Table of Contents

CBSE Sample Papers for Class 12 Economics Outside Delhi -2011

Time allowed : 3 hours Maximum marks 100

GENERAL INSTRUCTIONS

- All questions in both the sections are compulsory.

- Marks for questions are indicated against each.

- Questions No. 1-5 and 17-21 are very short-answer questions carrying 1 nick each. They are required to be answered in one sentence each.

- Questions No. 6-10 and 22-26 are? short-answer questions carrying 3 marks each. Answers to them should normally not exceed 60 words each.

- Questions No. 11-13 and 27-29 are also short-answer questions carrying 4 marks each. Answers to them should normally not exceed 70 words each.

- Questions No. 14-16 and 30-32 are long-answers questions carrying 6 marks each. Answers to them should normally not exceed 100 words each.

- Answers should be brief and to the point and the above word limit should be adhered to as far as possible.

SET I

SECTION A

Question.1.What is a planned economy?

Answer. It is an economy where organisation and operation of economic activities is in hands of the government.

Question.2. Where is a firm called price maker?

Answer. A firm will be called a price maker when it participates in the price fixafionproCess. A firm is a price maker when it can influence the market price of the product it produces. A monopoly firm is a price maker.

Question.3. Define a budget line.

Answer. The Budget line graphically shows all the bundles of two goods that can be bought by spending the entire income.

Question. 4. What is decrease in supply?

Answer. Decrease in supply of a good means fall in supply due to any other factor other than its own price.

Question.5. Define production function.

Answer. Production function shows the relation between physical inputs and-outputs of a good under given technological conditions.

Question.6. How is production possibility curve affected by unemployment in the economy ? Explain.

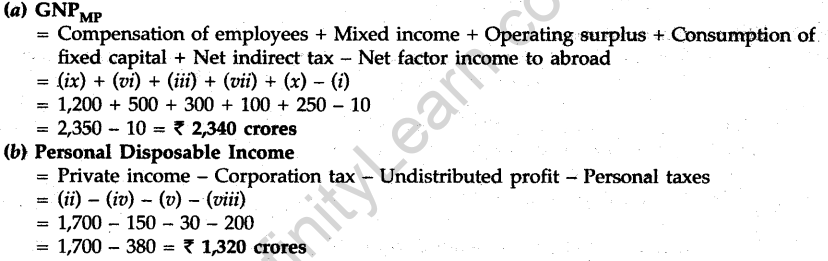

Answer. If resources ere fully employed (used), only then various bundles of two commodities indicated on the PP curve (production frontier) can be produced. However, if there is unemployment, i.e., some resources are either lying unused or not being fully utilised, in that case production possibilities of two commodities will not be on the TV cuiVe, rather production possibility will be inside it as show ‘in Diagram 1. Point K shows such a situation

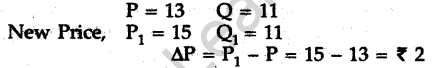

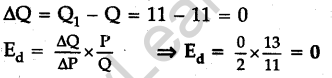

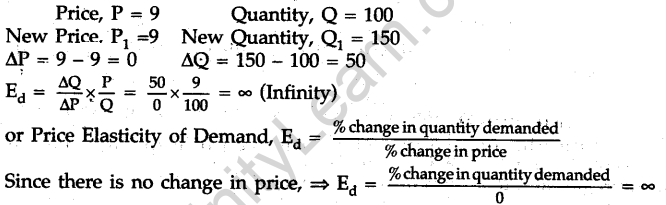

Question.7. When price of a good is Rs 13 per unit, the consumer buys 11 units that good. When place rises to Rs 15 per unit, the consumer continues to buy 11 units. Calculate price elasticity of demand.

Answer.

It is a case of perfectly inelastic demand.

Question.8. Distinguish-between explicit cost and implicit cost and give examples.

Answer. Explicit cost: The cost or the expenses which are incurred in getting inputs/factors from the market are called explicit cost. For example, expenditure on buying raw materials. However, there are certain inputs which are provide by the producer/entrepreneur himself for which no payment is made.

Implicit cost: It refers to the estimated value of the inputs provided by the owner. For example, use of factory building owned by the producer.

