Table of Contents

Tools of Financial Statements Analysis There are different tools of financial statements analysis available to the analyst. The following tools are used to measure the operational efficiency and financial soundness of an enterprise.

The most common used techniques of financial analysis are:

1. Comparative financial statements

2.Common size statements

3.Ratio analysis

4.Cash flow statements

1.Comparative Financial Statements Statements used to compare the items of income statement i.e. profit and loss account and position statement i.e. balance sheet for ascertaining the trend of the performance and profitability of an enterprise are known as comparative financial statements.

(i)Comparative income statement It is a statement which shows in percentage term the total of income earned and expenses incurred during two or more accounting periods.

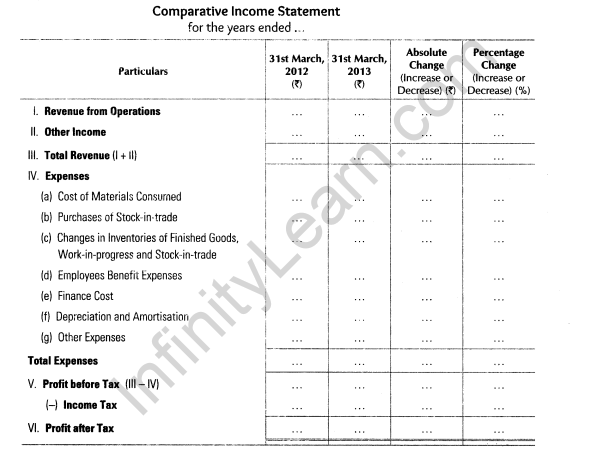

Format of Comparative Income Statement

Also Check: CBSE Syllabus Class 1 to 12

(ii)Comparative balance sheet It is a statement showing assets and liabilities of the business for two or more accounting periods. It also shows the percentage change in the monetary value of the assets and liabilities.

Format of Comparative Income Statement

2.Common Size Statement The statement wherein figures reported are converted into percentage to some common base is known as common size statement. Each percentage shows the relation of the individual item to its respective total.

(i) Common size income statement The statement in which sales figure is assumed to be 100 and all other figures are expressed as a percentage of sales is known as common size income statement.

(ii)Common size balance sheet In common size balance sheet, the total of assets or liabilities is assumed to be 100 and figures are expressed as a percentage of the total.

Also Check: CBSE Board Exam Date Sheet 2024

Format of Common Size Balance Sheet

3.Ratio Analysis The mathematical expression that shows the relationships between various groups of items contained in the financial statements is known as ratio analysis.

4.Cash Flow Statement It shows the inflows and outflows of cash and cash equivalents of an enterprise by classifying cash flows into operating, investing and financing activities during a particular period and analysing the reasons for changes in balance of cash between the two balance sheets dates.

Previous Years Examinations Questions

1 Mark Questions

1.Which item is assumed to be 100 while preparing common size statement of profit

and loss? (Compartment 2014)

Ans. Revenue from operations are assumed to be 100 while preparing common size statement of profit and loss.

2.Name any two tools of analysis of financial statements. (Compartment 2014)

Ans. Two tools of analysis of financial statements are:

(i) Ratio analysis (ii) Cash flow statement

3.What is meant by a common size statements? (Delhi 2011)

Ans. The statement wherein figures reported are converted into percentage to some common base are known are common size statements. Each percentage shows the relation of the individual item to its respective total. In common size income statement, net sales figure is assumed to be 100 and all other figures of expenses are expressed as a percentage of sales. In common size balance sheet, the total of assets or liabilities is assumed to be 100 and figures are expressed as a percentage of the total.

