1.Terms of Issue of Shares

(i) Issue of shares at par When shares are issued at their face value, the shares are said to have been issued at par. i.e. issue price and face value are same.

(ii) Issue of shares at premium When shares are issued at a value that is higher than the face value of the shares, the shares are said to have been issued at premium, i.e. issue price is more than face value.

2.Utilisation of Securities Premium Reserve Section 52 (2) of the Companies Act, 2013 restrict the use of the amount received as premium on securities for the following purposes

(i) In purchasing its own shares (buy back) (Section 77A).

(ii)Issuing fully paid bonus shares to the members (Section 78).

(iii)Writing-off preliminary expenses of the company (Section 78).

(iv)Writing-off the expenses of, or the commission paid or discount allowed on any issue of securities or debentures of the company (Section 78).

(v)Providing for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company (Section 78).

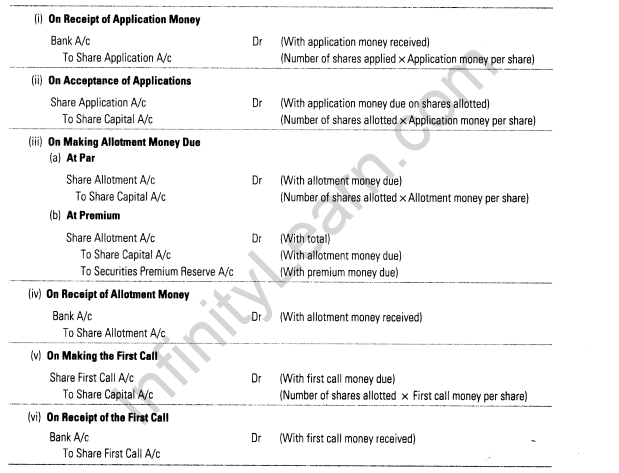

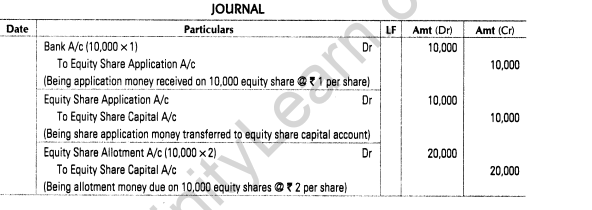

3.Accounting Treatment for Issue of Shares for Cash

4.Full Subscription of Shares When the number of shares applied for, is equal to the number of shares offered for subscription, the shares are said to be fully subscribed.

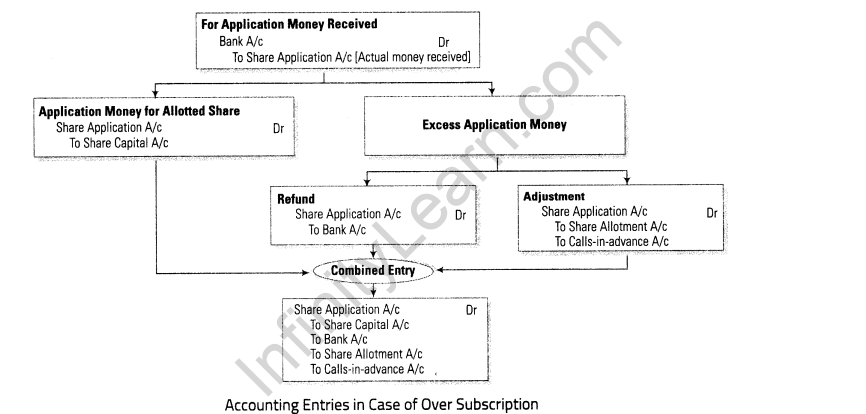

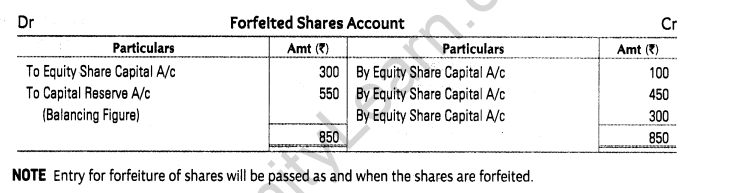

5.Over Subscription of Shares When the number of shares applied for, is more than the number of shares offered for subscription, the shares are said to be oversubscribed. Allotment of shares cannot be made to all the applicants in full.

In case of oversubscription, following three alternatives are available (i) Rejection of applications (ii) Partial or pro-rata allotment (iii) Combination of pro-rata allotment and rejection

6.Under Subscription of Shares When the number of shares applied for, is less than the number of shares offered to the public, the shares are said to be under subscribed.

7.Issue of Shares for Consideration other than Cash

I.Issue of Shares to Vendors

In this regard, the purchase of assets and issue of shares are to be treated as two separate transactions.

(i) (a) When Assets are Purchased

Assets A/c (Individually) Dr

To Vendor

(Being assets purchased from…… )

(b) When Business is Purchased

Sundry Assets A/c Dr

Goodwill A/c Dr

To Sundry Liabilities A/c To Vendor

To Capital Reserve A/c*

(Being business purchased from vendor for purchase consideration of Rs )

NOTE ‘Vendor’ is credited with purchase consideration payable to him Either goodwill or capital Reserve will come.

(ii)On Issue of Shares

(a)At Par

Vendor Dr

To Share Capital A/c

(b)At Premium

Vendor Dr

To Share Capital A/c

To Securities Premium Reserve A/c

II.Issue of Shares to Promoters

Formation Expenses/ Incorporation Cost/Goodwill A/c Dr

To Share Capital A/c

(Being … share of ? … each issued to promoters of the company)

III.Issue of Shares to Underwriters

(i)Making Underwriting Expenses Due

Underwriting Expenses A/c Dr

To Underwriters A/c (Being underwriting commission due)

(ii)Issuing Shares to Underwriters

Underwriters A/c Dr

To Share Capital A/c

(Being …shares issued @ …… per share to underwriters)

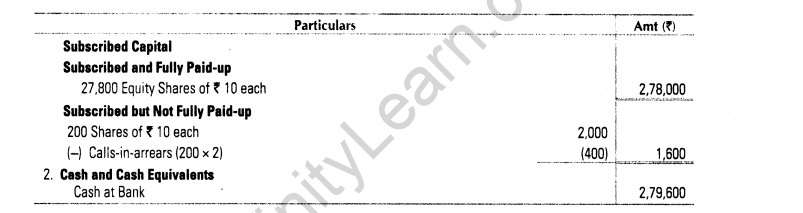

8.Calls-in-arrears When one or more shareholders fail to pay their dues at the time of allotment or call, it is technically called calls-in-arrears.

Table F of the Companies Act, 2013, provides for the payment of interest on calls-in-arrears at a rate not exceeding 10% per annum.

9.Calls-in-advance The part of the whole amount received from the shareholders before the call is made, is called calls-in-advance.

This amount is shown on the liabilities side of the balance sheet as a separate item under the head ‘share capital’ but is not added to the amount of paid-up capital.

Table F of the Companies Act, 2013, provides for the payment of interest on calls-in-advance at a rate not exceeding 12% per annum.

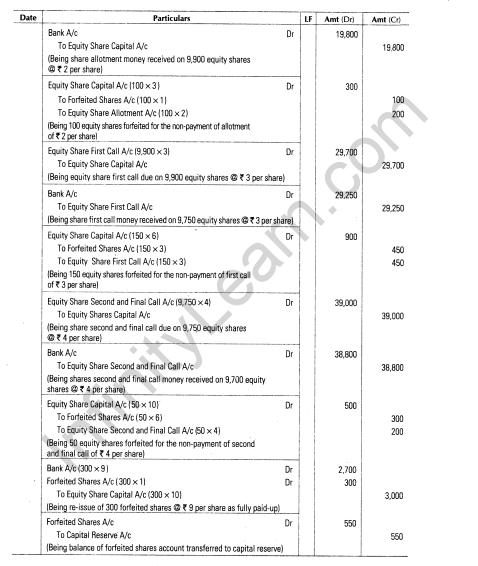

10.Forfeiture of Shares

Forfeiture of shares means cancellation of shares and seizure of the amount already received from defaulting shareholders.

(i) Forfeiture of Shares Originally Issued at Par

Share Capital A/c Dr (Called-up money)

To Forfeited Shares A/c (Paid-up money)

To Share Unpaid Calls A/c (Unpaid money or calls-in-arrears)

(Being forfeiture of…… shares for non-payment of call of…….. per share)

(ii)Forfeiture of Shares Originally Issued at Premium and Premium was Received

Share Capital A/c Dr (Called-up money)

To Forfeited Shares A/c (Paid-up money)

To Share Allotment A/c (Unpaid money excluding premium)

To Share Unpaid Call A/c (Unpaid money or calls-in-arrears)

(Being forfeiture of …… shares for non-payment of allotment and call of…… per share)

(iii)Forfeiture of Shares Originally Issued at Premium and Premium was not Received

Share Capital A/c Dr (Called-up money)

Securities Premium Reserve A/c Dr (Unpaid premium)

To Forfeited Shares A/c (Paid-up money)

To Share Allotment A/c (Unpaid money including premium)

To Share Unpaid Call A/c (Unpaid money or calls-in-arrears)

(Being forfeiture of …… shares for non-payment of allotment and call of ……per share)

11.Re-issue of Shares

The directors can either cancel or re-issue the forfeited shares. Shares forfeited can be re-issued at par, at premium or at a discount

In case, they are re-issued at par, accounting entry will be

Bank A/c Dr

To Share Capital A/c

In case, shares are re-issued at a discount, the amount of discount allowed on the re-issue of forfeited shares must not exceed the amount forfeited on re-issued shares. The discount allowed on re-issue of forfeited shares should be debited to the ‘share forfeiture account’. The journal entry will be

Bank A/c Dr [With the amount received on re-issue]

Share Forfeiture A/c Dr [With the discount allowed on re-issue]

To Share Capital A/c [With the amount credited as paid-up]

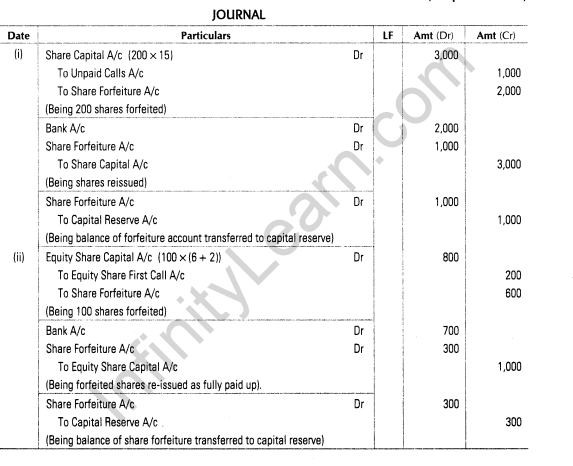

It is calculated as

Number of Shares Re-issued x (Paid-up Value – Re-issue Price Per Share)

If the forfeited shares are re-issued at a price higher than that paid-up, the excess is credited to securities premium reserve account. The journal entry will be

Bank A/c Dr

To Share Capital A/c To Securities Premium Reserve A/c

Transfer of Balance in Forfeited Share Account Forfeited Shares A/c Dr

To Capital Reserve A/c (Being balance of share forfeiture account transferred to capital reserve account)

Previous Years’Examination Questions

1 Mark Questions

1.What is the maximum amount of discount at which forfeited shares can be re-issued? (Delhi 2014)

Ans. When forfeited shares are re-issued at a discount, the discount cannot exceed the amount forfeited on re-issued shares.

2.Give any one purpose for which the amount received as ‘securities premium reserve’ may be utilised. (Compartment 2014)

Ans. Securities premium can be utilised in writing-off preliminary expenses of the company.

3.A Ltd forfeited 100 equity shares of Rs 10 each issued at premium of 20% for the non-payment of final call of Rs 5 including premium. State the maximum amount of discount at which these shares can be re-issued. (All India 2014)

Ans. Maximum amount of discount that can be allowed at the time of re-issue is the amount forfeited on re-issued shares, i.e. Rs 7.

4.What is meant by private placement of shares? (Compartment 2014)

Ans. Private placement of shares means selling of shares to a relatively small number of select investors. Private placement is the opposite of a public issue, in which securities are made available for sale in the open market.

5.Give the meaning of forfeiture of shares. (All India 2014(c), 2010)

Ans. Forfeiture of shares means cancellation of shares and seizure of the amount received from the defaulting shareholders, whose shares have been forfeited. Upon forfeiture, the name of original shareholder must be removed from the register of members. Forfeiture results in reduction of share capital.

6.What is meant by ‘calls-in-arrears’? (All India 2013)

Ans. If shareholders make default in paying the money due on allotment or any call, the money not so paid is called calls-in-arrears.

7.What rate of interest the company pays on calls-in-advance, if it has not prepared its own Articles of Association?(Delhi 2013)

Ans. As per Table F, of the Companies Act, interest on calls-in-advance is payable @ 12% per annum by the company.

8.What is meant by’securities premium reserve’? (Delhi 2013)

Ans. A company can issue its shares at more than its face value. Excess of issue price of shares over its face value is termed as securities premium.

9.What is meant by calls-in-advance? (All India 2012; Delhi 2008)

Ans. Calls-in-advance means the amount paid by shareholders in excess of the amount due from them. The company may receive calls-in-advance if the articles permit. It is shown as a current liability in the balance sheet.

10.State the steps other than rejecting applications that a company can take in case of over subscription. (Delhi 2011c)

or

Give any two alternatives available to a company for the allotment of shares in case of over subscription. (Delhi 2009 c)

Ans. The step’s other than rejecting applications that a company can take in case of over subscription are:

(i) All applicants are allotted shares on pro-rata basis.

