Foreign Exchange Rate and Balance of Payments Important Questions for class 12 economics Foreign Exchange Rate

1. Foreign Exchange It refers to the reserve of foreign currencies.

e.g. INR is Indian currency except that all other currency will be foreign exchange for India.

2. Foreign Exchange Rate It is the rate at which one currency can be exchanged for the other currency in foreign exchange market, e.g. ? 58 are to be paid to buy one dollar, then the t/ $ (Rupees per dollar) exchange rate is 58 i.e. ?58 per $ .

3.Exchange Rate System

(i) Fixed exchange rate system It is a system in which the central authority or government maintains their exchange rate fixed either against gold or some other currency. Fixed exchange rate has two important types:

(a) Gold standard Under gold standard, a country’s Central Bank fixes its currency against certain quantity of gold.

(b) Bretton woods system Under this system, Central Bank ties its currency with USD, as the official reserve asset.

(ii) Flexible Exchange Rate System The rate of exchange which is determined by the market forces of demand and supply of foreign currencies in the foreign exchange market, is termed as flexible exchange rate system. Flexible exchange rate system has two main types:

(a)Clean floating system Under this system, exchange rate is freely determined by the market forces of demand and supply of foreign exchange with no interference by the central authority.

(b) Managed floating system Under this system, exchange rate is determined by the market forces of demand and supply of foreign exchange and the excessive fluctuation is checked by the central authority, it is also termed as dirty floating.

4. Merits of Fixed Exchange Rate System

(i) Minimise exchange rate fluctuations

(ii) Reduces volatility and fluctuations in prices

(iii)Imposes discipline on the monetary authority

(iv) Encourages international trade and investment flows

(v) Less speculation in the currency market

5. Demerits of Fixed Exchange Rate System

(i) Central Bank needs to hold huge stocks of either Gold or USD.

(ii) Do not allow for automatic stabilisation of exchange rate.

(iii) Diverts Central Banks focus from economic problems to exchange rate

(iv) It discourages venture capital.

(v) These exist the possibility of policy delay.

6. Merits of Flexible Exchange Rate System

(i) Independent monetary policy

(ii) Encourages international mobility of capital and trade

(iii) Encourages venture capital

(iv) No need to maintain huge stock of gold or other currency

7. Demerits of Flexible Exchange Rate System

(i) Creates the condition of instability in the international trade

(ii) Adverse effect on economic structure

(iii) Unnecessary capital movements

(iv) Inflationary problems

(v) Difficulty in policy formation

8. Different Concepts of Foreign Exchange Rate

(i) Nominal exchange rate It refers to the number of units of domestic currency, one must give up to get an unit of foreign currency. In simple term, it refers to the price of foreign currency in terms of domestic currency.

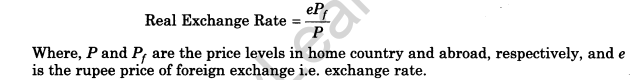

(ii) Real exchange rate The real exchange rate is the ratio of foreign to domestic prices, measured in the same currency. It is defined as

(iii) Nominal Effective Exchange Rate (NEER) It is that type of effective exchange rate which does not account for change in price level while measuring average strength of one currency in relation to the other.

(iv) Real Effective Exchange Rate (REER) It is that type of effective exchange rate which accounts for changes in the price level across different countries of the world.

9. Sources of Demand for Foreign Exchange

(i) Payment of loans and interest to international organisations

(ii) Gifts and grants to rest of the world

(iii) Foreign investment across the world

(iv)Foreign trade i.e. Imports

(v) Foreign exchange trade for speculation

(vi) Foreign tourism

10. Sources of the Supply of Foreign Exchange

(i) Exports of goods and services from domestic country

(ii) Foreign investment

(a) Foreign direct investment

(b) Portfolio

(iii)Foreign tourism from abroad.

(iv)Purchases by non-residents in the domestic country.

(v) Remittances from abroad

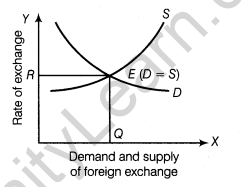

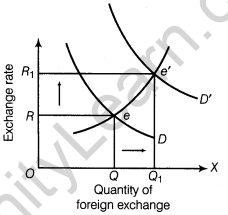

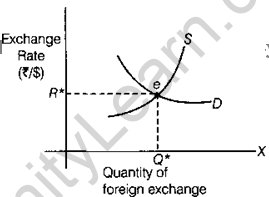

Determination of Exchange Rate Exchange rate is determined by the demand and supply forces of foreign exchange in foreign exchange market.