3 Marks Question

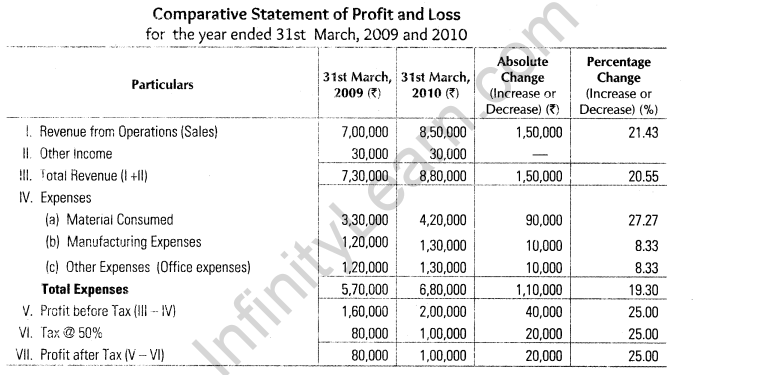

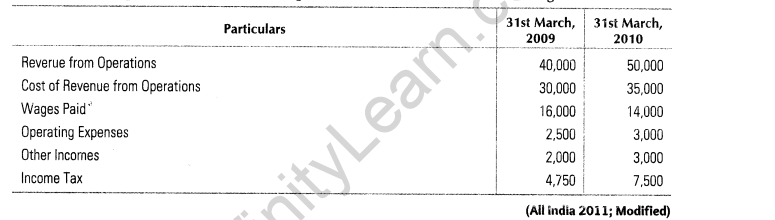

4. From the following information, prepare a comparative statement of profit and loss for the year 2009-2010

Other Information

(i)Income tax is calculated @ 50%.

(ii)Manufacturing expenses are 50% of the total of that category. (All India 2011; Modified)

Ans.

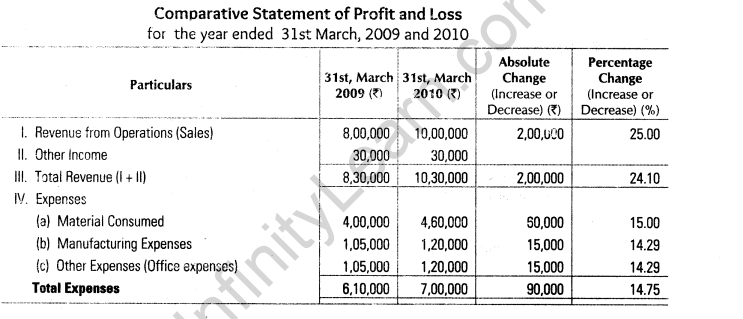

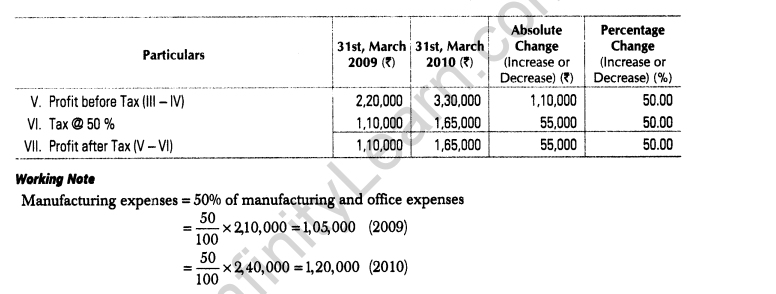

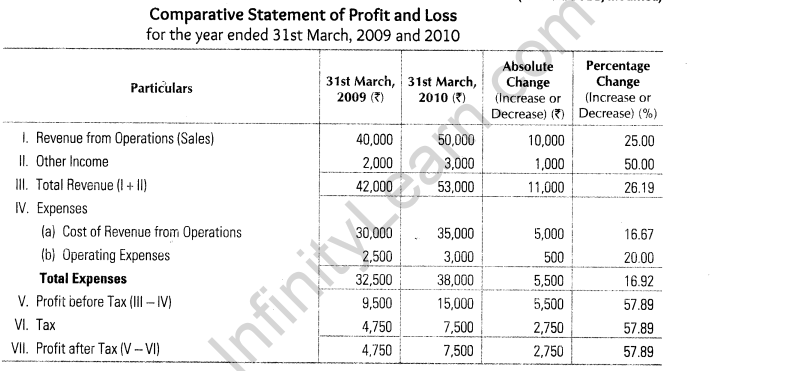

5.From the following information, prepare a comparative statement of profit and loss for the years 2009 and 2010

Other Information

(i) Income tax is calculated @ 50%.

