Table of Contents

Money and Banking Important Questions for class 12 economics Commercial Banks and Central Bank

1. Bank It is an institution which receives funds from the public and gives loans and ; advances to those who need them.

2. Commercial Banks A profit making financial institution which accepts chequeable and non-chequeable deposits from the people and offers different kind of loans for the purpose of consumption or investment, is termed as commercial banks.

3. Definition of Commercial Bank by Indian Banking Companies Act ‘Banking company is one which transacts the business of banking which means the accepting (for the purpose of lending or investment) of deposits of money from the public repayable on demand or otherwise withdrawal by cheque, draft order or otherwise.’

4. Functions of Commercial Banks

(i) Acceptance of deposits (chequeable and non-chequeable)

(ii) Advancement of loans

(iii) Credit creation

(iv) Transfer of funds

(v) Overdraft facility

(vi) Discounting bills of exchange

(vii) Agency functions i.e. fund transfer, fund collecton, etc.

5. Chequeable Deposits Deposits against which cheques can be issued for withdrawing money any time on demand, are termed as chequeable deposits, e.g. saving deposits, current deposits, etc.

6. Non-chequeable Deposits Deposits against which cheques can not be issued for money withdrawal any time on demand, are termed as non-chequeable deposits. These deposits are fixed for a period of time and also, termed as time deposits e.g. fixed deposits, recurring deposits etc.

7. Money or Credit Creation by Commercial Banks Commercial banks increases the flow of money in an economy by credit creation. This process of credit creation is an outcome of its two primary functions, i.e. acceptance of loans and advancement of deposits. The banks issue loans from their cash reserves with the confidence on their historical experience that all depositors will not withdraw their funds at the same time. In this way, commercial banks create credit many more times than their cash reserves and contributes to increase money supply in the economy. It depends on initial level of deposits and money multiplier.

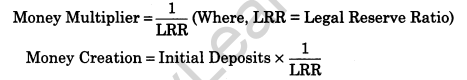

8. Money Multiplier It refers to the fraction by which commercial banks would be able to multiply money from their initial level of deposits. It is obtained by the following formula

9. Difference between a Banking Institution and Financial Institution

A financial institution will not be called a banking institution, until it performs the following two primary functions, i.e.

(i) Acceptance of deposits (chequeable and non-chequeable).

(ii) Providing loans.

Hence, all financial institutions are not banking institutions, but all banking institutions are financial institutions. Other financial institutions are known as non-banking financial institution, which performs some but not all functions of a bank. They can accepts deposits but cannot give loans such as LIC, UTI, etc.

10. The Central Bank It is an apex banking institution which controls and regulates the entire banking system and money supply of a country. Reserve Bank of India is the Central Bank of India.

11. Functions of Central Bank

(i) Authority for issuing of currency notes

(ii) Banker to the government

(iii) Banker’s bank

(iv) Lender of the last resort

(v) Supervision of all commercial banks

(vi) Maintains the custody of nation’s foreign currency reserves

(vii) Clearing house

(viii) Controls the supply of credit

(ix) Collection of statistical information

12. Credit Control Policy/Monetary Policy of Central Bank The central policy to control and regulate the supply of money or credit within an economy, is termed as monetary policy.

The following instruments are used in monetary policy to control the flow of credit:

(i) Quantitative Instruments These instruments affect the overall supply of money in an economy. These are

(a) Bank rate policy (b) Open market operations

(c) Cash reserve ratio (d) Statutory liquidity ratio

(e) Repo rate (f) Reverse repo rate.

