Government Budget and the Economy – CBSE Notes for Class 12 Macro Economics

Introduction

This is a descriptive chapter on government budget of Indian economy, wherein its objectives, importance, types, components, budget deficits and its types (Revenue, Fiscal, Primary Deficit) and their implications are studied.

Chapter at a Glance

Government Budget And Its Related Concepts

1. A government budget is an annual financial statement showing item wise estimates of

expected revenue and anticipated expenditure during a fiscal year.

2. Budget has two parts:

(a) Receipts; and (b) Expenditure.

3. Objectives of budget:

(a) Activities to secure a reallocation of resources:

(i) Private enterprises always desire to allocate resources to those areas of production where profits are high.

(ii) However, it is possible that such areas of production (like production of alcohol) may not promote social welfare.

(iii) Through its budgetary policy the government of a country directs the allocation of resources in a manner such that there is a balance between the goals of profit maximisation and social welfare.

(iv) Production of goods which are injurious to health (like cigarettes and whisky) is discouraged through heavy taxation.

(v) On the other hand, production of “socially useful goods” (like electricity, ‘Khadi’) is encouraged through subsidies.

(vi) So, finally government has to reallocate resources in accordance to social and economic considerations in case the free market fails to do or does so inefficiently.

(b) Redistributive activities:

(i) Budget of a government shows its comprehensive exercise on the taxation and subsidies.

(ii) A government uses fiscal instruments of taxation and subsidies with a view of improving the distribution of income and wealth in the economy.

(iii) A government reduces the inequality in the distribution of income and wealth by imposing taxes on the rich and giving subsidies to the poor, or spending more on welfare of the poor.

(iv) It reduces income of the rich and raises the living standard of the poor, thus, leads to equitable distribution of income.

(v) Expenditure on special anti poverty and employment schemes will be increased to bring more people above poverty line.

(vi) Public distribution system should be inferred so that only the poor could get foodgrains and other essential items at subsidised prices.

(vii) So finally, Equitable distribution of income and wealth is a sign of social justice which is the principal objective of any welfare state in India.

(c) Stabilising activities:

(i) Free play of market forces (or the forces of supply and demand) are bound to generate trade cycles, also called business cycles.

(ii) These refer to the phases of recession, depression, recovery and boom in the economy. (Hi) The government of a country is always committed to save the economy from

business cycles. Budget is used as an important policy instrument to combat(solve) the situations of deflation and inflation.

(iv) By doing it the government tries to achieve the state of economic stability.

(v) Economic stability leads to more investment and increases the rate of growth and development.

(d) Management of public enterprises:

(i) A government undertakes commercial activities that are of the nature of natural monopolies; and which are established and managed for social welfare of the public.

(ii) A natural monopoly is a situation where there are economies of scale over a large range of output.

(iii) Industries which are potential natural monopolies are railways etc.

4. Importance of a budget:

(a) Today every country aims at its economic growth to improve living standard of its people. Besides, there are many other problems such as poverty, unemployment, inequalities in incomes and wealth etc. Government strives hard to solve these problems through budgetary measures.

(b) The budget shows the fiscal policy. Itemwise estimates of expenditure discloses how much and on what items, the government is going to spend. Similarly, itemwise details of government receipts indicate the sources from where the government intends to get money to finance the expenditure.

In this way budget is the most important instrument in hands of governments to achieve their objectives and there lies the importance of the government budget. Note: Fiscal year is the year in which country’s budgets are prepared. Its duration is from 1st April to 31st March.

5. Types of budget: It may be of two types:

(a) Balanced Budget (b) Unbalanced Budget

Let us discuss them in detail:

(a) Balanced Budget: If the government revenue is just equal to the government expenditure made by the general government, then it is known as balanced budget.

(b) Unbalanced Budget: If the government expenditure is either more or less than a government receipts, the budget is known as Unbalanced budget.

