Reconstitution of a partnership Firm:Retirement/Death of a partner Important Questions for CBSE Class 12 Accountancy Settlement of Amount Due to Retiring partner

1. Calculation of Amount Payable to Retiring/Deceased Partner The amount due to a retiring partner is ascertained by preparing retiring partner’s capital account, after taking into account the following

Items to be Credited

(i) Opening balance of capital and current account of retiring partner.

(ii) His share in the profit of revaluation account.

(iii) His share of reserve and accumulated profit.

(iv) His share of goodwill of the firm.

(v) His share of profit till the date of his retirement.

(vi) His salary and/or interst on capital due to the retiring partner till the date of his retirement.

Items to be Debited

(i) Drawings and interest thereon.

(ii) Share in the accumulated losses of past year/years.

(iii) Share in the loss of revaluation account.

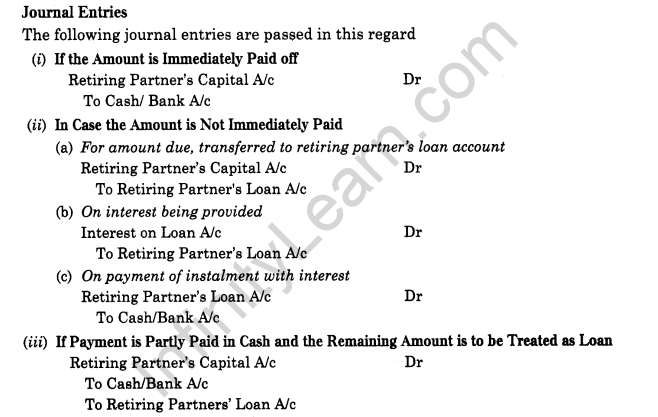

2. Settlement of the Amount Due to the Retiring Partner The amount due to retiring partner is either paid off immediately or is transferred to his loan account. The retiring partner’s loan account will appear in the books of the new firm as a liability until it is paid off finally.

Previous Years Examination Questions

4 Marks Question

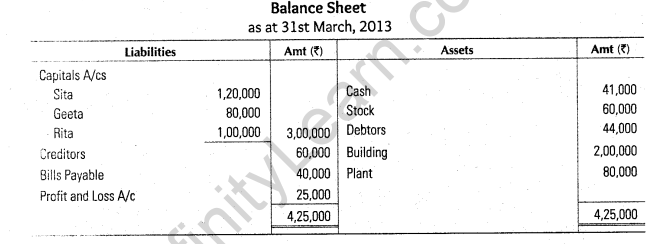

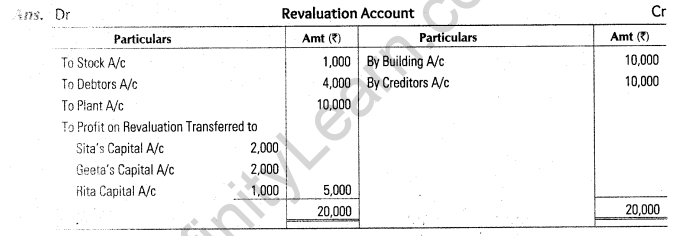

1. Sita, Geeta and Rita were partners sharing profits in the ratio of 2:2:1 respectively. Following was their balance sheet as at 31st March, 2013.

On the above date Sita retired and following were agreed

(i) Stock was valued at Rs. 59,000; debtors Rs. 40,000; building Rs. 2,10,000; plant Rs. 70,000 and creditors Rs. 50,000.

(ii) Amount due to Sita will be transferred to Sita’s loan account. Prepare revaluation account and Sita’s capital account. (Compartment 2014)