(i) Qualitative Instruments These instruments affect the flow of money in selected cmp intended sectors. These are

(a) Margin requirement

(b) Rationing of credit or selective credit control

(c) Direct action

(d) Moral suasion

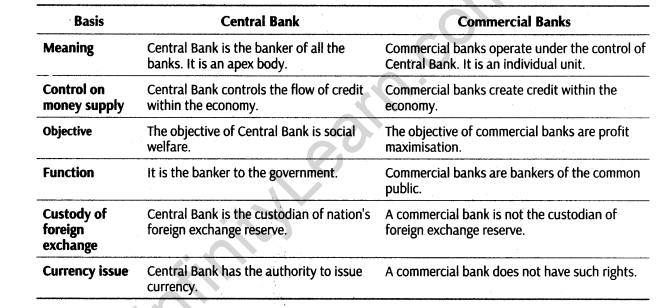

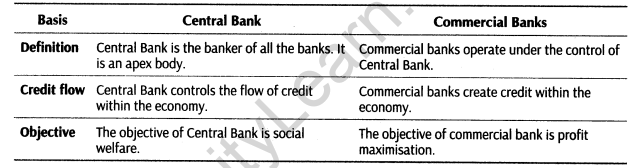

13. Difference between Central Bank and commercial banks

–14. Some Important Concepts

–14. Some Important Concepts

(i) Repo rate The rate at which the (Central Bank) offers loans to other commercial banks for a period ranging from 1 to 14 days.

(ii) Reverse repo rate The interest rate at which commercial banks can deposit their surplus funds with Central Bank, or in other words the rate at which Central Bank borrows from commercial banks.

(iii) Cash Reserve Ratio The percentage of total deposits,which a commercial bank needs to keep as reserve with the Central Bank, this ratio is termed as Cash Reserve Ratio.

(iv) Statutory Liquidity Ratio (SLR) Every commercial bank is required to maintain a fixed percentage of its assets in the form of cash or other liquid assets. This is termed as statutory liquidity ratio.

(v) Legal Reserve Ratio (LRR) It refers to that legal minimum fraction of total deposits which the commercial banks are required to keep. It is sum of CRR and SLR.

(vi) Bank rate The rate at which commercial banks can borrow money from RBI, when they run short of reserves, is termed as bank rate. This loan is given for a period of more than 90 days.

15. High Powered Money The total liability of the Central Bank is termed as high powered money or monetary base. It includes the currency notes and coins held by public and commercial banks, deposits held by the government and commercial banks with the Central Bank.

Previous Years Examination Questions

1 Mark Questions

1. What are demand deposits?

(All India 2014,2011,2010; Delhi 2013,2012)

Ans. Demand deposits are current and savings account deposits with banks or other financial institutions, which are payable on demand. No interest payments are given on current account deposits whereas, on saving account very low rate of interest are given.

2. What are time deposits? (All India 2014,2012; Delhi 2010C; Compartment 2014)

Ans. Time deposits are fixed term and recurring deposits having a fixed period of maturity, where the term of deposit may vary. Cheques cannot be issued aganist them and are not payable on demand and these deposits yield interests for the depositor.

3. What is a Central Bank? (Foreign 2014; Delhi 2009C, 2008)

Ans. The Central Bank is an apex banking institution which controls the entire banking system and money supply of a country. Reserve Bank of India is the Central Bank of India.

4. Define Cash Reserve Ratio. (Delhi 2011)

Ans. The percentage of total deposits, which a commercial bank needs to keep as reserve with the Central Bank, this ratio is termed as Cash Reserve Ratio.

5. Define Statutory Liquidity Ratio. (All India 2011)

Ans. Every commercial bank is required to maintain a fixed percentage of its assets in the form of cash or other liquid assets. This is termed as Statutory Liquidity Ratio.

6. Define bank rate. (Delhi 2009,2008C)

Ans. The rate at which commercial banks can barrow funds from Central Bank for a period of more than 90 days is termed as bank Rate.

7. What is commercial bank? (All India 2008)

Ans. Commercial bank is financial institution which accepts chequeable and non-chequeable deposits from the people and offers different kind of loans for the purpose of consumption or investment.