(ii) Some applicants are allotted shares in full and some are allotted shares on pro-rata basis.

11.Can securities premium be used as working capital? Give reason in support of your answer.(All India 2011; HOTS)

Ans. Securities premium cannot be used as working capital.

According to Section 52 (2) of the Companies Act, 2013, the securities premium can be applied only for the following purposes:

(i) Issuing fully paid bonus shares to the members.

(ii) Writing-off the preliminary expenses of the company.

(iii) Writing-off the expenses on issue of shares, commission paid on any issue of shares or debentures of the company and discount allowed on any issues of shares and debentures.

(iv) Providing for the premium payable on the redemption of redeemable preference shares or debentures of the company.

12.What is meant by pro-rata allotment of shares? (All India 2010)

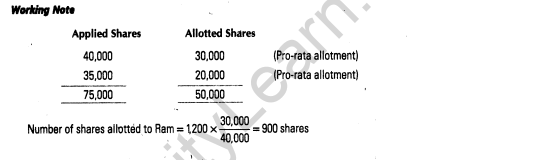

Ans. In the case of over subscription, it is not possible to allot shares to all applicants. Applicants may be allotted less number of shares than they have applied for. This type of allotment of shares is known as pro-rata allotment of shares, e.g. if company allots 50,000 shares to applicants of 75,000 shares, it is pro-rata allotment in proportion of 2 : 3.

13.Give the meaning of over subscription. (All India 2008)

Ans. Over subscription is a situation in which applications received are for more shares than the number of shares offered to the public for subscription through prospectus by a company.

3 Marks Questions

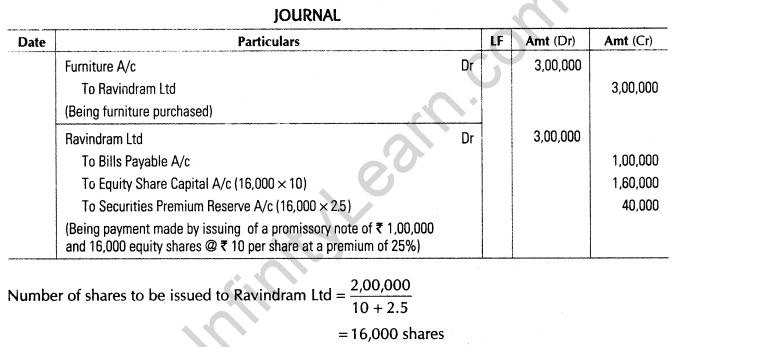

14. Sundram Ltd purchased furniture for Rs 3,00,000 from Ravindram Ltd, Rs 1,00,000 were paid by drawing a promissory note in favour of Ravindram Ltd. The balance was paid by issue of equity shares of Rs 10 each at a premium of 25%. Pass journal entries in the books of Sundram Ltd. (All India 2012)

Ans.

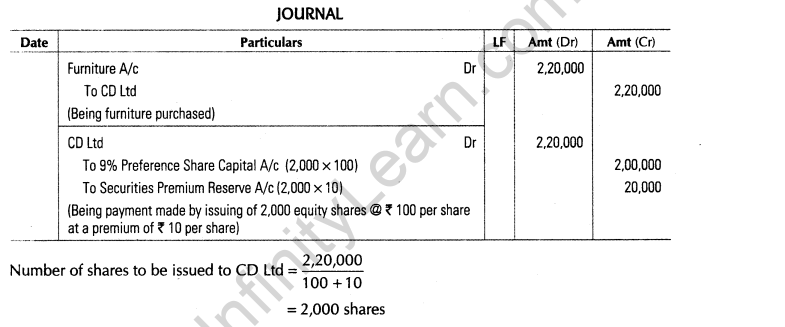

15.Z Ltd purchased furniture costing Rs 2,20,000 from CD Ltd. The payment was to be made by issuing of 9% preference share of Rs 100 each at a premium of Rs 10 per share.Pass necessary journal entries in the books of Z Ltd. (Delhi 2011)

Ans.

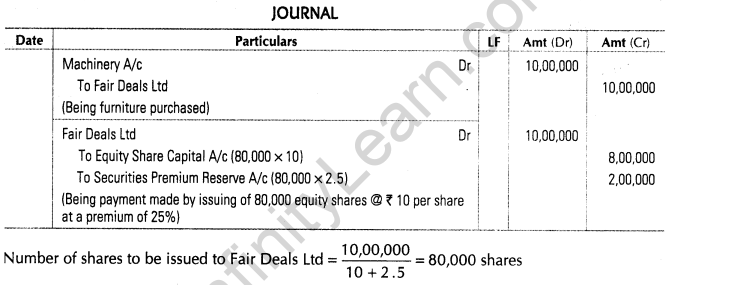

16.Goodluck Ltd purchased machinery costing Rs 10,00,000 from Fair Deals Ltd. The company paid the price by issue of equity shares of Rs 10 each at a premium of 25%. Pass necessary journal entries for above transactions in the books of Goodluck Ltd.(All India 2011)

Ans.

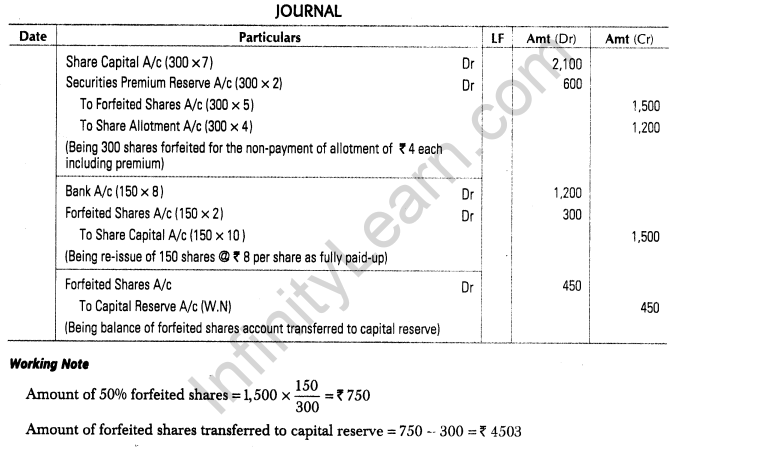

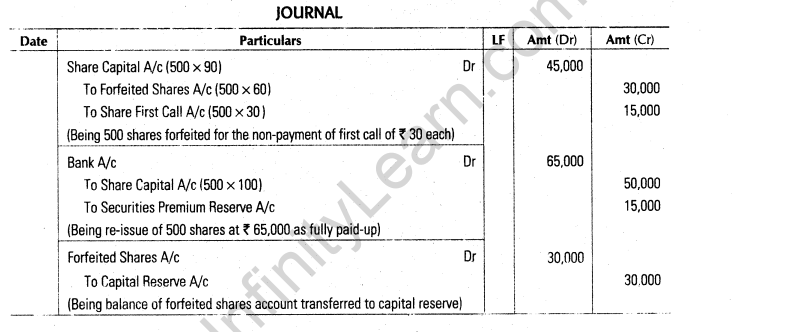

17.SSP Ltd forfeited 300 shares of Rs 10 each issued at a premium of Rs 2 per share for the non-payment of allotment of Rs 4 per share (including premium). The first and final call of Rs 3 per share has not been made yet, 50% of forfeited shares were re-issued at Rs 8 per share fully paid-up. Pass necessary journal entries for the forfeiture and re-issue of shares. (Delhi 2011)

Ans.

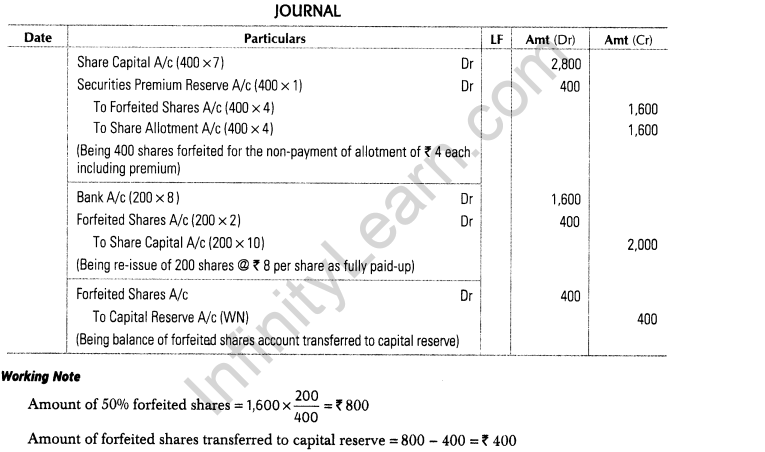

18.TAG Ltd forfeited 400 shares of Rs 10 each issued at a premium of Rs 1 per share for the non-payment of allotment of Rs 4 per share (including premium). The first and final call of Rs 3 per share has not been made yet. 50% of forfeited shares were re-issued at Rs 8 per share fully paid-up. Pass necessary journal entries for the forfeiture and re-issue of shares. (All India 2011)

Ans.

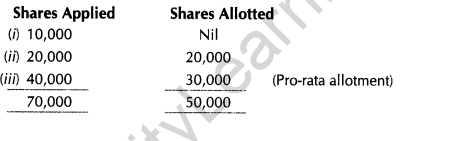

19. DN Ltd issued 50,000 shares of 110 each payable as Rs 2 per share on application, Rs 3 per share on allotment and Rs 5 on first and final call. Applications were received for It was decided that

(i)Refuse allotment to the applicants of 10,000 shares.

(ii)Allot 20,000 shares to Mohan who had applied for similar number.

(iii)Allot the remaining shares on pro-rata basis.

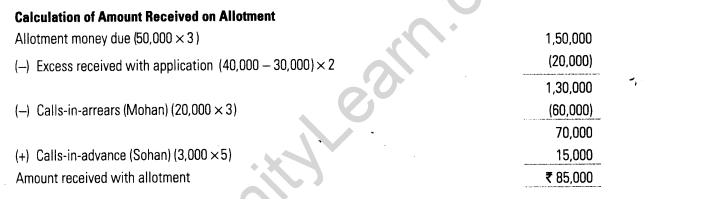

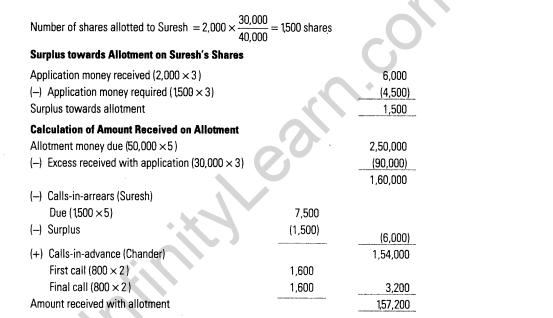

Mohan failed to pay the allotment money and Sohan who belonged to the category (iii) and was allotted 3,000 shares paid both the calls with allotment. Calculate the amount received on allotment. (All India; Delhi 2010)

Ans.

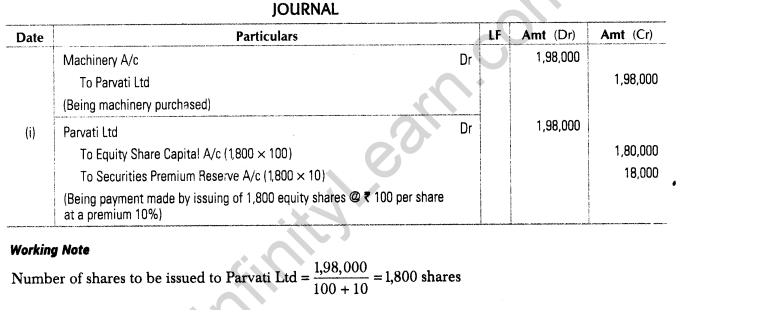

20.Shanker Ltd purchased machinery for Rs 1,98,000 from Parvati Ltd. The payment of Parvati Ltd was made by issue of equity shares of Rs 100 each.

Pass necessary journal entries in the books of Shanker Ltd for the above transactions when shares were issued at 10% premium.(All India 2010)

Ans.

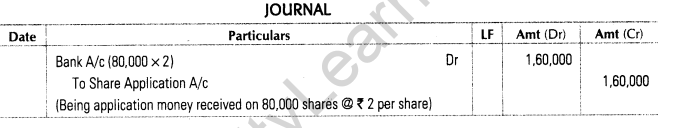

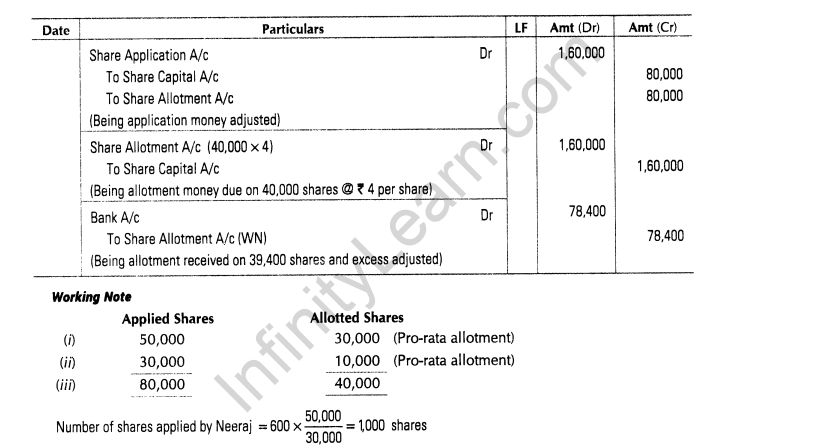

21. MCS.Ttd issued 40,000 shares of Rs 10 each payable at Rs 2 on application, Rs 4 on allotment arid’balance, in two equal instalments.