6 Marks Questions

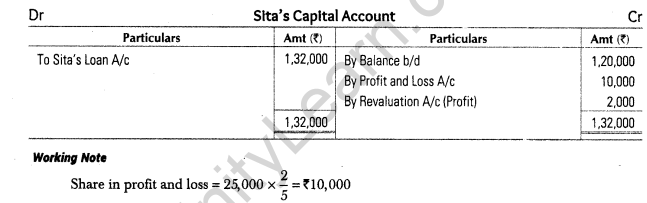

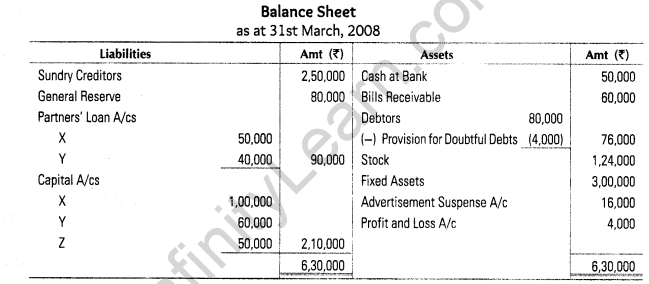

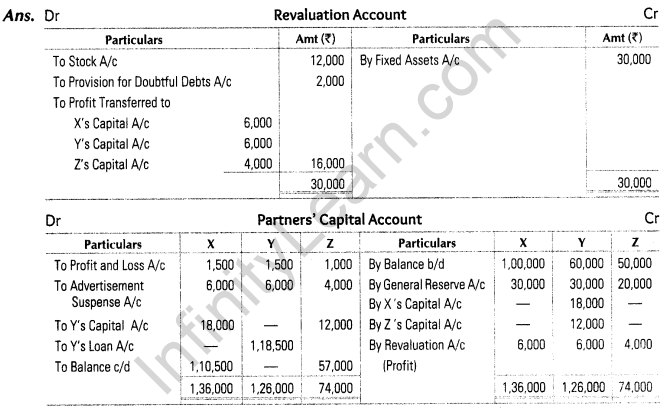

2. Following is the balance sheet of X, Y and Z as on 31st March, 2008. They shared profits in the ratio of 3 : 3 : 2

On 1st April, 2008, Y decided to retire from the firm on the following terms

(i) Stock to be depreciated by Rs. 12,000.

(ii) Advertisement suspense account to be written-off.

(iii) Fixed assets to be appreciated by 10%.

(iv) Provision for doubtful debts to be increased to Rs. 6,000.

(v) Goodwill of the firm valued at Rs. 80,000 and the amount due to the retiring partner be adjusted in X’s and Z’s capital account.

Prepare revaluation account, partners’ capital account and the balance sheet to give effect to the above. (All India 2009)

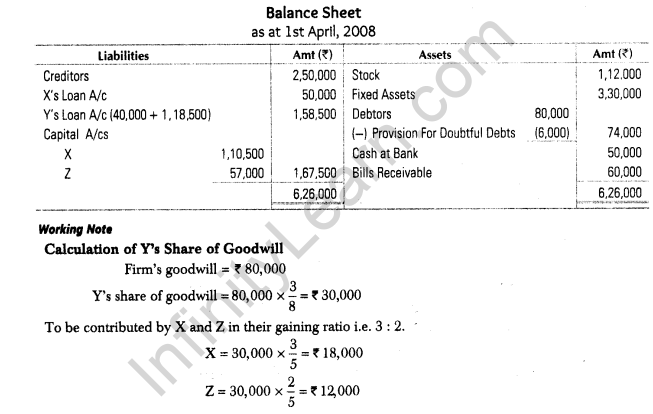

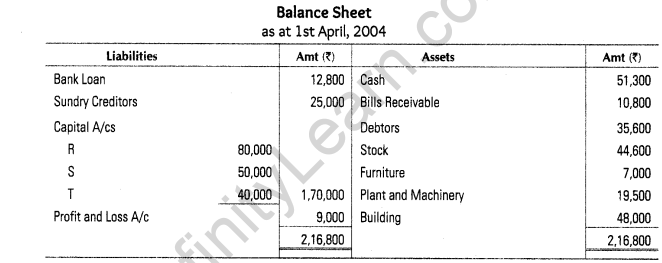

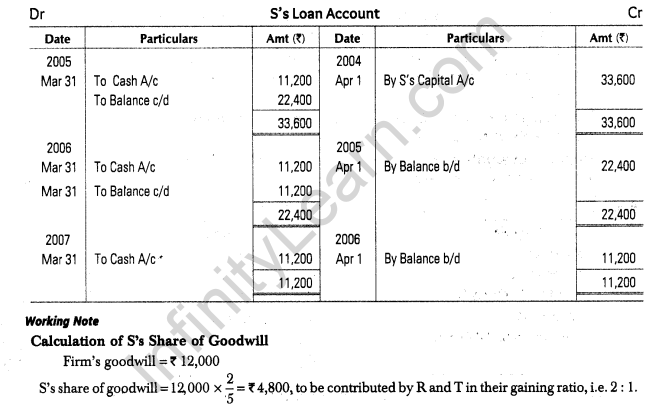

3. R, S and T were partners in a firm sharing profits in 2 : 2 : 1 ratio. On 1st April, 2004, their balance sheet was as follows

