Issue and Redemption of Debentures Important Questions for CBSE Class 12 Accountancy Redemption of Debentures

1.Redemption of Debentures

Redemption of debentures means discharging the liability on account of debentures in accordance with the terms and conditions.

2.Methods of Redemption of Debentures

(i) Redemption of debentures in lump sum on maturity.

(ii) Redemption of debentures in instalments by d: aw of lots.

(iii) Redemption of debentures by conversion.

(iv)Redemption by purchase in open market.

NOTE Redemption of debentures by conversion is not in syllabus.

3.Debenture Redemption Reserve (DRR)

it is the amount set aside out of surplus, i.e Balance in Statement of Profit and Loss for redeeming the debentures. Section 71(4) of the Companies Act, 2013 requires the company to create debenture redemption reserve out of the profits available for payment of dividend and the amount so credited to debenture redemption reserve account si mil not be utilised by the company except for the redemption of debentures.

According to Ri de 18(7) of the Companies (Share Capital and Debentures) Rules, 2014, following; companies would now be required to create DRR of an amount equal to 25% of the value of debentures.

Rule 18(7) further requires every company required to create DRR shall on or before 30th April in each year, invest or deposit in specified securities, a sum at least equal to 15% of the amount of debentures maturing for payment during the year ended 31st March of the next year.

Exemption to Create DRR Rule 18(7) of Companies (Share Capital and Debentures) Rules, 20 s 1 exempts the following types of companies from creating DRR:

(i) All India Financial Institution regulated by Reserve Bank of India; and

(ii) Banking Companies.

4.Redemption of Debentures in Lump Sum on Maturity When all the debentures are redeemed by paying in lump sum at a time, it is called redemption in lump sum.

Journal Entries

(i) On Debentures becoming Due for Payment

(ii)On Redemption, i.e. on making payment to debentureholders

Debentureholders’ A/c Dr [With nominal value]

To Bank A/c

5.A company may adopt any of the following two options for redeeming debentures in lump sum

(i) Redemption out of capital When, before or at the time of redemption, profits are neither required by law nor otherwise transferred to DDR, such redemption is said to be out of capital. Section 71 of the Companies Act, 2013 restricts redemption of debentures out of capital by requiring every Company (except All India Financial Institutions and Banking Companies) to create a Debenture Redemption Reserve (DRR) out of profit available for dividend.

The journal entries passed in this case are:

(a) On debentures becoming due for payment Debentures A/c Dr [With nominal value]

Premium on Redemption of Debentures A/c Dr [If premium is payable on redemption]To Debentureholders’ A/c [With total]

(b) On payment to debentureholders Debentureholders’ A/c Dr [With the amount paid]

(ii)Redemption of debentures out of profits When amount specified in Section 71(4) of the Companies Act, 2013 is transferred to debenture redemption reserve out of the profit available for dividend, it is redemption of debentures out of profit.

Section 71(4) of the Companies Act, 2013 along with rules requires that an amount equal to at least 25% of the value of debentures to be transferred to debenture redemption reserve account before the redemption of debentures. The company at its option, amy transfer more amount to debenture redemption reserve than prescribed. The transfer of amounts to DRR reduces the profit available for distribution of dividend.

Further, every company that is required to create DRR is also required to invest or deposit in specified securities by 30th April a sum which is at least equal to 15% of the amount of debentures maturing for payment during the year ending on 31st March of the next year.