It may be of two types:

(i) Surplus budget (ii) Deficit budget

Let us discuss them in detail:

(i) Surplus Budget: If the revenue received by the general government is more in comparison to expenditure, it is known as surplus budget.

In other words, surplus budget implies a situation where government income is in excess of government expenditure.

(ii) Deficit Budget: If the expenditure made by the general government is more than the revenue received, then it is known as deficit budget.

In other words, in deficit budget, government expenditure is in excess of government income.

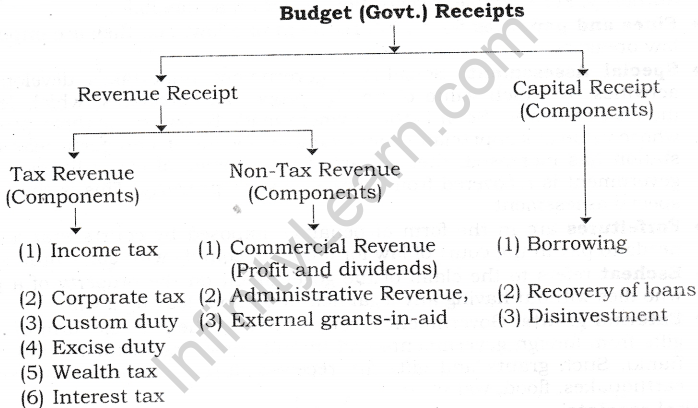

Components Of Government Budget, Budget Receipts Its Types

1. Components of a government budget: Government budget, comprises of two parts—

(a) Revenue Budget and (b) Capital Budget.

(a) Revenue Budget: Revenue Budget contains both types of the revenue receipts of the government, i.e., Tax revenue and Non tax revenue ; and the Revenue expenditure.

(i) Revenue Receipts: These are the receipts that neither create any liability nor reduction in assets of the government. It includes tax revenues like income tax, corporation tax and non-tax revenue like fines and penalties, special assessment, escheat etc.

(ii) Revenue Expenditure: An expenditure that neither creates any assets nor cause reduction of liability is called revenue expenditure.

(b) Capital Budget: Capital budget contains capital receipts and capital expenditure of the government.

(i) Capital Receipts: Government receipts that either creates liabilities (of payment of loan) or reduce assets (on disinvestment) are called capital receipts. Capital receipts include items, which are non-repetitive and non-routine in nature.

(ii) Capital Expenditure: This expenditure of the government either creates physical or financial assets or reduction of its liability. Acquisition of assets like land, machinery, equipment, its loans and advances to state governments etc. are its examples.

2. Budget receipts (government receipt): Budget receipt refers to the estimated receipts of the government from various sources during a fiscal year. It shows the sources from where the government intends to get money to finance the expenditure. Budget receipts are of two types:

(a) Revenue receipts

(i) Meaning:

• Government receipts, which

-> Neither create any liabilities for the government; and

-> Nor cause any reduction in assets of the government, are called revenue receipts.

In revenue receipts both the conditions should be satisfied.

• Revenue receipts include items which are Repetitive and routine in nature.

(ii) Revenue receipts are further classified into:

• Tax Revenue:

-> Tax revenue refers to receipts from all kinds of taxes such as income tax, corporate tax, excise duty etc.

-> A tax is a legally compulsory payment imposed by the government on income and profit of persons and companies without reference to any benefit. Taxes are of two types: Direct taxes and Indirect taxes.

• Non-Tax Revenue:

-> Non-tax revenue refers to government revenue from all sources other than taxes.

-> These are incomes, which the government gets by way of sale of goods and services rendered by different government departments.

-> Components of Non-Tax Revenue:

♦ Commercial Revenue (Profit and interest):

♦ It is the revenue received by the government by selling the goods and services produced by the government agencies.

♦ For example, profit of public sector undertakings like Railways, BHEL, LIC etc.

♦ Government gives loan to State Government, union territories, private enterprises and to general public and earns interest receipts from these loans.

♦ It also includes interest and dividends on investments made by the government.

