Excess Demand and Deficient Demand – CBSE Notes for Class 12 Macro Economics

Introduction

An illustration of meaning, diagram, reasons, impacts and measures to control excess demand (inflationary gap) and deficient demand (deflationary gap); basic definitions of full employment, over full employment, involuntary unemployment, voluntary unemployment is also dealt with in this chapter.

Excess Demand And Its Related Concepts

1. Excess Demand and Inflationary Gap:

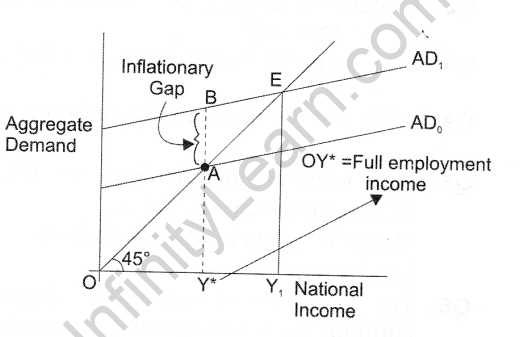

(a) When in an economy, aggregate demand exceeds “aggregate supply at full employment level”, the demand is said to be an excess demand.

(b) Inflationary gap is the gap showing excess of current aggregate demand over ‘aggregate supply at the level of full employment’. It is called inflationary because it leads to inflation (continuous rise in prices).

(c) A simple example will further -clarify it. Let us suppose that an imaginary economy by employing all its available resources can produce 10,000 quintals of rice. If aggregate demand of rice is say 12,000 quintals, this demand will be called an excess demand, because aggregate supply at level of full employment of resources is only 10,000 quintals and the result of the gap of 2000 quintals will be called as inflationary gap. In the above diagram Inflationary gap is AB because at Full employment Y*, Aggregate demand (BY*) is greater than Aggregate Supply(AY*).

2. Reasons or causes for excess demand: The main reasons for excess demand are

apparently the increase in the following components of aggregate demand:

(a) Increase in household consumption demand due to rise in propensity to consume.

(b) Increase in private investment demand because of rise in credit facilities.

(c) Increase in public (government) expenditure.

(d) Increase in export demand.

(e) Increase in money supply or increase in disposable income.

3. Impacts or effects of excess demand on price, output, employment:

(a) Effect on General Price Level: Excess demand gives a rise to general price level because it arises when aggregate demand is more than aggregate supply at a full employment level. There is inflation in economy showing inflationary gap.

(b) Effect on Output: Excess demand has no effect on the level of output. Economy is at full employment level and there is no idle capacity in the economy. Hence output can’t increase.

(c) Effect on Employment: There will be no change in thq. level of employment also.

The economy is already operating at full employment equilibrium, and hence, there is no unemployment.

4. Measures to control the excess demand: We can control the excess demand with the help of the following policy:

(a) Monetary Policy (b) Fiscal Policy

Let us discuss it in detail:

(a) Monetary Policy: Monetary policy is the policy of the central bank of a countiy to control money supply and availability of credit in the economy. The central bank can take the following steps:

(i) Quantitative Instruments or General Tools of Monetary Policy: These are the instruments of monetary policy that affect overall supply of money/credit in the economy. These instruments do not direct or restrict the flow of credit to some specific sectors of the economy. They are as under

• Bank Rate or Discount Rate (Increase in Bank Rate)

-> Bank rate is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan). The thing, which has to be remembered, is that central bank lends to commercial banks and not to general public.

-> In a situation of excess demand leading to inflation

-> Central bank raises bank rate that discourages commercial banks in borrowing from central bank as it will increase the cost of borrowing of commercial bank.

❖ It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

❖ Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

❖ Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

• Repo Rate (Increase in Repo Rate):

-> Repo rate is the rate at which commercial banks borrow money from the central bank for short period by selling their financial securities to the central bank.

-> These securities are pledged as a security for the loans.

-> It is called Repurchase rate as this involves commercial bank selling securities to RBI to borrow the money with an agreement to repurchase them at a later date and at a predetermined price.