The journal entries passed in this case are:

(a)On creation of debenture redemption reserve

Surplus i.e. Balance in Statement of Profit and Loss Dr

To Debenture Redemption Reserve A/c

(b)On investment or deposit being made in specified securities

Debenture Redemption Investment A/c Dr

To Bank A/c

(c)On the amount being due to debentureholders’on redemption

■ At par

Debentures A/c Dr [With nominal value]

To Debentureholders’ A/c

■ At a premium

Debentures A/c Dr [With premium payable]

Premium on Redemption of Debentures A/c Dr [With nominal value]

To Debentureholders’ A/c

(d)On encashing investment

Bank A/c

To Debenture Redemption Investment A/c

(e)On payment to debentureholders’

Debentureholders’ A/c

To Bank A/c

6.Redemption of Debentures in Instalment by Draw of Lots In this method, the company may redeem its debentures in instalments beginning from a particular year i.e. by payment in each year of a certain portion. The actual debentures to be redeemed are selected usually by draw of lots. The holders are repaid the amount at par or at a premium as per the terms of issue.

NOTE DRR must be created before commencing redemption of debentures under this method also.

7.Redemption by Purchase in Open Market When a company purchases its own debentures in the open market for the purpose of immediate cancellation, the purchase and cancellation of such debentures are termed as redemption by purchase in the open market. The advantage of such an option is that a company can redeem the debentures at its convenience whenever it has surplus funds. Secondly, the company can purchase them when they are available in market at a discount.

Debenture Redemption Reserve The company should have balance of debenture redemption reserve atleast equal to 25% vof the debenture issue, before it initiates the purchase of debentures for cancellation.

Investment in Specified Securities Section 71(4) of the Companies Act, 2013 requires that amount at least equal to 15% of nominal value of the debentures to be redeemed by 31st March of next year should be invested in specified securities by 30th April.

(i)When debentures are purchased at nominal value

(a) On purchase of debentures

Own Debentures A/c Dr [with purchase cost]

To Bank A/c

(b) On cancellation of own debentures

X% Debentures A/c Dr

To Own Debentures A/c

(ii) When debentures are purchased at a price below nominal value of debentures

(a) On purchase of debentures

Own Debentures A/c Dr [with purchase cost]

To Bank A/c

(b)On cancellation of own debentures

X% Debentures A/c Dr [with nominal value]

To Own Debentures A/c [with purchase price]

To Gain or Profit on Cancellation of Own Debentures A/c [Excess of face value over cost of own debentures cancelled]

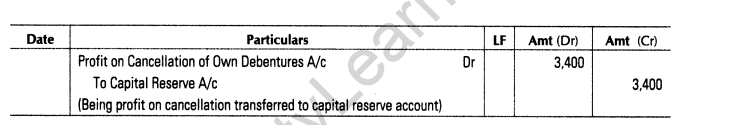

On Transfer of Gain on Cancellation Gain or profit on cancellation of debentures is transferred to capital reserve (or may be used to write off discount/loss on issue of debentures) as it is a capital profit.

Gain or Profit on Cancellation or Redemption of Own Debentures A/c Dr

To Capital Reserve A/c

(iii) When debentures are purchased at price higher than the nominal value of debentures

(a)When debentures are purchased

Own Debentures A/c Dr

To Bank A/c (b)

(b)For cancellation of own debentures

X % Debentures A/c Dr[with nominal value]

Loss on Cancellation of Own Debentures A/c Dr[with excess of cost over nominal value]

To Own Debentures A/c [with purchase cost]

Previous Years’ Examination Questions

2 Marks Questions

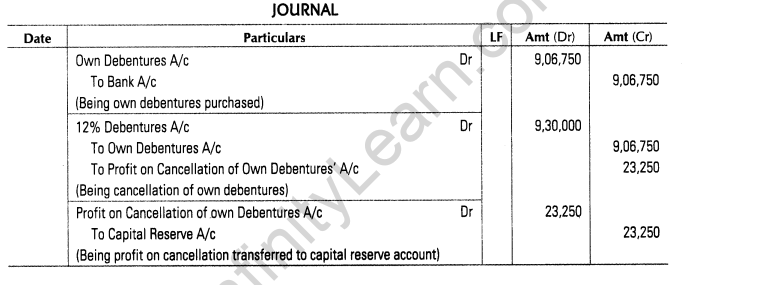

1.Pass necessary journal entries for the redemption of debentures in the following case in the books of Jain Ltd.Purchased for immediate cancellation 930, 12% debentures of Rs 1,000 each at Rs 975 each. (All India 2009)

Ans.

