Table of Contents

CBSE Sample Papers for Class 12 Accountancy Solved 2016 Set 5

Part A

(Accounting for Partnership Firms and Companies)

1.Balance of share forfeiture account is shown in the balance sheet under which sub heading?

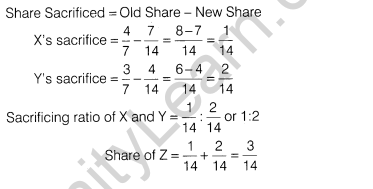

2.X and Y are partners sharing profits and losses in the ratio of 4:3. Z joins the firm as a new partner. The new profit sharing ratio of X, Y and Z is agreed at 7:4:3 respectively. Calculate the sacrificing ratio and the share of incoming partner.

3.How will the goodwill account appearing in the balance sheet be treated in case of dissolution of firm.

4.State any one deduction that may have to be made from the amount payable to the legal representative of a deceased partner.

5.X, Y and Z are partners in a firm having no partnership agreement. They contributed Rs 1,00,000, Rs 2,00,000 and Rs 3,00,000 respectively as capitals. X and Y desire that the profits should be divided in the ratio of capital contribution. Z does not agree to this. Is Z correct? Give reason.

6.XYZ Ltd issued 1,00,000 equity shares of Rs 10 each. The amount was payable as follows:

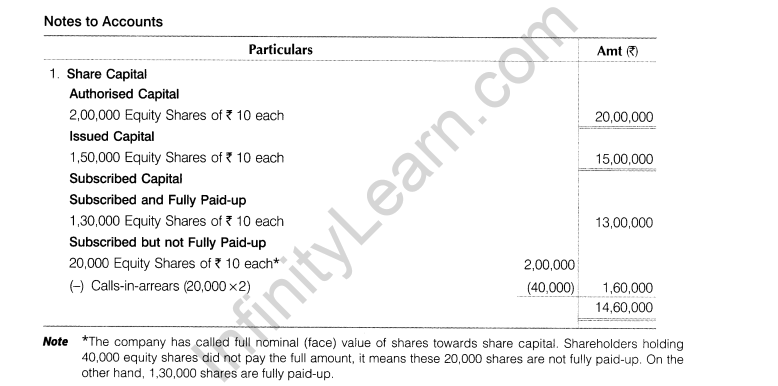

On application— Rs 3 per share

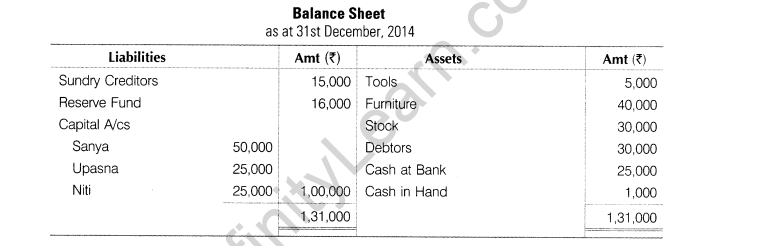

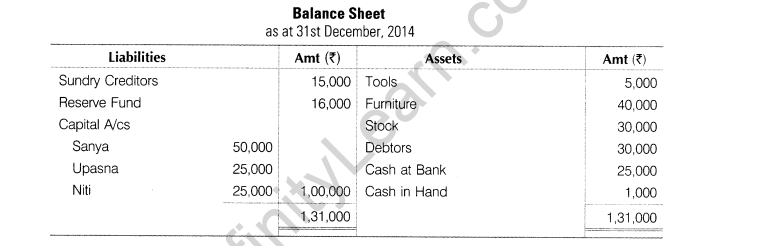

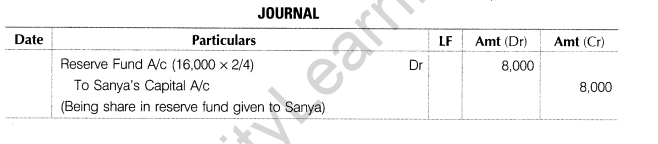

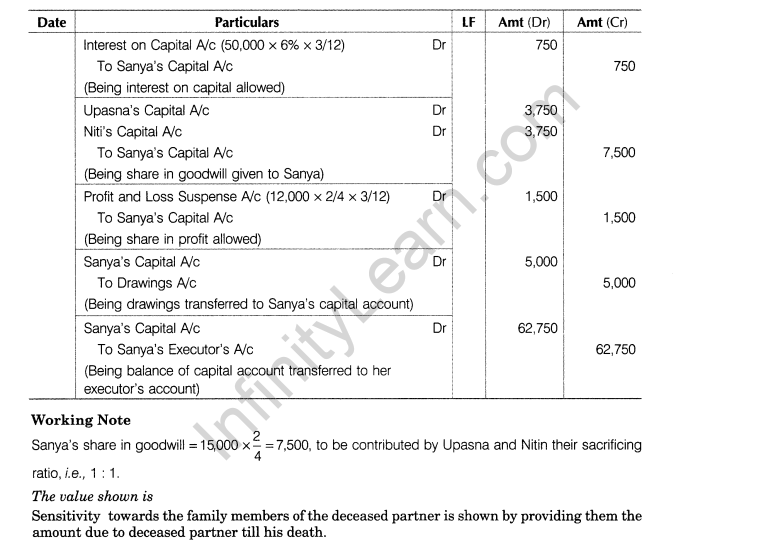

On allotment — Rs 2 per share

On first and final call — The balance

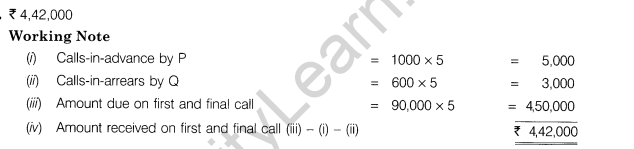

Applications for 90,000 shares were received and shares were allotted to all the applicants. P to whom 1,000 shares were allotted, paid her entire share money at the time of allotment, whereas Q did not pay the first and final call on his 600 shares. The amount received at the time of making first and final call was

7.What is securities premium reserve? State any two purposes for which securities premium reserve can be used?

