Cost – CBSE Notes for Class 12 Micro Economics

Introduction

This chapter gives a detailed version of cost and its types, related numericals and the

relationship between them.

Cost In Economics

1. Cost of producing a good, in Economics is the sum total of all the,

(a) Direct expenditure (actual money expenditure of a firm on purchasing goods or hiring factor services, called explicit cost) and

(b) Indirect expenditures (imputed value of the owners estimated value of inputs provided, called ‘implicit cost’) and

(c) Certain minimum profit (refers to that amount of profit which a producer must get in the long run to continue to produce the given goods, called ‘normal profit’.)

So, the sum total of explicit cost, implicit cost and normal profit is called economic cost.

2. Explicit Cost:

(a) It refers to the actual money expenditure of a firm on purchasing goods or hiring factor services and non-factor inputs (like raw material, electricity, fuel etc.)

(b) In other words, “explicit cost are those cash payments which the firm makes to outsiders for their goods and services.”

(c) For example—explicit cost of biscuit factory consists of flour, milk, sugar etc. purchased from outside and rent, electricity, wages, interest etc paid to factor of production.

3. Implicit Cost:

(a) Implicit cost is the imputed or estimated value of inputs supplied by the owner of the firm himself.

(b) In other words, Implicit costs are cost of self-supplied factors of production, which are generally not recorded in firm’s account book.

(c) Implicit costs of a biscuit factory are imputed rent of owner’s own factory building,imputed wages for owner’s working as a manager himself, imputed interest on his money capital used in the factory, depreciation.

Short Run Cost

1. Cost function shows functional relationship between output and cost of production. It

gives the least cost combination of inputs corresponding to different levels of output.

Cost function is given as:

C = f(X), ceteris paribus, where, C = Cost and X = Output

2. Short Run cost are those in which some factors of production are fixed and others are variable. So, it is divided into two parts:

(a) Fixed costs (b) Variable costs

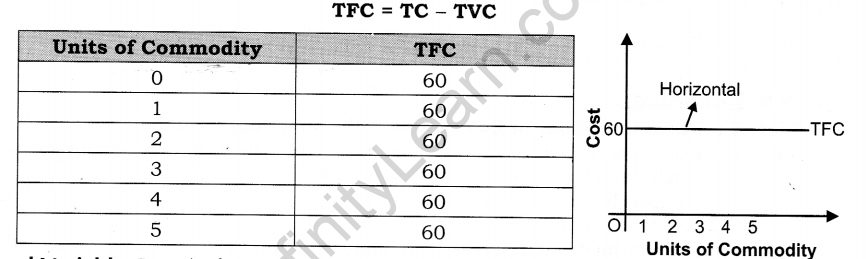

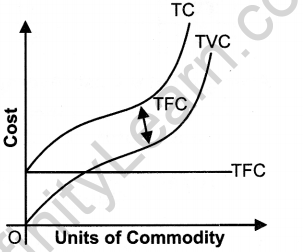

Total Fixed Cost (Supplement/Indirect/Overhead Cost)

1. Fixed costs are those costs of production which do not change with a change in output.

2. These are the costs incurred on fixed factors, like rent of land and building, interest, etc. These are unavoidable contractual costs.

3. Fixed costs are also called overhead costs or general costs because these are common for all the units produced. These costs are also called supplementary costs or indirect costs.

4. The shape of Total fixed Cost is horizontal (Parallel to X-Axis). They have to be incurred when the output is large or small or even zero.

Total Variable Cost (Prime/Direct Cost)

1. The cost incurred on variable factors of production is known as TVC.

TVC = TC – TFC

2. TVC is very much related with the production and fluctuates with the fluctuation in production. In case of zero level of production, TVC would also be zero.

3. For example, Wages of casual labour, payment for raw material, etc.

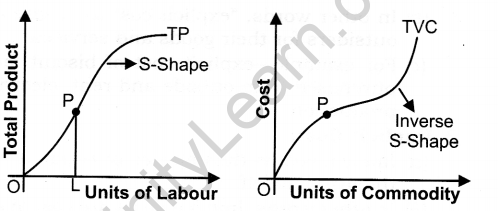

4. The shape of Total Variable Cost is Inverse S-shape because of Law of variable Proportion. There are two phases on which shape of total variable cost depends.