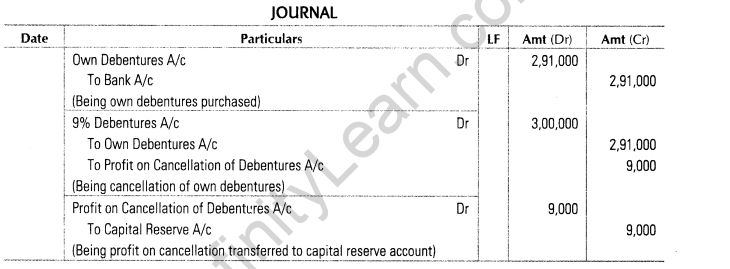

2.Pass necessary journal entries for the following transactions Purchased 3000, 9% own debentures of Rs 100 each at Rs 97 each for immediate cancellation.(Delhi 2008)

Ans.

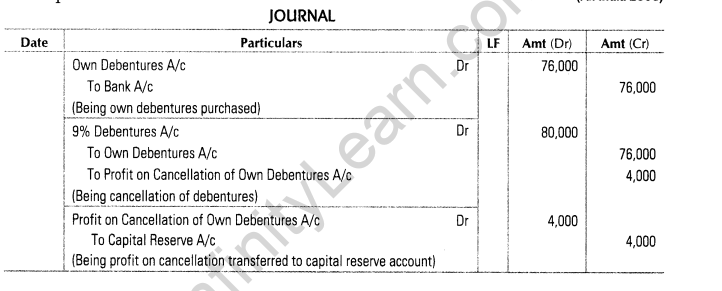

3.Pass necessary journal entries in the books of Rachana Ltd for the following transactions Purchased 800, 9% own debentures of Rs 100 each for Rs 95 per debenture for redemption. (All India 2008)

Ans.

3 Marks Questions

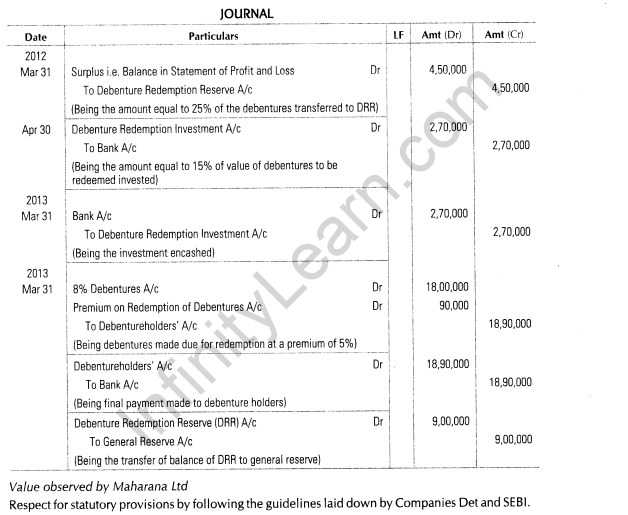

4.Maharana Ltd main business is manufacturing of tyres. The company is very particular about the observation of the provisions of the Companies Act and SEBI guidelines. On 1st April, 2010 the company issued Rs 18,00,000, 8% debentures of Rs 100 each. The debentures were redeemable at a premium of 5%. On 31st March, 2013, all the debentures were redeemed. Since, the manufacturing of tyres results in air pollution, the company had installed a plant for its effective control.

Pass necessary journal entries for the redemption of debentures. Also, identify the value observed by Maharana Ltd. It is assumed that the company has adequate balance in Debenture Redemption Reserve Account. (Compartment 2014)

Ans.