-> So, keeping securities and borrowing is repo rate.

-> In a situation of excess demand leading to inflation

❖ Central bank raises repo rate that discourages commercial banks in borrowing from central bank as it will increase the cost of borrowing of commercial bank.

❖ It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans, which discourages investment.

❖ Again high rate of interest induces households to increase their savings by restricting expenditure on consumption.

❖ Thus, expenditure on investment and consumption is reduced, which will control the excess demand.

• Reverse Repo Rate (Increase in Reverse Repo Rate):

-> It is the rate at which the central bank (RBI) borrows money from commercial bank.

-> In a situation of excess demand leading to inflation, Reverse repo rate is increased, it encourages the commercial bank to park their funds with the central bank to earn higher return on idle cash. It decreases the lending capability of commercial banks, which controls excess demand.

• Open Market Operations (OMO) (Sale of securities):

-> It consists of buying and selling of government securities and bonds in the open market by central bank.

-> In a situation of excess demand leading to inflation, central bank sells government securities and bonds to commercial bank. With the sale of these securities, the power of commercial bank of giving loans decreases, which will control excess demand.

• Increase in Varying Reserve Requirements or Legal Reserve Ratio:

-> Banks are obliged to maintain reserves with the central bank, which is known as legal reserve ratio. It has two components. One is the Cash Reserve Ratio or CRR and the other is the SLR or Statutory Liquidity Ratio.

-> Cash Reserve Ratio (Increase in CRR):

❖ It refers to the minimum percentage of a bank’s total deposits, which

it is required to keep with the central bank. Commercial banks have to keep with the central bank a certain percentage of their deposits in the form of cash reserves as a matter of law.

❖ For example, if the minimum reserve ratio is 10% and total deposits of a certain bank is Rs.100 crore, it will have to keep Rs.10 crore with the central bank.

❖ In a situation of excess demand leading to inflation, cash reserve ratio (CRR) is raised to 20 per cent, the bank will have to keep Rs.20 crore with the central bank, which will reduce the cash resources of commercial bank and reducing credit availability in the economy, which will control excess demand.

-> Statutory Liquidity Ratio (Increase SLR):

❖ It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

❖ In a situation of excess demand leading to inflation, the central bank increases statutory liquidity ratio (SLR), which will reduce the cash resources of commercial bank and reducing credit availability in the economy.

(ii) Qualitative Instruments or Selective Tools of Monetary Policy: These instruments are used to regulate the direction of credit. They are as under:

(i) Imposing margin requirement on secured loans (Increase):

• Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security.

• So, the difference between the value of security and value of loan is called marginal requirement.

• In a situation of excess demand leading to inflation, central bank raises marginal requirements. This discourages borrowing because it makes people get less credit against their securities.

(ii) Moral Suasion:

• Moral suasion implies persuasion, request, informal suggestion, advice and appeal by the central banks to commercial banks to cooperate with general monetary policy of the central bank.

• In a situation of excess demand leading to inflation, it appeals for credit contraction.

(iii) Selective Credit Control (SCC) [Introduce Credit Rationing]:

• In this method the central bank can give directions to the commercial banks not to give credit for certain purposes or to give more credit for particular purposes or to the priority sectors.

• In a situation of excess demand leading to inflation, the central bank introduces rationing of credit in order to prevent excessive flow of credit, particularly for speculative activities. It helps to wipe off the excess demand.

(b) Fiscal Policy: The expenditure and revenue policy taken by the general government to accomplish the desired goals is known as fiscal policy. A general government can take the following steps:

(a) Revenue Policy (Increase Taxes):

(i) Revenue policy is expressed in terms of taxes.

(ii) During inflation the government impose higher amount of taxes causing the decrease in purchasing power of the people.

(iii) It is so because to control excess demand we have to reduce the amount of liquidity from the economy.

(b) Expenditure Policy (Reduces Expenditure):

(i) Government has to invest huge amount on public works like roads, buildings, irrigation works, etc.