♦ Administrative Revenue: The revenue that arises on account of the administrative function of the government. This includes:

♦ Fee: Fee refers to a payment made to the government for the services that it renders to the citizens. Such services are generally in public interest and fees are paid by those, who receive such services. For example, passport fees, court fees, school fees in government schools.

♦ License Fee: License fee is a payment to grant a permission by a government authority. For example, registration fee for an automobile.

♦ Fines and penalties for an infringement of a law, i.e., they are imposed on law breakers.

♦ Special Assessment: Sometimes government undertakes developmental activities by which value of nearby property appreciates, which leads to increase in wealth. So, it is the payment made by owners of those properties whose value has appreciated. For example, if value of a property near a metro station has increased, then a part of developmental expenditure made by government is recovered from owners of such property. This is the value of special assessment.

♦ Forfeitures are in the form of penalties imposed by courts that a person needs to pay in the court of law for failing to comply with court orders.

♦ Escheat refers to the claim of the government on the property of a person who dies without having any legal heir or without leaving a will.

♦ External grants: Government receives financial help in the form of grants, gifts from foreign governments and international organisations (IMF, World Bank). Such grants and gifts are received during national crisis such as earthquakes, flood, war etc.

(b) Capital receipts:

(i) Meaning:

• Government receipts, that either creates liabilities (of payment of loan) or reduce assets (on disinvestment) are called capital receipts.

In capital receipts any one of the conditions must be satisfied.

• Capital receipts include items which are non-repetitive and non-routine in nature,

(ii) Components:

• Borrowing (Domestic and External): Borrowings are made to meet the financial requirement of the country. A government may borrow money:

-> Domestically: General Public (By issuing government bonds in the open market). Reserve Bank of India.

-> Externally: Rest of the world (foreign government and international institutions)

• Recovery of Loans and Advances: Loans offered to others are assets of the government. It includes recovery of loans granted by the central government to state and union territory governments. It is a capital receipt because it reduces financial assets of the government. For example, The Government of India may give Rs. 1000 crore as a loan to The Government of Delhi. Here the value of asset is Rs. 1000 crore. When The Government of Delhi repaid Rs. 100 crore, the value of The Government of India assets reduces to Rs. 900 crore. Since, recovery of loan reduces the value of assets, it is termed as a capital receipts.

• Disinvestment: A government raises funds from disinvestment also. Disinvestment means selling whole or a part of the shares (i.e., equity) of selected public sector enterprises held by government. As a result, government assets are reduced.

Types Of Taxes:

1. Direct Taxes: When (a) liability to pay a tax (Impact of Tax), and (b) the burden of that tax (Incidence of tax), falls on the same person, it is termed as direct tax. A direct tax is paid directly by the same person on whom it has been levied. It means a tax in which impact and incidence of tax falls on the same persons, then it is termed as direct tax. In other words, burden of a direct tax is borne by the person on whom it is imposed which means the burden cannot be shifted to others. Alternatively, the person from whom the tax is collected is also the person who bears the ultimate burden of the tax. Income tax and corporate (profit) tax are most appropriate examples of direct tax.

2. Indirect Tax: When (a) liability to pay a tax (Impact of tax) is on one person; and

(b) the burden of that tax (Incidence of tax), falls on the other person, it is termed as indirect tax. It means a tax in which impact and incidence of tax lie on two different persons, then it is termed as indirect tax. In other words, indirect taxes are the taxes of whose burden can be shifted to others. In case of an indirect tax, person first pays the tax but he is able to transfer the burden of the tax to others. For instance, sales tax is an indirect tax because indirect tax is collected by government from the seller of the commodity who in turn realizes the tax amount from the buyer by including it in the price of the commodity. Other examples of indirect taxes are excise duty, custom duty, entertainment tax, service tax etc.