(ii) Manufacturing expenses are 50% of the total of that category. (Delhi 2011 C; Modified)

Ans.

6.What are common size statements? State any two uses of common size statements.(All India 2008)

Ans. Common size statement The statement wherein figures reported are converted into percentage to some common base are known are common size statements. Each percentage shows the relation of the individual item to its respective total. In common size income statement, net sales figure is assumed to be 100 and all other figures of expenses are expressed as a percentage of sales. In common size balance sheet, the total of assets or liabilities is assumed to be 100 and figures are expressed as a percentage of the total.

Uses of common size statements are as follows:

(i) It helps in comparing the relative values of various items of income statement and position statement over two or more accounting periods. Thus, financial managers prepare common size statements for business reporting and decision-making purposes.

(ii) Common size statements prepared by the firm over the years would highlight the relative change in each group of income, expenses, assets and liabilities.

4 Marks Questions

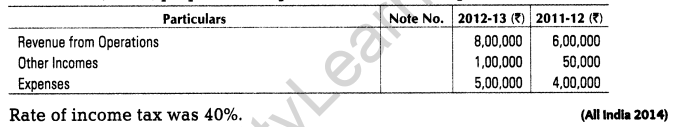

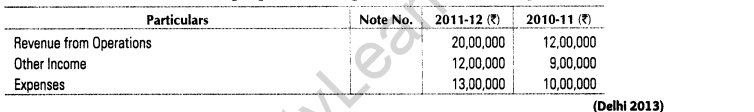

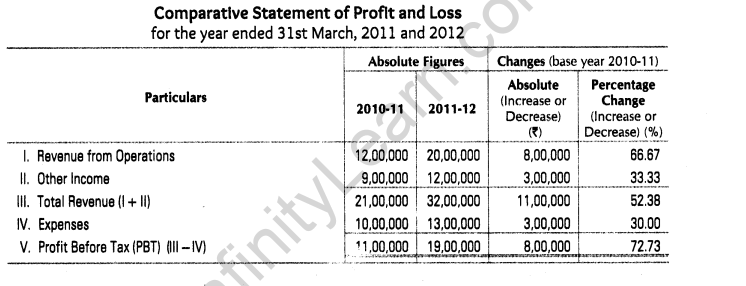

7.From the following statement of profit and loss of Fenox Ltd for the year ended 31st March, 2013, prepare a comparative statement of profit and loss

Ans.

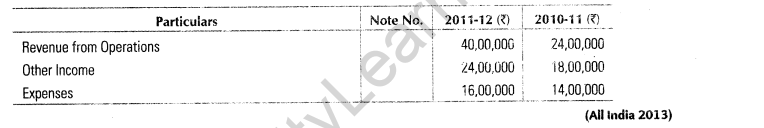

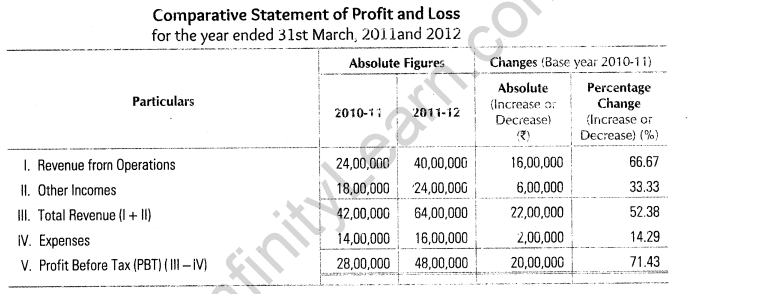

8.On the basis of the following information extracted from the statement of profit and loss for the year ended 31st March, 2012 and 2013, prepare a comparative statement of profit and loss:

Ans.

9.From the following statement of profit and loss of Suntrack Ltd, for the years ended 31st March, 2011 and 2012, prepare a ‘comparative statement of profit and loss’.

Ans.

