, then NIT = IT (For this put subsidy 0)

Example, IT = 100

NIT = Indirect Tax – subsidies = 100-0 = 100 and vice versa

Case III: If IT and subsidy both are given, then NIT is the difference.

Example, IT = 100

Subsidy = 80

NIT = Indirect Tax – subsidies = 100-80 = 20

Case IV: If sales tax and excise duty are given, then by adding both, we get indirect taxes.

Example, Sales tax = Rs. 1000

Excise duty = Rs.1000 Subsidy = Rs.500

NIT = Indirect Tax(sales tax + excise duty)-subsidies = (1000 + 1000) – 500 = 1500

Case V: If Net subsidy is given, then to convert it into Net Indirect tax, we have to inverse the sign,

Net Subsidy = Subsidy – Indirect Tax

Example,

(a) Net Subsidy = 100. In this, Net subsidy is positive, which means that indirect tax is less than subsidy which makes,

NIT = (-) 100

(b) Net Subsidy = (-) 100. In this Net subsidy is negative which means that Indirect tax is greater than subsidy which makes,

NIT = 100

Case VI: If Net subsidy and Indirect tax both are given, then we have to ignore Indirect Tax and inverse the sign of Net subsidy.

Example, Net Subsidy = 100

Indirect Tax = 20 Net Indirect Tax = (-) 100 Numeribals Illustration on Basic Concept

Aggregate Of National Income

1. Gross Domestic Product at Market Price (GDPMP ): GDPMP is defined as the gross market value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units.

(a) ‘Gross’ in GDPMP signifies that depreciation is included, i.e., no provision has been made for depreciation.

(b) ‘Domestic’ in GDPMP signifies that it includes all the final goods and services produced by all the production units located within the economic territory (irrespective of the fact whether produced by residents or non-residents).

(c) ‘Market Price’ in GDPMP signifies that indirect taxes are included and subsidies are excluded, i.e., it shows that Net Indirect Taxes (NIT) have been included.

(d) ‘Product’ in GDPMP signifies that only final goods and services have to be included and intermediate goods should not be included to avoid the double counting.

2. Gross Domestic Product at Factor Cost ( GDPFC): GDPFC is defined as the gross factor value of the final goods and services produced within the domestic territory of a country during an accounting year by all production units excluding Net Indirect Tax.

GDPFC = GDPMP – Net Indirect Taxes

3. Net Domestic Product at Market Price (NDPMP ).

NDPMP is defined as the net market value of all the final goods and services produced within the domestic territory of a country by its normal residents and non-residents during an accounting year.

NDPMP =GDPMP – Depreciation

4. Net Domestic Product at Factor Cost (NDPFC ).

NDPFC refers to a total factor income earned by the factor of production within the domestic territory of a country during an accounting year.

NDPFC = GDPMP – Depreciation – Net Indirect Taxes NDPFC is also known as Domestic Income or Domestic factor income.

5. Gross National Product at Market Price (GNPMP).

GNPMP refers to market value of all the final goods and services produced by the normal residents of a country during an accounting year.

GNPMP = GDPMP + Net factor income from abroad It must be noted that GNPMP can be less than GDPMP when NFIA is negative. However, GNPMP will be more than GDPMP when NFIA is positive.

6. Gross National Product at Factor Cost (GDPFC ) or Gross National Income GNPFC refers to gross factor value of all the final goods and services produced by the normal residents of a country during an accounting year.

GDPFC = GNPMP – Net Indirect Taxes

7. Net National Product at Market Price (NNPMP ).

NNPMP refers to net market value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPMP = GNPMP – Depreciation

8. Net National Product at Factor Cost (NNPFC ).

NNPFC refers to net money value of all the final goods and services produced by the normal residents of a country during an accounting year.

NNPFC = GNPMP – Depreciation – Net Indirect Taxes It must be noted that NNPFC is also known as National Income.