Determination of Equilibrium Rate of Exchange The equilibrium exchange rate is obtained at the point where supply of foreign exchange equakb,.tp the demand for foreign exchange.

Some Important Terms Related to Foreign Exchange Market

(i) Foreign exchange market It is that market where exchange of foreign currencies took place. The major participants in this market are commercial banks, brokers, other authorised dealers, etc.

(ii) Functions of foreign exchange market

(a) Transfer function

(b) Credit function

(c) Hedging function

(iii) Forward market It refers to that market which covers sale and purchase of foreign exchange for future delivery, at a rate decided today.

(iv) Spot market The market which handles only spot transactions or current transactions of foreign exchange are termed as spot market or current market.

Some Important Terms Related to Foreign Exchange Rate

(i) Appreciation of currency When the value of domestic currency increases in relation to a foreign currency due to demand and supply forces in the free market, it is termed as appreciation of the domestic currency, (under flexible exchange rate system.)

(ii)Depreciation of currency Depreciation of domestic currency occurs when the value of domestic currency decreases in relation to the value of foreign currency (under flexible exchange rate system) .

(iii) Revaluation of currency Revaluation is the rise in the value of domestic currency in relation to foreign currency as planned by Central Bank in a situation when exchange rate is not determined by market forces of demand and supply (under fixed exchange rate system.)

(iv) Devaluation of currency Devaluation is the fall in the value of domestic currency in relation to foreign currency as planned by the Central Bank in a situation when exchange rate is not determined by forces of demand and supply under fixed exchange rate system.

(v) Spot exchange rate It refers to that situation where exchange rate is determined on spot. However, actual transaction may take 1 day or 2 to get settled.

(vi) Forward exchange rate Under this system, exchange rate is determined on some specified future date at a rate decided at present.

Previous Years Examination Questions

1 Mark Questions

1. Give the meaning of managed floating exchange rate. (All India 2014; Delhi 2012)

Ans. The system of adjusting the exchange rates as per the rules and regulations of foreign exchange market is termed as managed floating.

2. Define foreign exchange rate. (All India 2014:1 Delhi 2011)

Ans. Foreign exchange rate refers to the rate at which one currency can be exchanged for the other currency in foreign exchange market, e.g. if Rs. 58 is paid to buy one US dollar, then Rs./$ exchange rate will be 58 i.e. Rs.58 per dollar.

3. What is floating exchange rate? (All India 2014)

or

Define flexible exchange rate system. (Delhi 2008)

Ans. The rate of exchange which is determined by the market forces of demand and supply of foreign currencies in the foreign exchange market, is termed as flexible exchange rate system.

4. What is a fixed exchange rate? (Ail India 2013)

or

Give the meaning of fixed foreign exchange rate.(All India 2012,2009,2008; Delhi 2009)

Ans. Fixed exchange rate is the system under which the central authority or government maintains their exchange rate fixed either against gold or some other foreign currency, (say USD)

5. What is foreign exchange? (All India 2011; Delhi 2009c)

or

Give meaning of foreign exchange. (Delhi 2009c)

Ans.Foreign exchange refers to the reserve of foreign currency with a country, e.g. currency of US and UK are the foreign exchanges for India.

6. State two sources of supply of foreign exchange. (Delhi 2010)

Ans. Two sources of supply of foreign exchange are:

(i) Export of goods and services from domestic country to foreign country.

(ii) Foreign direct investment.

7. State two sources of demand for foreign exchange. (All India 2010)

Ans. Two sources of demand for foreign exchange are

(i) Payment of loans and interest to international organisations.

(ii) Gifts and grants to rest of the world.

3 Mark Questions

8. How does giving incentives for exports influence foreign exchange rate? Explain (Delhi 2014)

Ans. The incentives for exports boosts exports for the country. As a result of increase in exports the supply of foreign currency in the country increases. With demand remaining the same, this results in a fall in the exchange rate implying currency appreciation.

9. Recently Government of India has doubled the import duty on gold. What impact is it likely to have on foreign exchange rate and how? (Delhi 2014)

Ans.When government increase the import duty of gold, the import of gold will fall. This reduces the demand for foreign currency. With the supply of foreign currency remaining same, the foreign exchange rate would fall.

This implies appreciation of rupees.

10. Visits of foreign countries for sightseeing etc. by the people of India is on the rise. What will be its likely impact on foreign exchange rate and how? (Delhi 2014)

Ans. When there is a rise in the visit of foreign countries by the people in India, the demand for foreign currency increases. With the supply of foreign currency remaining same, the foreign exchange rises, implying a depreciation of rupee.