(a) In the first phase, TVC increase at a to lower cost of production. This is because of proper utilization of fixed factor by employing more units of variable factor, specialization and division of labour. diminishing rate, [concave shape] i.e., every additional unit of output produced leads

(b) In the second phase, TVC increase at an increasing rate, [convex shape]

i. e., every additional unit of output produced leads to higher cost of production. This is because of non-optimal combination of variable factor with the fixed factor.

Total Cost

1. During production, the expenditure incurred on various factors of production is known as total cost.

2. The thing, is has to remember, is that enterprise is one of the factors of production and the return of enterprise is normal profit. So, normal profit is also included in total cost.

3. In other words, it is a sum of total fixed cost and total variable cost.

TC = TFC + TVC

4. The shape of Total Cost is Inverse S- shaped because of law of variable Proportion.

(a) TC is divided into two parts TFC and TVC such that

TC = TFC + TVC.

(b) TFC curve is a horizontal line parallel to the x-axis.

(c) TVC is inverse S-shaped starting from the origin due to law of variable proportion.

(d) TC is aggregate of TFC and TVC. TC curve is inverse S-shaped starting from the level of fixed cost. The reason behind it shape is the law of variable proportion.

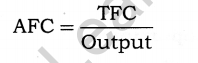

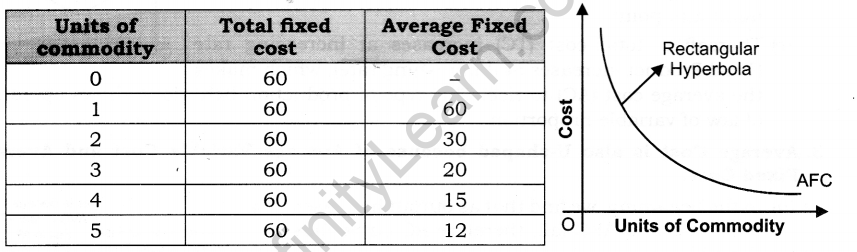

Average Fixed Cost (AFC)

1. The per unit cost incurred on fixed factors of production is known as average fixed cost.

2. AFC falls as output increases because AFC

3.The shape of AFC curve is a rectangular hyperbola as area under AFC curve (i.e. total fixed cost) remains same at different levels of output.

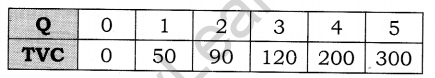

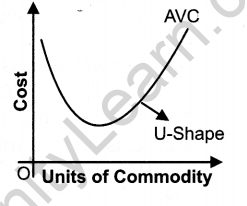

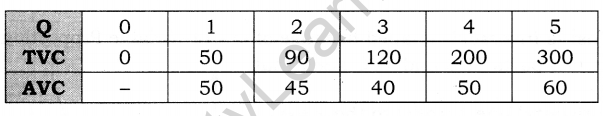

Average Variable Cost (AVC)

1. The per unit cost incurred on variable factors of production is known as AVC.

2. Average Variable Cost is U-shaped because of Law of Variable Proportion.

(a) As we know the shape of AVC depends upon the shape of TVC. Initially, TVC increases at diminishing rate (because Total Product Increases at increasing Rate), that makes the AVC to fall.

(b) Thereafter, TVC increases at increasing rate(because Total Product Increases at diminishing Rate), that makes the average variable cost to rise.

(c) So, from inverse S-shape, TVC curve, we derive the U shape AVC curve. It can also be explained with the help of the following schedule and diagram.

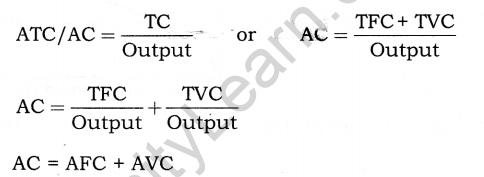

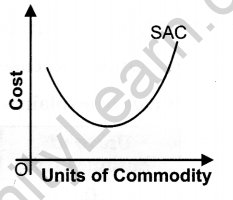

Average Total Cost/Average Cost (ATC)

1. The per unit cost incurred on various factors of production is known as average cost. In other words, it is the sum total of average variable cost and average fixed cost.