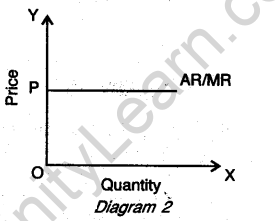

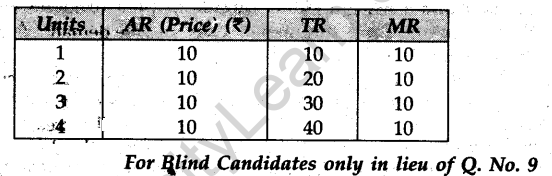

Question.9. Draw in a single diagram the average revenue and marginal revenue curves of a firm which can sell any quantity of the good at a given price. Explain.

Answer. In such a market whether the firm sells more or sells less it does not affect the market price. If AR (price) is constant throughout, in that case AR and MR are equal and result in a single horizontal curve, as shown in the diagram. The AR curve coincides with MR curve. This is a case of perfect competition.

A competitive-firm is a price-taker and can sell any quantity of its product at the price fixed by supply find demand of the industry. The idea of equality of AR and- MR also becomes evident looking at the schedule given below:

Or

Explain the relation between average revenue and marginal revenue of a firm which is free to sell any quantity at a given price.

Answer. Under perfect competition a firm can sell as much as it wants on the given price. This means price (AR) is constant throughout. In this case, when AR and MR are equal. This becomes evident looking at the table given below:

Question.10. Explain the implications of the feature ‘large number of buyers’ in a perfectly competitive market.

Answer. Under perfect competition, the number of buyers is very large. The number is so large that no individual buyer can influence the price. Every buyer buys only a fraction of the total sale of the product, It is an important characteristic of perfect competition because of which every buyer, like a firm, has to accept the price which is fixed by the supply and demand of the whole industry. At this price a buyer can buy any quantity of the product.

Or

Explain the implications of the feature ‘homogeneous products’ in a perfectly competitive market.

Answer. Under perfect competition, products sold by all the firms are homogeneous i.e., they are identical in all respects like quantity, design,colour, weight, size etc. With the result no firm can command a higher price for its product on the basis of, its product being different or superior to the products sold or produced by other firms. With the result, the price of the products produced by all the firms tends1 to be the same. All the firms have to charge the same price, otherwise no one will buy from the firm selling at a higher price. This price is determined by the demand and supply of the whole industry.

Question.11. A consumer consumes only two goods’ X and Y. At a consumption level of these two goods, he finds that the ratio of marginal utility to price in case of X is higher than in case of Y. Explain the reaction of the consumer.

Answer. In the case of two commodities, the necessary condition of consumers equilibrium, where consumer’s satisfaction is maximum, is:

\(\frac { MU\quad (X) }{ Price\quad of\quad X } =\frac { MU\quad (Y) }{ Price\quad of\quad Y } \)

If the ratio of commodity X, i.e., MU(X)/Price,of X is higher than the ratio of commodity Y, i.e. MU(X)/Price of Y, then more of commodity X and less of commodity Y should be used. Only then, the ratios of two commodities will be-equal and the satisfaction of the consumer will be maximum. At any level, other than this, the satisfaction of the consumer will not be maximum.

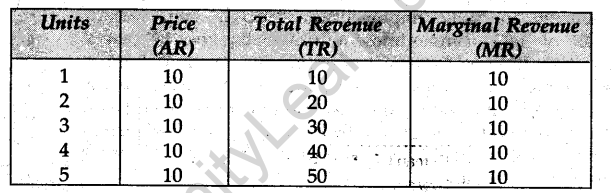

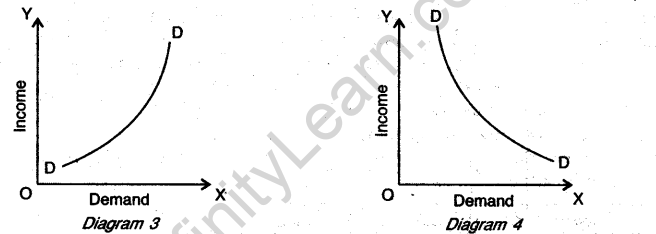

Question.12. Explain how rise in income of a consumer affects the demand of a good. Give examples.

Answer. The effect of rise in the income of a consumer is not the same on the demand of all the goods. The likely effect depends on the nature of good.