Real, Nominal Aggregates, Activities Excluded From GDP And Does GDP Measures Social Welfare:

1. National Income at Constant Price:

(a) If national income is calculated on the basis of base year price index, then it is known as National income at constant price.

(b) It is also called Real National Income as it fluctuates due to the fluctuation in the flow of goods and services and price remains constant.

2. National Income at Current Price:

(a) If National Income is calculated on the basis of current year price index, then it is known as national income at current price.

(b) It is also called Monetary National Income as it fluctuates due to the fluctuation in the flow of goods and services along with the price of the commodity.

3. GNP at current MP: When final goods and services included in GNP are valued at current MP, i.e., prices prevailing in the year for which GNP is being measured, it is called GNP at current MP or Nominal GNP.

4. GNP at constant MP: When final goods and services included in GNP are valued at constant prices, i.e. prices of the base year, it is called GNP at constant MP or Real GNP.

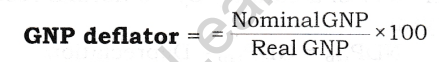

5. GNP Deflator: GNP Deflator measures the average level of the prices of all the final goods and services that are produced within the domestic territory of an economy including NFIA. GNP deflator is measured as the ratio of nominal GNP to real GNP, multiplied by 100.

6. Green GNP: Green GNP refers to GNP adjusted for loss of value due to,

(a) Environmental degradation; and

(b) Depletion of natural resources on account of overall production activity in the

economy.

7. Activities excluded from GDPMP: The activities are as follows:

(a) Purely financial transactions: It may be of three types:

(i) Buying and selling of securities

(ii) Government Transfer payments

(iii) Private Transfer Payments

(i) Buying and selling of securities:

• In financial markets potential savers and investors buy and sell financial assets such as shares and bonds.

• While someone buys a share, there is only a transfer of ownership right. It is a claim to ownership of assets.

• Trading in financial instruments does not imply production of final goods and services. As such these are not included in the GNP.

(ii) Government Transfer Payments:

• Transfer Payments are payments for which no goods and services are provided in exchange.

• • Pension payments employees social security measures, etc. are examples for

Government Transfer Payment as there is no production of final goods and services in response to transfer Payment, transfer payments are not included in GNP.

(iii) Private Transfer Payments:

• Items such as pocket money given by parents to their children, elders gifting money to the young ones are private transfer payments.

This is merely a transfer of money from one individual to another. Hence, this is not included in GNP.

(b) Transfer of used goods:

(i) GNP refers to the value of the final goods and services produced in a given year.

(ii) Hence, goods produced in the previous time period cannot be included in the GNP. For example, Mr A sells his old bike to Mr B for rs. 30,000 on 25th April 2011 which was purchased by Mr A on 1st March 2010 for Rs. 45,000. This transaction should not be included as it has already been included in the 2010 GNP and if we again include it, then it will create the problem of double counting.

(c) Non-market goods and services:

(i) Many final goods and services are not acquired through regular market transaction. Vegetables can be grown in the backyard instead of buying them from the super market or an electrical fault can be repaired by the house owner himself instead of hiring an electrician.

(ii) These are examples of Non-marketed goods and services that have been consumed with using organized markets as GNP includes only those transactions that occur through market activities.

(d) Illegal Activities: Activities like gambling, black-marketing etc., should be excluded because all unlawful activities are beyond the scope of NY and also because there is statistical problem of their estimation.

(e) Leisure Time Activities: Activities like painting, growing of flowers in kitchen garden, etc. is not included as their aim is not to earn money but to pass away free time in one’s hobby or entertainment, again there is statistical problem of measuring their satisfaction derived in painting or any other leisure activities.

8. Limitations of using GDP as an index of welfare of a country: There are many

reasons behind this. These are:

(a) Many goods and services contributing economic welfare are not included in GDP or Non-Monetary exchanges:

(i) There are many goods and services which are left out of estimation of national income on account of practical estimation difficulties e.g., services of housewives and other members, own account production, etc.