10.From the following statement of profit and loss of Moontrack Ltd., for the years ended 31st March, 2011 and 2012, prepare a ‘comparative statement of profit and loss.

Ans.

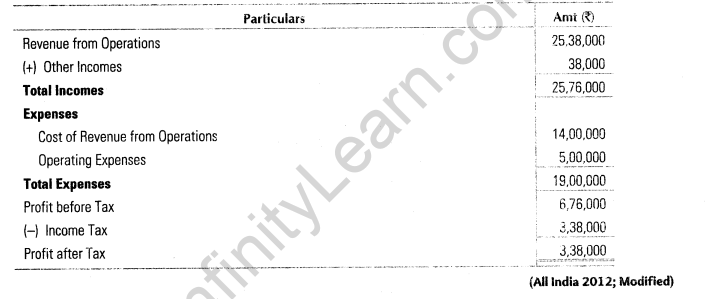

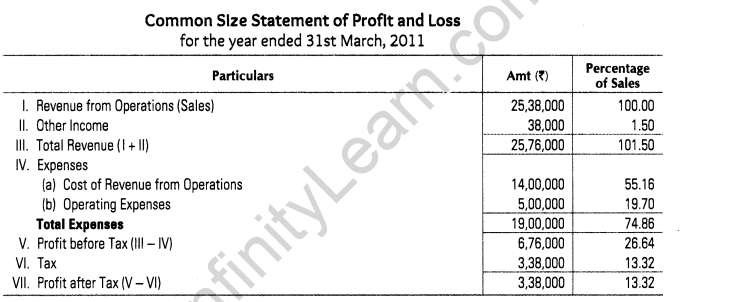

11.From the following income statement, prepare a common size statement of profit and loss Jayant Ltd for the year ended 31st March, 2011

Ans.

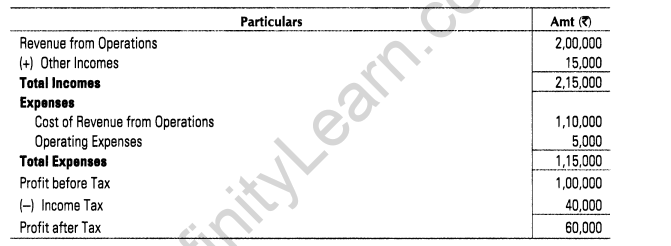

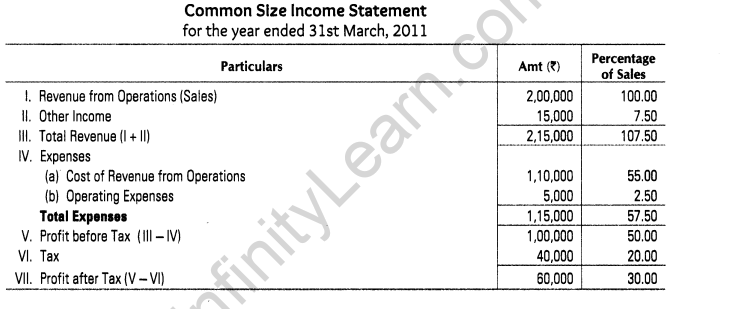

12.Followings is the statement of profit and loss of Raj Ltd for the year ended 31st March, 2011

Prepare a common size statement of profit and loss of Raj Ltd for the year ended 31st March, 2011.(Delhi 2012; Modified)

Ans.