Applications were received for 80,000 shares and the allotment was made as follows: *

(i)Applications of 50,000 shares were allotted 30,000 shares.

(ii)Applications of 30,000 shares were allotted 10,000 shares.

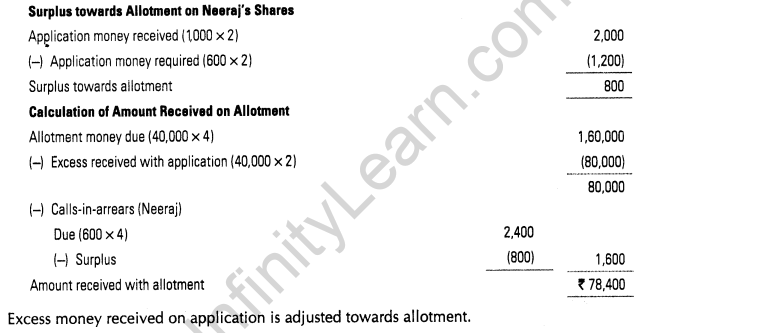

Neeraj to whom 600 shares were allotted from category (i), failed to pay the allotment money.

Pass the necessary journal entries upto allotment only. (Delhi 2010c; All India 2009)

Ans.

22.SSS Ltd has a paid-up share capital of % 60,00,000 and a balance of Rs 15,00,000 in the securities premium account. The companies management do not want to carry over this balance. State the purpose for which this balance can be utilised. (Delhi 2010; HOTS)

or

State the purposes for which the securities premium can be utilised under Section 52 (2) of the Companies Act, 2013. (All India 2009)

Ans. According to Section 52 (2) of the Companies Act, 2013, SSS Ltd can utiiise the securities premium of Rs 15,00,000, only for the following purposes

(i) Issuing fully paid bonus shares to the members.

(ii) Writing off the preliminary expenses of the company.

(iii) Writing off the expenses of or the commission paid or the discount allowed on any issue of secuiries or debentures of the company.

(iv) Providing for the premium payable on the redemption of any redeemable preference shares or or any debentures of the company.

(v) In purchasing its own shares (Buy back).

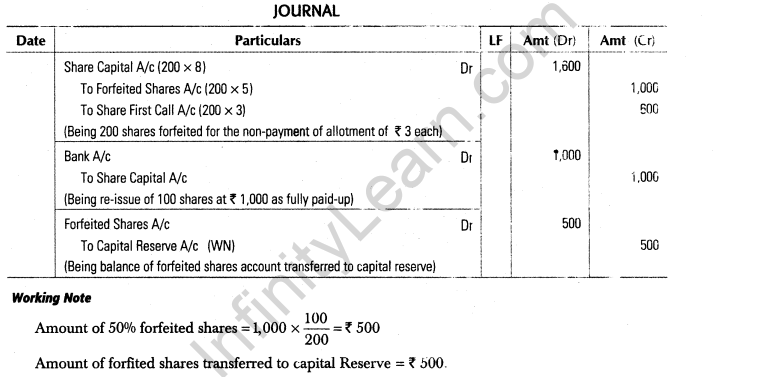

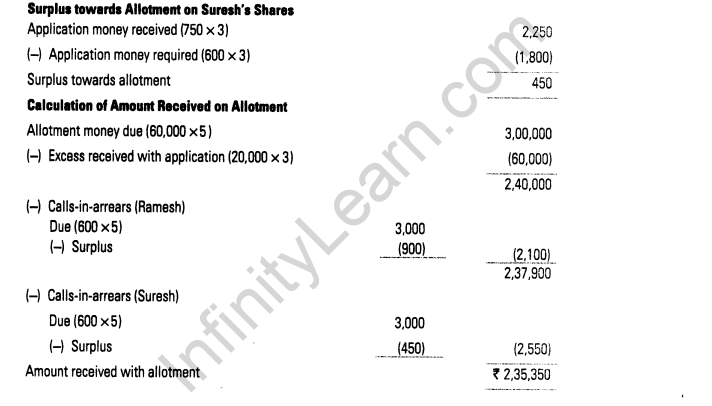

23.The directors of a company forfeited 200 shares of Rs 10 each issued at a premium of Rs 3 per share, for the non-payment of the first call money of Rs 3 per share. The final call of Rs 2 per share has not been made. Half the forfeited shares were re-issued at Rs 1,000 fully paid. Record the journal entries for the forfeited shares and re-issue of (Delhi 2009)

Ans.

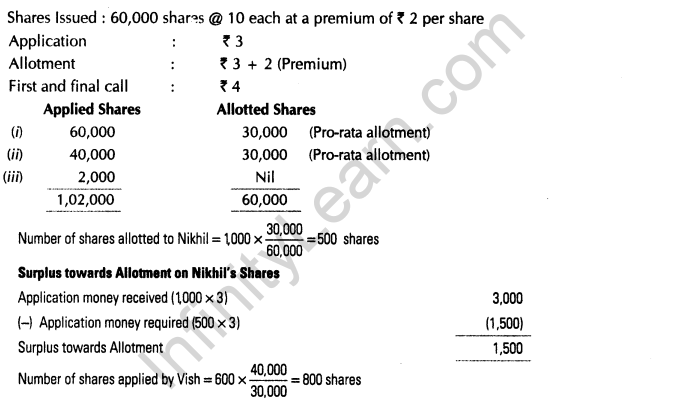

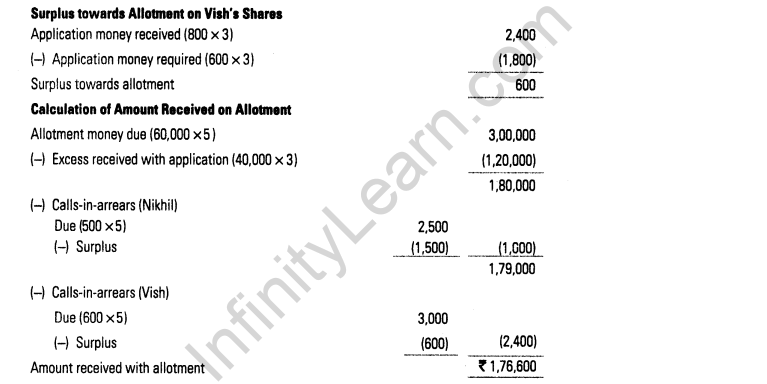

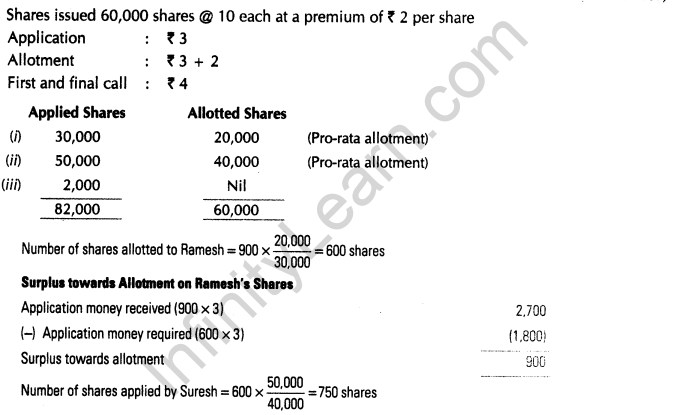

24.Meena Ltd issued 60,000 shares of Rs 10 each at a premium of Rs 2 per share payable as Rs 3 on application, Rs 5 on allotment (including premium) and balance on the first and final call. Applications were received for 1,02,000 shares.

The directors resolved to allot as follows

(i)Applicants of 60,000 shares — 30,000 shares

(ii) Applicants of 40,000 shares — 30,000 shares

(iii)Applicants of 2,000 shares — Nil

Nikhil who had applied for 1,000 shares in category (i) and Vish, who was allotted 600 shares in category (ii) failed to pay the allotment money. Calculate the amount received on allotment.(Delhi 200s)

Ans.

25.Jaya Ltd issued 60,000 shares of Rs 10 each at a premium of Rs 2 per share payable as Rs 3 on application, Rs 5 (including premium) on allotment and balance on the first and final call. Applications were received for 82,000 shares. The directors resolved to allot as follows

(i)Applicants of 30,000 shares — allotted 20,000 shares

(ii)Applicants of 50,000 shares — allotted 40,000 shares

(iii)Applicants of 2,000 shares — Nil

Ramesh who had applied for 900 shares in category (i) and Suresh who was allotted 600 shares in category (ii) failed to pay the allotment money. Calculate the amount received on allotment. (All India 2009)

Ans.

26.The directors of a company forfeited 500 shares of Rs 10 each issued at a premium of Rs 3 per share, for the non-payment of the first call money of Rs 3 per share. The final call of Rs 2 per share has not been made. Half the forfeited shares were re-issued at Rs 2,500 fully paid. Record the journal entries for the forfeited shares and re-issue of shares. (All India 2009)

Ans.

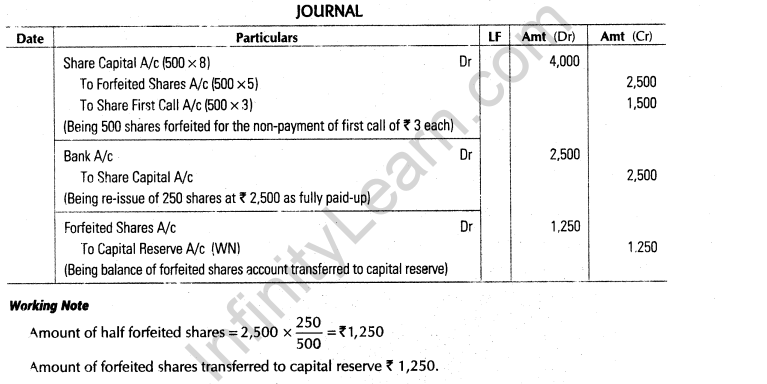

27.PS Ltd forfeited 500 shares of Rs 100 each for the non-payment of first call of Rs 30 per share. The final call of Rs 10 per share was not yet made. The forfeited shares were re-issued for Rs 65,000 fully paid-up. Pass necessary journal entries for the books of the company. (Delhi 2008)

Ans.

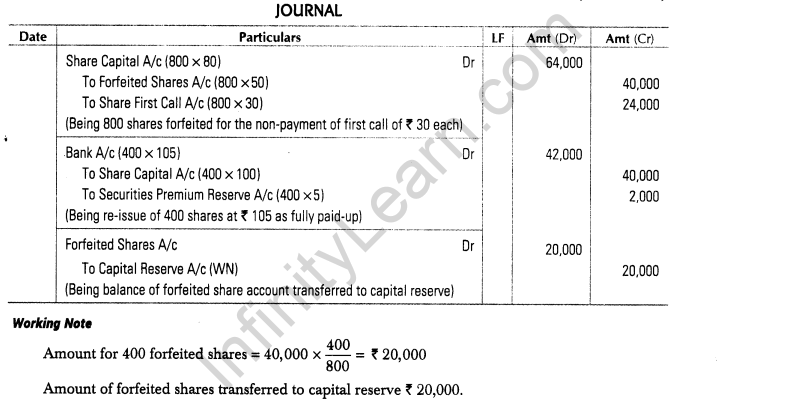

28.Samta Ltd forfeited 800 equity shares of 1100 each for the non-payment of first call of Rs 30 per share. The final call of Rs 20 per share was not yet made. Out of the forfeited shares 400 were re-issued at the rate of Rs 105 per share fully paid-up. Pass necessary journal entries in the books of Samta Ltd for the above transactions.(All India 2008)

Ans.

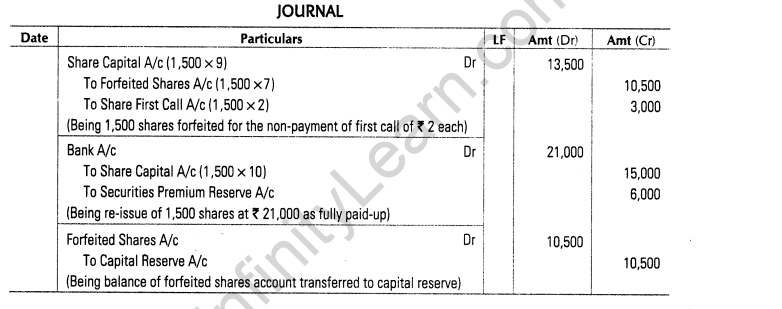

29.Gagan Ltd forfeited 1,500 equity shares of Rs 10 each for the non-payment of first call of Rs 2 per share. The final call of Rs 1 per share was not yet made. The forfeited shares were re-issued for Rs 21,000 fully paid-up.Pass necessary journal entries in the books of the company for forfeiture and re-issue of the shares. (All India 2008)

Ans.