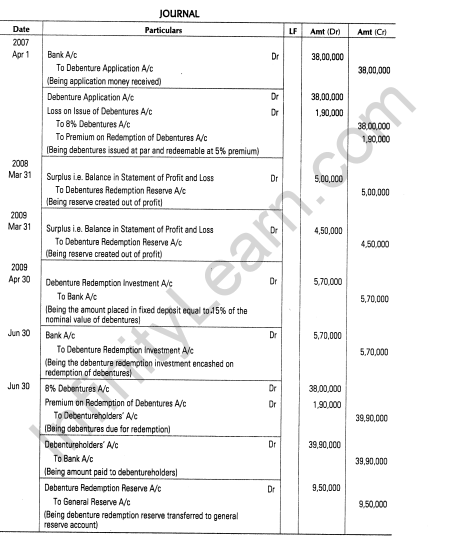

5.Manish Ltd issued Rs 38,00,000, 8% debentures of 1100 each on 1st April, 2007. The terms of issue stated that the debentures were to be redeemed at a premium of 5% on 30th June, 2009. The company decided to transfer out of profits t 5,00,000 to debenture redemption reserve on 31st March, 2008 and Rs 4,50,000 on 31st March, 2009.Pass necessary journal entries regarding the issue and redemption of debentures, without providing for either the interest or loss on issue of debentures. (AH India 2011)

Ans.

6.On 1st April, 2005 Rohim Ltd had made an issue of 3,000, 6% debentures of Rs 100 each. The company during the year 2006-07 purchased for cancellation 600 of these debentures. The company paid Rs 95 per debenture for 500 Debentures and Rs 98 per debenture for the rest.The expenses on purchase amounted to Rs 400.Pass journal entries in the books of the company for the period 2006-07. (All India 2008)

Ans.

4 Marks Questions

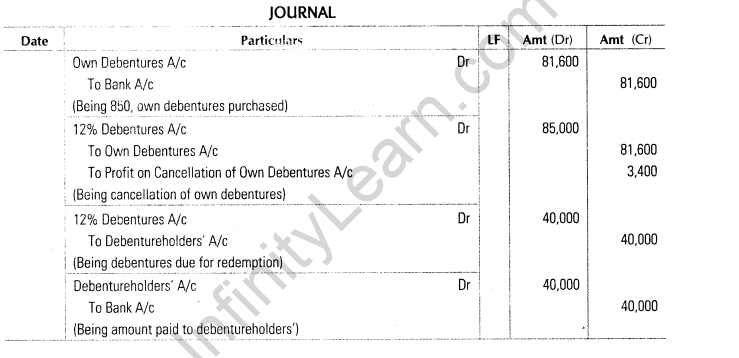

7. Sarvottam Ltd decided to redeem its 1,250, 12% debentures of Rs 100 each. It purchased 850 debentures from the open market at Rs 96 per debenture. The remaining debentures were redeemed out of profit. The company has already made a provision for debenture redemption reserve in its books.Pass necessary journal entries in the books of the company for the above transactions.(All India 2012)

Ans.