3 Marks Questions

8. Explain the currency authority function of Central Bank. (Foreign 2014)

Ans. Central Bank of the country has the sole authority of currency issue in the country, which gives it a monopoly in issuing currency. As in India RBI issues the currency, while currency notes are printed by the subsidies of RBI and coins are minted by the Central Government of the country, however both currency notes and coins are circulated by RBI, which gives RBI the power to control, superwise and enhance the money supply in the economy.

9. Explain lender of the last resort function of the Central Bank.

(Delhi 2014,2010; All India 2013,2010)

When a commercial bank fails to accommodate its financial requirements, the Central Bank acts as the lender of last resort. The Central Bank issues loans to a commercial bank against specified and approved securities of the bank.

In this way, the Central Bank ensures the smooth functioning of commercial banks and appropriate flow of credit in the economy.

10. Explain the banker to the government function of the Central Bank.

(Delhi 2013,2010; Ml India 2010)

Central Bank acts as a banker, advisor and agent to the Central and State Governments. As the common public keep their cash balance, demand deposits and time deposits with commercial banks; the Central Bank manages the cash reserves and demand deposits of governments in current accounts. It carries out the exchange, remittance and other banking operations on behalf of the government, i.e. the Central Bank maintains same relation with the government as commerical banks has with genes.

11.Explain the meaning of Cash Reserve Ratio and Statutory Liquidity Ratio. (All India 2010)

Cash Reserve Ratio The percentage of total deposits, which a commercial bank needs to keep as reserve with the Central Bank, this ratio is termed as Cash Reserve Ratio.

Statutory Liquidity Ratio Every commercial bank is required to maintain a fixed percentage of its assets in the form of cash or other liquid assets. This is termed as Statutory Liquidity Ratio.

12. State any three points of distinction between Central Bank and commercial banks.

(Delhi 2009; All India 2008)

13. State three main functions of commercial bank. Explain any one of them. (All India 2009)

Ans.The three main functions of commercial banks are

(i) Accepting deposits

(ii) Advancing loans

(iii) Credit/money creation

Accepting deposits It is one of the primary function of commercial banks. It accepts chequeable and non-chequeable deposits from public in the form of demand deposits (which can be withdrawn on demand) and time deposits (which cannot be withdraws on demand).

14. Explain any two functions of a Central Bank. (Delhi 2009; All India 2009)

Ans. The two main functions of a Central Bank are

(i) Bank of Issue Note issue is the main function of a Central Bank. It has the monopoly or we can say, have a sole authority to issue currency notes.

(ii) Banker’s bank Central Bank keeps the cash balances of commercial banks and issues loans to them on requirements in the same manner as the commercial bank does for its customers. A Central Bank has almost the same relation with the other commercial banks of the country that the commercial banks have with the common public. That is why the Central Bank is also called as banker’s bank.

15. What is bank rate policy? How does it work as a method of credit control? (Delhi 2008)

Ans. Central bank adopts bank rate policy as a quantitative technique to control credit in an economy. This is the rate at which commercial banks can barrow funds from Central Bank for a period of more than 90 days.

It works accordingly when the bank rate is increased by RBI, it discourages commercial banks and people from taking loans. It decreases the credit multiplier and the money/credit flow is controlled. On the other hand, at time of credit crunch, RBI decreases the bank rate and this encourages commercial banks and people to take more loans due to low interest payments. This enhances the flow of credit in the economy.

16. What are open market operations? How do these work as a method of credit Control? (Delhi 2008)

Ans. Under open market operations, RBI purchases or sells government securities to commercial banks and general public for the purpose of increasing or decreasing the stock of money in an economy. The purchase or sale of securities controls the money in the hands of public as they deposit or withdraw the money from commercial banks. Thus, money creation by commercial banks get affected. By selling the securities, the Central Bank withdraws cash balances from the economy and by buying the securities, the Central Bank adds to the balance in the economy, in this way, it works as a method of credit control. Based on economic conditions, the Central Bank conduct buying and selling of securities in the open market.