3. Progressive Tax: A tax the rate of which increases with the increase in income and decreases with the fall in income is called a progressive tax. The higher is the income of a taxpayer, the higher is proportionate tax he pays. For example, in India income tax is considered a progressive tax because its rate goes on increasing with the increase in annual income. For example, presently (2012-2013) there is no tax up to annual income of Rs. 2,00,000 but the.rate of income tax increases with the increase in incomes. It is 10% on incomes between Rs. 2,00,000 and Rs. 5,00,000; 20% on incomes between Rs. 5,00,000 and Rs.10,00,000 and 30% on incomes above Rs. 10,00,000.

4. Proportional Taxation: A tax is called proportional when the rate of taxation remains constant as the income of the taxpayer increases.

Example: If tax rate is 10% and the annual income of a person is Rs. 2,00,000, then he will have to pay Rs. 20,000 per year as tax. If income rises to Rs. 3,00,000 per annum, then the tax liability will rise to Rs. 30,000 per year. In this case, burden of tax is more on the poor section as compared to rich section.

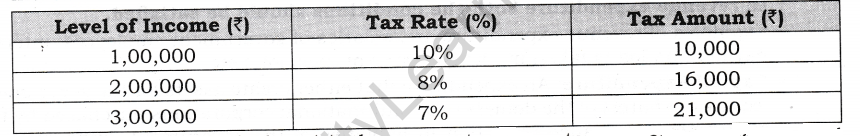

5. Regressive Tax: In a regressive tax system, the rate of tax falls as the tax base increases.

In this case, we find that (a) the amount of tax to be paid increases, and (b) the rate at which tax is to be paid falls.

Budget Expenditure & Its Related Concepts

1. Meaning: Budget expenditure refers to the estimated expenditure of the government on its “development and non-development programmes or “plan and non-plan programmes during the fiscal year.

2. Types:

(a) Plan and non-plan expenditure

(b) Revenue and capital expenditure

(c) Developmental and non-developmental Expenditure

(a) Plan and non-plan expenditure:

(i) Plan Expenditure: Plan expenditure refers to that expenditure which is incurred by the government to fulfill its planned development programmes. This includes both consumption and investment expenditure by the government or Planning Commission of a country. Expenditure on agriculture, industry, public utilities, health and education etc. are examples of plan expenditure.

(ii) Non-Plan Expenditure: This refers to all such government expenditures which are beyond the scope of its planned development programmes. For instance, no government can escape from its basic function of protecting the lives and properties of the people. For this government has to spend on police, judiciary, military etc. In short, expenditure other than expenditure related to current Five-year plan is treated as non-plan expenditure.

(b) Revenue and capital expenditure:

(i) Revenue Expenditure: An expenditure that (a) Neither creates any assets (b) nor causes any reduction of liability.

In revenue expenditure both the conditions should be satisfied.

Examples of revenue expenditure are: salaries of government employees, interest : payment on loans taken by the government, pensions etc.

(ii) Capital Expenditure: An expenditure that either create assets for the government [equity or shares) of the domestic, or multinational corporations purchased by the government), or cause reduction in liabilities of the government, [repayment of loans reduces liability of the government).

In capital expenditure any one of the above conditions must be satisfied.

Thus, it refers to expenditure that leads to creation of assets and reduction in liabilities. Such expenditure is incurred on long period development.

Conclusion: A basic difference between capital expenditure and revenue expenditure is that the capital expenditure is incurred on creation or acquisition of assets, whereas, the revenue expenditure is incurred on rendering services.

For example: Expenditure on construction of a hospital building is capital expenditure, but expenditure on medicines, salaries of doctors etc. for rendering services by the hospital is revenue expenditure.

(c) Developmental and non-developmental Expenditure:

(i) Developmental Expenditure: Developmental expenditure is the expenditure on activities which are directly related to economic and social development of the country. This includes expenditure on education, health, agriculture, transport, roads, rural development etc. This also includes loans given by the government to enterprises like Sahara for the purpose of development.

(ii) Non-developmental Expenditure: Non-developmental expenditure of the

government is the expenditure on the essential general services of the government. This includes expenditure on defence, payment of old age pension, collection of taxes, interest on loans, subsidies etc.