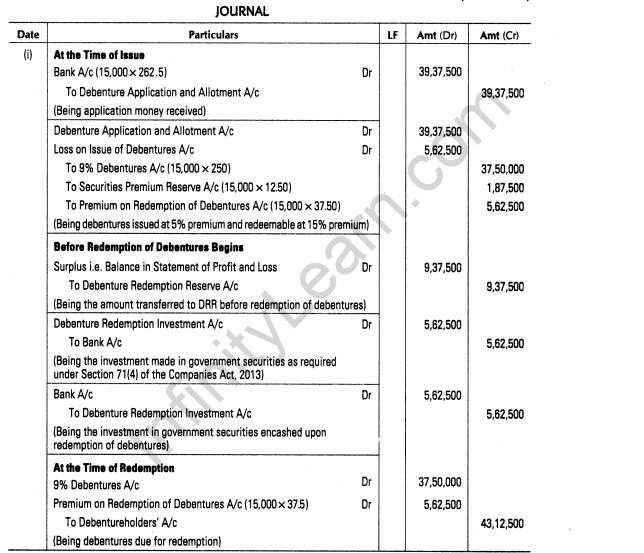

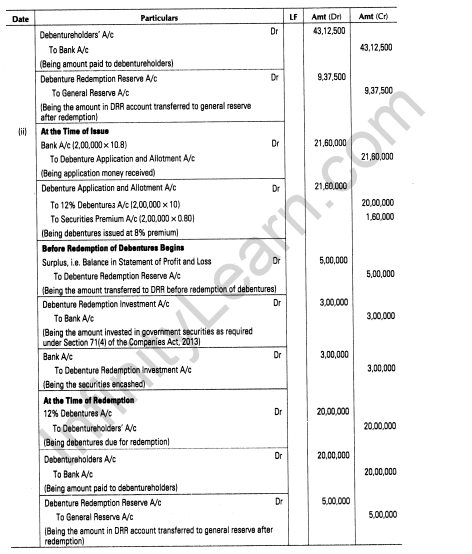

8.Pass the necessary journal entries for the issue and redemption of debentures in the following cases:

(i)15,000,9% debentures of Rs 250 each issued at 5% premium, repayable at 15% premium.

(ii)2,00,000,12% debentures of Rs 10 each issued at 8% premium, repayable at par.(All India 2011)

Ans.

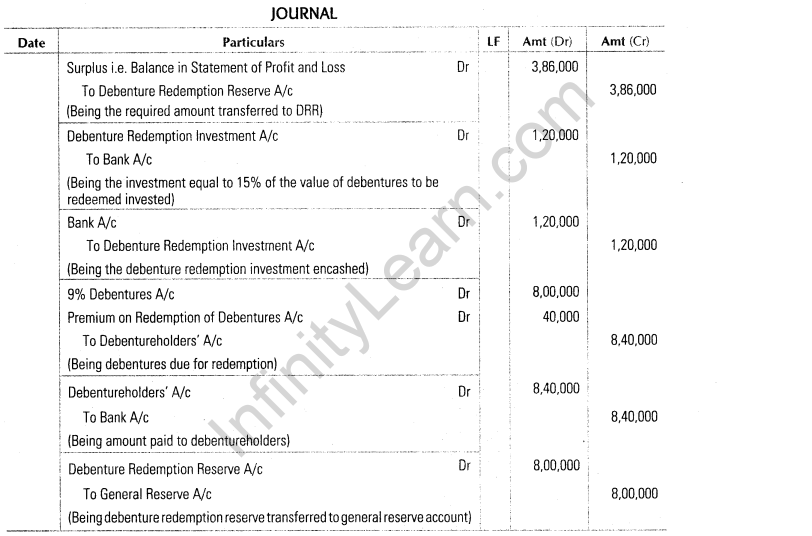

9.X Ltd has Rs 8,00,000, 9% debentures due to be redeemed out of profits on 1st October, 2009 at a premium of 5%. The company had a debenture redemption reserve of Rs 4,14,000. Pass necessary journal entries at the time of redemption. (Delhi 2010; Modified)

Ans.

