Table of Contents

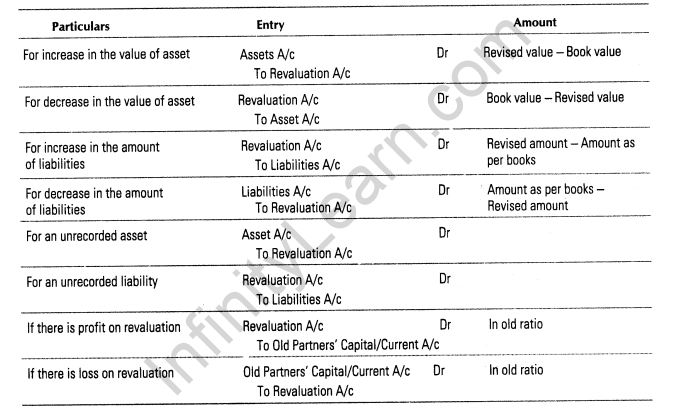

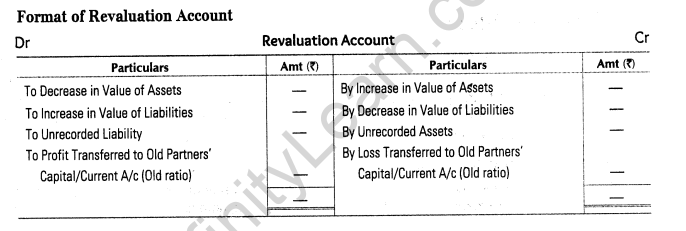

1. Meaning of Revaluation Account The account which is prepared to record changes in the value of assets and liabilities at the time of admission, retirement, death and change in profit sharing ratio is called revaluation account.

2. Accounting Treatment

The relevant journal entries are:

3. Accounting Treatment of Reserves, Undistributed Profits or Losses

The new partner is not entitled to any share in undistributed profits or losses appearing in the balance sheet at the time of admission, as these are earned by the old partners. So, these should be transferred to old partners’ capital/current account.

Journal entries passed will be

(i) For Undistributed Profits ,

General Reserve A/c Dr

Profit and Loss A/c Dr

Workmen Compensation Fund A/c Dr [Excess of reserve over actual liability]

Investment Fluctuation Fund A/c Dr [Excess of reserve over the difference

between book value and market value]

Old Partners’ Capital/Current A/c Dr [Old ratio]

(ii) For Undistributed Losses

To Old Partners’ Capital/Current A/c [Old ratio]

To Profit and Loss A/c

To Deferred Revenue Expenditure A/c

Previous Years Examination Questions

1 Mark Question

1. Why are assets and liabilities revalued at the time of admission of a partner? (Compartment 2014)

Ans. Assets and liabilities are revalued at the time of admission of a partner, so that profit or loss arising on account of revaluation, may be adjusted among old partners in their old profit sharing ratio, since it belongs to them.

2 Marks Questions

2. State any two reasons for the preparation of revaluation account on the admission

of a partner. (All India 2008)

Ans. At the time of admitting a new partner, revaluation account is prepared for the below stated reasons:

(i) An incoming partner will not likely to suffer any loss relating to the period prior to his admission.

(ii) Old partners will not like to share the gain relating to the period prior to his admission.

3. What is a revaluation account? (All India 2008)

Ans. The account which is prepared to record changes in the value of assets and liabilities at the time of admission, retirement, death and change in profit sharing ratio is called revaluation account.