(ii) These are left on account of non-availability of data and problem in valuation.

(iii) It is generally agreed that these items contribute to economic welfare.

(iv) So, if we depend only on GDP, we would be underestimating economic welfare.

(b) Externality:

(i) When the activities of somebody result in benefits or harms to others with no payment received for the benefit and na payment made for the harm done, such benefits and harms are called externalities.

(ii) Activities resulting in benefits to others are positive externalities and increase welfare; and those resulting in harm to others are called negative externalities, and thus decrease welfare.

(iii) GDP does not take into account these externalities.

For example, construction of a flyover or a highway reduces transport cost and journey time of its users who have not contributed anything towards its cost. Expenditure on construction is included in GDP but not the positive externalities flowing from it. GDP and positive externalities both increase welfare. Therefore, taking only GDP as an index of welfare understates welfare. It means that welfare is much more than it is indicated by GDP.

(iv) Similarly, GDP also does not take into account negative externalities. For examples, factories produce goods but at the same time create pollution of water and air. River Yamuna, now a drain, is a living example. The pollution harms people. The factories are not required to pay anything for harming people. Producing goods increases welfare but creating pollution reduces welfare. Therefore, taking only GDP as an index of welfare overstates welfare. In this case, welfare is much less than indicated by GDP.

(c) Change in the distribution of income (GDP) may affect welfare:

(i) All people do not earn the same amount of income. Some earn more and some earn less. In other words, there is unequal distribution of income.

(ii) At the same time, it is also true that in the event of rise in ‘per capita real income’ all are not better off equally. ‘Per capita’ is only an average. Income of some may rise by less and of some by more than the national average. In case of some it may even fall.

(iii) It means that the inequality in the distribution of income may increase or decrease.

(iv) If it increase it implies that rich become more rich and the poor become more poor.

(v) Utility of a rupee of income to the poor is more than to the rich. Suppose, the income of the poor declines by one rupee and that of the rich increases by one rupee. In such a case, the decline in welfare of the poor will be more than the increase in welfare of the rich.

(vi) Therefore, if the rise in per capita real income inequality increases, it may lead to a decline in welfare (in the macro sense).

(d) All products may not contribute equally to economic welfare:

(i) GDP includes different types of products, like food articles, houses, clothes, police services, military services, etc.

(ii) Some of these products contribute more to the welfare of the people, like food, clothes, houses, etc. Other products like police services, military services etc. may comparatively contribute less and may not directly affect the standard of living of the people.

(iii) Therefore, how much is the economic welfare would depend more on the types of goods and services produced, and not simply how much is produced.

(iv) It means that if GDP rises, the increase in welfare may not be in the same proportion.

(e) Contribution of some products may be negative:

(i) GDP includes all final products whether it is milk or liquor.

(ii) Milk may provide both immediate and ultimate satisfaction to consumers. On the other hand, liquor may provide some immediate satisfaction, but because of its harmful effects on health it may lead to decline in welfare.

(iii) GDP include only the monetary values of the products and not their contribution to welfare.

(iv) Therefore, economic welfare depends not only on the volume of consumption but also on the type or goods and services consumed.

Methods Of National Income And How To Determine National Income By Income Method And Its Numericals, Steps And Precaution:

There are three methods of calculating national income.

These are:

(a) Income Method

(b) Expenditure Method

(c) Value Added Method/Product Method/Output Method

National Income determination under income method:

(a) “Production creates income”. If we want to calculate National Income by Income method, then we have to add different factor incomes from the economy.

(b) The addition of all these factor incomes gives us the calculation near by the

National Income, i.e., Net Domestic Product at FC (NDPfc).

(c) Components of Income Method

1. Compensation Of Employees (COE)/Emoluments of employees: The amount

earned by employees from their employers, whether in cash or in kind or through any

other social security scheme is known as compensation of employees.