4 Marks Questions

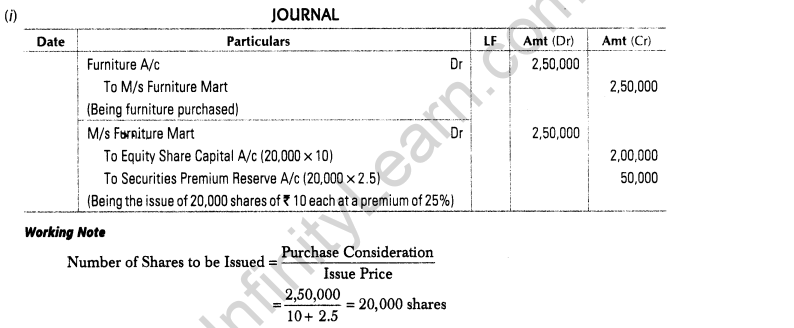

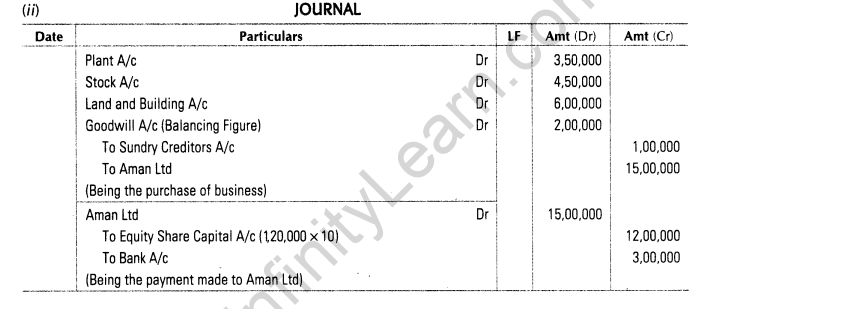

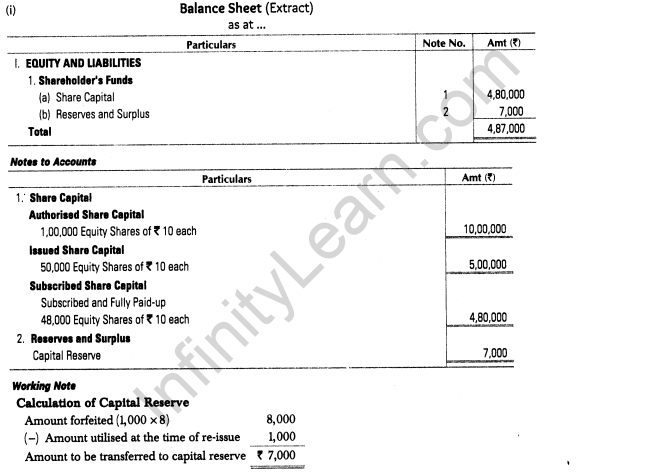

30.Pass necessary journal entries for the following transactions in the books of Gopal Ltd

(i)Purchased furniture for Rs 2,50,000 from M/s Furniture Mart. The payment to M/s Furniture Mart was made by issuing equity shares of Rs 10 each at a premium of 25%.

(ii)Purchased a running business from Aman Ltd for a sum of Rs 15,00,000. The payment of Rs 12,00,000 was made by issue of fully paid equity shares of Rs 10 each and balance by a bank draft. The assets and liabilities consisted of the following plant Rs 3,50,000; stock Rs 4,50,000; land and building Rs 6,00,000; sundry creditors Rs 1,00,000. (All India 2014)

Ans.

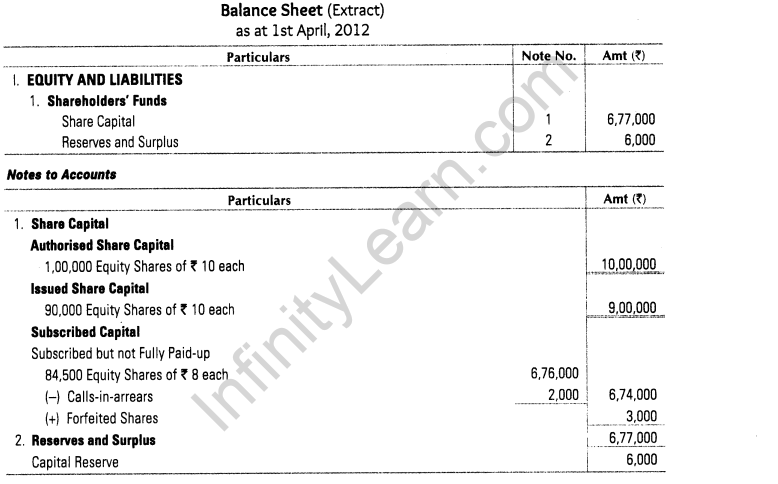

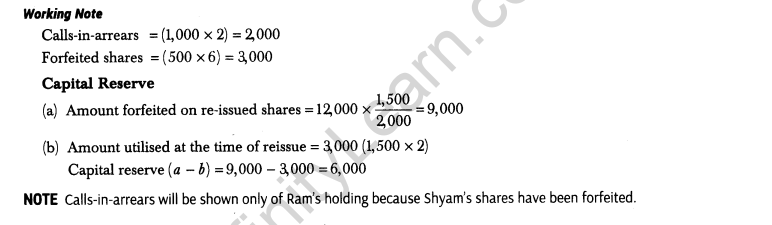

31.On 1st April, 2012, Vishwas Ltd was formed with an authorised capital of Rs 10,00,000 divided into 1,00,000 equity shares of Rs 10 each. The company issued prospectus inviting applications for 90,000 equity shares. The company received applications for 85,000 equity shares. During the first year, Rs 8 per share were called. Ram holding 1,000 shares and Shyam holding 2,000 shares did not pay the first call of Rs 2 per share. Shyam’s shares were forfeited after the first call and later on 1,500 of the forfeited shares were re-issued at Rs 6 per share, Rs 8 called up. Show the following

(i)Share capital in the balance sheet of the company as per Revised Schedule VI Part I of the Companies Act, 1956.

(ii)Also prepare ‘notes to accounts’ for the same. (All India 2014)

Ans.

Ans.

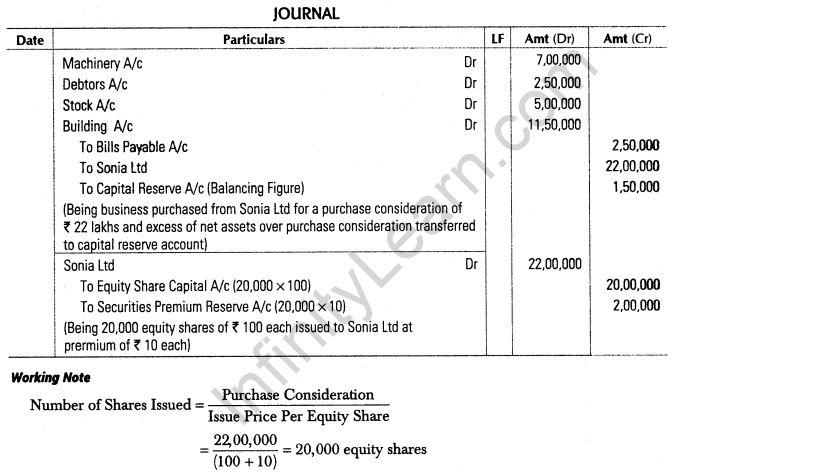

33.Nikhil Ltd purchased a running business from Sonia Ltd for a sum of Rs 22,00,000 by issuing 20,000 fully paid equity shares of Rs 100 each at a premium of 10%. The assets and liabilities consisted of the following Machinery Rs 7,00,000, debtors Rs 2,50,000, stock Rs 5,00,000, budding Rs 11,50,000 and bills payable Rs 2,50,000.Pass necessary journal entries in the books of Nikhil Ltd for the above transactions. (All India 2013)

Ans.

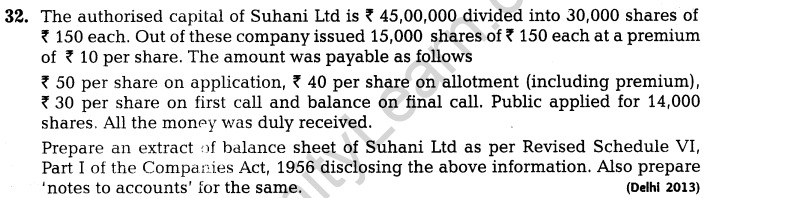

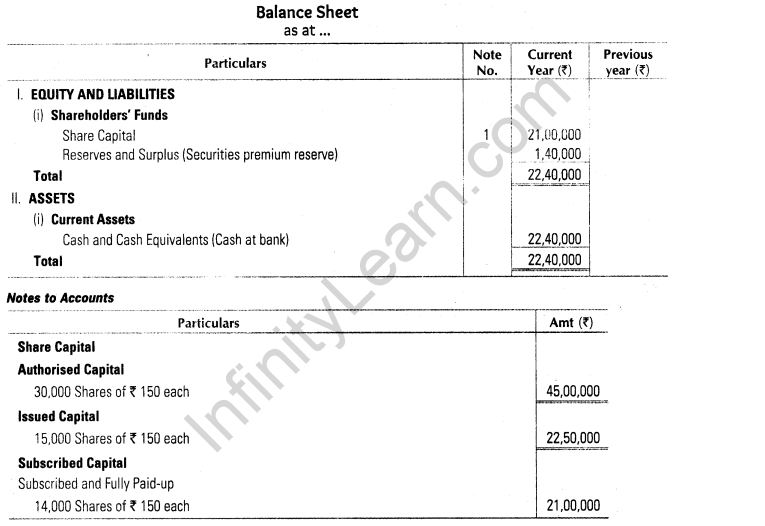

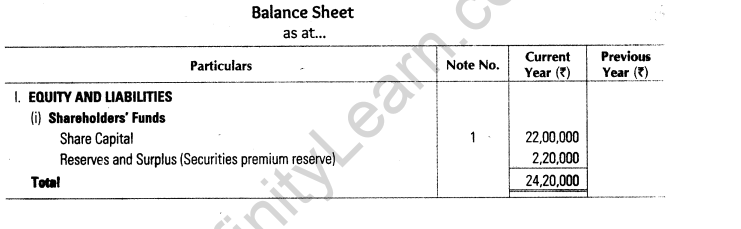

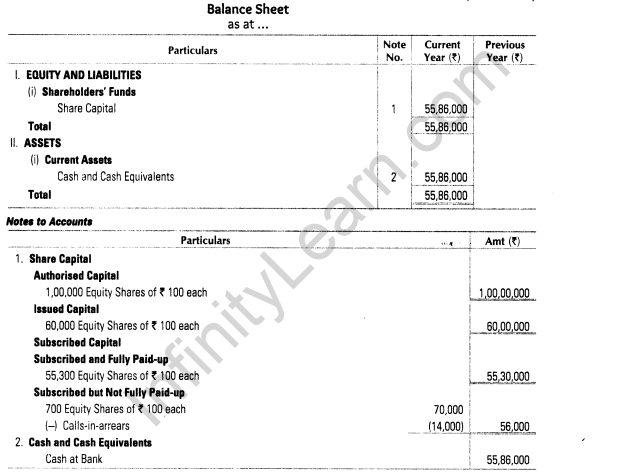

34.The authorised capital of Suhas Ltd is Rs 50,00,000 divided into 25,000 shares of Rs 200 each. Out of these, the company issued 12,000 shares of Rs 200 each at a premium of 10%. The amount per share was payable as follows Rs 60 on application Rs 60 on allotment (including premium) Rs 30 on first call and balance on final call.Public applied for 11,000 shares. All the money was duly received.Prepare an extract of balance sheet of Suhas Ltd as per Revised Schedule VI, Part I of the Companies Act, 1956 disclosing the above information. Also prepare ‘notes to accounts’ for the same. (All India 2013)

Ans.

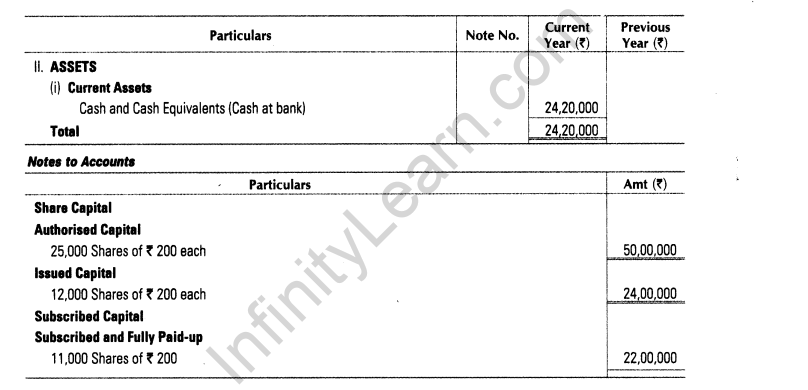

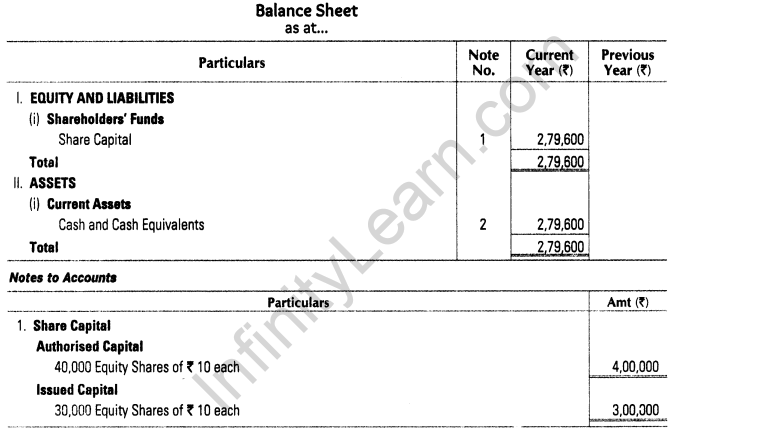

35.S Ltd registered with an authorised capital of Rs 4,00,000 divided into 40,000 equity shares of Rs 10 each. The company offered to the public for subscription 30,000 equity shares. Applications for 28,000 equity shares were received and allotment was made to all the applicants. All calls were made and were duly received except the final call of Rs 2 per share on 200 shares. Prepare the balance sheet of the company showing the different categories of share capital. (Delhi 2008)

Ans.