8 Marks Questions

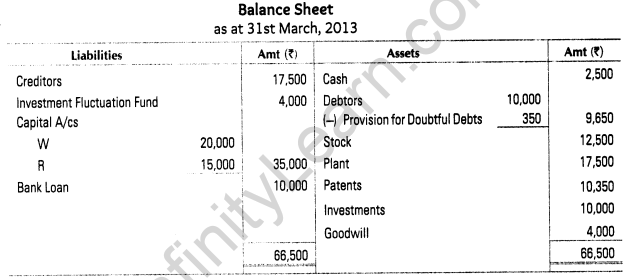

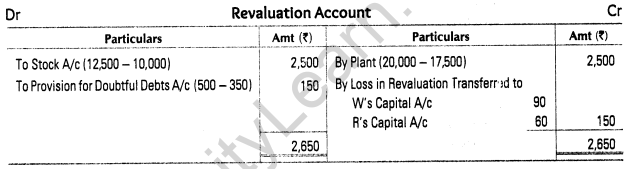

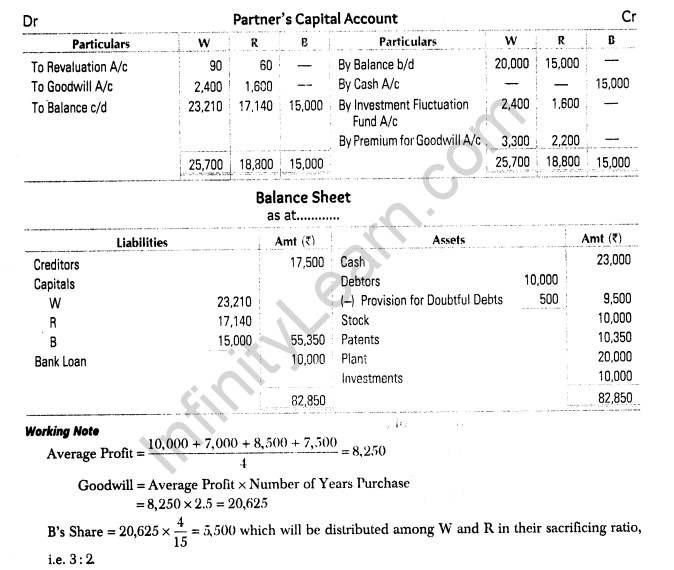

4. W and R were partners in a firm sharing profits in the ratio of 3 : 2 respectively. On 31st March, 2013, their balance sheet was as follows

B was admitted as a new partner on the following conditions:

(i) B will get 4/15th share of profits.

(ii) B had to bring Rs. 15,000 as his capital.

(iii) B would pay cash for his share of goodwill based on 2.5 years purchase of average profit of last 4 years.

(iv) The profits of the firm for the years ending 31st March, 2010, 2011, 2012 and 2013 were Rs. 10,000, Rs. 7,000 , Rs. 8,500, and Rs. 7,500 respectively.

(v) Stock was valued at Rs. 10,000 and provision for doubtful debts was raised up to X

(vi) Plant was revalued at Rs. 20,000.

Prepare revaluation account, partners’ capital account and the balance sheet of the new firm. (Compartment 2014)

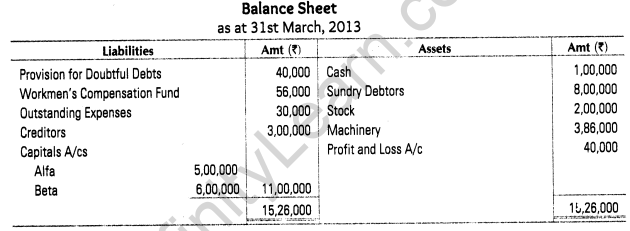

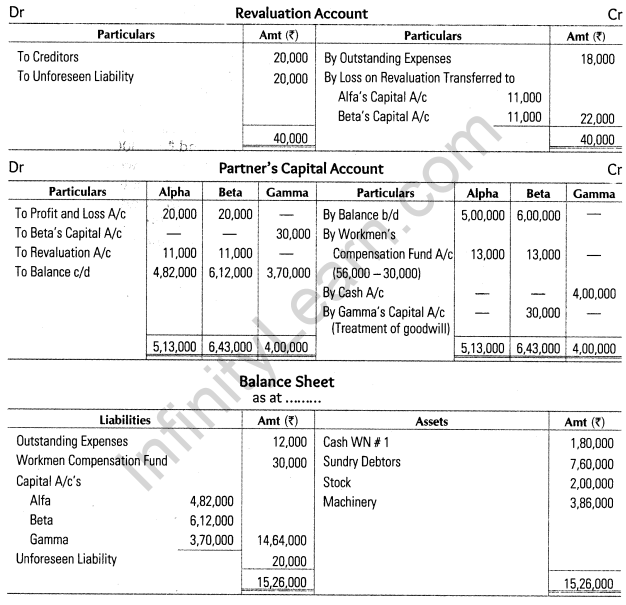

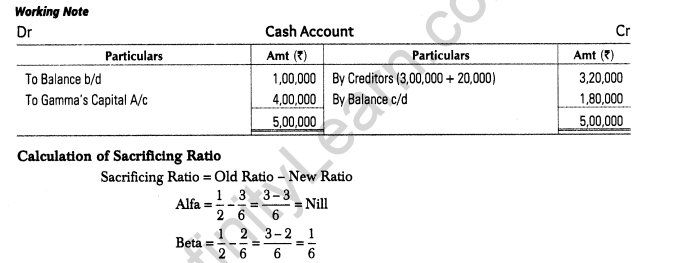

5. Alfa and Beta were partners in a firm. They were trading in artificial limbs. On 1st April, 2013 they admitted Gama, a good friend of Beta into the partnership, Gama lost his one hand in accident and Alfa and Beta decided to give one artificial hand free of cost to Gama. The balance sheet of Alfa and Beta as at 31st March, 2013 was as follows.