2. Average Cost is U-Shaped because of Law of variable proportion:

(a) The shape of average cost (AC) depends upon total cost (TC).

(b) Initially, total cost (TC) increases at a diminishing rate (Total Product increases at Increasing rate), which makes its average, i.e., average cost (AC) to fall, then reaches its minimum point.

(c) Thereafter, total cost (TC) increases at increasing rate (Total Product increases at diminishing rate), which makes the average cost (AC) to rise. This type of production behaviour shows operation of law of variable proportion.

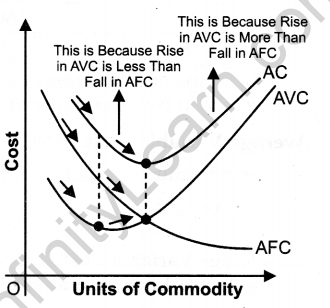

3. Average Cost is also U-shaped because of Average Variable Cost and Average Fixed Cost:

(a) In the beginning, we find that as output increases both AVC and AFC fall, therefore AC curve falls sharply.

(b) When AVC has started rising and AFC is falling, AC may continue to fall if the fall in AFC is more than the rise in the AVC curve.

(c) But with further increase in output, AC would

start increasing because the rise in AVC offsets the fall in AFC.

(d) Therefore, the shape of the AC curve would be U-shaped—first falling and then rising.

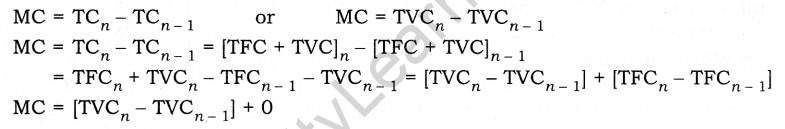

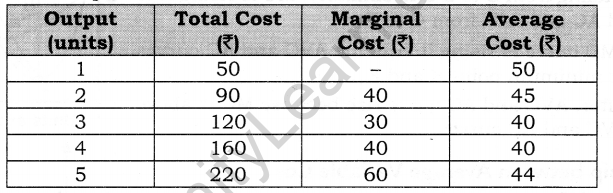

Marginal Cost

1. The cost incurred on additional unit of output is known as Marginal cost.

(a) As we know the shape of MC depends on the shape of TVC or TC. Let us suppose TVC.

(b) Initially, TVC increases at a diminishing rate (Total Product increases at Increasing rate), which makes the gap of TVC, i.e. MC to fall.

(c) Thereafter, TVC increases at an increasing rate (Total Product increases at diminishing rate) which makes the marginal cost to rise.

(d) So, from inverse S-shape TVC curve, we derive U shape MC curve. It can be explained with the-help of following schedule and diagram.

Relationship Between the cost and curve

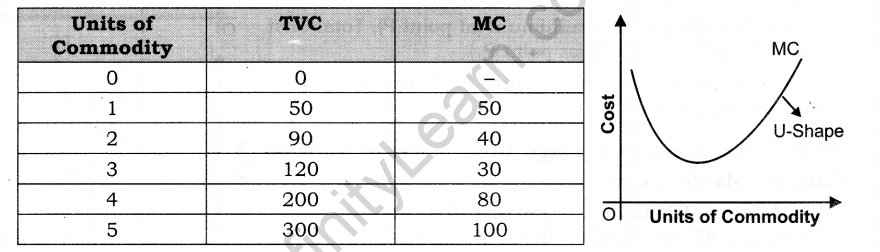

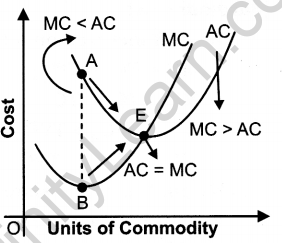

Relationship between AC and MC

1. The relationship between marginal cost anci average cost can be shown with the help of schedule.

The table given below shows the marginal costs, total costs and average costs at different levels of output.

(a) When MC is less than AC, AC falls (because MC pulls AC down). It can be seen from the first three units of the table.

(b) When MC = AC, AC is constant and at its minimum.

It can be seen from the fourth unit of the table.

(c) When MC is more than AC, AC rises (because MC pulls up AC). It can be seen from the fifth unit of the table.