The demand of normal goods will increase when income of the consumer increases. Thus, as shown in Diagram 3, income demand curve rises upwards to the right For Example, With an increase in income, the demand for normal goods like fruits will increase.

On the other hand, the effect of rise in the income of the consumer on the demand of inferior goods will be negative, i.e the demand will fall. Thus, as shown in Diagram 4, the income demand curve of inferior goods will slope downwards to the right. For Example, the demand for inferior goods like toned milk will fall with rise in income as the consumer will now buy full-cream milk.

Question.13. Define marginal cost. Explain its relation with average cost.

Answer. Marginal cost (MC) is the change in total cost (TC), which takes place by producing an additional unit.

In the form of an equation: \(MC={ TC }_{ (n) }-{ TC }_{ (n-1) }\)

Thus, if the Total Cost of producing, two units is X 38 and by producing a third unit it goes up to Rs 54, then MC of third unit is 16 (54 – 38). Average Cost (AC) is mathematically derived by dividing the TC by, the number of units produced.

In short, AC =\( \frac { TC }{ n } =\frac { 54 }{ 3 } =18\)

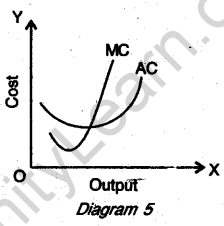

MC is ‘U’-shaped. Thus, when MC is falling, AC is higher than MC. When MC is rising, AC is less than MC. MC curve cuts AC from below at its lowest point. The relationship between MC and AC becomes evident looking at the given Diagram 5.

Or

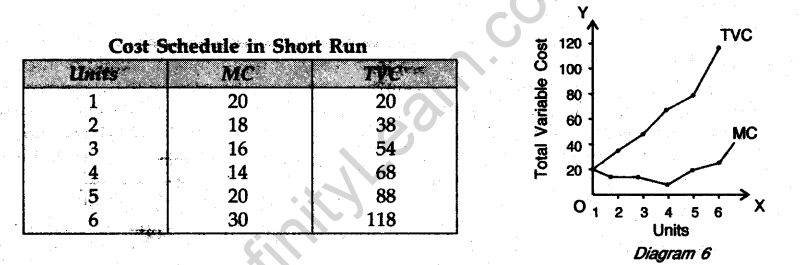

Define variable cost. Explain the behaviour of total variable cost as output increases.

Answer. Variable cost is that which is incurred on variable inputs or factors such as raw materials, wages, etc. Variable cost changes with change in ouput. It is zero at zero level of production. The behaviour of Total Variable Cost ( TVC) depends upon the nature or behaviour of MC. MC curve is generally U-shaped. Therefore, when MC is falling but positive, TVC is increasing at a decreasing rate and when MC is rising then TVC is increasing at an increasing rate. The nature of TVC becomes dear looking at the table and Diagram 6 given below.

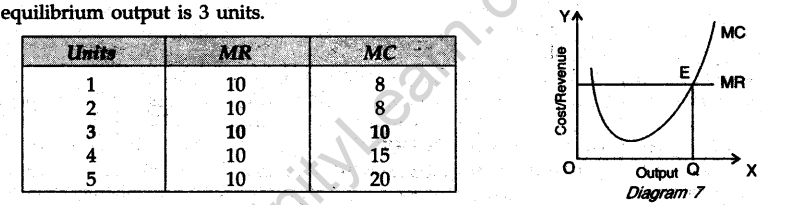

Question.14. What is producer’s equilibrium? Explain the conditions of producer’s equilibrium through the ‘marginal cost and marginal revenue’ approach. Use diagram.

Answer. Producer’s equilibrium refers to a position when profits of the firm are maximum or losses are minimum. According to Marginal Cost (MC) and Marginal Revenue (MR) the equilibrium will be established at a point when MC and MR are equal. Any deviation from that position will reduce file profits of the firm or increase the losses. As long as MR is higher than MC, a firm shall go on producing, but with the increase in output a situation arrives when these MR and MC are equal. This is the point of equilibrium.

Equilibrium Conditions:

(i) MC = MR at point E

(ii) MC > MR after equilibrium i.e., after point E According to Diagram 7, OQ is the equilibrium output and according to the table the equilibrium output is 3 units.