This is broadly divided into the following three components:

(a) Wages and Salaries payable in Cash:

(i) Wages and salaries receivable by the employees in respect of their work.

(ii) Special allowances for working overtime.

(iiij Cost of travel to and from work, and car parking.

(iv) Bonuses

(v) Commissions, gratuities, tips, cost of living (i.e., dearness allowance paid in our country) honorarium, vacation, sick leave allowance etc.

(vi) Pensions at the time of retirement (Deferred Wage): Pensions at the time of retirement are related to factor services rendered by recipient prior to their retirement. It is also known as deferred wage.

Any expenses incurred by the employees and thereafter reimbursed by the business enterprise should be excluded from Compensation Of Employees (COE) as such expenses are part of intermediate consumption of business enterprise.

(b) Wages and Salaries in Kind: Remuneration in kind consists of goods and services that are not necessary for work and can be used by employees at their own discretion, for the satisfaction of their needs or wants or those of other members of their households. It includes:

(i) Meals and drinks including those consumed when travelling for business.

(ii) Accommodation.

(iii) The services of vehicles or other durables provided for the personal use of the employees.

(iv) Goods and services produced as outputs from the employer’s own process of production such as free travel for the employees of railways or airlines, or free coal for miners.

(v) Sports, recreation or holiday facilities for employees and their families.

(vi) Creches for children of employees.

(vii) Value of the interest foregone by employers when they provide loans to employees at reduced, or even zero rates of interest for the purposes of buying houses, furniture or other goods and services.

It should be kept in mind that it does not include any facilities which are necessary for work and in which employees do not have any discretion.

For example, uniforms or other forms of special clothing to be used for work only. Examples are uniforms for police, uniforms of drivers, uniforms for nurses in the hospital. It’s so because such payments are intermediate consumption of business enterprises.

(c) Employers’ Contribution to Social Security Schemes: Employers’ make payments to social security schemes like life insurance, causality insurance, pension schemes etc. For example, there is a Contributory provident Fund Scheme for employees of educational institutions and public sector undertakings. The contribution made by the employers for such schemes is a part of compensation of employees.

The thing which has to be remembered is that, employers’ contribution towards social security scheme should be included whereas employees’ contribution towards Social Security Scheme should not be included as COE is that what the employer pays to employee and if anything borne by employee himself should not be included under COE.

2. Operating Surplus: The CSO (Central Statistical Organization) has defined operating surplus as “value of gross output less the sum of intermediate consumption, compensation of employees, mixed income, depreciation and NIT.”

Operating Surplus = GVOMP – Intermediate consumption – COE – Mixed Income – Depreciation – NIT

In other words, it is the sum of income from property and income from entrepreneurship. Operating surplus have the following two components:

(a) Income from property: It is the income which has been arisen from rent, interest and royalty.

It is divided into three components:

(i) Rent: The income arising from ownership of land and building is known as rent. It also includes imputed rent. If a person living in his own house, then it is assumed in an economy that he is paying rent to himself. This concept is known as imputed rent.

(ii) Royalty: Royalties are the payments made for the use of mineral deposits such as coal, oil, etc. or for the use of patents, copyrights, trademarks, etc.

(iii) Interest: It is the amount earned for lending funds to the production units. It also includes imputed interest of funds provided by entrepreneur. But interest income includes interest on loan taken for productive services only.

The following categories of interest should not be included :

• Interest on national debt or interest paid by government on nation debt should not be included as it is assumed that such interest is paid on loan taken for consumption purpose.

• Interest paid by one firm to another firm as it is already included in the profit of the firm which pays it.

(b) Income from entrepreneurship: It is a return of entrepreneur after paying all the other factors of production. It is of the following three types:

(i) Distributed Profit (Dividend): It is that part of total profit which is given to shareholders.