2. The relationship between marginal cost and ave]rage cost with the help of Diagram:

(a) As long as MC is below AC, AC curve falls till intersection at point E.

(b) When MC curve comes to fall, it falls more rapidly than AC curve and reaches its minimum point B earlier than the AC curve reaches its minimum point E.

Therefore, MC curve is rising from B to E whereas AC curve is still falling from A to E.

(c) When MC curve is rising, it cuts the AC curve at its minimum point E and after that point MC is above than AC.

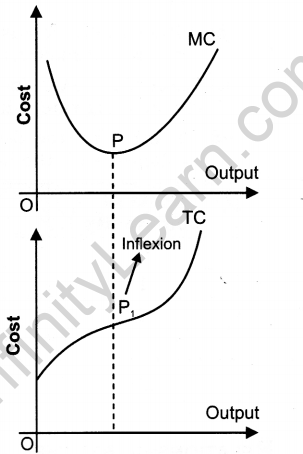

Relationship between TC and MC

1. When Marginal Cost falls, Total Cost increases at a diminishing rate.

2. When Marginal Cost is minimum (at point P), Total Cost is at its inflexion point (at point P1).

3.When Marginal Cost rises, Total Cost increases at an increasing rate.

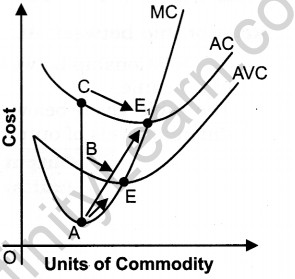

Relationship between Average Cost, Average Variable Cost and Marginal Cost –

1. As long as MC curve is below than AVC and AC Curve, AVC and AC curve fall till their intersection at a point E and E1

2. When MC curve comes to fall, it falls much rapidly than AVC and AC curves and reaches its minimum point A earlier than AVC and AC Curve reaches their minimum point E and E1

Therefore, MC Curve is rising from A to E whereas AVC is still falling from B to E and similarly, MC is rising A to E1 and AC still falls from C to E1

3. When MC curve is rising it cuts the AVC and AC curves at their minimum point E and E1

Thereafter, AVC and AC curve rise because MC is above than AVC and AC curves.

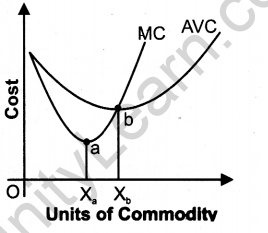

Relationship between Average Variable Cost and Marginal Cost

1.Both AVC and MC curve are U-shaped reflecting the law of Variable proportion.

2. The minimum point of AVC curve (point b) will always occur to the right of the minimum point of MC curve (point a).

3. When AVC is falling, MC is below AVC.

4. When AVC is rising, MC is above AVC

5. When AVC is neither falling nor rising, MC = AVC (point b).

6. There is a range over which AVC is falling and MC is rising. This range is between the v output levels Xa and Xb.

Words that Matter

1. Cost in economics: It is the sum total of explicit cost, implicit cost and certain minimum profit (normal profit).

2. Explicit Cost: It refers to the actual money expenditure of a firm on purchasing goods or hiring factor services and non-factor inputs (like raw material, electricity, fuel, etc.)

3. Implicit Cost: Implicit cost is the imputed or estimated value of inputs supplied by the owner of the firm himself.

4. Cost function: It shows functional relationship between output and cost of production. It gives the least cost combination of inputs corresponding to different levels of output.

5. Short Run Cost: Short run cost are those in which some factors of production are fixed and others are variable.

6. Total Fixed Costs: Total Fixed costs are those costs of production which do not change with a change in output.

7. Total Variable Cost: The cost incurred on variable factors of production is known as TVC.

8. Total Cost: During production, the expenditure incurred on various factors of production is known as total cost.

9. Average Fixed Cost: The per unit cost incurred on fixed factors of production is known as average fixed cost.

10. Average Variable Cost: The per unit cost incurred on variable factors of production is known as AVC.

11. Average Total Cost/Average Cost (ATC): The per unit cost incurred on various factors of production is known as average cost. In other words, it is the sum total of average variable cost and average fixed cost.

12. Marginal Cost: The cost incurred on additional unit of output is known as Marginal cost.