36.Sagar Ltd was registered with an authorised capital of Rs 1,00,00,000 divided into Rs 1,00,000 equity shares of Rs 100 each. The company offered for public subscription 60,000 equity shares. Applications for 56,000 equity shares were received and allotment was made to all the applicants. All calls were made and were duly received except the second and final call of Rs 20 per share on 700 shares. Prepare the balance sheet of the company showing the different types of share capital.

Ans.

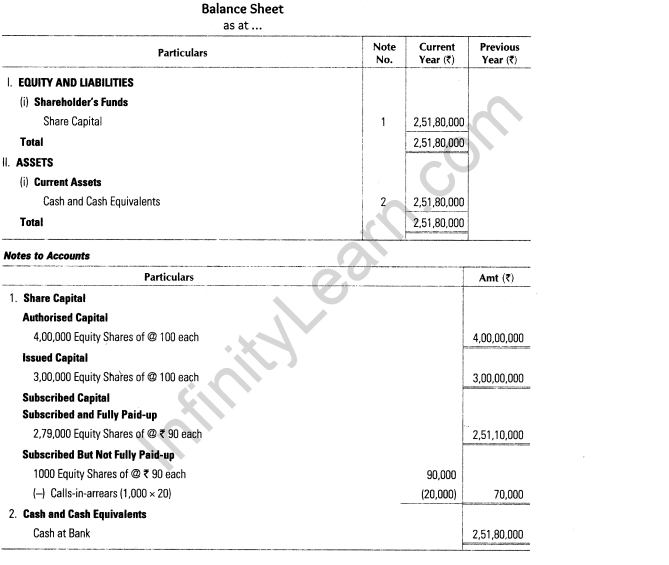

37.Poonam Ltd was registered with an authorised capital of Rs 4,00,00,000 divided into 4,00,000 equity shares of Rs 100 each. The company offered for public subscription 3,00,000 equity shares. The public applied for 2,80,000 shares and all were allotted.

The company did not make the second and final call of Rs 10 per share. The first call of Rs 20 per share was not received on 1,000 shares. Prepare the balance sheet of the company showing the different types of share capital. (All India 2008)

Ans.

8 Marks Questions

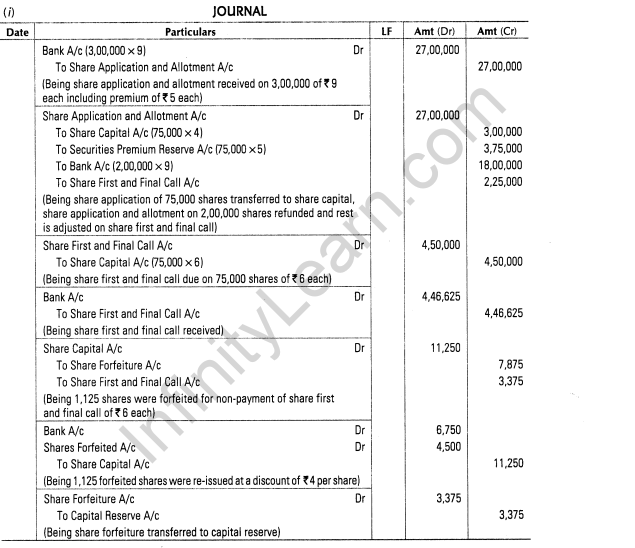

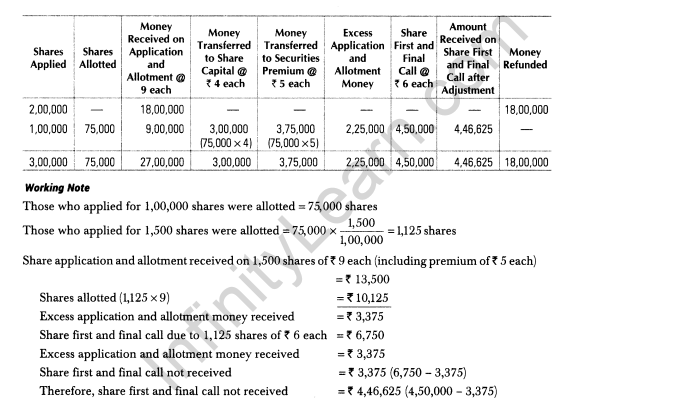

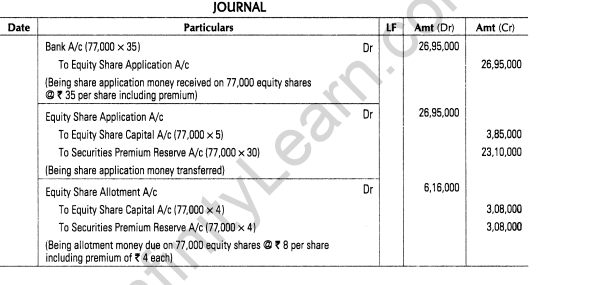

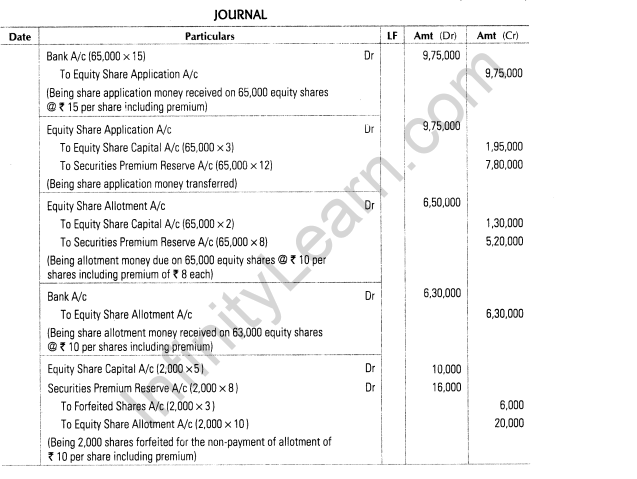

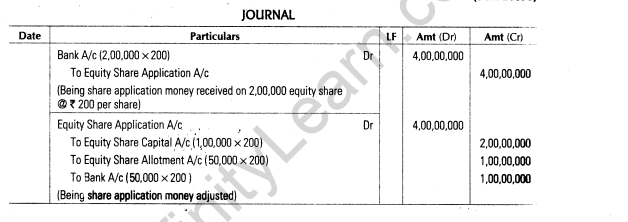

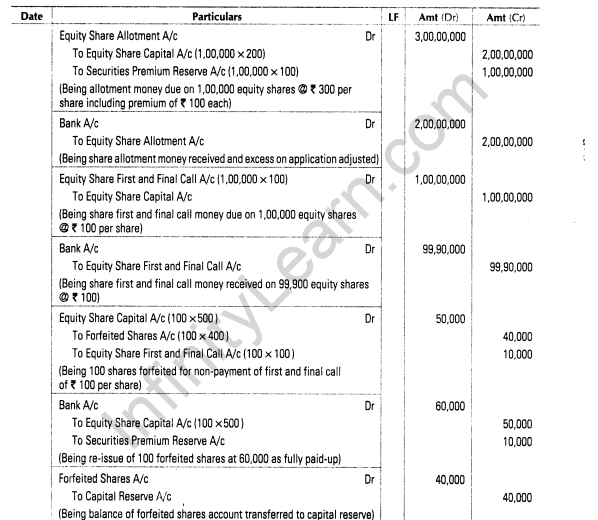

38.X Ltd invited applications for issuing 75,000 equity shares of Rs 10 each at a premium of Rs 5 per share. The amount was payable as follows On application and allotment — Rs 9 per share (including premium) On first and final call — Balance amount.

Applications for 3,00,000 shares were received. Applications for 2,00,000 shares were rejected and money refunded. Shares were allotted on pro-rata basis to the remaining applicants. The first and final call was made. The amount was duly received except on 1,500 shares applied by Ravi. His shares were forfeited. The forfeited shares were re-issued at a discount of Rs 4 per share. Pass necessary journal entries for the above transactions in the books of X Ltd. (All India 2014)

Ans.

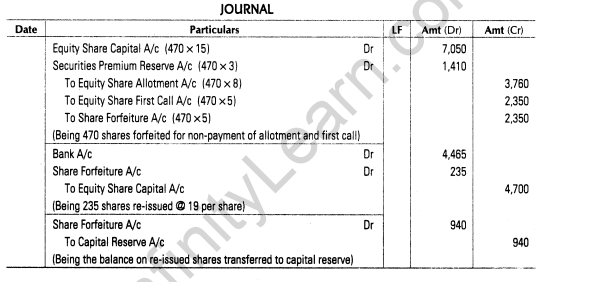

39.L Ltd forfeited 470 equity shares of Rs 20 each issues at a premium of Rs 3 per share for the non-payment of allotment money of Rs 8 (including premium Rs 3) and first call of Rs 5 per share. Final call of Rs 5 per share was not made. Out of these 235 shares were reissued at Rs 19 each fully paid. Pass necessary journal entries for the above transactions in the books of L Ltd. (Compartment 2014)

Ans.

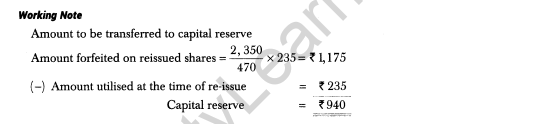

40.(i)A company forfeited 200 shares of Rs 20 each, Rs 15 per share called-up on which Rs 10 per share had been paid. Directors reissued all the forfeited shares to B as Rs 15 per share paid up for a payment of Rs 10 each. Give journal entries in the books of the company for forfeiture and re-issue of shares.

(ii)A Ltd forfeited 100 equity shares of the face value of Rs 10 each, for the non-payment of first call of Rs 2 per share Rs 6 per share had already been called and paid. These shares were subsequently re-issued as fully paid at the rate of Rs 7 per share. Give journal entries in the books of the company for forfeiture and re-issue of shares.(Compartment 2014)

Ans.

41. Bhagwati Ltd invited applications for issuing 2,00,000 equity shares of Rs 10 each. The amounts were payable as follows:

On application — Rs 3 per share

On allotment — Rs 5 per share ,

On first and final call — Rs 2 per share

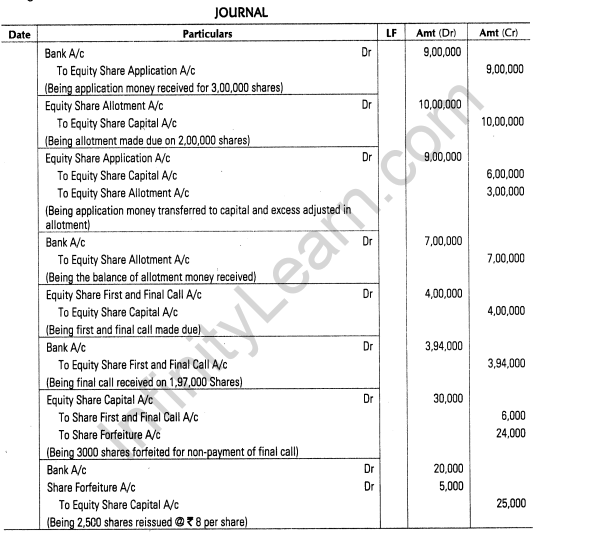

Applications were received for 3,00,000 shares and pro-rata allotment was made to all the applicants. Money overpaid on application was adjusted towards allotment. B, who was allotted 3,000 shares, failed to pay the first and final call money. His shares were forfeited. Out of the forfeited shares, 2,500 shares were re-issued as fully paid up @ Rs 8 per share.Pass necessary journal entries to record the above transactions in the books of Bhagwati Ltd. (Compartment 2014)

Ans.

42.A Ltd purchased running business from B Ltd for a sum of Rs 1,50,000 payable by issue of 10,000 equity shares of Rs 10 each at a premium of Rs 2 per share and balance in cash. The assets and liabilities taken over were:

Plant — Rs 40,000; building — Rs 40,000; debtors — Rs 30,000 ;

Stock — Rs 50,000; furniture — Rs 20,000; creditors — Rs 20,000

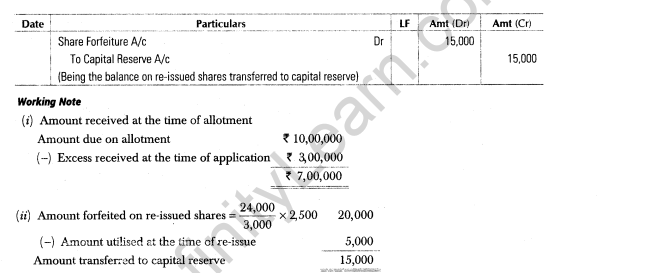

You are required to pass necessary journal entries for the above transactions in the books of A Ltd. (Compartment 2014)

Ans.

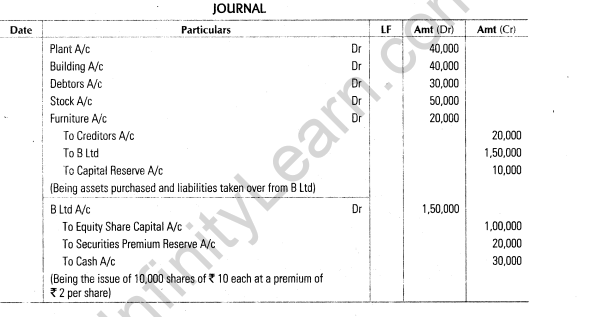

43.A Ltd was registered with an authorised capital of Rs 10,00,000 divided into equity shares of Rs 10 each. The company invited applications for the issue of 50,000 shares. Applications for 48,000 shares were received. All calls were made and were duly received except the final call of Rs 2 per share on 1,000 shares. All these shares were forfeited and later on re-issued at Rs 9,000 as fully paid.