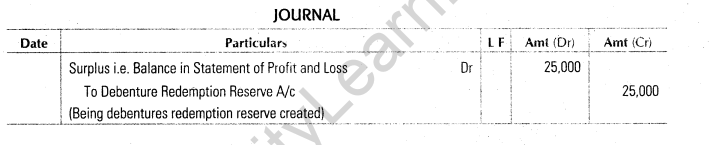

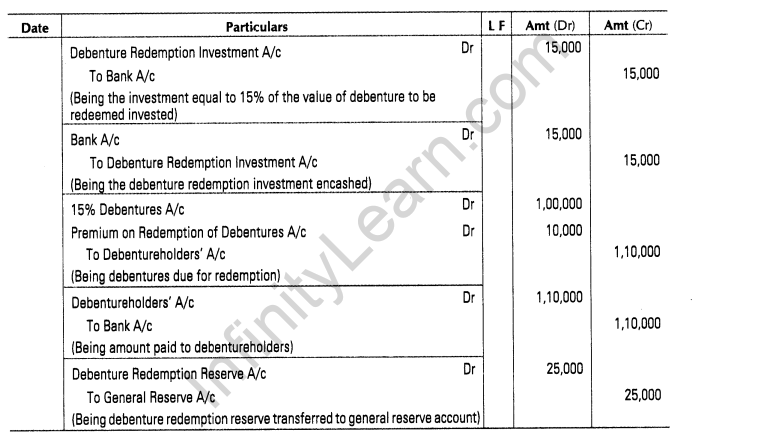

10.F Ltd issued Rs 1,00,000, 15% debentures of Rs 100 each at a premium of 5%, redeemable at a premium of 10% at the end of 4 years. The board of directors decided to transfer the minimum required amount to debenture redemption reserve account at the time of redemption.Pass journal entries at the time of redemption of debentures. (All India 2010; Modified)

Ans.

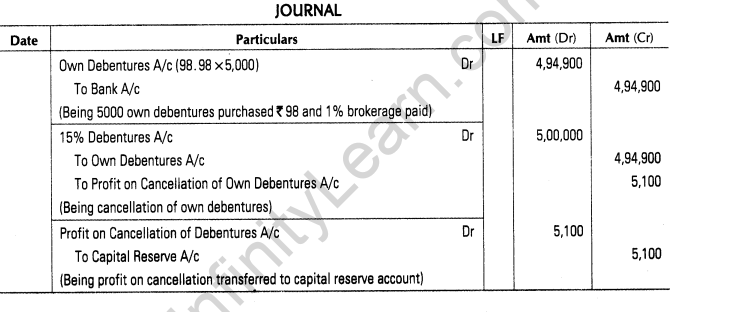

11.On 1st January, 2009, Tanisha Ltd purchased 5,000, 15% own debentures of Rs 100 each for immediate cancellation Rs 98, the brokerage being 1%.Pass the necessary journal entries. (Delhi 2010 c)

Ans.

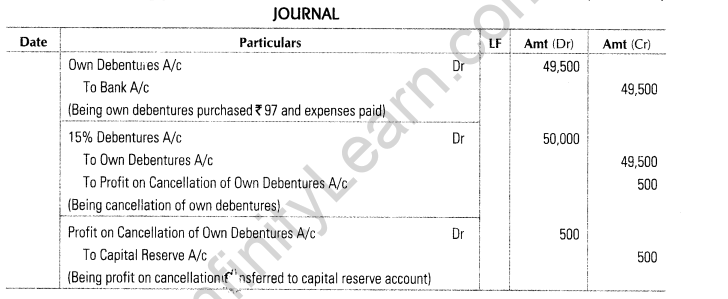

12.On 1st January, 2009, NK Ltd purchased for immediate cancellation Rs 50,000 of its 15% debentures @ 97, the expenses being Rs 1,000.Pass the necessary journal entries. (Delhi 2010 c)

Ans.