17. State three methods of credit control used by the Central Bank. (All India 2008)

Ans. The three methods of credit control used by the Central Bank are as follows:

(i) Bank rate policy

(ii) Open market operations

(iii) Legal Reserve Ratio

18. Explain any two main functions of commercial banks. (Delhi 2008C)

Ans. Commercial banks perform two primary functions are:

(i) Accepting deposits Bank accepts deposits from the public in the form of chequeable or non-chequeable deposits, e.g. saving and current account deposits and fixed and recurring deposits.

(ii) Providing loans Commercial bank provides loans and advances to the public to fulfil their needs of money. Loan may be granted in the form of cash, credit, ordinary loans, overdraft, discounting of bills, short-term loan, consumer credit etc.

4 Marks Questions

19.Explain the credit creation role of commercial banks with the help of a numerical. (Compartment 2014; All India 2013)

or

How do commercial banks create deposits? Explain. (Delhi 2013)

Ans. Commercial banks increases the flow of money in an economy by credit creation. This process of credit creation is an outcome of its two primary functions, i.e. advancement of loans and acceptance of deposits. The banks issue loans from their cash reserves with the confidence on their historical experience that all depositors will not withdraw their funds at the same time. In this way, commercial banks create credit many more times than their cash reserves and contributes to increase money supply in the economy. Demand deposits of the commercial banks are many times more than their cash reserves.

Money creation is determined by *

(i) The amount of the initial fresh deposits.

(ii) The Legel Reserve Ratio (LRR) is the minimum ratio of deposits legally required to be kept as cash by the banks.

(iii) Money Multiplies = 1/LRR

Total Money Creation = Initial Deposits x 1/LRR

e.g. Let the LRR be 20%

Fresh deposits = Rs. 10000

Amount required by the banks to keep = Rs. 2000 as cash suppose the banks lend the remaining amount of Rs. 8000. The commercial banks also know by way of their historical experience that all the depositors would not show up in the banks to withdraw all their deposits at a point of time. Those person who borrow, use this money for making payments, also all the transactions will be carried out through banks.

Further, it is also assumed that, those who receive fresh deposits of Rs. 8000, the banks again keep Rs. 1,600 as cash and lend Rs. 6,400, which is also 80% of the last deposit, the money again comes back to the banks leading to a fresh deposit of Rs.6,400. In this way, the money goes on multiplying and ultimately total money creation is Rs.50,000.

As, according to the formula

Total money creation =10,000 x 1/20 x 100 = Rs. 50,000

20.Explain the banker’s bank function of Central Bank. (All India 2014; Delhi 2012)

Ans. Banker’s bank Central Bank keeps the cash balances of commercial banks and issues loans to them on requirements in the same manner as the commercial bank does for its customers. A Central Bank has almost the same relation with the other commercial banks of the country that the commercial banks have with the common public. That is why the Central Bank is also called as banker’s bank.

21. Explain the lender of last resort function of the Central Bank. (Compartment 2014; All India 2012)

Ans. In emergency situations, when a commercial bank fails to accommodate its financial requirements from any other sources, the Central Bank acts as the lender of last resort. The Central Bank issues loans to a commercial bank against specified and approved securities of the bank.

In this way, the Central Bank ensures the smooth functioning of commercial banks and appropriate flow of credit in the economy. Due to the above stated reason, the Central Bank is termed as lender of the last resort.

22. Explain government banker function of the Central Bank. (All India 2014; All India 2012)

Ans. Central Bank acts as a banker, advisor and agent to the Central and State Governments. As the common public keep their cash balance, demand deposits and time deposits with commercia banks; the Central Bank manages the cash reserves and demand deposits of governments in current accounts. It carries out the exchange, remittance and other banking operations on behalf of government.

It issues loans and advances to the government and does buying and selling of securities on behalf of government. It also advises the government to frame fiscal policy of the country. That is why, the Central Bank is called as ‘government’s banker’.