11. Foreign exchange rate in India is on the rise recently. What impact is it likely to have on exports and how? (All India 2014)

Ans. With the rise in foreign exchange rate in India, the demand for foreign currency increases. This rise in exchange rate implies depreciation in domestic currency. It encourages exports from a country.

12. When foreign exchange rate in a country is on the rise, what impact is it likely to have on imports and how? (All India 2014)

Ans. With the rise in foreign exchange rate in India, the demand for foreign currency increases. This rise in exchange rate implies depreciation in domestic currency. It encourages exports from a country and discourages imports from rest of the world.

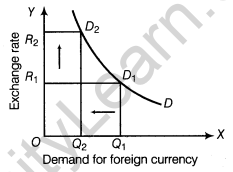

13. What is ‘appreciation’ of domestic currency? What is its likely effects an exports and how? (Foreign 2014)

or

Explain the effect of appreciation of domestic currency on imports. (Delhi 2013)

Ans. Domestic currency appreciates when there is a fall in foreign exchange rate, the domestic economy can now buy more quantity of goods and services from foreign countries with the same amount of domestic currency. As a result imports rise.

e.g. When Rs. / $ exchange rate falls from 55 to 50, it leads to currency appreciation and this will help in buying more and more units of foreign goods as a result demand for foreign goods will rise. i.e. imports will rise.

14.Explain the effect of depreciation of domestic currency on exports. (All India 2013)

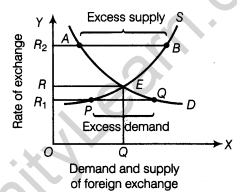

Ans. Domestic currency depreciates when there is a rise in foreign exchange rate. Depreciation has an expansionary effect on Aggregate Demand and output. Depreciation increases the demand for domestically produced goods by reducing their relative price. This will lead to increase in exports and hence fall in imports, as now foreign country can buy greater units in the domestic country with same amount of their currency.

15. How is exchange rate determined in the foreign exchange market? (All India 2013)

Ans. Foreign exchange rate is determined by the market forces of demand and supply in foreign exchange market. The point where demand and supply of foreign exchange meet, gives the equilibrium rate of exchange as shown in figure and quantity of foreign exchange.

16. How can Reserve Bank of India help in bringing down the foreign exchange rate which is very high? (All India 2013)

Ans. Central Bank starts selling foreign exchange from its reserve to bring down the foreign exchange rate, as the demand for foreign exchange is very high.

17. How can increase in foreiqn direct investment affect the price of foreign exchange? (Delhi 2013)

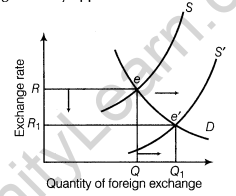

Ans. Increase in foreign direct investment will result in more supply of foreign exchange therefore, due to excess supply, price of foreign exchange will fall. i.e. exchange rate falls which leads to appreciation of domestic currency.

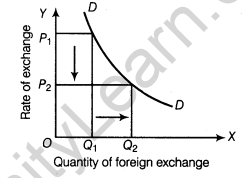

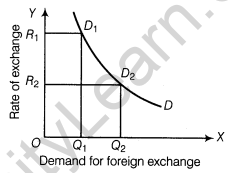

18. When price of a foreign currency rises, its demand falls. Explain why? (Delhi 2011)

or

Explain, why there is a fall in demand of foreign exchange, when its price rises. (All India 2011)

or

There is an inverse relationship between foreign exchange rate and demand for foreign exchange. Explain why? (Delhi 2009c)

Ans. Exchange rate of foreign currency is inversely related to the demand. When price of a foreign currency rises, it results into costlier imports for the country. As imports become costlier, the demand for foreign products also reduce. This leads to reduction in demand for that foreign currency and vice-versa.

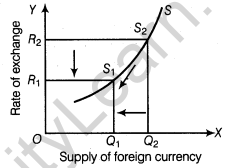

19. When price of a foreign currency rises, its supply also rises. Explain why? (Delhi 2011)

or

There is a direct relationship between price of foreign exchange and supply of foreign exchange. Explain why?(All India 2009; Delhi 2008)

or

When the rate of a foreign currency rises, its supply iises. How?(Delhi 2008)

Ans. Rise in exchange rate of foreign currency refers to appreciation of foreign currency in relation to domestic currency. When there is rise in foreign exchange rate (Say from Rs. 55 per$ to Rs. 60 per $), it leads to depreciation of domestic currency and rise in exports leading to rise in supply of foreign exchange supply.