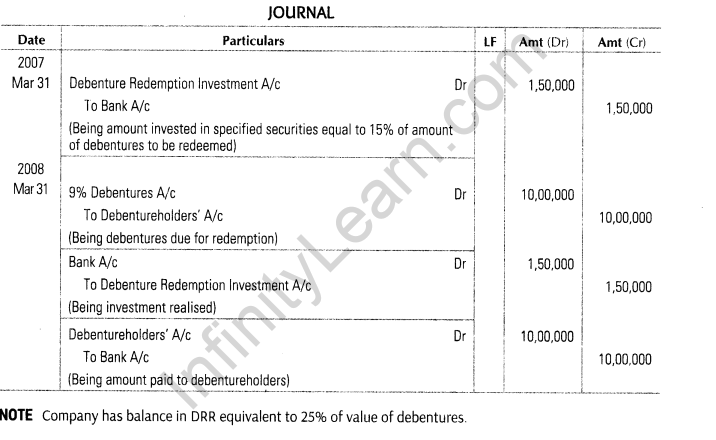

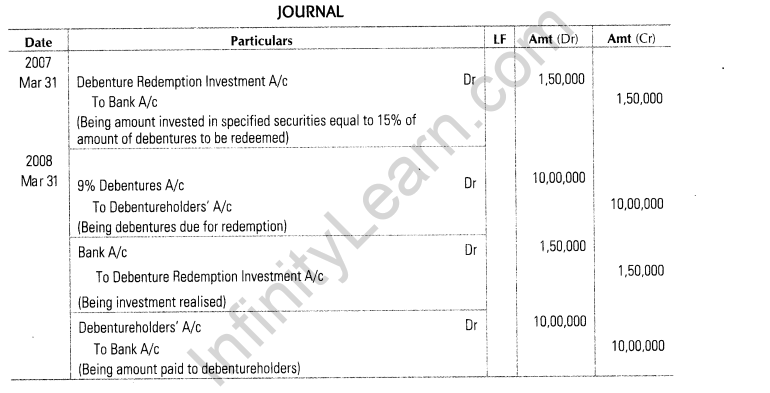

13.Mona Ltd has issued 20,000, 9% debentures of Rs 100 each of which half the amount is due for redemption on 31st March, 2008. The company has in its debenture redemption reserve account a balance of Rs 5,00,000. Record the necessary journal entries at the time of redemption of debentures. (Delhi 2009; Modified)

Ans.

14. Anupama Ltd had issued 10,000, 9% debentures of Rs 100 each which were due for redemption on 31st March, 2008. The company has in its debenture redemption reserve account a balance of Rs 2,50,000. Record the necessary journal entries at the time of redemption of debentures. (All India 2009)

Ans.

6 Marks Questions

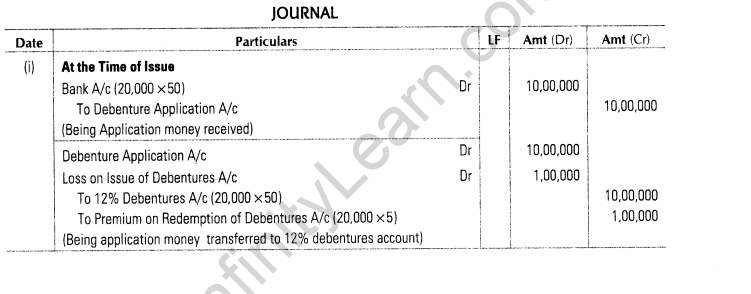

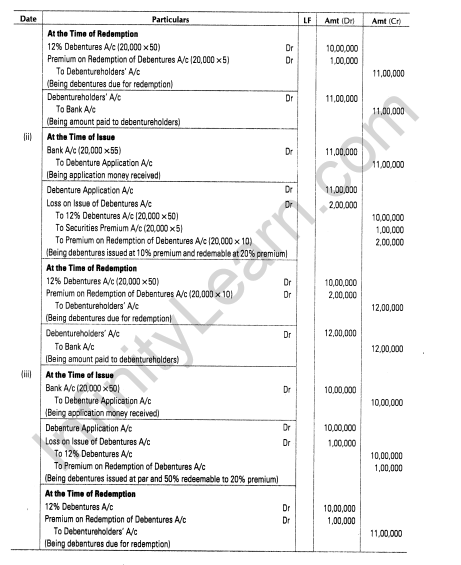

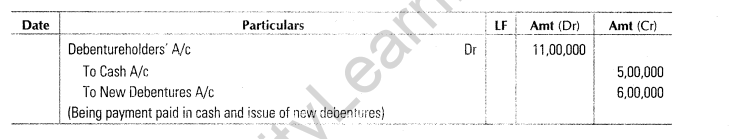

15.Pass necessary journal entries for the issue and redemption of debentures in the following cases 20,000, 12% debentures of Rs 50 each were issued and to be redeemed as follows

(i)Issued at par and redeemed at a premium of 10%.