The thing to be noted here is that profit earned by one firm to another should not be included under this head because it is already included in the profit of the firm which pays it.

(ii) Undistributed Profit (Saving of private corporate sector or Retained £arnings):

It is that part of total profit which is not given to shareholders and kept as a reserve for future uncertainties.

(iii) Corporation Tax (Profit Tax): It is that part of total profit which is given by a firm to the government as Tax.

The concept of operating surplus is applicable to all producing enterprises, whether they belong to the private sector or to the government. The government enterprises also are expected to earn reasonable rate of profit on the funds invested.

But, operating surplus does not arise in the general government sector as they produce goods and services for the social welfare of the country and not for profit motive i.e., why rent, interest and profit are zero in general government sector.

3. Mixed Income: Income of own account workers (like farmers, doctors, barbers, etc.) and unincorporated enterprises (like small shopkeepers, repair shops) is known as mixed income. They do not maintain proper accounts. They do not generally hire factor services from the market rather use their own resources like land, labour, funds, etc. As the result of, it becomes difficult to classify their income distinctly among rent, wages, interest and profit.

NDPFC Compensation of employees (COE) + Operating surplus (OS) + Mixed Income (MY)

Method For Calculating National Income By Income Method:

If we want to calculate National Income by Income method, we have to add different factor incomes from the economy.

The addition of all these factor incomes gives us the calculation near by the National Income, i.e. Net Domestic Product at FC (NDPFC).

Important Note:

1. Profit earned by one firm to another should not be included because it is a part of intermediate consumption.

2. If Profit after tax is given and corporate tax is given, then by adding them we get profit. Profit after tax = 1000

Corporate tax =100 Profit =1100

3. If Profit before tax and corporate tax are given, then ignore corporate tax.

Profit before tax = 1000

Corporate tax =100 Profit = 1000

Steps for calculating national income by income method:

Step 1: To identify enterprises which employ primary factors (Land, Labour, Capital, enterprise).

Step 2: To classify various types of factor income like:

(a) Compensation of employees: The amount earned by employees from their employer, whether in cash or in kind or through any other social security scheme is known as compensation of employees.

(b) Operating Surplus: It is the sum of income from property and income from entrepreneurship.

(c) Mixed Income: Income of own account workers (like farmers, doctors, barbers, etc.) and unincorporated enterprises (like small shopkeepers, repair shops) is known as mixed income.

Step 3: To estimate amount of factor payments made by each producing unit.

Step 4: To add all factor incomes / payments within domestic territory to get domestic income, i.e., NDPFC .

NDPFC = Compensation of employees + Operating Surplus + Mixed Income Step 5: Addition of NFIA to NDPFC to get NY, i.e., NNPFC .

![]()

Precautions of income method.

(a) Avoid transfers: National income includes only factor payments, i.e., payment for the services rendered to the production units by the owners of factors. Any payment for which no service is rendered is called a transfer, not a production activity. Gifts, donations etc. are main examples. Since transfers are not a production activity it must not be included in national income.

(b) Avoid capital gain: Capital gain refers to the income from the sale of second hand goods and financial assets. Income from the sale of old cars, old house, bonds, debentures, etc. are some examples. These transactions are not production transactions. So, any income arising to the owners of such things is not a factor income.

(c) Include income from self-consumed output: When a house owner lives in his house, he does not pay any rent. But infact he pays rent to himself. Since, rent is a payment for services rendered, even though rendered to the owner itself, it must be counted as a factor payment.

(d) Include free services provided by the owners of the production units: Owners work in their own unit but do not charge salary. Owners provide finance but do not charge any interest. Owners do production in their own buildings but do not charge rent. Although they do not charge, yet the services have been performed. The imputed value of these must be included in national income.

How To Determine National Income By Expenditure Method And Its Numericals, Steps And Precautions:

National income determination by Expenditure method:

(a) “Production creates income, income creates expenditure”. If we want to calculate National Income by this method, we have to add different final expenditures from an economy.