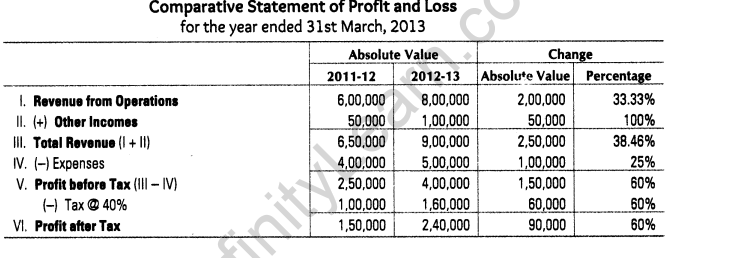

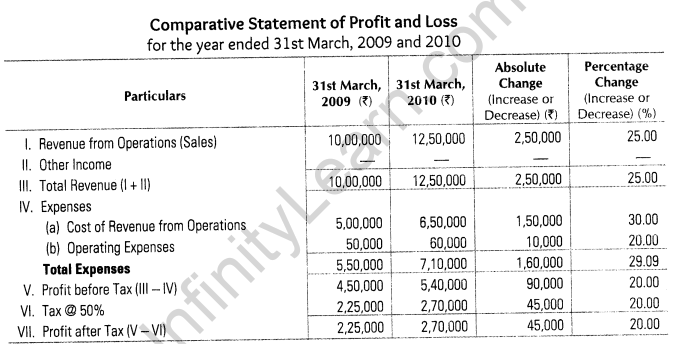

13.Prepare a comparative statement of profit and loss from the following informations

Ans.

NOTE Wages paid are a part of direct expenses and they are already included in cost of goods sold.

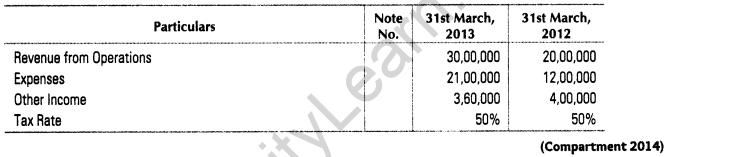

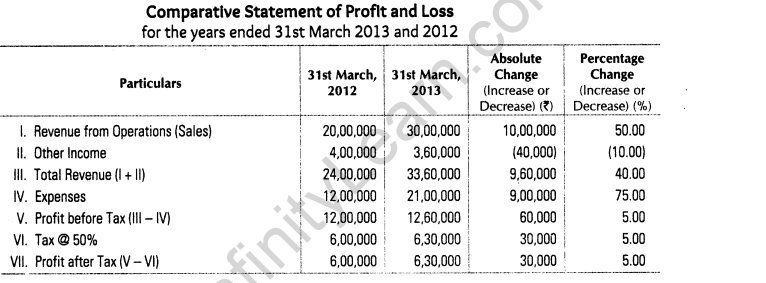

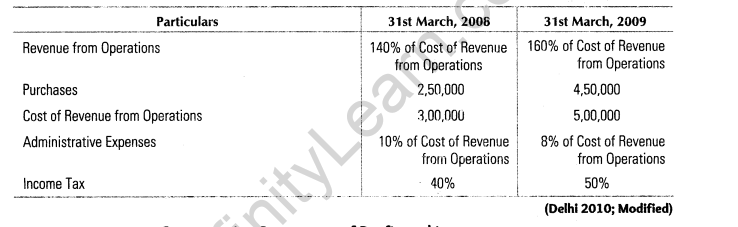

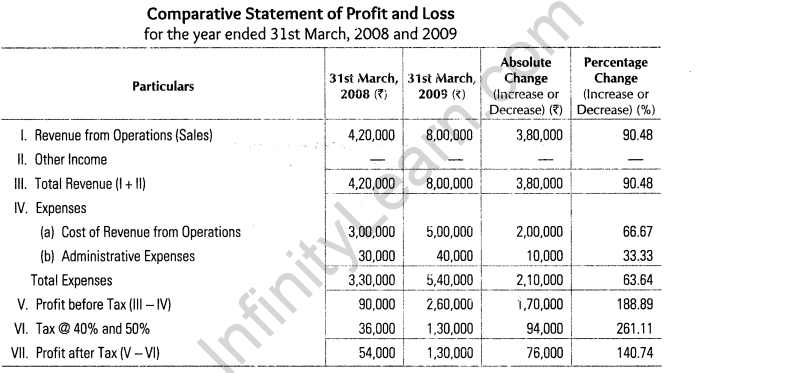

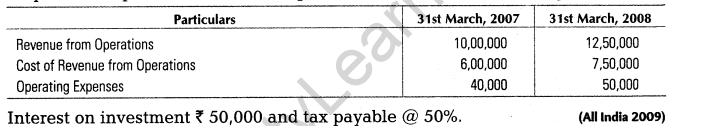

14.Prepare a comparative statement of profit and loss from the following information

Ans.