(ii)Issued at a premium of 10% and redeemable at a premium of 20%.

(iii)Issued at par and 50% of the redemption to be made in cash, and the balance to be redeemed at a premium of 20% through the issue of fresh debentures. (All India 2011)

Ans.

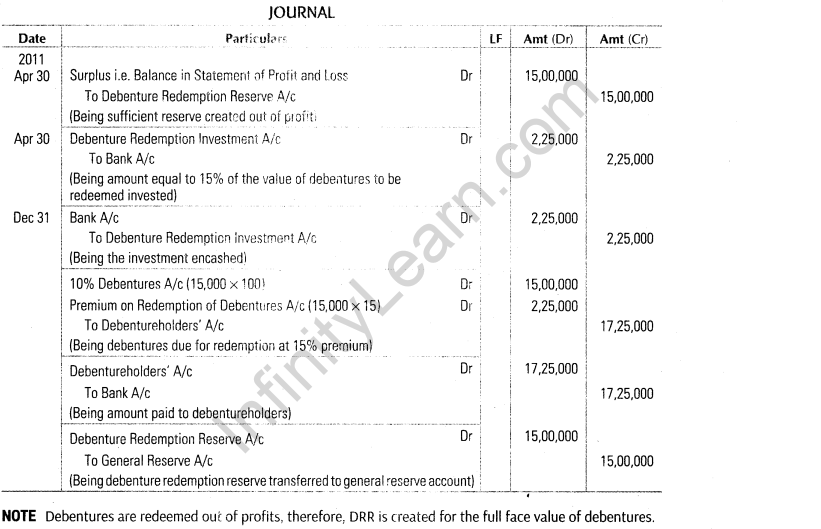

16.On 1st January, 2007 a public limited company issued 15,000, 10% debentures of Rs 100 each at par which were repayable at a premium of 15% on 31st December, 2011. On the date of maturity, the company decided to redeem the above mentioned 10% debentures as per the term of issue, out of profits. Surplus i.e. Balance in Statement of Profit and Loss shows a credit balance of Rs 20,00,000 on this date. The offer was accepted by all the debentureholders and all the debentures were redeemed. Pass the necessary journal entries in the books of the company only for the redemption of debentures. (All India 2011; Modified)

Ans.

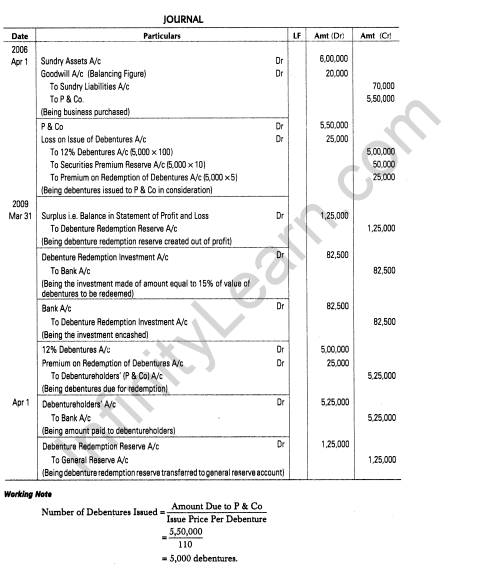

17 . Suresh Ltd on 1st April, 2006 acquired assets of the value of Rs 6,00,000 and liabilities worth Rs 70,000 from P & Co at an agreed value of Rs 5,50,000. Suresh Ltd issued 12% debentures of Rs 100 each at a premium of 10% in full satisfaction of purchase consideration. The debentures were redeemable 3 years later at a premium of 5%. Pass entries to record the above including redemption of debentures.(Delhi; All India 2010; Modified)

Ans.