8. Ram and Shyam agreed to share profits and losses as follows First Rs 25,000 to Ram and the balance in the ratio of 3 : 2. The profit for the year was Rs 30,000, which has been distributed among the partners. The opening capitals of the partners are; Ram Rs 50,000 and Shyam Rs 36,000. Interest on capital was omitted from the books which is to be allowed at 6% per annum. Adjust the same.

9.Shiva Ltd issued 1,00,000 equity shares of Rs 10,00,000 at Rs 2 premium, full amount called-up on application. 1,20,000 applications are received and shares are allotted on pro-rata basis. Money overpaid on application is refunded. Pass journal entries.

10.Arihant Ltd is registered with a capital of Rs 20,00,000 equity shares of Rs 10 each.1,50,000 equity shares were offered for subscription to public. Applications were received for 1,50,000 shares. All calls were made and amount was duly received except final call of Rs 2 on 20,000 shares. Show the share capital in the balance sheet of the company.

11.Following is the balance sheet of Sanya, Upasna and Niti as at 31st December, 2014 who shared profits in the ratio of 2 : 1 : 1.

Sanya died on 31 March, 2015. Under the partnership agreement, the executor of Sanya was entitled to

(i)Amount standing to the credit of her capital account.

(ii)Interest on capital at the rate of 6% per annum.

(iii) Goodwill of the firm valued at Rs 15,000.

(iv)Her drawings upto the date of death Rs 5,000.

(v)Her share of profit upto the date of death, calculated on the basis of previous year’s profit which was Rs 12,000.

Pass necessary journal entries. What value is shown in the above problem?

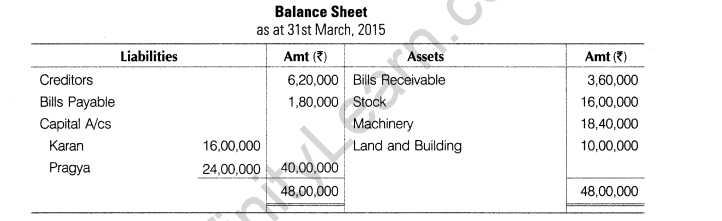

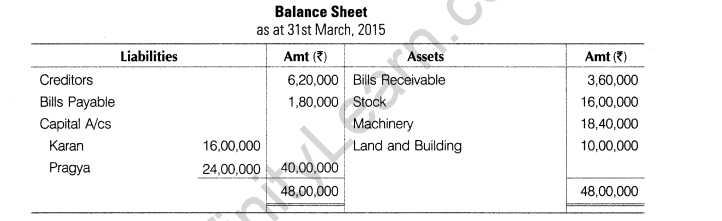

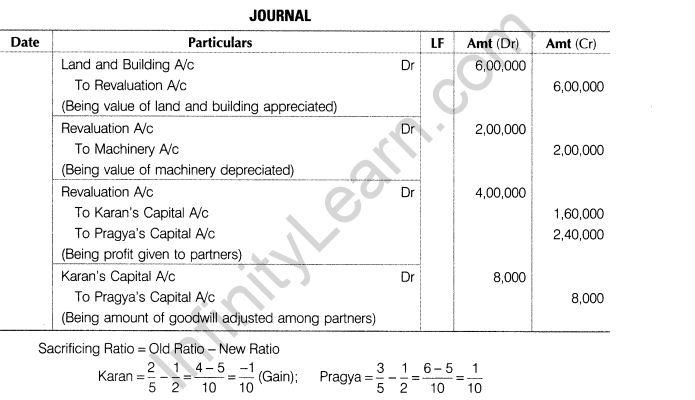

12.Karan and Pragya are partners in a firm sharing profits in the ratio of 2 : 3. The balance sheet of the firm as on 31st March, 2015 is given below

The partners decided to share profits in equal ratio with effect from 1st April, 2015. The following adjustments were agreed upon

(i)Land and building was valued at Rs 16,00,000 and machinery at Rs 16,40,000 and were to appear at revalued amounts in the balance sheet.

(ii)The goodwill of the firm was valued at Rs 80,000 but it was not to appear in books.

Pass the necessary journal entries to affect the above.

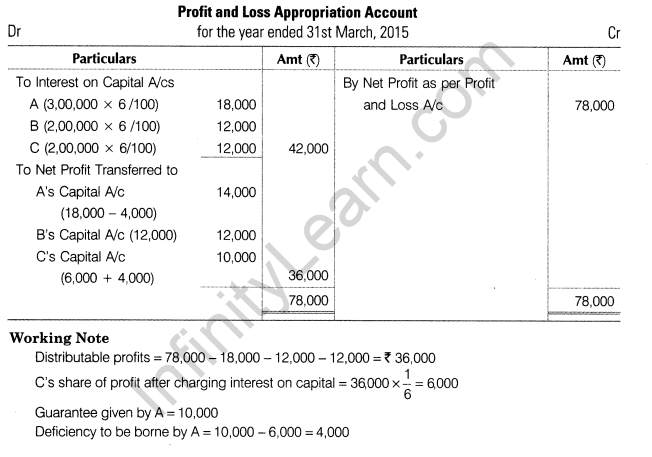

13.A, B and C entered into partnership on 1st April, 2014 to share profit and losses in the ratio of 3 : 2 :1. A however, personally guaranteed that C’s share of profit after charging interest on capital @ 6% per annum would not be less than Rs 10,000 in any year as he needed this money for his children’s education. Their capitals were A Rs 3,00,000; B Rs 2,00,000 and C Rs 2,00,000. The profit for the year ended on 31st March, 2015 amount to Rs 78,000.