NOTE Carriage inwards are a part of direct expenses and they are already included in cost of goods sold.

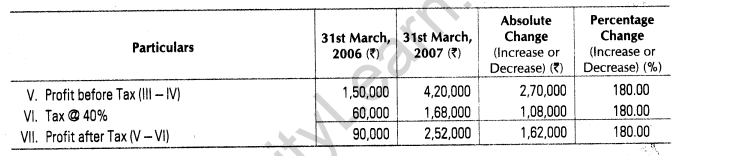

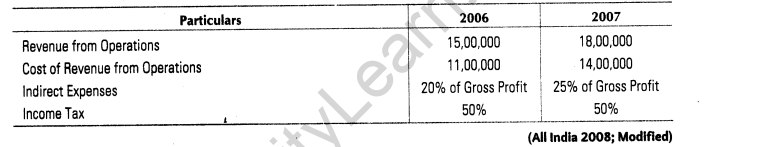

15.From the following information given below, prepare a comparative statement of profit and loss

Ans.

NOTE Purchase is a part of cost of goods sold and thus not shown separately

16.From the following information given below, prepare a comparative income statement of profit and loss

Ans.

17.Prepare a comparative statement of profit and loss from the following

Ans.

NOTE Purchase is a part of cost of goods sold and thus not shown separately.

18.Prepare a comparative statement of profit and loss from the following

Ans.

NOTE Purchase is a part of cost of goods sold and thus not shownseparately.