23. Explain, how do open market operations by the Central Bank affect money creation by commercial banks? (Compartment 2014; All India 2010)

Ans. Under open market operations, RBI purchases or sells government securities to commercial banks and general public for the purpose of increasing or decreasing the stock of money in an economy. The purchase or sale of securities controls the money in the hands of public as they deposit or withdraw the money from commercial banks. Thus, money creation by commercial banks get affected. By selling the securities, the Central Bank withdraws cash balances from the economy and by buying the securities, the Central Bank adds to the balance in the economy, in this way, it works as a method of credit control. Based on economic conditions, the Central Bank conduct buying and selling of securities in the open market.

Suppose, the Central Bank purchase securities of Rs. 1,000 from a bond holder by issuing a cheque, The seller of the bond produces this cheque of Rs. 1,000 to his bank. The bank credits the account of the seller by Rs. 1,000 and the deposits of the bank goes up by Rs. 1,000, which is a liability to the bank on the other hand, the assets of the commercial, also go up as the cheque in its possession is a claim on the Central Bank.

Thus, purchase of security, increases the money creation of commercial banks and similarly, sale securities decreases the credit creation of commercial banks. Thus, the Central Bank controls the process of money creation by commercial banks by open market operations.

24. Explain any two methods of credit control used by Central Bank. (All India 2013)

Ans. The Central Bank acts as a controller of money supply and credit, using the following methods

(i) Margin requirement It is a qualitative method of credit control. A margin refers to the difference between market value of the security offered for loan and the amount loan offered by the ‘ commercial banks. During inflation, supply of credit is reduced by raising the requirement of margin. During deflation supply of credit is increased by lowering the requirement of ‘margin’. This measure is often used to discourage the flow of credit into speculative business activities.

(ii) Open market operations Under open market operations, RBI purchases or sells government securities to commercial banks and general public for the purpose of increasing or decreasing the stock of money in an economy. The purchase or sale of securities controls the money in the hands of public as they deposit or withdraw the money from commercial banks. Thus, money creation by commercial banks get affected.

By selling the securities, the Central Bank withdraws cash balances from the economy and by buying the securities, the Central Bank adds to the balance in the economy, in this way, it works as a method of credit control. Based on economic conditions, the Central Bank conduct buying and selling of securities in the open market

25. Explain the components of Legal Reserve Ratio. (Delhi 2012)

Ans. The minimum percentage of a bank’s total demand and time deposits, that is required to be maintained in the form of cash or specified liquid assets by the commercial banks with the Central Bank is termed as Legal Reserve Ratio.

The components of Legal Reserve Ratio are as follows

(i) Cash Reserve Ratio The percentage of total deposits, which a commercial bank needs to keep as reserve with the Central Bank, this ratio is termed as Cash Reserve Ratio.

(ii) Statutory Liquidity Ratio Every commercial bank is required to maintain a fixed percentage of its assets in the form of cash or other liquid assets. This is termed as Statutory Liquidity Ratio.

26. How do changes in bank rate affect money creation by commercial banks? (Delhi 2010)

Ans. The rate at which commercial banks can borrow money from RBI, when they run short of reserves, is called bank rate. When the Central Bank increase the bank rate, it increases the cost of borrowing and hence, discourages the borrowers from taking a loan. Due to this, the process of credit creation and flow of money also reduces.

On the other hand, when the Central Bank decreases the bank rate, it encourages the borrower to take more and more loan. A high demand of loan increases the credit multiplier and credit creation process of the commercial banks.

27. Explain banker’s bank and supervisor function of Central Bank. (Delhi 2009c)

Ans. (i) Banker’s bank Central Bank keeps the cash balances of commercial banks and issues loans to them on requirements in the same manner as the commercial bank does for its customers. A Central Bank has almost the same relation with the other commercial banks of the country that the commercial banks have with the common public. That is why the Central Bank is also called as banker’s bank..

(ii) Supervisor A Central Bank supervises the operation of all commercial banks. It supervises in the form of licensing of the commercial banks, expansion and opening of branches of commercial banks, merger of banks and the liquidation of the banks. Thus, the Central Bank supervises the smooth functioning of commercial banks.