Show the profit and loss appropriation account and also identify the value highlighted.

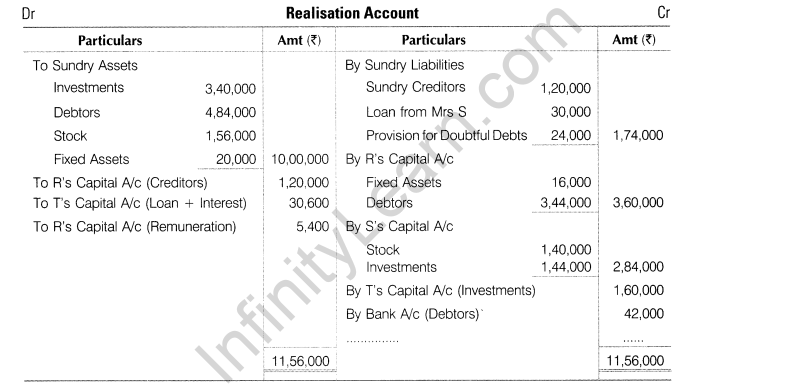

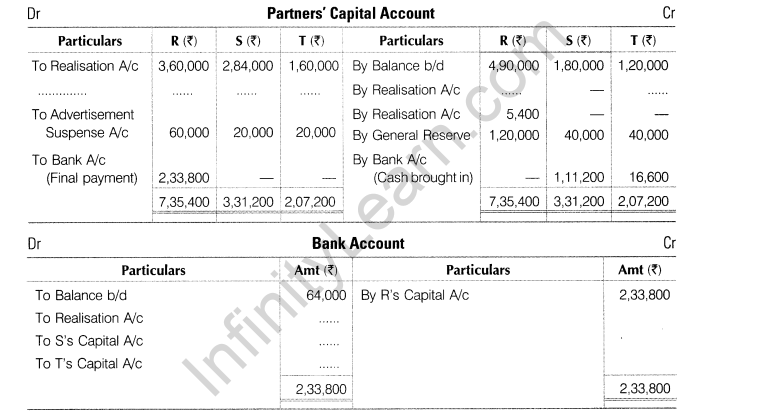

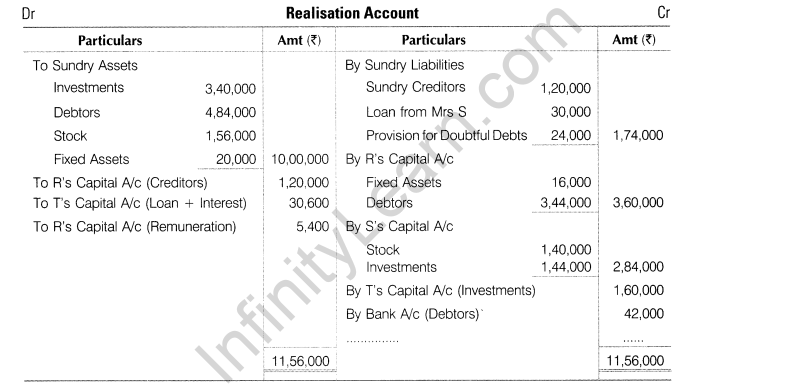

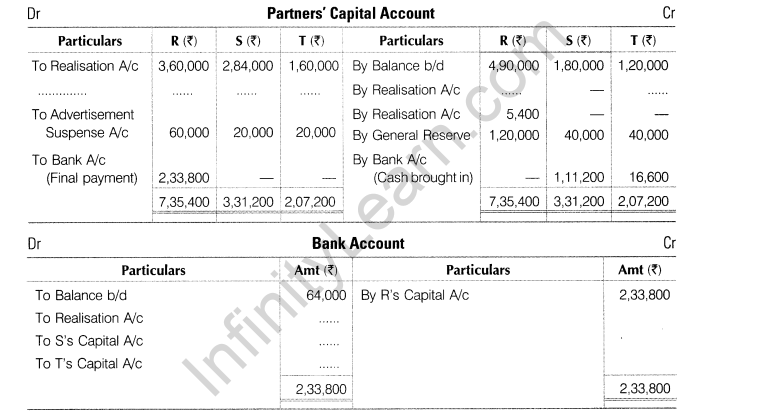

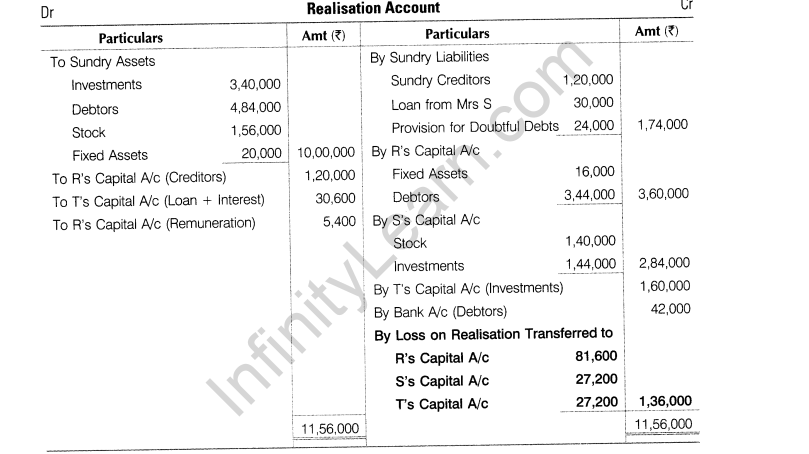

14.R, S and T who were sharing profits and losses in the ratio of 3:1:1 respectively decided to dissolve the firm. From the information given below, complete the realisation account, partners’ capital account and bank account.