(b) The addition of all those final expenditure gives us the calculation near by the National Income, i.e. GDPMP .

Components of Expenditure Method

1. Government Final Consumption Expenditure (GFCE): The expenditure made by a general government on current expenditure on goods and services like public health, defence, law and order, education, etc. These goods and services generate no income because it is produce by a general government without any profit motive.

These goods and services are valued at their cost to the government as they are not sold to the citizen and have been produced for the social welfare of the citizens. So, GFCE = Intermediate consumption of government + Compensation of employees (wages and salaries in cash and in kind) by government + Direct purchases made abroad by government (purchases made by embassies and consulates located in foreign countries) + Consumption of fixed capital (depreciation) – Sale of goods and services by government.

2. Private Final Consumption Expenditure (PFCE): Private final consumption expenditure is defined as consumption expenditure by consumer households (household final consumption expenditure) and private NPISH (Non-profit Institution serving households) on all types of consumer goods.

PFCE = Household final consumption expenditure + Private non-profit Institution serving households final consumption expenditure.

The value of following items is measured for getting private final Consumption Expenditure.

(a) Purchases of currently produced goods and services in the domestic market by consumer households and NPISH.

(b) Direct purchases made abroad by resident households are added but direct purchases in domestic market by non-resident households and extra territorial bodies are deducted.

PFCE = Purchases of currently produced goods and services in the domestic Market by consumer households and NPISH households + direct purchases made abroad by resident households – direct purchases in domestic market by non¬resident households.

Note: If in the examination problem household final consumption expenditure is not given, it can be calculated as under

Household Final Consumption Expenditure = Personal disposable income – Personal (Household) Saving

3. Gross Domestic Capital Formation or Gross Investment or Investment Expenditure:

It refers to additions to the physical stock of capital during a period of time. It includes building machinery, Housing construction, construction of factories, etc. It has been classified into the following categories.

(a) Gross Domestic Fixed Capital Formation (GDFCF): It is the expenditure incurred on purchase of fixed assets. It is of three types:

(i) Gross Business Fixed Investment: It is the amount that the business units spend on purchase of newly produced capital goods like plant and equipments. Gross business fixed investment is the gross amount spent on newly produced fixed capital goods. When depreciation is deducted from it, we obtain Net Business fixed Investment.

Gross Business Fixed Investment = Net Business fixed Investment + Depreciation

(ii) Gross Residential Construction Investment: This is the amount spent on construction of flats and residential houses. The investment is said to be gross when depreciation is not deducted and Net when depreciation is deducted.

(iii) Gross Public Investment: This includes capital formation by government in the form of building of roads, bridges, schools, hospitals, etc. This investment is called Gross when depreciation is not deducted and Net when depreciation is subtracted.

(b) Change In Stock (Closing Stock – Opening Stock) Or Inventory Investment: It is the net change in inventories of final goods, finished goods, semi-finished goods and raw material. These are included as they represent currently produced goods, which are not included in the current sale of final output. It is a difference between closing stock and the opening stock of the year.

(c) Net Acquisition Of Valuables: These are those high value durable goods like gold, silver, amtiques, etc. which are taken at market price.

GDCF = Gross domestic fixed capital formation (GDFCF) + Change in Stock (Closing Stock – Opening Stock) + Net acquisition of valuables

Or

GDCF = Gross Business Fixed Investment + Gross Residential Construction +

Gross Public Investment + Inventory Investment + Net Acquisition of Valuables

4. Net Export (Export – Import): It shows the difference between Domestic spending

on foreign goods (i.e., imports) and foreign spending on domestic goods (i.e., exports).

Thus, the difference between exports and imports of a country is called Net Exports.

Net Exports = Export – Import

GDPMP = Government final consumption expenditure + Private final consumption expenditure + Gross domestic capital formation + Net export

Numerical Problems on Expenditure Method