Reconstitution of a Partnership Firm — Admission of a Partner – CBSE Notes for Class 12 Accountancy

Topic 1: Introduction and New Profit Sharing Ratio and Sacrificing Ratio

1. Meaning Admission of a partner is one of the modes of reconstituting the firm under which old partnership comes to an end and a new one between all partners (including incoming partner) comes into existence.

According to Section 31(1) of Indian Partnership Act, 1932, ‘A new partner can be admitted only with the consent of all the existing partners’.

A new partner is admitted for the following purposes:

(i) For procuring additional capital.

(ii) For acquiring additional managerial skills.

A newly admitted partner acquires following two main rights in the firm:

(i) Share in the future profits of the firm.

(ii) Share in the assets of the firm.

2. Adjustments Required at the Time of Admission of a New Partner

(i) Calculation of new profit sharing ratio and sacrificing ratio.

(ii) Accounting treatment of goodwill.

(iii) Accounting treatment of revaluation of assets and re-assessment of liabilities.

(iv) Accounting treatment of reserves accumulated profit and losses.

(v) Adjustment of capital.

3. New Profit Sharing Ratio The ratio in which all the partners (including incoming partner) share the future profits and losses is known as new profit sharing ratio.

New Profit Sharing Ratio = Old Ratio – Sacrificing Ratio

4. Sacrificing Ratio It is the ratio in which the old partners have agreed to sacrifice their share of profits in favour of new or incoming partner.

Sacrificing Ratio = Old Ratio – New Ratio

Topic 2: Treatment of Goodwill

1. Accounting Treatment of Goodwill When a new partner is admitted, his share in future profits of the firm is equal to the sacrifice of profit by an existing partner or partners of the firm, the amount he pays to compensate this sacrifice is called goodwill.

2. Various cases related to the treatment of goodwill

(i) When premium for goodwill is paid privately by new partner.

In case a new partner pays premium to the old partners privately or directly or outside the business, it will not be recorded because it is an out of business transaction. However, entry will be passed for capital brought in by new partner.

(ii) When premium for goodwill is brought in business by new partner in cash and retained in the business

(a) Write-off the existing goodwill (if any) appearing in the books of the firms

Old Partner’s Capital A/c Dr [In old ratio]

To Goodwill A/c

(b) For bringing premium for goodwill and capital in cash:

Cash/Bank A/c Dr

To Premium for Goodwill A/c To New Partner’s Capital A/c

(c) For distributing premium to sacrificing (old) partners in their sacrificing ratio:

Premium for Goodwill A/c Dr

To Sacrificing Partner’s Capital A/c

(iii) When premium for goodwill is brought in kind

(a) For bringing premium for goodwill and capital in assets:

Assets A/c Dr

To Premium for Goodwill A/c To New Partner’s Capital A/c

(b) For distributing premium to sacrificing (old) partners in their sacrificing ratio:

Premium for Goodwill A/c Dr

To Sacrificing Partner’s Capital A/c

(iv) When premium for goodwill is brought in by new partner and is withdrawn by old (sacrificing) partners folly or partly.

(a) For bringing premium for goodwill in cash by new partner

Cash/Bank A/c Dr [Amount of premium]

To Premium for Goodwill A/c

(b) For sharing of premium for goodwill by sacrificing partners

Premium for Goodwill A/c Dr [Amount of premium]

To Sacrificing Partner’s Capital A/c (in sacrificing ratio)

(c) For withdrawal of premium money by sacrificing partners fully/partly

Sacrificing Partner’s Capital A/c (Amount withdrawn) Dr To Cash/Bank A/c

(v) When a new partner brings only a part of premium for goodwill in cash

(a) For amount brought in by incoming Partner

Cash/Bank A/c Dr

To Premium for Goodwill A/c To New Partner’s Capital A/c

(b) For distributing the total goodwill due from incoming partner to sacrificing (old) partners in their sacrificing ratio

Premium for Goodwill A/c Dr

New Partner’s Capital/ Current A/c Dr

To Sacrificing (old) Partner’s Capital/ Current A/c

(vi) When the new partner is unable to bring his share of premium for goodwill in cash or kind

New Partner’s Capital/Current A/c Dr

To Sacrificing (old) Partner’s Capital/Current A/c

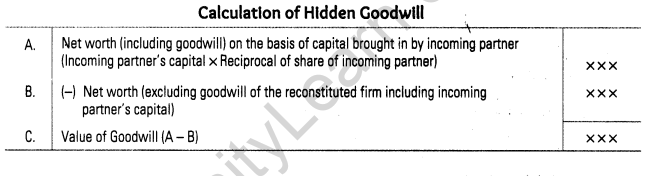

3. Hidden Goodwill Hidden or inferred goodwill is the excess of desired total capital of the firm over the actual combined capital of all the partners. In case, the value of goodwill is not given at the time of admission of a new partner, it is required to be calculated on the basis of an inferred method of profit sharing ratio or capitalisation.