For Blind Candidates only, in lieu of Q. No. 14

What is producer’s equilibrium? Explain the conditions of producer’s equilibrium through the ‘marginal cost and marginal revenue’ approach. Use a schedule.

Answer. Same as Q. 14

Question.15. Explain the conditions of consumer’s equilibrium with the help of the Indifference Curve Analysis.

Answer. See Q. 14, 2010 (I Delhi).

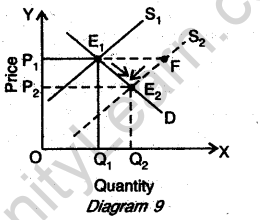

Question.16. Market for a good is in equilibrium. There is ‘increase’ in supply of the good. Explain the chain of effects of this change. Use a diagram.

Answer.

- Increase in supply shifts the supply curve from S1 to S2 to the right leading to excess supply E1F at the given price OP1.

- Since the firms will not be able to sell all that they want to sell, there will be competition among sellers leading to a fall in price.

- As price falls, demand starts rising (along D) and supply starts falling (along S2) as shown by arrows in the diagram.

- These changes continue till D = S at a new equilibrium at E1.

The quantity rises to OQ2 but price falls to OP2.

For blind candidates only in lieu of Q. No. 16 Market for a good is in equilibrium. There is ‘increase’ in supply of this good. Explain the chain of effects of this change. Use a numerical example.

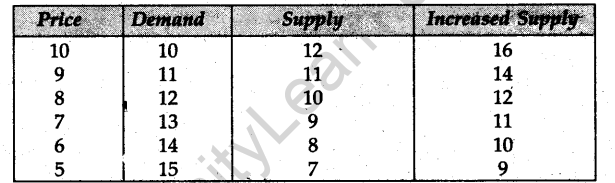

Answer. Chain of Effects: Same as Q.16 above Numerical Example:

Originally at a price of Rs 10 Demand is 10 units whereas increased supply is 16 units. Since the Firms are not able to sell they reduce the price as well as the supply till a price of Rs 8 where die demand and increased supply are equal.

Or

Distinguish between ‘non-collusive’ and ‘collusive’ oligopoly. Explain the following features of oligopoly:

(i) Few firms

(ii) Non-price competition

Answer. Oligopoly is a market situation where there are only a-few firms in the industry and each firm has a substantial share in the market. Oligopoly may be non-collusive as well as collusive. In the case of non-collusive oligopoly, firms compete With each their. In the case of collusive oligopoly firms cooperate with each other in determining price or output Or both. In this situation firms may form some cartels to avoid competition.

(i) In oligopoly there are only few firms but they are dominant firms. Each firm produces a its price policy. However, in actual practice firms do not change the prices of their significant portion of total market output.

(ii) There is a situation of non-price competition. This means each firm is free to pursue products because they feel that other firms may do the same. Because of that, by and large, price tends to be rigid.

SECTION B

Question.17. What are stock variables?

Answer. Stock variables are those concepts whose values are related to a point of time such as wealth, stock of capital, etc.

Question.18. Define ‘depreciation’.

Answer. Decline in the value of fixed capital goods, e.g. Wear and tear that takes place in machines during production process is called depreciation.

Question.19. Define ‘Statutory Liquidity Ratio’.

Answer. SLR is that part of the deposits which commercial banks are legally bound to keep in the form of cash and designated assets and securities as per the directions of the central bank.

Question.20. Define money.

Answer. Money is anything which is accepted as a medium of exchange and has general acceptability for that.

Question.21. What is foreign exchange?

Answer. Currency of other countries is called foreign exchange, such as American dollars, UK pounds etc.

Question.22. Which transactions determine the balance of trade? When is balance of trade in surplus?

Answer. There are only two transactions which determine or are the constituents of balance Of trade. These are payments made and received on account of export and import of goods. In other words, payments made and received for export and import of visible items only. Balance of trade will be in surplus when the export value of goods exported is more than the value of goods imported and vice versa.

Question. 23. Explain how ‘non-monetary exchanges’ are a limitation in taking gross domestic product as an index of welfare.

Answer. Many activities are not evaluated in monetary terms, such as services of women who perform domestic activities at home. However, if these services would have been hired from the market, payments relating to them would have been included in gross domestic product (GDP). As such, to the extent to which non-monetary exchanges (activities not evaluated in money terms) GDP is under-estimated, it adversely affects economic welfare.