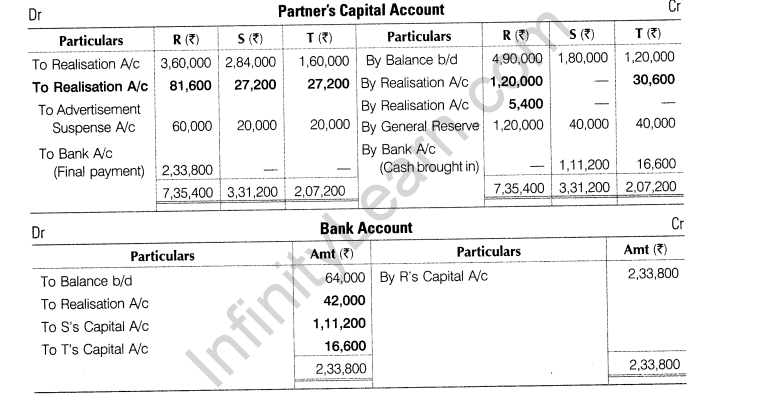

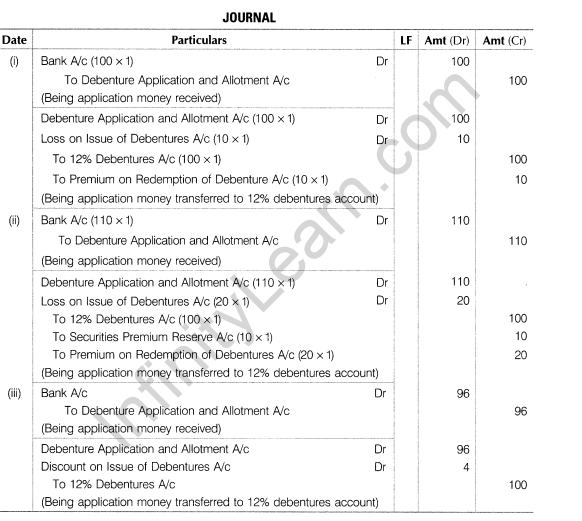

15.Journalise the following transaction when the whole amount is payable on application

(i)12% debentures issued at Rs 100 repayable at Rs 110.

(ii)12% debentures issued at Rs 110 repayable at Rs 120.

(iii) 12% debentures issued at Rs 96 and redeemable at Rs 100.

Note Face value of the debentures is Rs 100.

16.On 1st June, 2015, Kartik Ltd offered for subscription 50,000 equity shares of Rs 100 each at a premium of Rs 20 per share payable as given below On application Rs 20 per share; on allotment (including premium) t50 per share and two months after allotment Rs 50 per share.

Applications were received for 84,000 shares. On 1st July, 2015, the Directors proceed to allot shares proportionately. Of these, application for 4,500 shares were accompanied with full amount and hence were accepted in full and the balance allotment was made on pro-rata basis. Excess amount paid by applicants was utilised towards allotment and call money due from them.

One of the applicants to whom 300 shares were allotted proportionately, failed to pay the call money. His shares were forfeited on 30th November, 2015 and subsequently issued @ Rs 130 per share.

Record entries relating to these transactions in the journal of the company.

or

Jatin Ltd has been registered with an authorised capital of Rs 2,00,000 divided into 2,000 shares of Rs 100 each of which 1,000 shares were offered for public subscription at a premium of Rs 5 per share payable as under

On application Rs 10; on allotment Rs 25 (including premium); on first call 40 and on final call 30.

Applications were received for 1,800 shares of which applications for 300 shares were rejected outright, the rest of the applications were allotted 1,000 shares on pro-rata basis. Excess application money was transferred to allotment.

All the money were duly received except from Sachin, a holder of 200 shares, who failed to pay allotment and first call money. His shares were later on forfeited and reissued to Shyam at Rs 60 per share Rs 70 paid-up, final call has not been made. Record necessary journal entries.