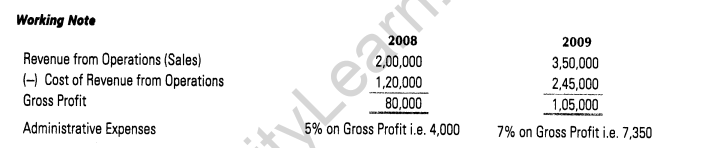

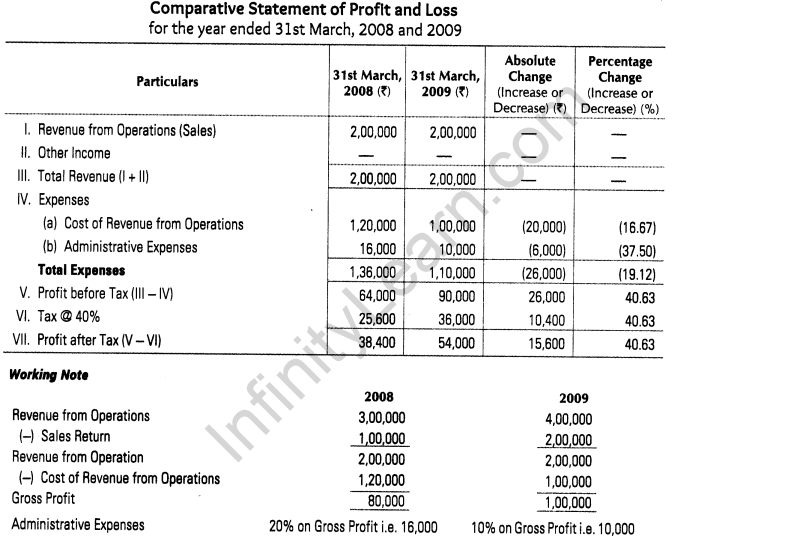

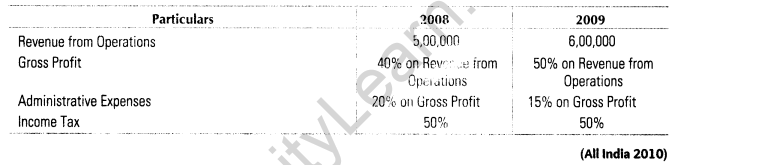

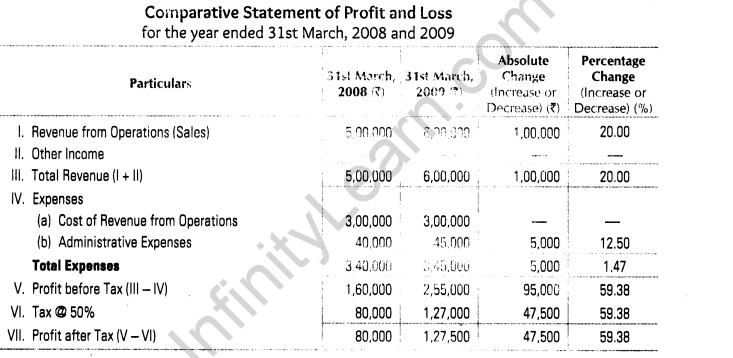

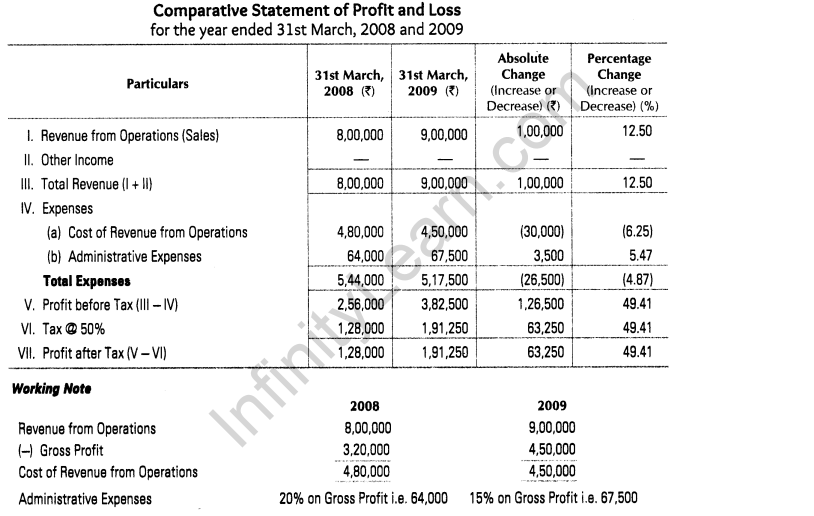

19.From the following information provided, prepare a comparative statement for the period 2008 and 2009

Ans.