(ii) During inflation, government should curtail (reduce) its expenditure on public works like roads, buildings, irrigation works thereby reducing the money income of the people and their demand for goods and services.

(c) Increase in Public Borrowing/Public Debt:

(i) This measure means that government should raise loans from public and hence borrowing decreases the purchasing power of people by leaving them with lesser amount of money.

(ii) So, government should resort to more public borrowing during excessive demand.

(iii) Government should make long term debts more attractive so that public may use their excess liquidity amount of money in purchasing these bonds, which will reduce the liquidity amount of money in the economy and thereby inflation could be controlled

Deficient Demand And Its Related Concepts

1. Deficient Demand or Deflationary Gap:

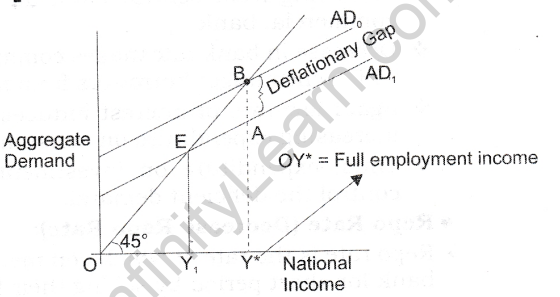

(a) When in an economy, aggregate demand falls short of aggregate supply at full employment level, the demand is said to be a deficient demand.

(b) Deflationary gap is the gap showing Demand

deficient of current aggregate demand over ‘aggregate supply at the level of full employment’. It is called deflationary because it leads to deflation (continuous fall in prices).

(c) Let us suppose that an imaginary economy by employing all its available resources can produce 10,000 quintals of rice. If aggregate demand of rice is, say 8,000 quin tals, this demand will be called a deficient demand and the gap of 2000 quintals will be called as deflationary gap. Clearly here equilibrium between AD and AS is at a point less than level of full employment. Keynes called it an under employment equilibrium.

2. Reasons or causes for deficient demand: The main reasons for deficient demand are apparently the decrease in four components of aggregate demand:

(a) Decrease in household consumption demand due to fall in propensity to consume.

(b) Decrease in private investment demand because of fall in credit facilities.

(c) Decrease in public (government) expenditure.

(d) Decrease in export demand.

(e) Decrease in money supply or decrease in disposable income.

3. Impacts or effects of deficient demand:

(a) Effect on General Price Level: Deficient demand causes the general price level to fall because it arises when aggregate demand is less than aggregate supply at full employment level. There is deflation in an economy showing deflationary gap.

(b) Effect on Employment: Due to deficient demand, investment level is reduced, which causes involuntary unemployment in the economy due to fall in the planned output.

(c) Effect on Output: Low level of investment and employment implies low level of output.

4. Measures to Control the deficient demand: We can control the deficient demand with the help of the following policies:

(a) Monetary policy (b) Fiscal policy

Let us discuss it in detail:

(a) Monetary Policy: Monetary policy is the policy of the central bank of a country of controlling money supply and availability of credit in the economy. The central bank takes the following steps:

(i) Quantitative Instruments or General Tools of Monetary Policy: These are the instruments of monetary policy that affect overall supply of money/credit in the economy. These instruments do not direct or restrict the flow of credit to some specific sectors of the economy. They are as under:

• Bank Rate or Discount Rate (Decrease in Bank Rate):

-> Bank rate is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan). The thing, which has to be remembered, is that central bank lends to commercial banks and not to general public.

-> In a situation of deficient demand leading to deflation,

❖ Central bank decreases bank rate that encourages commercial banks in borrowing from central bank as it will decrease the cost of borrowing of commercial bank.

❖ Decrease in bank rate makes commercial bank to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

❖ Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

❖ Thus, expenditure on investment and consumption increase, which will control the deficient demand.

• Repo Rate (Decrease Repo Rate):

-> Repo rate is the rate at which commercial banks borrow money from the central bank for short period by selling their financial securities to the central bank.

-> These securities are pledged as a security for the loans.

-> It is called Repurchase rate as this involves commercial bank selling securities to RBI to borrow the money with an agreement to repurchase them at a later date and at a predetermined price.