Gama was admitted in the firm on the following terms:

(i) Gama will bring Rs. 4,00,000 as his share of capital, but he was unable to bring any amount for goodwill.

(ii) The new profit sharing ratio between Alfa, Beta and Gamma will be 3 : 2 : 1.

(iii) Claim on account of workmen compensation was Rs. 30,000.

(iv) To write off bad debts amounted to Rs. 40,000.

(v) Creditors were paid Rs. 20,000 more.

(vi) Outstanding expenses be brought down to Rs. 12,000.

(vii) Rs. 20,000 be provided for an unforeseen liability.

(viii) Goodwill of the firm was valued at Rs. 1,80,000.

Prepare revaluation account, capital accounts of partners and the opening balance sheet of the new firm. Also, identify any one value which the partners wanted to communicate to the Society. (Compartment 2014; VBQ)

Value conveyed by the partners

Care and concern towards differently abled persons.

NOTE (i) In the absence of any information, old ratio is assumed to be equal.

(ii) Bad debts are written-off from provision for doubtful debt.

(iii) Only Beta sacrifices on Gamma’s admission.

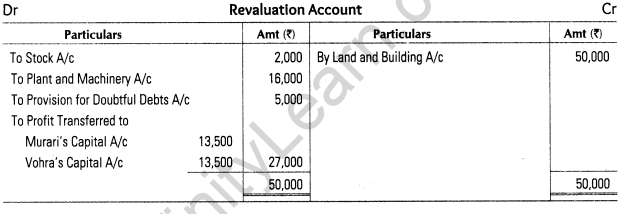

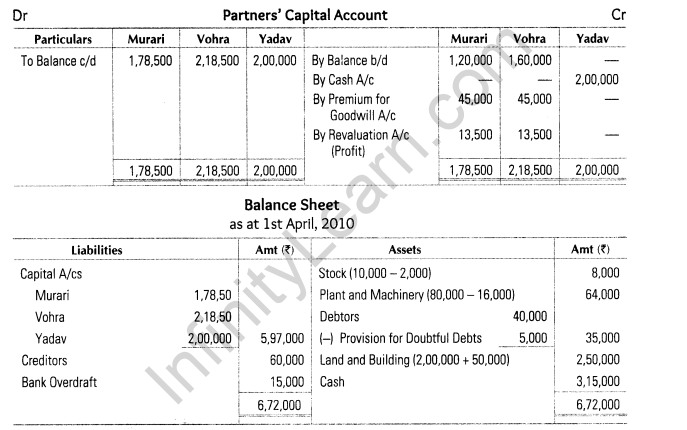

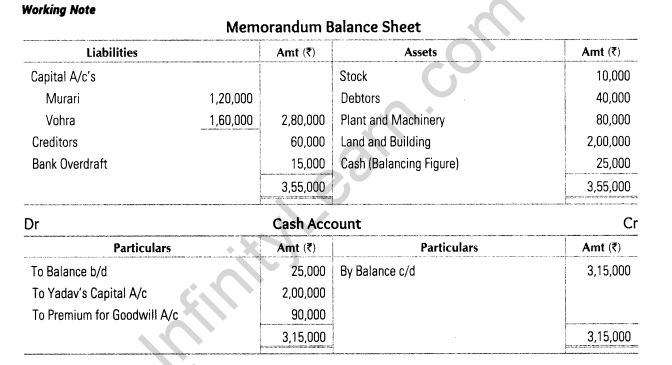

6. Murari and Vohra were partners in a firm with capitals of Rs. 1,20,000 and Rs. 1,60,000 respectively. On 1st April, 2010 they admitted Yadav as a partner for l/4th share in profits on his payment of Rs. 2,00,000 as his capital and Rs. 90,000 for his l/4th share of goodwill. On that date, the creditors of Murari and Vohra wereRs. 60,000 and bank overdraft was Rs. 15,000. Their assets apart from cash included stock Rs. 10,000; debtors Rs. 40,000; plant and machinery Rs. 80,000; land and building Rs. 2,00,000. It was agreed that stock should be depreciated by Rs. 2,000; plant and machinery by 20%, Rs. 5,000 should be written-off as bad debts and land and building should be appreciated by 25%.

Prepare revaluation account, capital accounts of Murari, Vohra and Yadav and the balance sheet of the new firm. (All India 2011)