Deficits And Implications Of These Deficits

1. Budget deficit:

(a) Meaning:

(i) Budgetary deficit refers to the excess of total budgeted expenditure (both revenue expenditure and capital expenditure) over total budgetary receipts (both revenue receipt and capital receipt).

(ii) In other words, when sum of revenue receipts and capital receipts fall short of the sum of revenue expenditure and capital expenditure, budgetary deficit is said to occur. Symbolically,

Budgetary Deficit = Total Expenditure – Total Receipts

(b) Types:

(i) Revenue deficit, (ii) Fiscal deficit and (iii) Primary deficit

2. Revenue deficit:

(a) Meaning:

(i) Revenue deficit refers to the excess of revenue expenditure of the government over its revenue receipts. Symbolically,

Revenue Deficit = Total Revenue Expenditure – Total Revenue Receipts

(ii) The government of India budget for the year 2012-2013, total expenditure is Rs. 12,42,263 crore against total revenue receipts of Rs. 8,78,804 crore. As a result there is revenue deficit of Rs. 3,63,459 (12,42,263-8,78,804) crore, which is 3.6% of GDP.

(b) Implications of revenue deficit:

(i) Revenue deficit indicates dis-savings on government account because the government has to make up uncovered gap.

(ii) Revenue deficit implies that the government has to cover this uncovered gap by drawing upon capital receipts either through borrowing or through sale of its assets.

(iii) Since government is using capital receipts to generally meet consumption expenditure of the government, it leads to an inflationary situation in the economy.

(c) Measures to reduce revenue deficit are:

(i) Government should reduce its unproductive or unnecessary expenditure.

(ii) Government should increase its receipts from various sources of tax and non-tax revenue.

3. Fiscal deficit:

(a) Meaning:

(i) Fiscal deficit is defined as excess of total expenditure over total receipts (revenue and capital receipts) excluding borrowing. In the form of an equation:

(ii) Fiscal deficit is a measure of total borrowings required by the government.

(iii) Fiscal deficit indicates capacity of a country to borrow in relation to what it produces. In other words, it shows the extent of government dependence on borrowing to meet its budget expenditure.

(iv) Another point to be noted here is that as the government borrowing increases, its liability in future to repay loan with interest also increases leading to a higher revenue deficit. Therefore, fiscal deficit should be as low as possible.

(v) Fiscal deficit for the year 2012-2013 is 4,89,890 crore which is 4.9% of GDP.

(b) Implications of fiscal deficit:

(i) Causes Inflation: An important component of government borrowing includes borrowing from the Reserve Bank of India. This invariably implies deficit financing or meeting deficit requirements of the government by way of printing more currency. This is a dangerous practice, though very convenient for the government. It increases circulation of money and causes inflation.

(ii) Increase in Foreign Dependence: Government also borrows from rest of the world. It increases our dependence on other countries. Foreign borrowing is often associated with economic and political interference by the lender countries. It increases our economic slavery.

(iii) Financial Burden for Future Generation: Borrowing implies accumulation of financial burdens for the future generations. It is for future generations to repay loans as well as the mounting interest thereon.

(iv) Deficits Multiply Borrowings: Payment of interest increases revenue expenditure of the government, causing an increase in its revenue deficit. Thus, a vicious circle is set wherein the government takes more loans to repay earlier loans, which is called Debt Trap.

4. Primary deficit:

(a) Meaning:

(i) Primary deficit is defined as fiscal deficit minus interest payments.

Primary Deficit = Fiscal Deficit – Interest Payments

(ii) The government of India budget for the year 2012-2013, fiscal deficit is 4,89,890 crore and Interest Payment is 3,11,996 crore. As a result, primary deficit is 1,77,894 crore, which is 1.8% of GDP.