(i)Show how ‘share capital’ will appear in the balance sheet of A Ltd. as per Schedule VI, Part I of the Companies Act, 1956. (Compartment 2014)

(ii)Also prepare ‘notes to accounts’ for the same.

Ans.

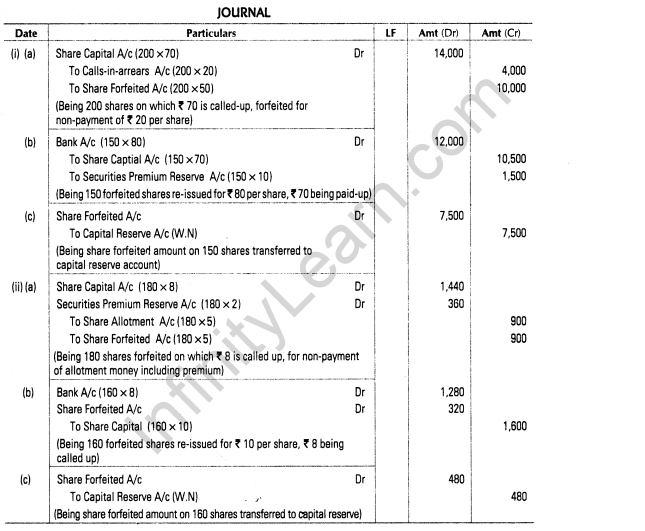

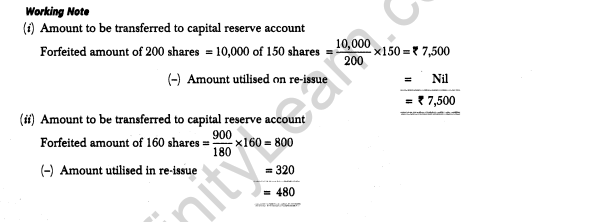

44.Record the journal entries for forfeiture and re-issue in the following cases

(i)X Ltd forfeited 200 shares of Rs 100 each, Rs 70 called up, on which the shareholders had paid application and allotment money of Rs 50 per share. Out of these, 150 shares were re-issued to Naresh as Rs 70 paid-up for Rs 80 per share.

(ii)Y Ltd forfeited 180 shares of Rs 10 each, Rs 8 called-up, issued at a premium of Rs 2 per

share to R for non-payment of allotment money of Rs 5 per share (including premium). Out of these, 160 shares were re-issued to Sanjay as Rs 8 called up for 110 per share fully paid-up.(All India 2013)

Ans.

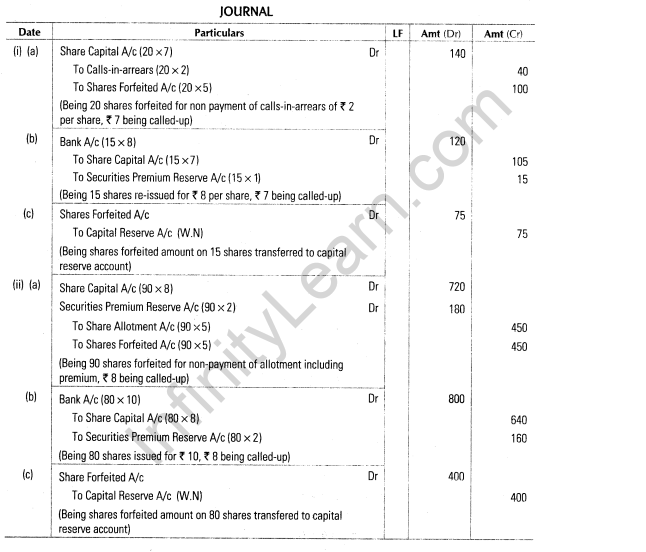

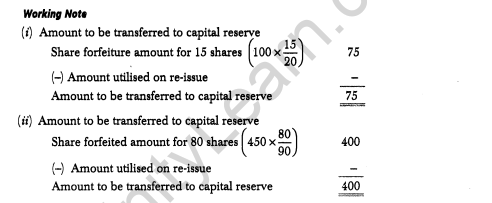

45.Record the journal entries for forfeiture and re-issue of shares in the following cases

(i) X Ltd forfeited 20 shares of Rs 10 each,Rs 7 called up on which the shareholder had paid application and allotment money of Rs 5 per share. Out of these, 15 shares were re-issued to Naresh as Rs 7 per share paid up for Rs 8 per share.

(ii) Y Ltd forfeited 90 shares of Rs 10 each, Rs 8 called up issued at a premium of Rs 2 per share to ’R’ for non-payment of allotment money of Rs 5 per share (including premium). Out of these, 80 shares were re-issued to Sanjay as Rs 8 called up for Rs 10 per share.(Delhi 2013)

Ans.

46.Shyam Ltd invited applications for issuing 80,000 equity shares of Rs 10 each at a premium of Rs 40 per share. The amount was payable as follows

On application — Rs 35 per share (including Rs 30 premium)

On allotment — Rs 8 per share (including Rs 4 premium)

On first and final call — Balance

Applications for 77,000 shares were received. Shares were allotted to all the applicants. Sundram to whom 7,000 shares were allotted failed to pay the allotment money. His shares were forfeited immediately after allotment.

Afterwards the first and final call was made. Satyam, the holder of 500 shares failed to pay the first and final call. His shares were also forfeited. Out of the forfeited shares 1,000 shares were re-issued at Rs 50 per share fully paid-up. The re-issued shares included all the shares of Satyam. Pass necessary journal entries for the above transactions in the books of Shyam Ltd. (Delhi 2012)

Ans.

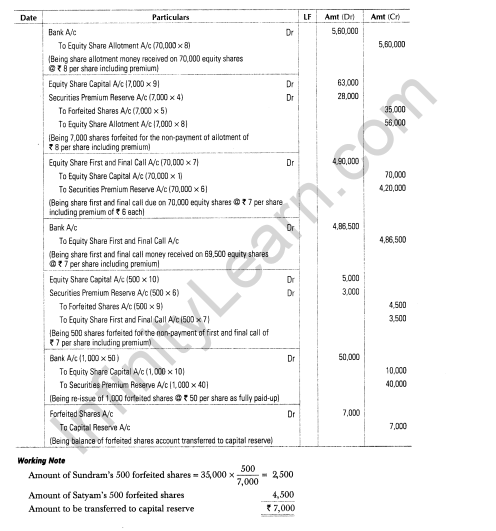

47.RK Ltd invited applications for issuing 70,000 equity shares of Rs 10 each at a premium of Rs 35 per share. The amount was payable as follows On application – Rs 15 per share (including Rs 12 premium)

On Allotment – Rs 10 per share (including Rs 8 premium)

On first and final call – Balance

Applications for 65,000 shares were received and allotment was made to all applicants. A shareholder Ram, who was allotted 2,000 shares, failed to pay the allotment money. His shares were forfeited immediately after allotment. Afterwards the first and final call was made. Sohan, who had 3,000 shares, failed to pay the first and final call. His shares were also forfeited. Out of the forfeited shares 4,000 shares were re-issued @ Rs 50 per share fully paid-up. The re-issued shares included all the shares of Ram.Pass necessary journal entries for the above transactions in the books of RK Ltd.(All India 2012)

Ans.

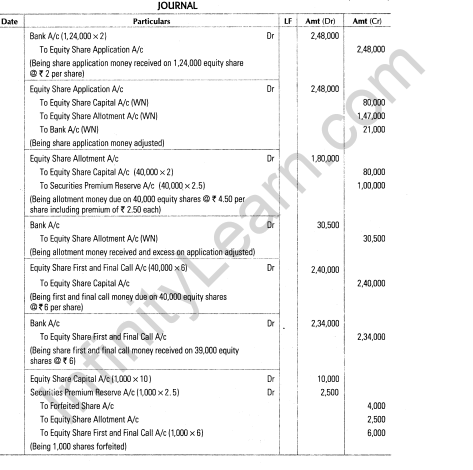

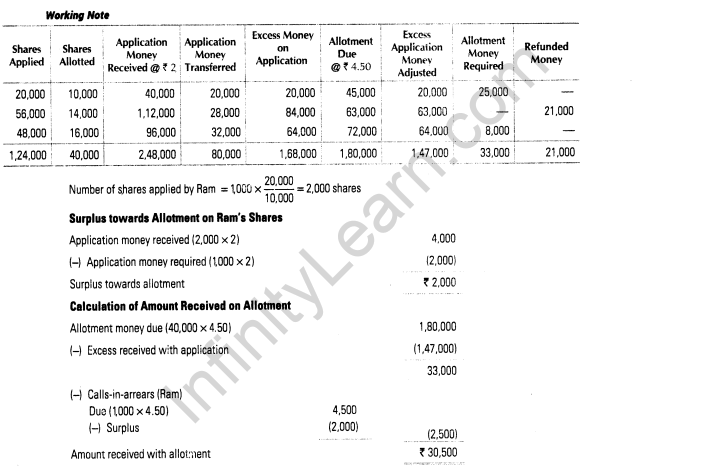

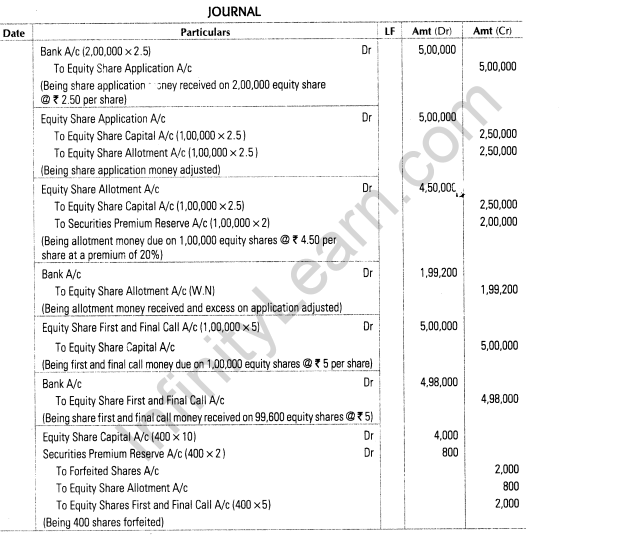

48.X Ltd issued 40,000 equity shares of Rs 10 each at a premium of Rs 2.50 per share. The amount was payable as follows

On application Rs 2 per share

On allotment Rs 4.50 per share (including premium)

and on call Balance Rs 6 per share

Owing to heavy subscription the allotment was made on pro-rata basis as follows

(i)Applications for 20,000 shares were allotted 10,000 shares.

(ii)Applications for 56,000 shares were allotted 14,000 shares.

(ii)Applications for 48,000 shares were allotted 16,000 shares.

It was decided that excess amount received on applications would be utilised on allotment and the surplus would be refunded.

Ram, to whom 1,000 shares were allotted, who belongs to category (i), failed to pay allotment money. His shares were forfeited after the call.

Pass necessary journal entries in the books of X Ltd for the above transactions.(Delhi 2011)

Ans.

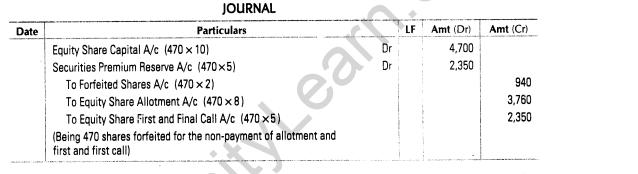

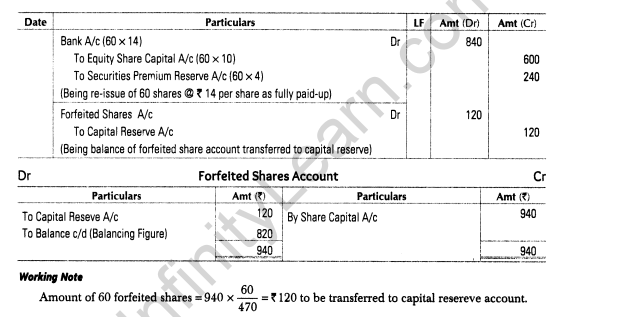

49.Give journal entries to record the following transactions of forfeiture and re-issue of shares and open share forfeiture account in the books of the respective companies.L Ltd forfeited 470 equity shares of Rs 10 each issued at premium of Rs 5 per share for non-payment of allotment money Rs 8 per share (including share premium Rs 5 per share) and the first and final call of Rs 5 per share. Out of these, 60 equity shares were subsequently re-issued @ Rs 14 per shares. (Delhi 2011)

Ans.