Topic 3: Revaluation of Assets and Re-assessment of Liabilities

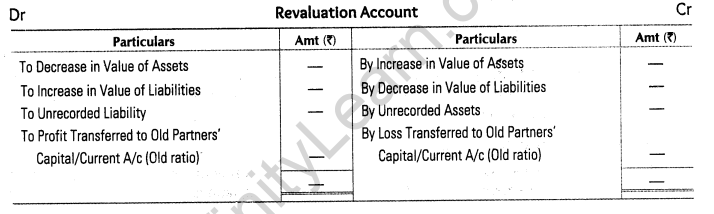

1. Meaning of Revaluation Account The account which is prepared to record changes in the value of assets and liabilities at the time of admission, retirement, death and change in profit sharing ratio is called revaluation account.

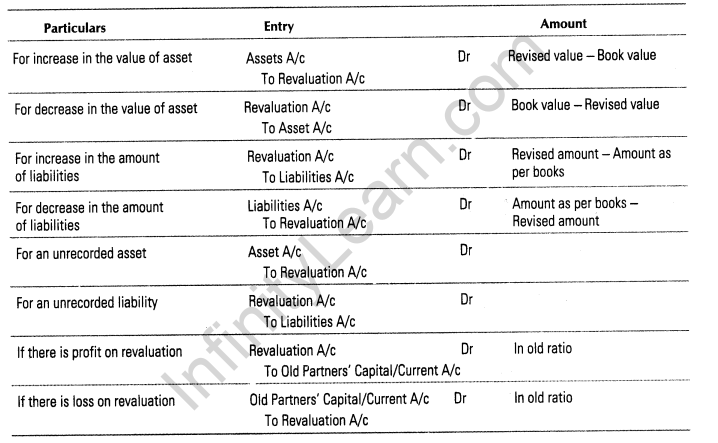

2. Accounting Treatment

The relevant journal entries are:

Format of Revaluation Account

3. Accounting Treatment of Reserves, Undistributed Profits or Losses

The new partner is not entitled to any share in undistributed profits or losses appearing in the balance sheet at the time of admission, as these are earned by the old partners. So, these should be transferred to old partners’ capital/current account.

Journal entries passed will be

(i) For Undistributed Profits,

General Reserve A/c Profit and Loss A/c Workmen Compensation Fund A/c Investment Fluctuation Fund A/c between book value and market value]

To Old Partner’s Capital/Current A/c [Old ratio]

(ii) For Undistributed Losses

Old Partner’s Capital/Current A/c Dr [Old ratio]

To Profit and Loss A/c To Deferred Revenue Expenditure A/c

Topic 4: Adjustment of Capital

At the time of admission of a new partner, the partners may agree that their capitals should also be adjusted so as to be proportionate to their profit sharing ratio.

The capitals of partners may be adjusted in any of the following ways:

(i) Adjusting the capitals of old partners on the basis of the capital of incoming partner

(When the total capital of the new firm is not given)

Steps involved in adjusting the capitals of old partners:

Step 1 Calculate total capital of the firm on the basis of capital of new partner.

Step 2 Calculate the new capitals of each partner.

Step 3 Ascertain the present capital of old partners (adjusted).

Step 4 Calculate the surplus/deficit capital by comparing Step 2 and Step 3.

(ii) Determining the new partner’s capital on the basis of combined capital of old partners

Steps involved in the determination of capital of new partner:

When a new partner joins an existing partnership firm, it is important to determine their capital contribution. This involves a process that includes several steps, as outlined below:

Step 1: Review the partnership agreement: The first step is to review the existing partnership agreement to understand the terms and conditions related to the admission of a new partner. This may include clauses related to capital contribution, profit-sharing, and decision-making.

Step 2: Determine the value of the business: The next step is to determine the value of the partnership business. This involves calculating the assets, liabilities, and goodwill of the firm. The new partner’s capital contribution will be based on their share of the total value of the business.

Step 3: Calculate the new profit-sharing ratio: The new profit-sharing ratio will determine the distribution of profits between the existing partners and the new partner. This ratio will depend on the capital contribution of each partner and their share of ownership in the business.

Step 4: Determine the new partner’s capital contribution: Based on the above calculations, the new partner’s capital contribution will be determined. This may be a fixed amount or a percentage of the total capital of the business.

Step 5: Draft a new partnership agreement: Once the new partner’s capital contribution has been determined, a new partnership agreement must be drafted to reflect the changes. This agreement should outline the new profit-sharing ratio, decision-making process, and any other relevant terms related to the admission of the new partner.

Step 6: Inform relevant authorities: If necessary, the relevant authorities must be informed of the admission of the new partner. This may include the Registrar of Companies or other government agencies.