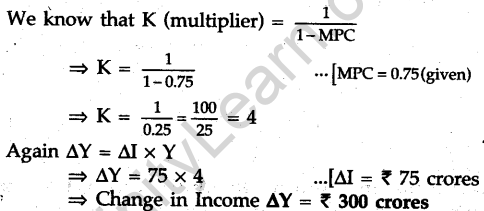

Question.24. In an economy the marginal propensity to consume is 0.75. Investment expenditure in the economy increases by ? Rs 5 crore. Calculate the total increase in national income.

Answer.

Question.25. Explain the distinction between voluntary and involuntary unemployment.

Answer. Voluntary unemployment is that when unemployed persons are not willing to accept .the jobs available because they do not like the jobs. On the other hand, involuntary unemployment refers to a situation when able bodied persons are willing to work but no jobs are available for them. Such persons are unemployed against their choice.

Question.26.When price of a foreign currency falls, the demand for that foreign currency rises. Explain, why.

Answer. When the price of a foreign currency falls, it becomes cheaper in comparison to home (domestic) currency. As such, with given amount of domestic currency, more foreign currency is obtained for it enables us to buy more foreign goods. This leads to an increase in the demand for foreign currency for, now more foreign goods can be bought with the given amount of foreign currency.

Or

When price of a foreign currency falls, the supply of that foreign currency also falls. Explain, why.

Answer. When the price of a foreign currency falls, its demand increases. More and more foreign currency will be used for buying foreign goods. This would lead to a fall in the supply of foreign currency. This would mean that at lower price of foreign currency its supply is going to fall.

Question.27.Explain the ‘redistribution of income’ objective of a government budget.

Answer.Through the budget, the Government may like to affect pattern of redistribution of income. For achieving it, Government has a number of fiscal tools at its disposal, such as taxation, subsidies, public expenditure, etc. Government can influence distribution of income by imposing taxes on the rich and spending more on the welfare of the poor. This will reduce income of the rich and raise standard of living of the poor.

Or

Explain the ‘economic stability’ objective of a government budget.

Answer.Government can bring in economic stability i.e., it can control fluctuation in general price level, through taxes, subsidies and expenditure. Inflation and deflation both are not good from the economic point of view. Therefore, whenever a country suffers from inflation or deflation, besides other corrective measures, appropriate budgetary steps are taken to remedy the situation.

When there is inflation, government can reduce its own expenditure. When there is deflation, government can reduce taxes and give subsidies to encourage spending by the people.

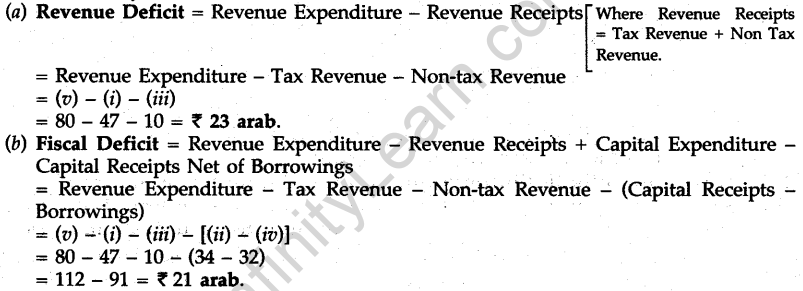

Question.28.From the following data about a government budget, find (a) revenue deficit, (b) fiscal deficit and (c) primary deficit.

Answer.

Question.29. Giving reasons, explain the treatment assigned to the following while estimating National Income:

(i) Family members working free on the farm owned by die family.

(ii) Payment of interest on borrowings by general government.

Answer. (i) Production for self consumption is included in National Income, therefore this would be included.

(ii) It will not be included because it is a non-factor payment. It does not relate to flow of goods and services.

Question.30. Explain the role of the following in correcting the inflationary gap in an economy: (i) Legal reserves (ii) Bank rate

Answer. The situation of inflationary gap arises when equilibrium is established after the stage of full employment. The excess of aggregae demand over aggregate supply at the full employment level is inflationary gap. For bringing equality between AD and AS at the full employment level AD has to be reduced because AS con not be increased since all the resources are fully employed.