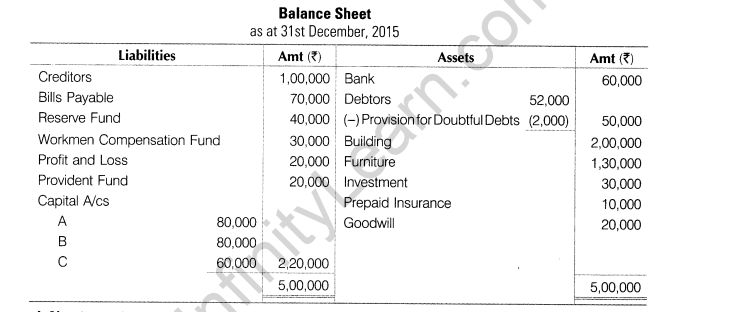

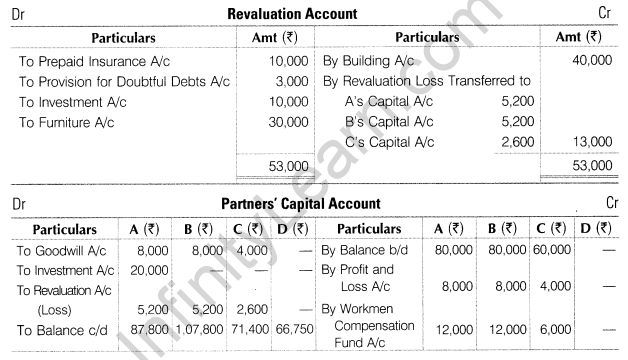

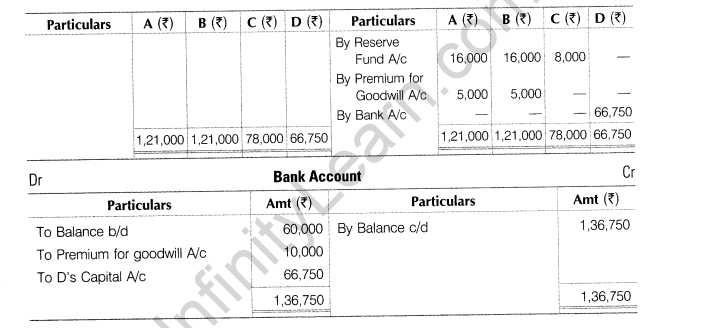

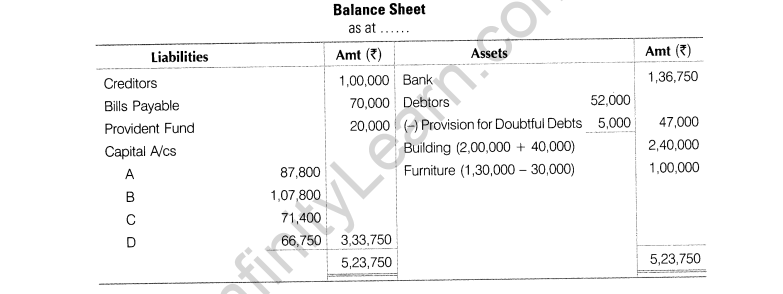

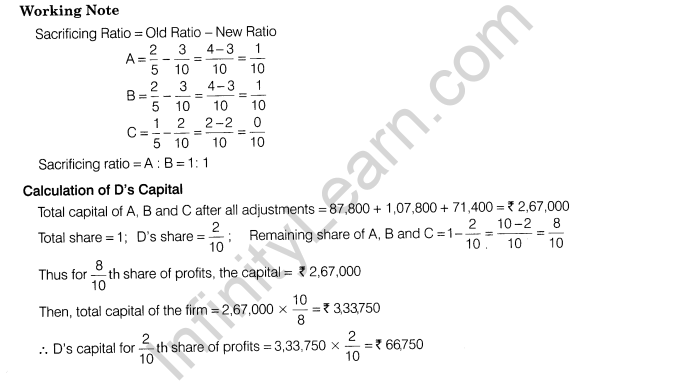

17.A, B and C are partners with profit sharing ratio of 2 : 2 : Their balance sheet is given below:

Adjustments

(i) D comes as a new partner and brings proportionate capital and goodwill,

(ii) New ratio is 3 : 3 : 2 : 2.

(iii) Goodwill of the firm is Rs 50,000.

(iv) Prepaid insurance no more required.

(v)Provision for doubtful debts is to be increased to Rs 5,000.

(vi)Investment is valued at Rs 20,000 and is taken over by A.

(vii)Furniture valued at Rs 1,00,000.

(viii) Building valued at 120%.

Prepare necessary accounts and balance sheet.

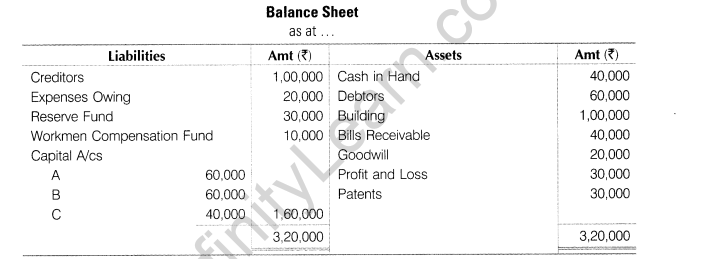

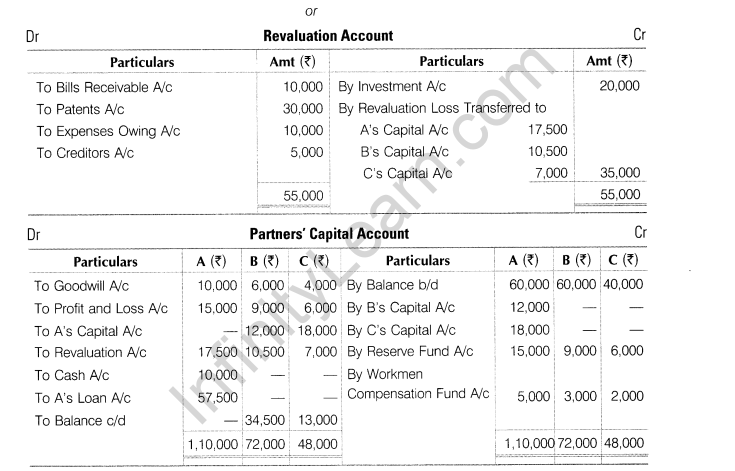

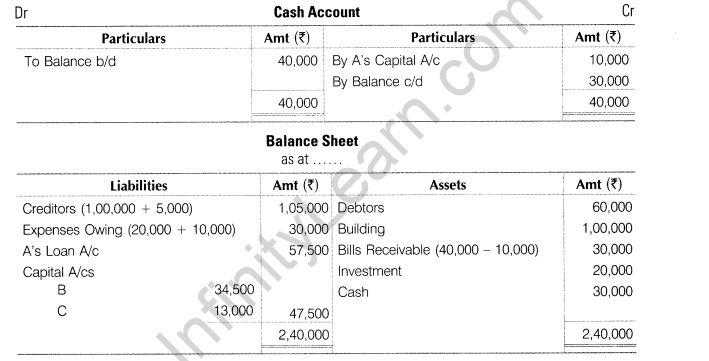

or

A, B and C are partners with ratio 5:3:2

Adjustments

(i)A takes retirement.