-> So, keeping securities and borrowing is repo rate.

In a situation of deficient demand leading to deflation,

❖ Central bank decreases Repo rate that encourages commercial banks in borrowing from central bank as it will decrease the cost of borrowing of commercial bank.

❖ Decrease in Repo rate makes commercial banks to decrease their lending rates, which encourages borrowers from taking loans, which encourages investment.

❖ Again low rate of interest induces households to decrease their savings by increasing expenditure on consumption.

❖ Thus, expenditure on investment and consumption increase, which will control the deficient demand.

• Reverse Repo Rate (Decrease Reverse Repo Rate):

-> It is the rate at which the central bank (RBI) borrows money from commercial bank.

-> In a situation of deficient demand leading to deflation, Reverse repo rate is decreased, it discourages the commercial bank to park their funds with the central bank. It increases the lending capability of commercial banks, which controls deficient demand.

• Open Market Operation (Purchase of Securities):

-> It consists of buying and selling of government securities and bonds in the open market by central bank.

-> In a situation of deficient demand leading to deflation, central bank purchases government securities and bonds from commercial bank. With the purchase of these securities, the power of commercial bank of giving loans increases, which will control deficient demand.

• Decrease in Varying Reserve Requirements:

-> Banks are obliged to maintain reserves with the central bank, which is known as legal reserve ratio. It has two components. One is the Cash Reserve Ratio or CRR and the other is the SLR or Statutory Liquidity Ratio.

-> Cash Reserve Ratio (Decrease):

❖ It refers to the minimum percentage of a bank’s total deposits, which is required to keep with the central bank. Commercial banks have to keep with the central bank a certain percentage of their deposits in the form of cash reserves as a matter of law.

❖ For example, if the minimum reserve ratio is 10% and total deposits of a certain bank is Rs. 100 crore, it will have to keep Rs.10 crore with the central bank.

❖ In a situation of deficient demand leading to deflation, cash reserve ratio (CRR) falls to 5 per cent, the bank will have to keep Rs. 5 crore with the central bank, which will increase the cash resources of commercial bank and increasing credit availability in the economy, which will control deficient demand.

-> The Statutory Liquidity Ratio (SLR) (Increase):

❖ It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

❖ In a situation of deficient demand leading to deflation, the central bank decreases statutory liquidity ratio (SLR), which will increase the cash resources of commercial bank and increases credit availability in the economy.

(ii) Qualitative Instruments or Selective Tools of Monetary Policy: These

instruments are used to regulate the direction of credit. They are as under:

• Imposing margin requirement on secured loans( Decrease):

-> Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security.

-> So, the difference between the value of security and value of loan is called marginal requirement.

-> In a situation of deficient demand leading to deflation, central bank decreases marginal requirements. This encourages borrowing because it makes people get more credit against their securities.

• Moral Suasion:

-> Moral suasion implies persuasion, request, informal suggestion, advice and appeal by the central banks to commercial banks to cooperate with general monetary policy of the central bank.

> In a situation of deficient demand leading to deflation, it appeals for credit expansion.

• Selective Credit Controls (SCCs):

-> In this method the central bank can give directions to the commercial banks not to give credit for certain purposes or to give more credit for particular purposes or to the priority sectors.

-> In a situation of deficient demand leading to deflation, the central bank withdraws rationing of credit and make efforts to encourage credit.

2. Fiscal Policy: The expenditure and revenue policy taken by the general government to accomplish the desired goals is known as fiscal policy. A general government has to take the following steps:

(a) Revenue Policy (Decrease in Taxes):

(i) Revenue policy is expressed in terms of taxes.

(ii) During deflation the government will impose lower amount of taxes so that purchasing power of the people be increased.

(iii) It is so because to control deficient demand we have to increase the amount of liquidity in the economy.

(b) Expenditure Policy (Increase in Expenditure):

(i) Government has to invest huge amount on public works like roads, buildings, irrigation works, etc.

(ii) During deflation government should increase its expenditure on public works like roads, buildings, irrigation works thereby increasing the money income of the people and their demand for goods and services.