(i) Legal reserves. Legal reserves refer to a minimum percentage of deposits commercial banks have to keep as Cash either with themselves or with the central bank; The central bank has the power to change it. When there is inflationary gap the central bank can raise the minimum limit of these reserves so that less funds are available to the banks for lending. This will reduce Aggregate Demand.

(ii) Bank rate. Bank rate is the rate of interest which central bank charges from commercial banks for giving them loans. If bank rate is increased, the rate of interest for general public also goes up and this reduces the demand for credit by the public for investment and consumption. Therefore, for controlling the situation of inflationary gap, bank rate is increased. This ultimately will lead to the decline in the demand for credit. Decline in the volume of credit as a component of money supply will have controlling pressure on inflationary forces.

Or

Explain the role of the following in correcting the deflationary gap in an economy:

(i) Open market operations (ii) Margin requirements

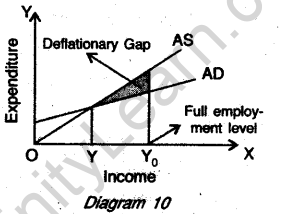

Answer. The situation of deflationary gap arises when equilibrium is established before the stage of full employment. In this case, at the full employment level, aggregate demand is less than aggregate supply. In Diagram 10, DEF is the deflationary gap. For removing deflationary gap, the level of aggregate demand needs to be increased to match the aggregate supply.

(i) Open market operations. This means sale and purchase of securities by the central bank which are bought and sold by the commercial banks to correct deflationary gap. Credit as a component of money supply needs to be increased. For achieving this- central bank buys securities from commercial banks in lieu of which cash flow or liquidity position of commercial banks improves and their lending capacity is raised. People can borrow more. This will raise AD.

(ii) Margin requirements. Commercial banks never advance loans to its customers equal to the full value of collateral or securities. They always keep a margin with them, such as keeping a margin of 20% and advancing loans equal to 80% of the value of security.

In the situation of deflationary gap, this margin is reduced so that more credit may be mode available against the security. This increases borrowing capacity of borrowers and thus will raise AD.

Question.31. Explain the following functions of the central bank:

(i) Bank of issue (ii) Bankers’ bank

Answer. (i) Bank of Issue. Bank of issue refers to the legal right to issue currency. The central bank enjoys complete monopoly of note issue. This brings about uniformity in note circulation. At the same time it gives the central bank power to influence money supply because currency with public is a part of money supply.

(ii) Bankers’ Bank. Central bank is the bank of banks. This signifies that it has the same relationship with commercial banks in the country which commercial banks have with their Customers. It keeps their required cash in reserve, provides them financial securities, gives them advice and discounts their bills and securities held by them. It also gives them loan in times of emergency.