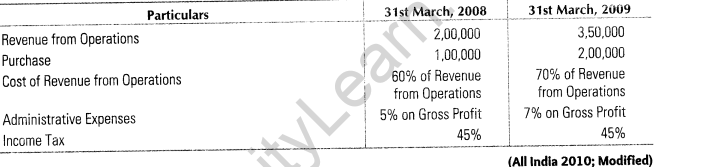

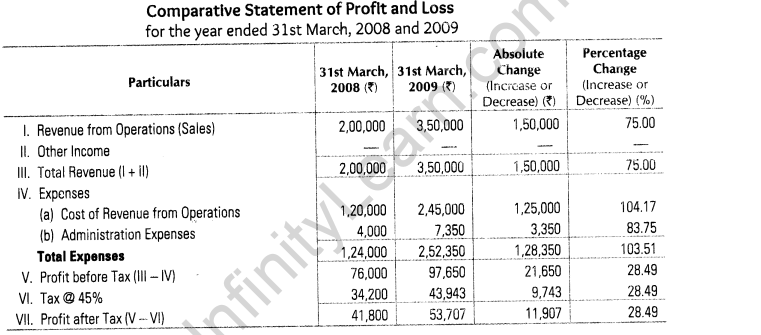

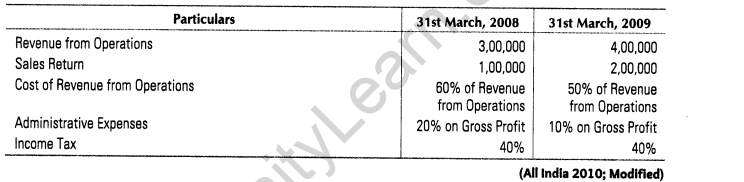

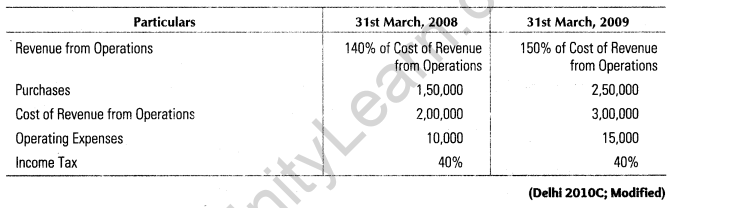

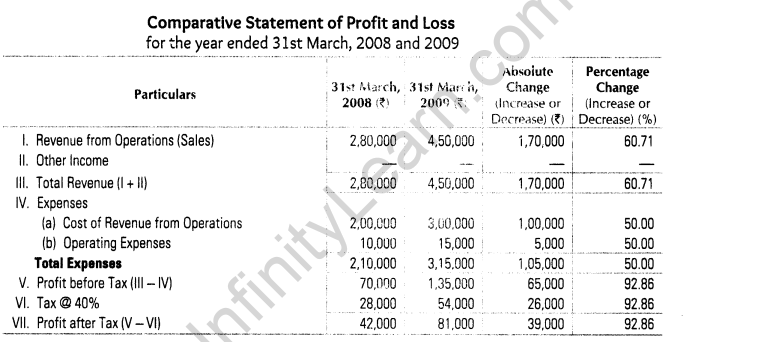

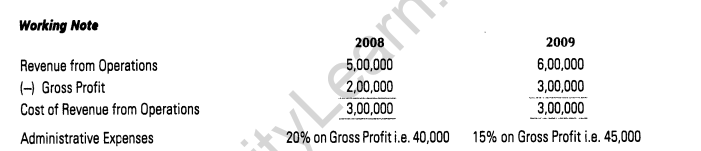

20.From the following information provided, prepare a comparative statement of profit and loss for the period 2008 and 2009.

Ans.

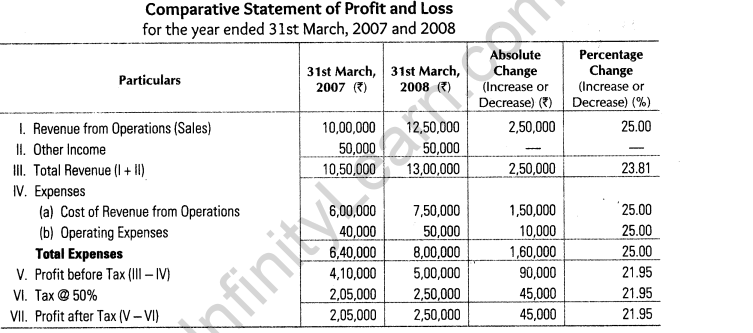

21. Prepare a comparative statement of profit and loss from the following

Ans.

22.From the following information, prepare a comparative statement of profit and loss Vimal Ltd.

Ans.

23. From the following information, prepare a comparative statement of profit and loss Victor Ltd.

Ans.

Financial Statement Analysis-Important Questions FAQs

What is the importance of financial statement analysis class 12?

Making better choices: Financial statements show how the company is doing financially. This lets the bosses compare where things are now with where they want them to be. It helps them decide what to do next to make things better in the future.

What is the most important financial statement for analysis?

Different Kinds of Financial Statements: Income Statement. This statement, usually seen as the most vital among financial statements, displays the amount of money a company earned and used within a certain duration.

What are the 5 methods of financial statement analysis?

There are five common ways to study financial statements: horizontal analysis, vertical analysis, ratio analysis, trend analysis, and cost-volume profit analysis. Each method helps create a detailed and more complete picture of a company's finances.

What is the significance of Analysis of Financial Statements to top management class 12?

Examining financial statements helps the finance manager understand how well the company runs its operations and how effective the managers are. It shows the current financial situation, the assets the company owns, its debts, and the money it holds. This analysis helps to see how much the company owes compared to what it owns.