(ii)New ratio of B and C is 1 : 1 and goodwill of the firm is valued at ? 60,000.

(iii)Expenses owing increase by 10,000.

(iv)Creditors increased to Rs 1,05,000.

(v)Rs 10,000 bills receivable dishonoured and are not recoverable.

(vi)Patents are now value less.

(vii)Rs 20,000 unrecorded investment brought into books.

(viii) Rs 10,000 paid to A in cash and balance is transferred to his loan account. Prepare necessary accounts and balance sheet.

Part B

(Financial Statements Analysis)

18.The accountant of DLF Finance Ltd, a company engaged in providing loans and investing into shares has shown dividend received on shares as an investing activity. Is the treatment correct?

19.What are cash equivalents?

20.(i)State the major headings on the liability side of the balance sheet according to Schedule III of the Companies Act, 2013.

(ii)State any one limitation of Analysis of financial Statements.

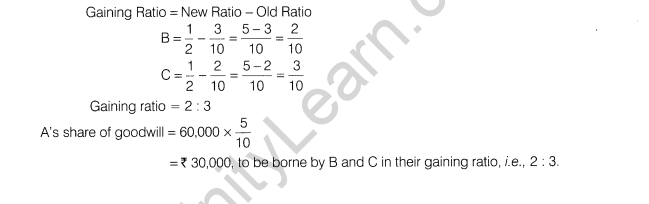

21. PQR Ltd is into the business of manufacturing tyres. Honesty and hard work are the two pillars on which the business has been built. It has a good turnover and profits. Encouraged by huge profits, it decided to give the workers bonus equal to two months salary.

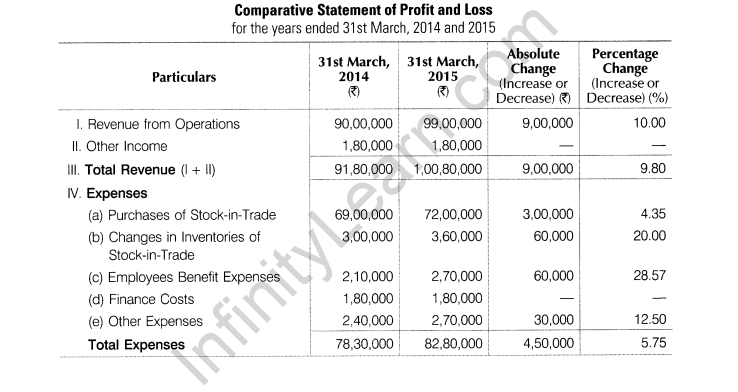

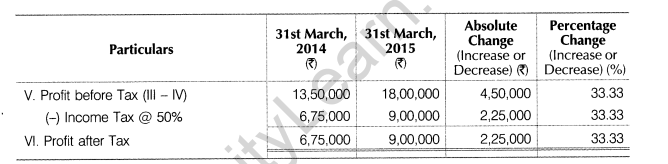

Following is the comparative statement of profit and loss of PQR Ltd for the years ended 31st March, 2014 and 2015.

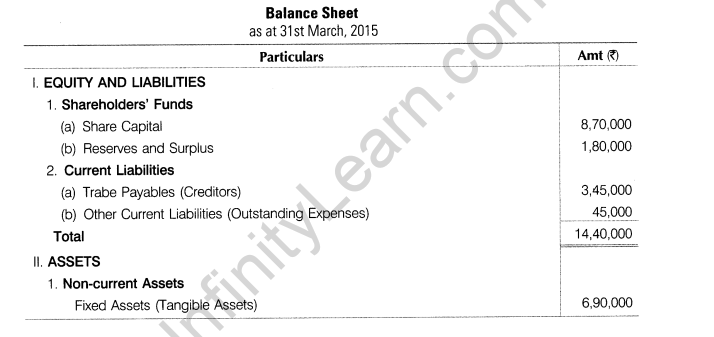

(i)Calculate net profit ratio for the years ending 31st March 2014 and 2015.

(ii)Identify the value which PQR Ltd wants to communicate to the society.