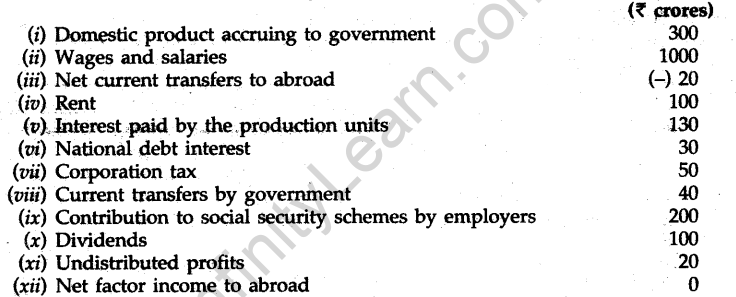

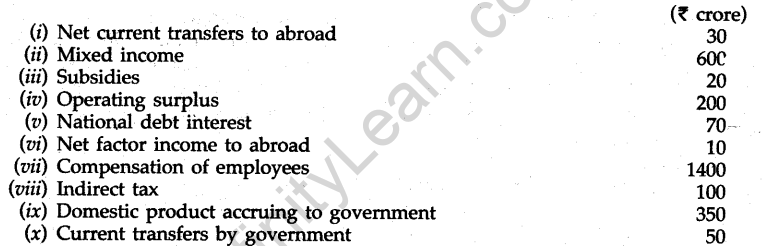

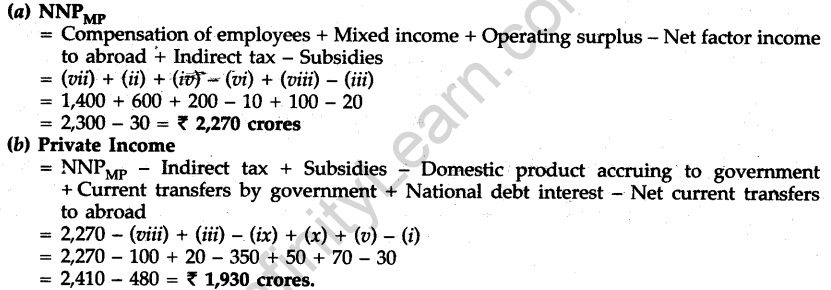

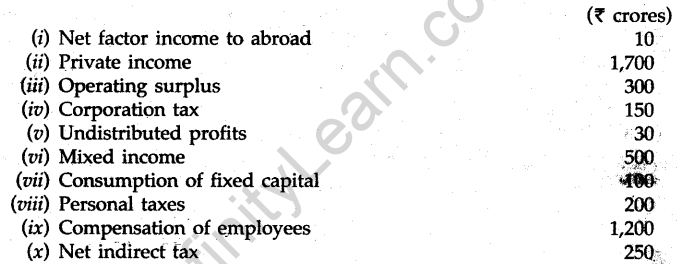

Question.32. Calculate (a) ‘Net Domestic Product at Factor Cost’ and (b) ‘Private Income’ from the following:

Answer.

SET II

Note : Except for the following questions, all the remaining questions have been asked in Set I.

SECTION A

Question.1. Define an economy?

Answer. An economy is a system which provides people with the means to work and earn their livelihood.

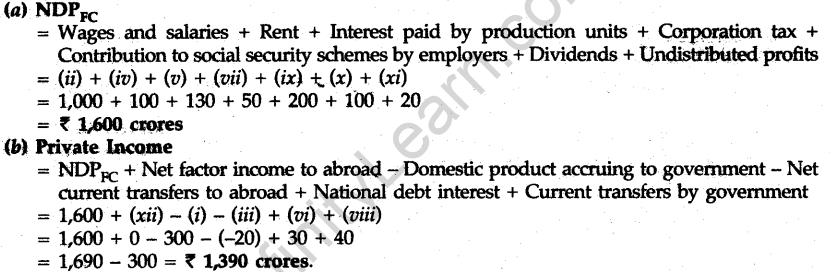

Question.7. When price of a good is Rs 12 per unit, the consumer buys 24 units of that good. When price rises to Rs 14 per unit, the consumer buys 20 units. Calculate price elasticity of demand.

Answer.

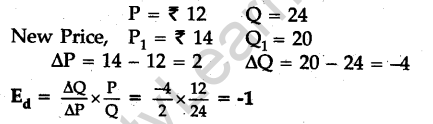

Question.11. A consumer consumes only two goods X and Y. At a certain consumption level of these goods, he finds that the ratio of marginal utility to price in case of X is lower than in case of Y. Explain the reaction of the consumer.

Answer. In the case of two commodities the condition of consumer’s equilibrium is:

\(\frac { MU(X) }{ PriceofX } =\frac { MU(Y) }{ PriceofY } \)

If the ratio of commodity X is lower than the ratio of commodity Y, then die consumer should use less of commodity X and more of commodity Y to arrive at a point where the ratios of MU’and thi prices of both the commodities is the same, otherwise satisfaction will not be maximum. In the table given below, 3 units of X and 4 units of Y should be consumed and not 4 units of X and 3 units of Y.

Question.15. Explain any three properties of Indifference Curves.

Answer. See Q. 15, 2011 (I Delhi).

SECTION B

Question.22. List the transactions of Current Account of the Balance of Payments Account.

Answer. See Q. 24, 2008 (I Delhi).

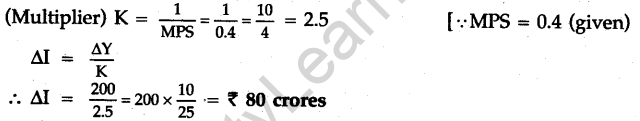

Question.24. In an economy the marginal propensity to save is 0.4. National Income in the economy increases by Rs 200 crore as a result of change in investment. Calculate the change in investment.

Answer.