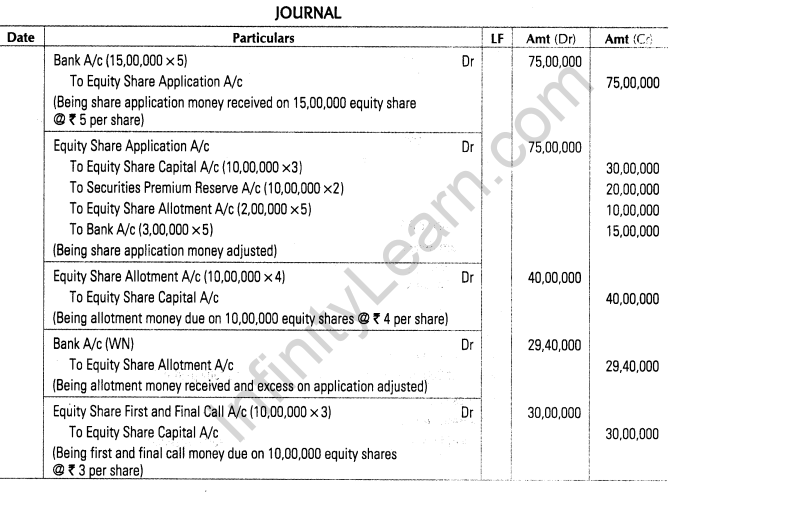

50.Dinesh Ltd invited applications for issuing 10,000 equity shares of Rs 10 each. The amount was payable as follows

On application Rs 1

On application Rs 2

On first call Rs 3

On second and final call Balance

The issue was fully subscribed. Ram, to whom 100 shares were allotted, failed to pay the allotment money and his shares were forfeited immediately after allotment. Shyam to whom 150 shares were allotted, failed to pay the first call. His shares were also forfeited after the first call. Afterwards the second and final call was made. Mohan to whom 50 shares were allotted failed to pay the second and final call. His shares were also forfeited. All the forfeited shares were re-issued @ Rs 9 per share fully paid-up. The re-issued shares included all the shares of Ram.Pass necessary journal entries in the books of Dinesh Ltd. (All India 2011)

Ans.

51.Moti Ltd invited applications for issuing 10,00,000 equity shares of Rs 10 each at a premium of Rs 2 per share. The amount was payable as follows On application Rs 5 (including premium)

On allotment Rs 4

On first and final call Rs 3

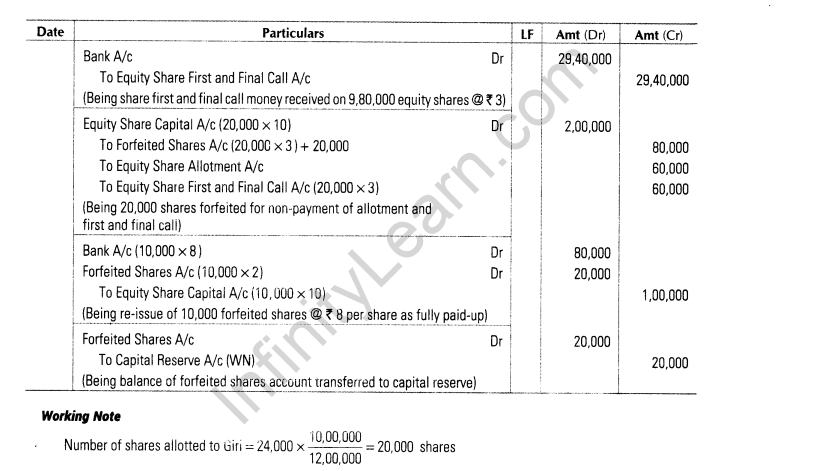

Applications for 15,00,000 shares were received. Applications for 3,00,000 shares were rejected and the pro-rata allotment was made to the remaining applicants. Excess application money was utilised towards sum due on allotment. Giri, who had applied for 24,000 shares, failed to pay allotment and call money. His shares were forfeited. Out of the forfeited shares, 10,000 shares were re-issued for Rs 8 per share fully paid-up.Pass necessary journal entries in the books of Moti Ltd. (All India 2011)

Ans.

52.Bhamashah Company Ltd made an issue of 1,00,000 equity shares of Rs 10 each at a premium of 20%, payable as follows

On application Rs 2.50 per share

On allotment Rs 4.50 per share

On first and final call Balance

Applications were received for 2,00,000 equity shares and the directors made pro-rata allotment.

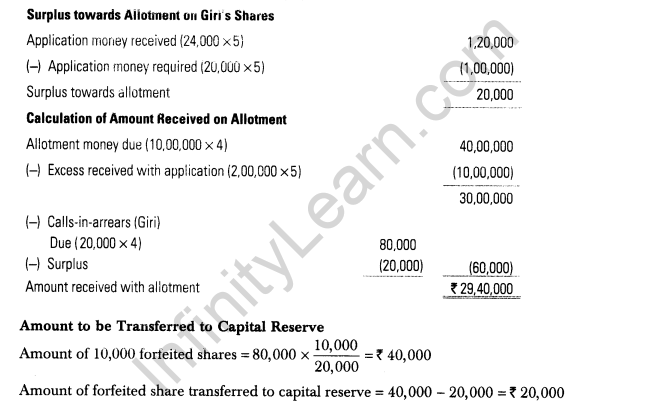

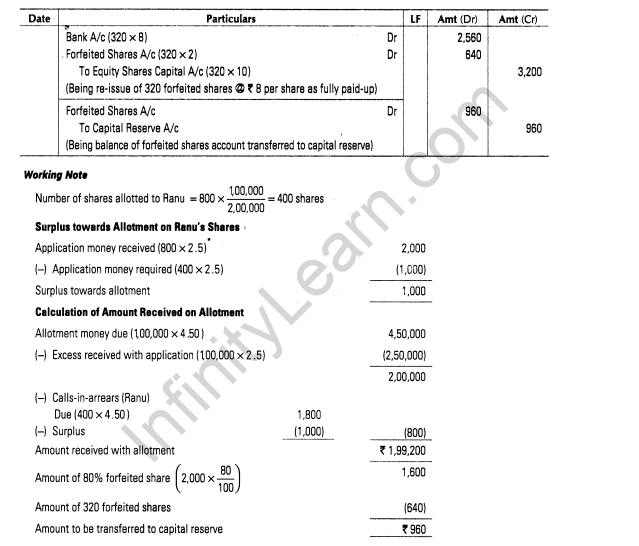

Ranu, who had applied for 800 shares, did not pay the allotment and final call money; with the result his shares were forfeited. Later on, 80% of the forfeited shares were re-issued @ Rs 8 per share fully paid-up.Pass necessary journal entries for the above mentioned transactions in the books of the company. (Delhi 2011 c)

Ans.

53.DP Shah Company Ltd made an issue of 1,00,000 equity shares of Rs 10 each at a premium of 30% payable as follows

On application Rs 3.50 per share

On allotment Rs 6.50 per share

On first and final call Balance

Applications were received for 2,00,000 equity shares and the directors made pro-rata allotment. Harsh who had applied for 1,600 shares did not pay the allotment and final call money. With the result his shares were forfeited. Later on 60% of the forfeited shares were re-issued at Rs 8 per share fully paid-up. Pass necessary journal entries for the mentioned transactions in the books of the company. (All India 2011)

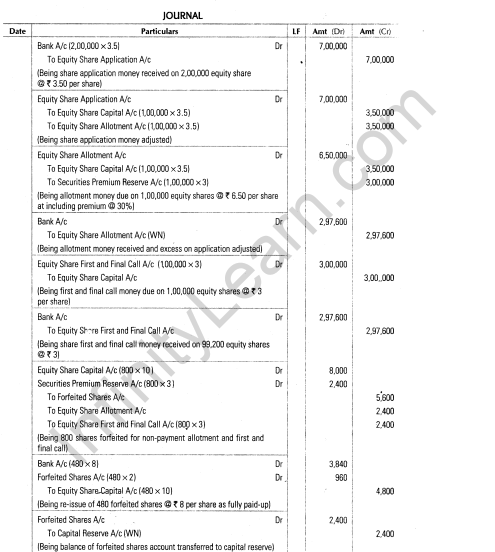

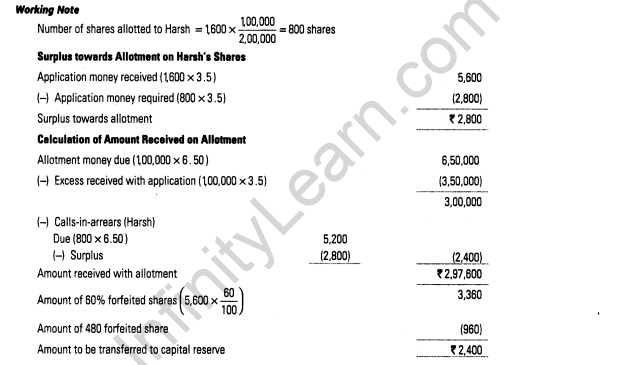

Ans.

54.X Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share, payable as follows Rs 3 on application Rs 6 on allotment (including premium) and Rs 3 on call Applications were received for 75,000 shares and a pro-rata allotment was made as follows.

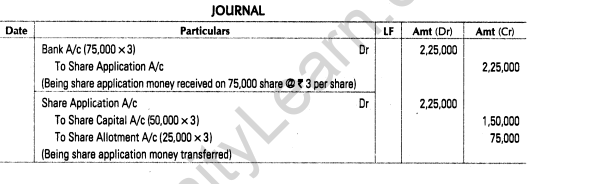

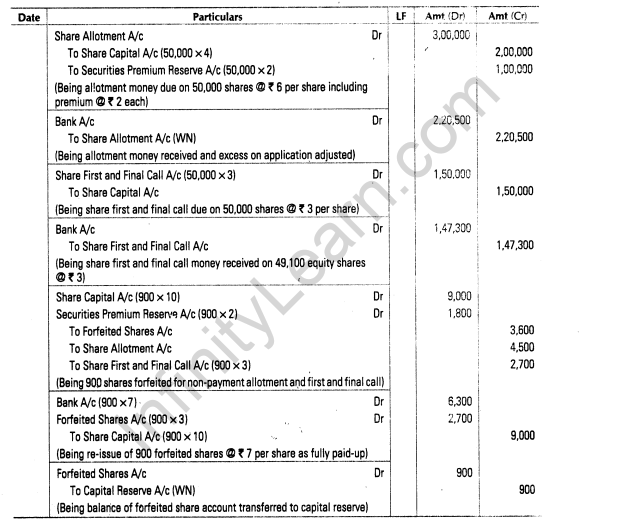

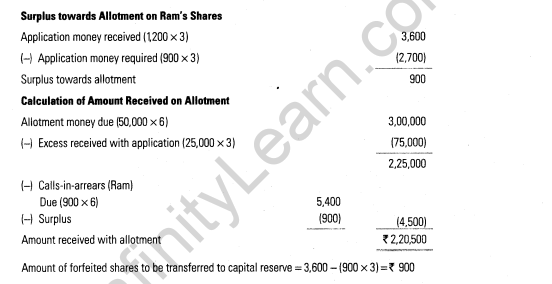

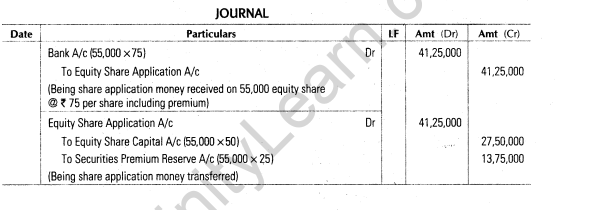

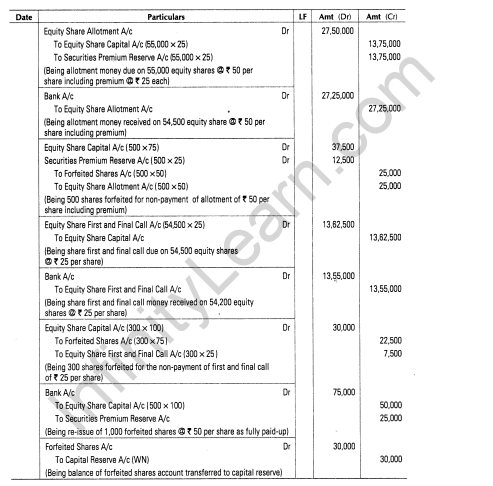

To the applicants of 40,000 shares, 30,000 shares were issued and for the rest 20,000 shares were issued. All money due were received except the allotment and call money from Ram who had applied for 1,200 shares (out of group of 40,000 shares). All his shares were forfeited. The forfeited shares were re-issued for Rs 7 per share fully paid-up.Pass necessary journal entries for the above transactions.(All India 2011)

Ans.

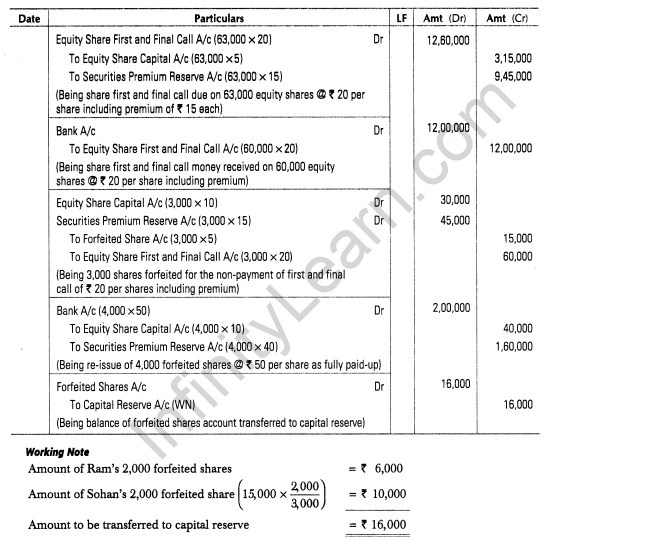

55.Som Ltd invited applications for issuing 60,000 equity shares of Rs 100 each at a premium of Rs 50 per share. The amount was payable as follows

On application Rs 75 per share (including Rs 25 premium)

On allotment Rs 50 per share (including Rs 25 premium)

On first and final call Balance amount

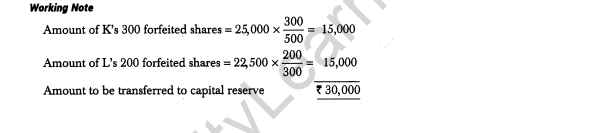

Applications for 55,000 shares were received. Allotment was made to all applicants and the company received all money due on allotment except ‘K’ who was allotted 500 share and his shares were immediately forfeited. Afterwards the first and final call was made. ‘Lr to whom 300 shares were allotted, failed to pay the first and final call. His shares were also forfeited. 300 shares of ‘K’ and 200 shares of ‘L’ were re-issued for 75,000 fully paid-up.Pass necessary journal entries in the books of Som Ltd for the above transactions.(Delhi 2010 C)

Ans.