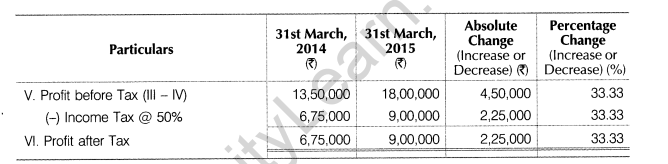

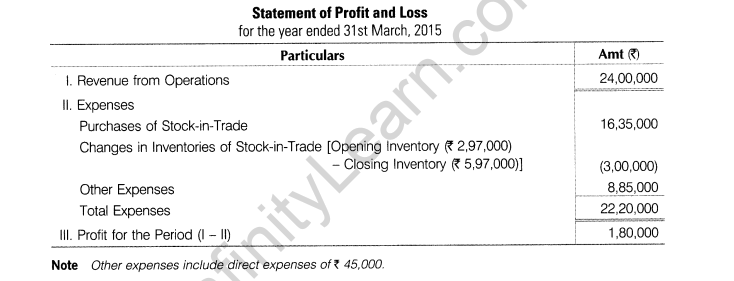

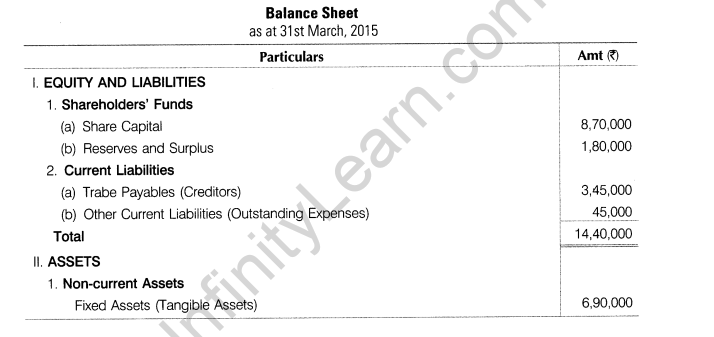

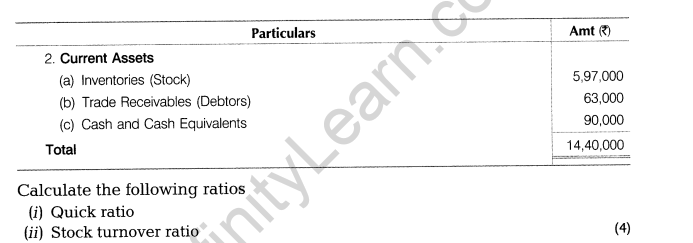

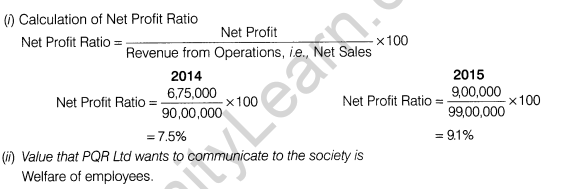

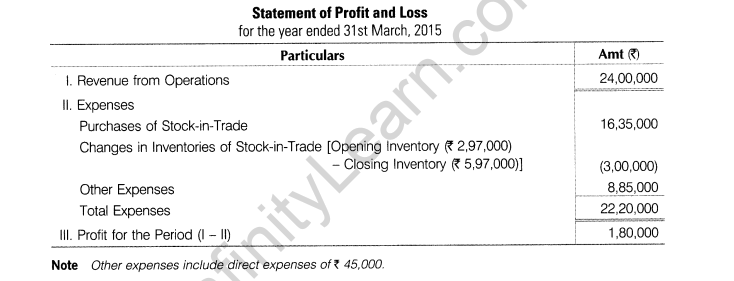

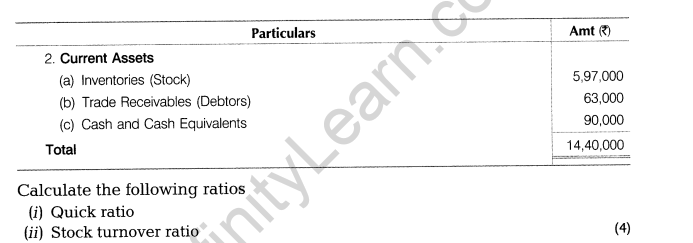

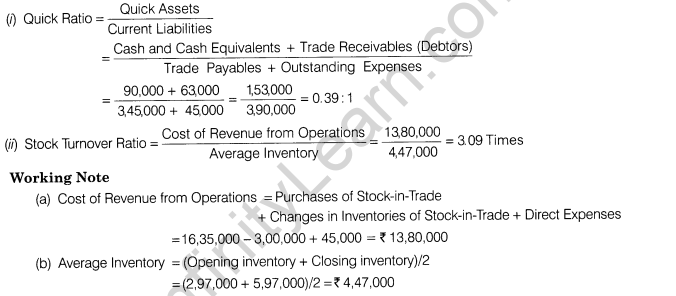

22.Following is the statement of profit and loss of Ronak Ltd for the year ended 31st March, 2015 and the balance sheet of the company as at that date.