20. When the price of a foreign currency falls, the demand for that foreign currency rises. Explain why? (All India 2011)

or

Explain why there is a rise in demand for foreign exchange, when its price falls? (All India 2011)

or

When the rate of exchange of foreign currency falls, its demand rises. Explain how? (All India 2008)

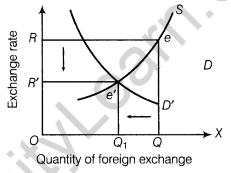

Ans. Foreign exchange rate shares an inverse relationship with the demand for that currency, with a fall in the price of foreign exchange, value of domestic currency increases (i.e. appreciation of domestic currency) and that means foreign goods become cheaper and their domestic demand (i.e. imports) increases. The rising domestic demand for foreign goods implies higher demand for foreign exchange which increased from OC1 to OQ2 as shown in the figure

21. When the price of a foreign currency falls, the supply of that foreign currency also falls. Explain why? (All India 2011,2008)

Ans. The supply of foreign currency is directly proportional to the price of foreign exchange. When the price of a foreign currency falls, it leads to cheaper imports and costlier exports as it leads to appre ciation of domestic currency. The exporters are discouraged due to costlier exports. This results lesser inflow or supply of foreign currency in the economy. As a result supply of foreign exchange decreases from OQ2 to OQ1

22. Give the meaning of foreign exchange rate. How it is determined under flexible exchange rate system? (All India 2011)

Ans. Foreign exchange rate Foreign exchange rate refers to the rate at which one currency can be exchanged for the other currency in foreign exchange market, e.g. if Rs. 58 is paid to buy one US dollar, then Rs./$ exchange rate will be 58 i.e. Rs.58 per dollar.

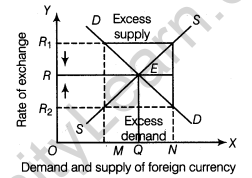

Flexible rate of exchange is also called free rate of exchange, as it is freely determined by the market forces of supply and demand of foreign exchange in the international market. If the demand for foreign exchange rises, its value will also rise and if demand for foreign exchange falls, its value will also fall.

Similarly, supply of foreign exchange also influences the exchange rate. Greater the supply, lower the rate of exchange. The point at which demand for foreign exchange and supply of foreign exchange meets, gives the equilibrium rate of exchange at OR. Any rate above equilibrium would lead to excess supply and any exchange rate below equilibrium would lead to excess demand.

23. Giving two examples, explain the relation between the rise in price of a foreign currency and its demand. (Delhi 2011)

Ans. (i) when the price of a foreign currency rises, the imports become costlier and exports become cheaper so the value of imports will fall with time, hence the demand for foreign exchange will fall.

(ii) When domestic companies want to buy foreign assets and with the rise in price of foreign currency the price of the assets also increases. Hence, the demand for foreign exchange falls.

24. Distinguish between devaluation and depreciation of domestic currency. (Delhi 2010)

Difference between devaluation and depreciation

| Basis | Devaluation | Depreciation |

| Meaning | Devaluation is the fall in the value of domestic currency in relation to foreign currency. It is planned by the Central Bank in situation, when exchange rate is not determined by the forces of demand and supply. | It occurs when the value of domestic currency decreases in relation to the value of foreign currency in the foreign exchange market. |

| Example | A government has set 10 units of its currency is equal to one dollar. | If US $ exchanges ? 45 instead of ? 40 earlier the domestic currency (Indian rupee) has shown depreciation of domestic currency. |

25. Giving two examples, explain why there is a rise in demand for a foreign currency

when its price falls? (All India 2010)

Ans. (i) when there is a fall in the price of foreign currency, the import gets cheaper. It encourages the importers to import more and consequently, the demand for that foreign currency increases.

(ii) When the price of a foreign currency falls, the price of foreign assets also falls. It encourages domestic people and companies to buy foreign assets and consequently, the demand for that foreign currency increases.

26. Distinguish between fixed and flexible foreign exchange rate. (All India 2010)

Ans. Fixed exchange rate is the system, under which the central authority or government maintains their exchange rate fixed either against gold or some other foreign currency. Whereas the rate of exchange which is determined by the market forces of demand and supply of foreign currencies in the foreign exchange market, is termed as flexible exchange rate.

27. Give meanings of fixed, flexible and managed floating exchange rates.

(All India 2010; Delhi 2010)

Ans. Fixed and flexible exchange rate

(i) Minimise exchange rate fluctuations

(ii) Reduces volatility and fluctuations in prices

(iii)Imposes discipline on the monetary authority

(iv) Encourages international trade and investment flows

(v) Less speculation in the currency market

The rate of exchange which is determined by the market forces of demand and supply of foreign currencies in the foreign exchange market, is termed as flexible exchange rate system.