Question.29. Giving reasons, explain the treatment assigned to the following while estimating national income:

(i) Social security contributions by employees

(ii) Pension paid after retirement

Answer. (i) Social security contributions are part of compensation of employees and are not separately included in National Income.

(ii) Pension paid after retirement is not included in the counting of National Income.

Or

Question.32. Calculate (a) ‘Net National Product at Market Price’ and (b) ‘Private Income’ from tire following:

Answer.

SET III

Note: Except for the following questions, all the remaining questions have been asked in Set I and Set II.

SECTION A

Question.1. Define macroeconomics.

Answer. Macroeconomics is the study of aggregates and averages of the entire economy such as national income, aggregate demand, aggregate supply etc.

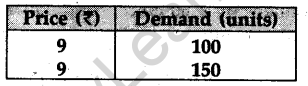

Question.7. From the following data, calculate price elasticity of demand:

Answer.

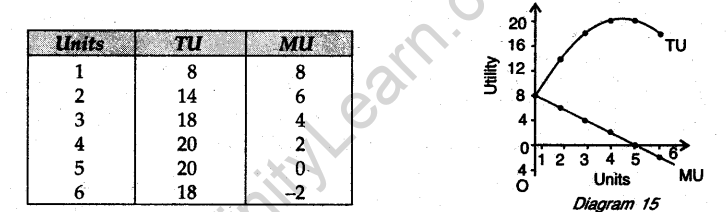

Question.11. Explain the law of diminishing marginal utility with the help of a total utility schedule.

Answer. The law of diminishing marginal utility states that ‘if we go on consuming the units of a commodity successively, the utility which we derive from each additional unit goes on declining, becomes zero and later on negative if we continue our consumption of that commodity. In other words, marginal utility

declines. In terms of total utility, when marginal utility is positive but declining, total utility increases at a decreasing rate. When marginal utility is zero, total utility is the maximum and when marginal utility is negative, total utility starts declining. The nature of law of diminishing .marginal utility becomes clear looking at the schedule and Diagram given below.

Question.15. Explain the concepts of (i) marginal rate of substitution and (ii) budget line equation with the help of numerical examples.

Answer. (i) Marginal rate of substitution. The rave at which a consumer is willing to substitute good X1 for an additional unit of good X2 without affecting his total utility is called marginal rate of substitution. For example, if for one unit of X1, the consumer substitutes 4 units of X2, then marginal rate of substitution (MRS) is:

[/latex] \frac { \Delta { X }_{ 2 } }{ \Delta { X }_{ 1 } } =\frac { 4 }{ 1 } [/latex]

MRS is always declining.

(ii) Budget line equation. Budget line graphically represents various bundles or combinations of two goods (X1 and X2) that can be obtained by spending the given income. Budget line equation is:

\({ X }_{ 1 }{ P }_{ 1 }+{ X }_{ 2 }{ P }_{ 2 }=M\)

Here, P1 is the price of good X1, P2 is the price of good X2 and M is the income of the consumer. One cannot spend beyond his income (M), that is why total expenditure on both the goods is equal to the income.

SECTION B

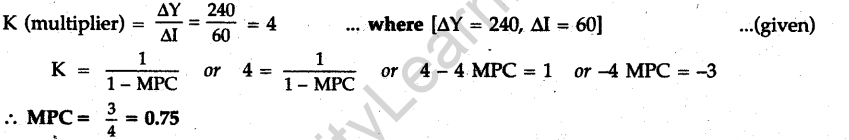

Question.24. As a result of increase in investment by Rs 60 crore, National Income rises by Rs 240 crore. Calculate marginal propensity to consume.

Answer.

Question.29. Giving reasons, explain the treatment assigned to the following while estimating National Income:

(i) Expenditure on maintenance of a building.

(ii) Expenditure on adding a floor to the building.

Answer. (i) Expenditure on maintenance of a building will not be included because it is not final expenditure.

(ii) Expenditure on adding a floor to the building will be included because it is a part of domestic capital formation.

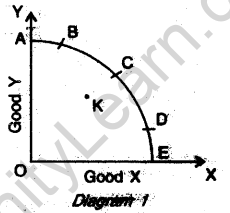

Question.32. Calculate (a) ‘Gross National Product at Market Price’ and (b) ‘Personal Disposable Income’ from the following:

Answer.