(c) Decrease in Public Borrowing / Public Debt:

(i) At the time of deficient demand public borrowing should be reduced.

(ii) People will have more money and more purchasing power.

(iii) In brief, during period of deficient demand government should adopt the pricing of deficit budget.

(iv) Old taken debts from public should be finished and paid back to increase money in the market.

Full Employment, Voluntary Unemployment And Involuntary Unemployment

1. Full employment:

(i) Full employment equilibrium refers to the situation where aggregate demand is equal to aggregate supply, and all those who are able to work and willing to work (at the existing wage rate) are getting work.

(ii) Full employment doesn’t means that there is no unemployment in an economy. Unemployment also exists at full employment level because of voluntary unemployment.

2. Voluntary unemployment:

(i) Voluntary unemployment refers to the situation when a person is unemployed because he is not willing to work at the existing wage rate, even when work is available.

(ii) Suppose, if the market wage rate for MBA in the industries is Rs.8,000 a month, but

some of the qualified MBA’s refuse to accept job at Rs.8,000 a month, they will be considered as voluntarily unemployed.

3. Involuntary unemployment:

(i) Involuntary unemployment refers to a situation in which all able and willing persons to work at existing wage-rate do not find work.

Words that Matter

1. Excess Demand: When in an economy, aggregate demand exceeds “aggregate supply at full employment level”, the demand is said to be an excess demand.

2. Inflationary gap: It is the gap showing excess of current aggregate demand over ‘aggregate supply at the level of full employment’. It is called inflationary because it leads to inflation (continuous rise in prices).

3. Deficient demand: When in an economy, aggregate demand falls short of aggregate supply at full employment level, the demand is said to be a deficient demand.

4. Deflationary gap: It is the gap showing deficient of current aggregate demand over ‘aggregate supply at the level of full employment’. It is called deflationary because it leads to deflation (continuous fall in prices).

5. Monetary policy: It is the policy of the central bank of a country to control money supply and availability of credit in the economy.

6. Quantitative Instruments or General Tools of Monetary Policy: These are the instruments of monetary policy that affect overall supply of money/credit in the economy.

7. Qualitative Instruments or Selective Tools of Monetary Policy: These instruments are used to regulate the direction of credit.

8. Bank rate: It is the rate of interest at which central bank lends to commercial banks without any collateral (security for purpose of loan).

9. Repo rate: It is the rate at which commercial bank borrow money from the central bank for short period by selling their financial securities to the central bank.

10. Reverse repo rate: It is the rate at which the central bank (RBI) borrows moneyfrom commercial bank.

11. Open Market Operation: It consists of buying and selling of government securities and bonds in the open market by central bank.

12. Cash Reserve Ratio: It refers to the minimum percentage of a bank’s total deposits, which it is required to keep with the central bank.

13. Statutory Liquidity Ratio: It refers to minimum percentage of net total demand and time liabilities, which commercial banks are required to maintain with themselves.

14. Marginal requirement: Business and traders get credit from commercial bank against the security of their goods. Bank never gives credit equal to the full value of the security. It always pays less value than the security. So, the difference between the value of security and value of loan is called marginal requirement.

15. Moral suasion: It implies persuasion, request, informal suggestion, advice and appeal by the central banks to commercial banks to cooperate with general monetary policy of the central bank

16. Selective credit control: In this method the central bank can give directions to the commercial banks not to give credit for certain purposes or to give more credit for particular purposes or to the priority sectors.

17. Fiscal policy: The expenditure and revenue policy taken by the general government to accomplish the desired goals is known as fiscal policy.

18. Full employment equilibrium: It refers to the situation where aggregate demand is equal to aggregate supply, and all those who are able to work and willing to work (at the existing wage rate) are getting work.

19. Voluntary unemployment: It refers to the situation when a person is unemployed because he is not willing to work at the existing wage rate, even when work is available.

20. Involuntary unemployment: It refers to a situation in which all able and willing persons to work at existing wage-rate do not find work.