Managed floating exchange rate The system of adjusting the exchange rates as per the rules and regulations of foreign exchange market is termed as managed floating.

28. What is meant by appreciation and depreciation of domestic currency? Explain. (All India 2010)

Ans. When the value of domestic currency increases in relation to a foreign currency due to demand and supply forces in a free market, it is termed as appreciation of the domestic currency.

Depreciation of the domestic currency occurs when the value of domestic country’s currency decreases in relation to the foreign currency.

For example, Increase in exchange rate is currency depreciation and decrease in exchange rate is currency appreciation.

(i) When Rs./$ exchange rate falls from 55 to 50 , it is termed as appreciation of domestic currency (i.e. Indian rupee) –

(ii) When Rs./$ exchange rate rises from 50 to 55, it is termed as depreciation of domestic currency .

29. Explain the meaning and two merits of fixed foreign exchange rate. (Delhi 2010,2009)

Ans.Fixed foreign exchange rate

(i) Minimise exchange rate fluctuations

(ii) Reduces volatility and fluctuations in prices

(iii)Imposes discipline on the monetary authority

(iv) Encourages international trade and investment flows

(v) Less speculation in the currency market

Two merits of fixed foreign exchange rate are:

(i) Less speculation in the currency market.

(ii) Encourages international trade and investment flows.

30. State two sources each of demand and supply of foreign exchange.

Ans. Two sources of demand for foreign exchange are:

(i) Imports from rest of the world.

(ii) Foreign investment across the world.

Two sources of supply of foreign currency are:

(i) Exports of goods and services from domestic country to foreign country .

(ii) Remittances from abroad.

4 Mark Questions

31. Explain two merits each of fixed exchange rate and flexible exchange rate. (Delhi 2009; All India 2009)

Ans. Merits of fixed exchange rate are as follows:

(i) Minimises exchange rate fluctuations.

(ii) Encourages international trade and investment flows.

Merits of flexible exchange rate are as follows:

(i) Independent monetary policy.

(ii) No need to maintain huge stock of gold or other currency.

32. How is foreign exchange rate is determined in the market?(All India 2009)

Foreign exchange rate is determined by the market forces of demand and supply in foreign exchange market. The point where demand and supply of foreign exchange meet, gives the equilibrium rate of exchange

In the above figure, D stands for the demand for foreign exchange and 5 curve represents the supply of foreign exchange for different values of R i.e. rate of exchange. Point E is the equilibrium point, where D =5, so R will be the rate of exchange. If the rate of exchange is arbitrarily fixed other than R, there wi 11 be a situation of either excess demand or excess supply of foreign exchange, so R is the rate of exchange which is obtained from the equilibrium point E. Any disequilibrium will be adjusted automatically by the forces of demand and supply of foreign exchange to attain equilibrium.

In the above figure, D stands for the demand for foreign exchange and 5 curve represents the supply of foreign exchange for different values of R i.e. rate of exchange. Point E is the equilibrium point, where D =5, so R will be the rate of exchange. If the rate of exchange is arbitrarily fixed other than R, there wi 11 be a situation of either excess demand or excess supply of foreign exchange, so R is the rate of exchange which is obtained from the equilibrium point E. Any disequilibrium will be adjusted automatically by the forces of demand and supply of foreign exchange to attain equilibrium.

6 Mark Question

33. Give the meaning of foreign exchange and foreign exchange rate. Giving reason, explain the relation between foreign exchange rate and demand for foreign exchange. (All India 2012)

Ans. Foreign exchange Foreign exchange rate is determined by the market forces of demand and supply in foreign exchange market. The point where demand and supply of foreign exchange meet, gives the equilibrium rate of exchange as shown in figure and quantity of foreign exchange.

Foreign exchange rate Foreign exchange rate refers to the rate at which one currency can be exchanged for the other currency in foreign exchange market, e.g. if Rs. 58 is paid to buy one US dollar, then Rs./$ exchange rate will be 58 i.e. Rs.58 per dollar.

Relation between foreign exchange rate and demand for foreign exchange There is an inverse relationship between the foreign exchange rate and demand for foreign exchange, with the rise in foreign exchange rate, demand for foreign exchange falls and vice-versa.

In the above figure, D curve represent the demand for foreign currency. When exchange rate is high (R1), demand for the foreign currency falls (Q1,). On the other hand, when exchange rate is low (R2), demand for the foreign currency rises Q2. The demand curve for the foreign currency is always downward sloped and signifies an inverse relationship between demand and exchange rate i.e. price of foreign exchange.