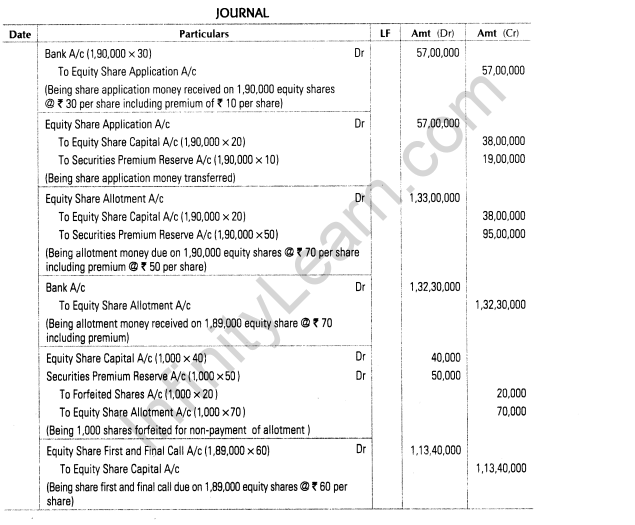

56.Shiva Ltd invited applications for issuing 2,00,000 equity shares of Rs 100 each at a premium of Rs 60 per share. The amount was payable as follows On application Rs 30 per share (including premium t10)

On allotment Rs 70 per share (including premium Rs 50)

On first and final call Balance amount

Applications for 1,90,000 shares were received. Shares were allotted to all the applicants and the company received all money due on allotment except Jain who had been allotted 1,000 shares, and his shares were immediately forfeited. Afterwards the first and final call was made. Gupta did not pay the first and final call on his 2,000 allotted shares. His shares were also forfeited. 50% of the forfeited shares of both Jain and Gupta were re-issued @ Rs 90 per share fully paid-up.Pass necessary journal entries in the books of Shiva Ltd for the above transactions.(All India 2010)

Ans.

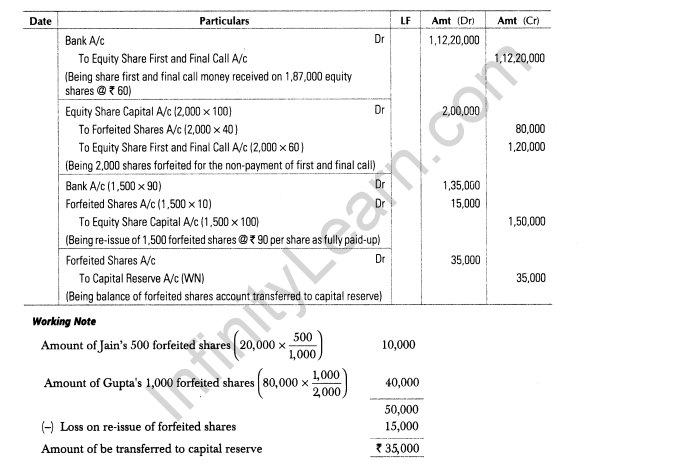

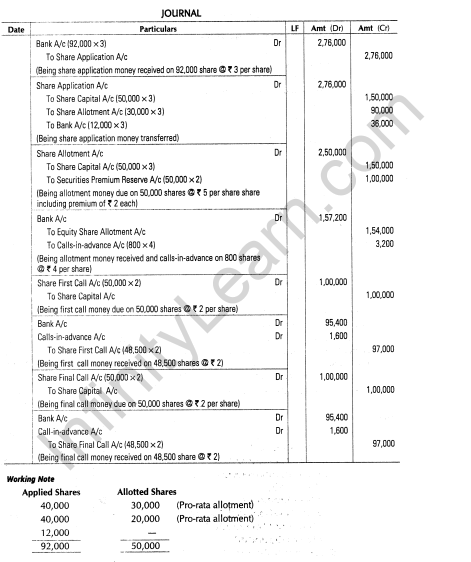

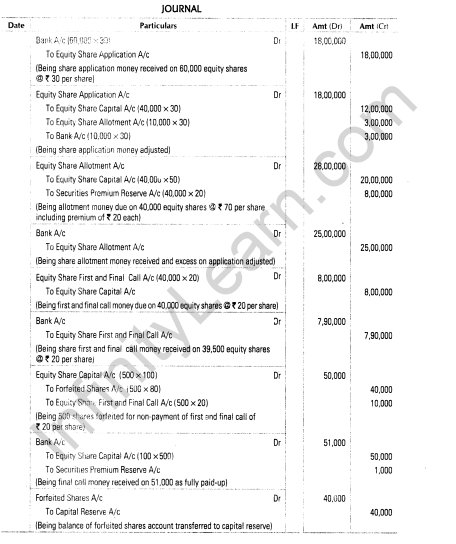

57.Petromax Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share payable as Rs 3 on application, Rs 5 including premium on allotment and balance in equal instalments over two calls. Applications were received for 92,000 shares and the allotment was done as under

(i)Applications of 40,000 shares – Allotted 30,000 shares

(ii)Applications of 40,000 shares – Allotted 20,000 shares

(iii)Applications of 12,000 shares – Nil

Suresh who had applied for 2,000 shares (category (i) did not pay any money other than application money. Chandar who was allotted 800 shares (category (ii) paid the call money due along with allotment.

All other allottes paid their dues as per schedule.Pass necessary journal entries in the books of Petromax Ltd for the above transactions. (Delhi; All India 2009)

Ans.

58.Veer Ltd invited applications for issuing 1,00,000 equity shares of Rs 500 each at a premium of Rs 100 per share. The amount was payable as follows On application Rs 200 per share

On allotment Rs 300 per share (including premium)

On first and final call Balance amount

Applications for 2,00,000 shares were received. Applications for 50,000 shares were rejected and the application money was refunded. Pro-rata allotment was made to the remaining applicants. Amount overpaid with application was adjusted towards sums due on allotment. All calls were made and were duly received except the first and final call on 100 shares allotted to Vasu. There shares were forfeited. The forfeited shares re-issued to Ravi for 60,000 fully paid-up.Pass necessary journal entries in the books of Veer Ltd for the above transactions.(Delhi 2009 C)

Ans.

59.Bharat Ltd invited applications for 40,000 equity shares of Rs 100 each at a premium of Rs 20 per share. The amount was payable as follows On application Rs 30 per share

On allotment Rs 70 per share (including premium)

On first and final call Balance amount

Applications for 60,000 shares were received. Applications for 10,000 shares were rejected and the application money on these shares was refunded. Pro-rata allotment was made to the remaining applicants and excess money received from them with applications was adjusted towards sums due on allotment.

All calls were made and were duly received except the first and final call on 500 shares allotted to Rajan. These shares were for feited. The forfeited shares were afterwards re-issued for Rs 51,000 fully paid-up.Pass necessary journal entries in the books of the compa ly for the above transactions. (All India 2009)

Ans.

60.X Ltd invited applications for issuing 80,000 equity shares of Rs 10 each at a premium of Rs 2 per share. The amount was payable as follows On application Rs 6 per share (including premium)

On allotment Rs 3 per share

On first and final call Balance amount

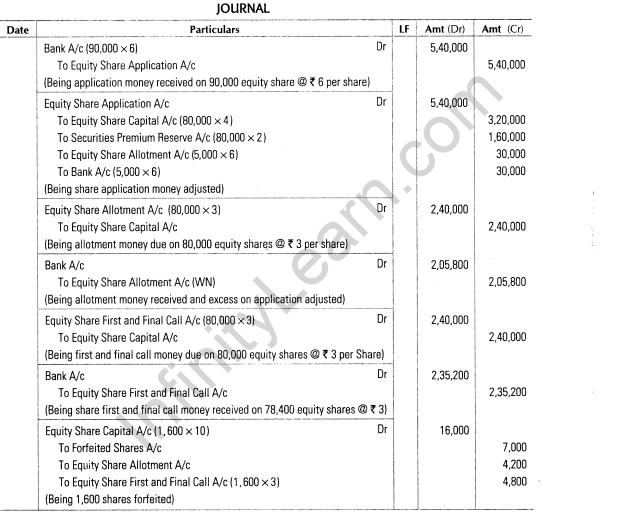

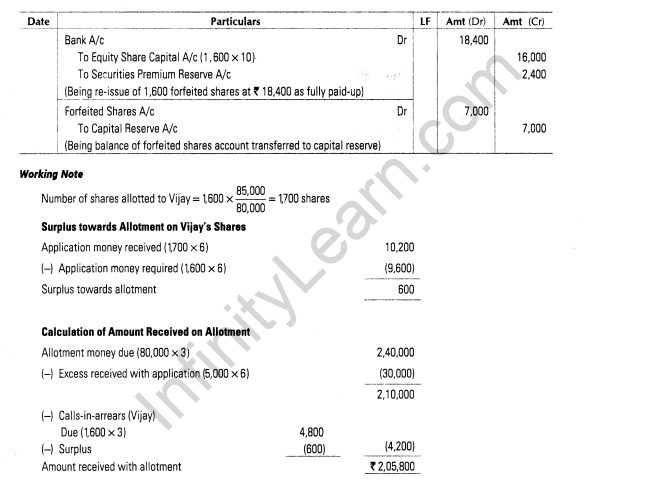

Applications for 90,000 shares were received. Applications for 5,000 shares were rejected and pro-rata allotment was made to the remaining applicant. Overpayment received on application was adjusted towards sum due on allotment. All calls were made and were duly received except the allotment and final call on 1,600 shares allotted to Vijay. These shares were forfeited and the forfeited shares were re-issued for Rs 18,400 fully paid-up.Pass necessary journal entries for the above transactions in the books of the company. (Delhi 2008)

Ans.

61.Janta Ltd invited applications for issuing 70,000 equity shares of Rs 10 each at a ’ premium of Rs 2 per share. The amount was payables as follows

On application Rs 4 per share (including premium)

On allotment Rs 3 per share

On first and final call Balance

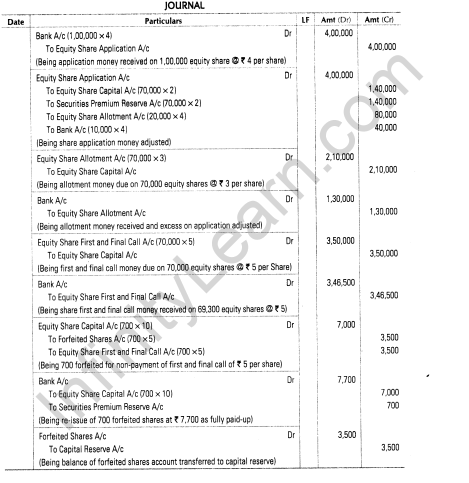

Applications for 1,00,000 shares were received. Applications for 10,000 shares were rejected. Shares were allotted to the remaining applicants on pro-rata basis. Excess money received with applications was adjusted towards sum due on allotment. All calls were made and were duly received except first and final call on 700 shares , allotted to Kanwar. His shares were for feited. The forfeited shares were re-issued for

Rs 7,700 fully paid-up.Pass necessary journal entries in the books of the company for the above transactions. (All India 2008)

Ans.

FAQ’s related to Important Questions for CBSE Class 12 Accountancy Accounting Treatment of Issue Shares from article point of view:

Here are some frequently asked questions related to Important Questions for CBSE Class 12 Accountancy Accounting Treatment of Issue Shares from an article point of view:

Question 1: What is the importance of studying accounting treatment of issue shares in CBSE Class 12 Accountancy?

Answer 1: Accounting treatment of issue shares is an important topic in CBSE Class 12 Accountancy as it deals with the ways in which a company can raise capital through the issuance of shares. It is essential for students who wish to pursue a career in finance or accounting to have a clear understanding of this topic.

Question 2: Where can I find important questions for CBSE Class 12 Accountancy Accounting Treatment of Issue Shares?

Answer 2: Important questions for CBSE Class 12 Accountancy Accounting Treatment of Issue Shares can be found on various educational websites and online learning platforms. There are also several books available in the market that contain a collection of important questions.

Question 3: How can I use the important questions for CBSE Class 12 Accountancy Accounting Treatment of Issue Shares to improve my exam preparation?

Answer 3: Students can use the important questions for CBSE Class 12 Accountancy Accounting Treatment of Issue Shares to practice and revise the concepts covered in the syllabus. By solving these questions, they can also identify their strengths and weaknesses and work on improving them.

Question 4: What are some common types of questions that can be expected from CBSE Class 12 Accountancy Accounting Treatment of Issue Shares?

Answer 4: Some common types of questions that can be expected from CBSE Class 12 Accountancy Accounting Treatment of Issue Shares include calculation-based questions, journal entries, and questions related to the legal provisions governing the issuance of shares.

Question 5: How can I score well in the CBSE Class 12 Accountancy exam by studying Accounting Treatment of Issue Shares?

Answer 5: To score well in the CBSE Class 12 Accountancy exam by studying Accounting Treatment of Issue Shares, students should have a clear understanding of the concepts and practice solving different types of questions. They should also stay updated with the latest legal provisions related to the issuance of shares.

In conclusion, Accounting Treatment of Issue Shares is an important topic in CBSE Class 12 Accountancy and requires a thorough understanding of the concepts and legal provisions. By practicing the important questions and revising the syllabus regularly, students can improve their exam preparation and score well in the exam.