(b) Implications of primary deficit: While fiscal deficit shows borrowing requirement of the government for financing the expenditure inclusive of interest payments, primary deficit reflects the borrowing requirements of the government for meeting expenditures other than interest payments on earlier loans.

Words that Matter

1. Government Budget: A government budget is an annual financial statement showing itemwise estimates of expected revenue and anticipated expenditure during a fiscal year.

2. Balanced Budget: If the government revenue is just equal to the government expenditure made by the general government, then it is known as balanced budget.

3. Unbalanced budget: If the government expenditure is either more or less than a government receipts, the budget is known as Unbalanced budget.

4. Surplus Budget: If the revenue received by the general government is more in comparison to expenditure, it is known as surplus budget.

5. Deficit Budget: If the expenditure made by the general government is more than the revenue received, then it is known as deficit budget.

6. Budget receipt: It refers to the estimated receipts of the government from various sources during a fiscal year.

7. Budget expenditure: It refers to the estimated expenditure of the government on its “development and non-development programmes or “plan and non-plan programmes during the fiscal year.

8. Revenue Budget: Revenue Budget contains both types of the revenue receipts of the government, i.e., Tax revenue and Non tax revenue ; and the Revenue expenditure.

9. Revenue Receipts: Government receipts, which

(a) Neither create any liabilities for the government; and

(b) Nor cause any reduction in assets of the government, are called revenue receipts.

10. Tax Revenue: Tax revenue refers to receipts from all kinds of taxes such as income tax, corporate tax, excise duty etc.

11. Tax: A tax is a legally compulsory payment imposed by the government on income and

profit of persons and companies without reference to any benefit.

12. Non-tax revenue: It refers to government revenue from all sources other than taxes called non-tax revenue.

13. Revenue Expenditure: An expenditure that (a) Neither creates any assets (b) nor causes any reduction of liability.

14. Capital Budget: Capital budget contains capital receipts and capital expenditure of the government.

15. Capital Receipts: Government receipts that either creates liabilities (of payment of loan) or reduce assets (on disinvestment) are called capital receipts.

16. Capital Expenditure: Government expenditure of the government which either creates physical or financial assets or reduction of its liability.

17. Direct Tax: When (a) liability to pay a tax (Impact of Tax), and (b) the burden of that tax (Incidence of tax), falls on the same person, it is termed as direct tax.

18. Indirect Tax: When (a) liability to pay a tax (Impact of tax) is on one person; and (b) the burden of that tax (Incidence of tax), falls on the other person, it is termed as indirect tax.

19. Progressive Tax: A tax the rate of which increases with the increase in income and decreases with the fall in income is called a progressive tax.

20. Proportional Taxation: A tax is called proportional when the rate of taxation remains constant as the income of the taxpayer increases.

21. Regressive Tax: In a regressive tax system, the rate of tax falls as the tax base increases.

22. Plan expenditure: It refers to that expenditure which is incurred by the government to fulfill its planned development programmes.

23. Non-Plan Expenditure: This refers to all such government expenditures which are beyond the scope of its planned development programmes.

24. Developmental Expenditure: Developmental expenditure is the expenditure on activities which are directly related to economic and social development of the country.

25. Non-developmental expenditure: Non-developmental expenditure of the government is the expenditure on the essential general services of the government.

26. Budgetary deficit: It refers to the excess of total budgeted expenditure (both revenue

expenditure and capital expenditure) over total budgetary receipts (both revenue receipt and capital receipt).

27. Revenue Deficit: Revenue deficit refers to the excess of revenue expenditure of the government over its revenue receipts.

28. Fiscal deficit: It is defined as excess of total expenditure over total receipts (revenue and capital receipts) excluding borrowing. Fiscal deficit indicates capacity of a country to borrow in relation to what it produces. In other words, it shows the extent of government dependence on borrowing to meet its budget expenditure.

29. Debt Trap: A vicious circle set wherein the government takes more loans to repay earlier loans, which is called Debt Trap.

30. Primary deficit: It is defined as fiscal deficit minus interest payments.