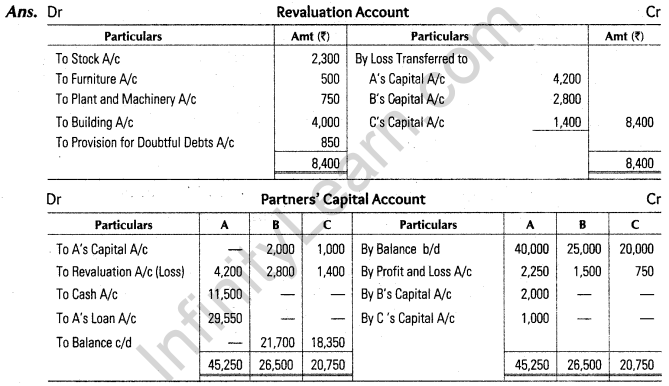

S retired from the firm on 1st April, 2004 and his share was ascertained on the revaluation of assets as follows; stock Rs. 40,000, furniture Rs. 6,000, plant and machinery Rs. 18,000, building Rs. 40,000; Rs. 1,700 were to be provided for doubtful debts. The goodwill of the firm was valued at Rs. 12,000.

S retired from the firm on 1st April, 2004 and his share was ascertained on the revaluation of assets as follows; stock Rs. 40,000, furniture Rs. 6,000, plant and machinery Rs. 18,000, building Rs. 40,000; Rs. 1,700 were to be provided for doubtful debts. The goodwill of the firm was valued at Rs. 12,000.

S was to be paid Rs. 18,080 in cash on retirement and the balance in three equal yearly instalments.

Prepare revaluation account, partners’ capital account, S’s loan account and balance sheet on 1st April, 2004. (All India 2008)

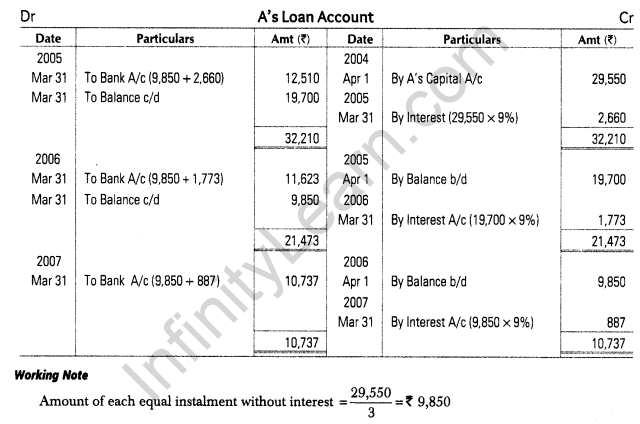

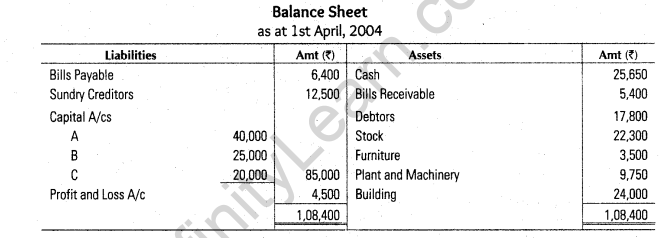

4. The balance sheet of A, B and C who were sharing profits and losses in the ratio of 1/2, 1/3 and 1/6 respectively, was as follows on 1st April, 2004

A retired from the business on 1st April, 2004 and his share in the firm was to be ascertained on the revaluation of the assets as follows

Stock Rs. 20,000; furniture Rs. 3,000; plant and machinery Rs. 9,000; building Rs. 20,000; Rs. 850 was to be provided for doubtful debts. The goodwill of the firm was valued at Rs. 6,000.

A was to paid Rs. 11,500 in cash on retirement and the balance in three equal yearly instalments with interest at 9% per annum.

Prepare revaluation account, partners’ capital account and As loan account on the date of his retirement. (Delhi 2008)