28. Explain the ‘acceptance of deposits’ function of commercial banks. (Delhi 2008)

Ans. Acceptance of deposits is one of the primary function of commercial banks. Commercial banks accept chequeable and non-chequeable deposits from its customer in the form of demand deposits, savings deposits and time deposits. Acceptance of chequeable deposits function discriminates a commercial bank from non-banking financial institutions, who can accepts deposits but cannot advance loans, e.g. LIC.

29.Give four agency functions of commercial banks. (Delhi 2008)

Ans. The agency functions of commercial banks are as follows

(i) Sale and purchase of securities The commercial banks help their customers to buy and sell government and private company’s securities.

(ii) Fund transfer Commercial banks transfer the customers’ funds from one place to another through cheques, demand drafts, NEFT, RTGS, etc.

(iii) Collection of funds Commercial banks collect the funds from cheques, demand drafts, etc for its customers.

(iv) Collection of dividends Commercial banks collect the dividends on shares of its customers.

30. Explain the lending function of commercial banks. (All India 2008)

Ans. Commercial banks give loans to its customers in many forms. The bank advances the following types of loans:

(i) Cash credit In this type of credit scheme, banks advance loans to its customers on the basis of securities inventories etc.

(ii) Overdraft Bank advance loans to its customer’s upto a certain amount through overdraft facility, if there are no deposits in the current account.

(iii) Short-term loan These loans may be given as personal loans, loans to finance working capital or as priority sector advances. These are made against some security.

(iv) Discounting of bills of exchange Under this system, banks advance loans to the traders and business firms by discounting their bills, before the maturity of the bill.

6 Marks Questions

31. Explain the process of money creation by commercial banks with the help of a numerical example. (Delhi 2011; All India 2010,2010c)

Ans. Commercial banks increases the flow of money in an economy by credit creation. This process of credit creation is an outcome of its two primary functions, i.e. advancement of loans and acceptance of deposits. The banks issue loans from their cash reserves with the confidence on their historical experience that all depositors will not withdraw their funds at the same time. In this way, commercial banks create credit many more times than their cash reserves and contributes to increase money supply in the economy. Demand deposits of the commercial banks are many times more than their cash reserves.

Money creation is determined by *

(i) The amount of the initial fresh deposits.

(ii) The Legel Reserve Ratio (LRR) is the minimum ratio of deposits legally required to be kept as cash by the banks.

(iii) Money Multiplies = 1/LRR

Total Money Creation = Initial Deposits x 1/LRR

e.g. Let the LRR be 20%

Fresh deposits = Rs. 10000

Amount required by the banks to keep = Rs. 2000 as cash suppose the banks lend the remaining amount of Rs. 8000. The commercial banks also know by way of their historical experience that all the depositors would not show up in the banks to withdraw all their deposits at a point of time. Those person who borrow, use this money for making payments, also all the transactions will be carried out through banks.

Further, it is also assumed that, those who receive fresh deposits of Rs. 8000, the banks again keep Rs. 1,600 as cash and lend Rs. 6,400, which is also 80% of the last deposit, the money again comes back to the banks leading to a fresh deposit of Rs.6,400. In this way, the money goes on multiplying and ultimately total money creation is Rs.50,000.

As, according to the formula

Total money creation =10,000 x 1/20 x 100 = Rs. 50,000

32. Explain the following functions of the Central Bank (All India 2011)

(i) Bank of issue

(ii) Banker’s bank

Ans. (i) Bank of issue Note issue is the main function of a Central Bank. It has the monopoly or we can say, have a sole authority to issue currency notes..

(ii) Banker’s bank Central Bank keeps the cash balances of commercial banks and issues loans to them on requirements in the same manner as the commercial bank does for its customers. A Central Bank has almost the same relation with the other commercial banks of the country that the commercial banks have with the common public. That is why the Central Bank is also called as banker’s bank.