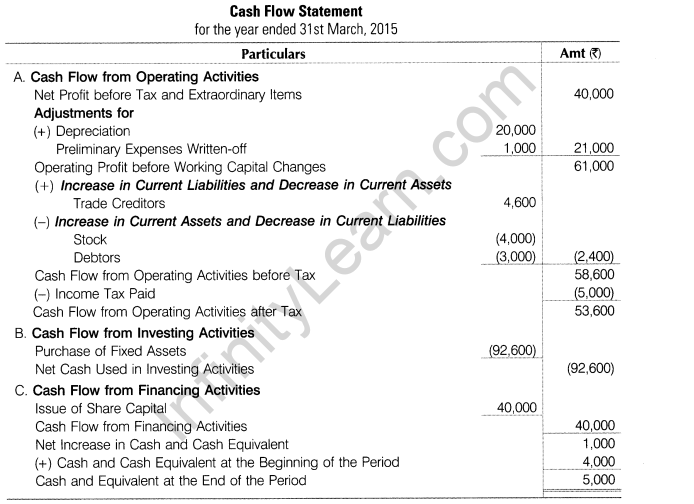

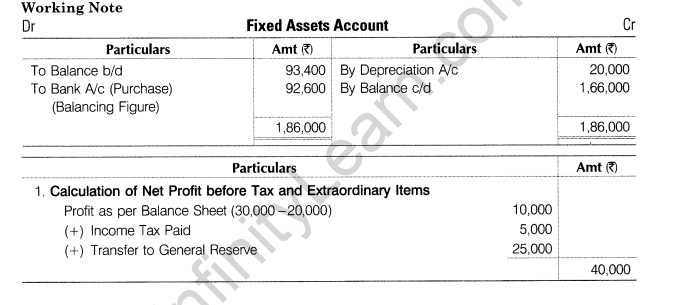

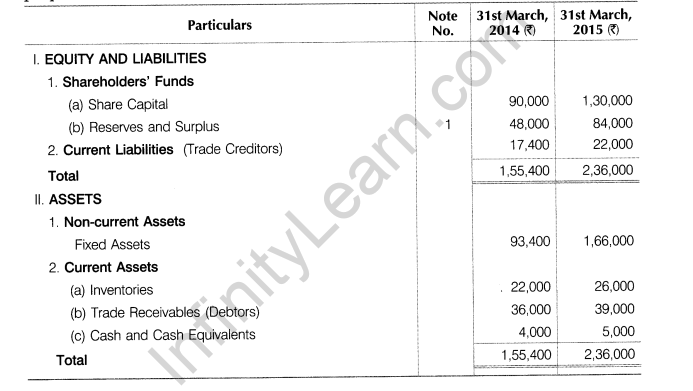

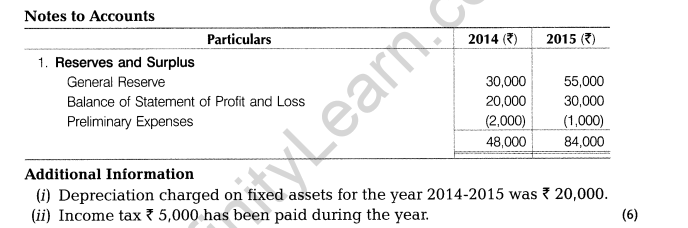

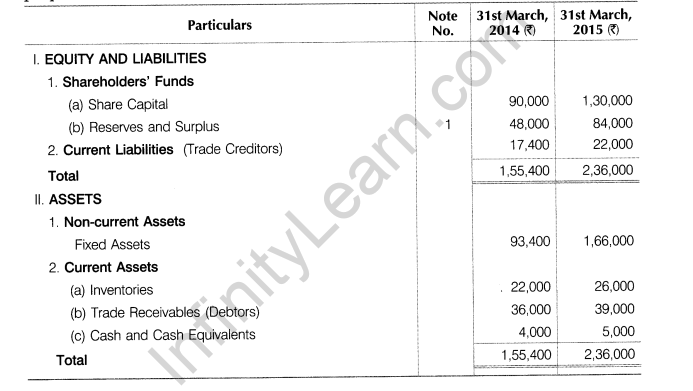

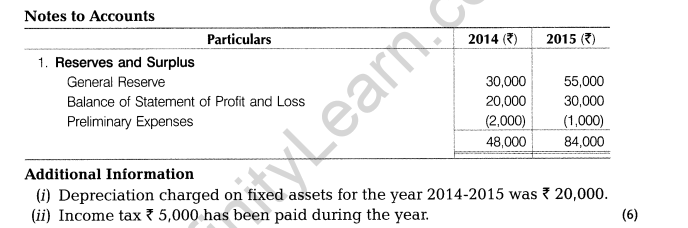

23.From the following balance sheet of Vikas Ltd as on 31st March, 2014 and 2015, prepare a cash flow statement.

Answers

Part A

(Accounting for Partnership Firms and Companies)

1.Balance of share forfeiture account is shown in the balance sheet under which sub heading?

Ans. Share capital.

2.X and Y are partners sharing profits and losses in the ratio of 4:3. Z joins the firm as a new partner. The new profit sharing ratio of X, Y and Z is agreed at 7:4:3 respectively. Calculate the sacrificing ratio and the share of incoming partner.

Ans.

3.How will the goodwill account appearing in the balance sheet be treated in case of dissolution of firm.

Ans. Goodwill account appearing in the balance sheet is closed like other assets, i.e., by transferring it to the realisation account (debit side) at book value.

4.State any one deduction that may have to be made from the amount payable to the legal representative of a deceased partner.

Ans. Retiring partner’s share of loss on revaluation of assets and liabilities.

5.X, Y and Z are partners in a firm having no partnership agreement. They contributed Rs 1,00,000, Rs 2,00,000 and Rs 3,00,000 respectively as capitals. X and Y desire that the profits should be divided in the ratio of capital contribution. Z does not agree to this. Is Z correct? Give reason.

Ans. Yes, Z is correct, because in the absence of partnership deed, profits are shared equally.

6.XYZ Ltd issued 1,00,000 equity shares of Rs 10 each. The amount was payable as follows:

On application— Rs 3 per share

On allotment — Rs 2 per share

On first and final call — The balance

Applications for 90,000 shares were received and shares were allotted to all the applicants. P to whom 1,000 shares were allotted, paid her entire share money at the time of allotment, whereas Q did not pay the first and final call on his 600 shares. The amount received at the time of making first and final call was

Ans.

7.What is securities premium reserve? State any two purposes for which securities premium reserve can be used?

Ans. A company can issue its shares at more than its face value. Excess of issue price of shares over its face value is termed as securities premium reserve.

Section 52(2) of the Companies Act, 2013 restricts the use of the amounts received as premium on securities except for the following purposes:

(i) Issuing fully paid bonus shares to the members.

(ii) Writing off preliminary expenses of the company.

8. Ram and Shyam agreed to share profits and losses as follows First Rs 25,000 to Ram and the balance in the ratio of 3 : 2. The profit for the year was Rs 30,000, which has been distributed among the partners. The opening capitals of the partners are; Ram Rs 50,000 and Shyam Rs 36,000. Interest on capital was omitted from the books which is to be allowed at 6% per annum. Adjust the same.

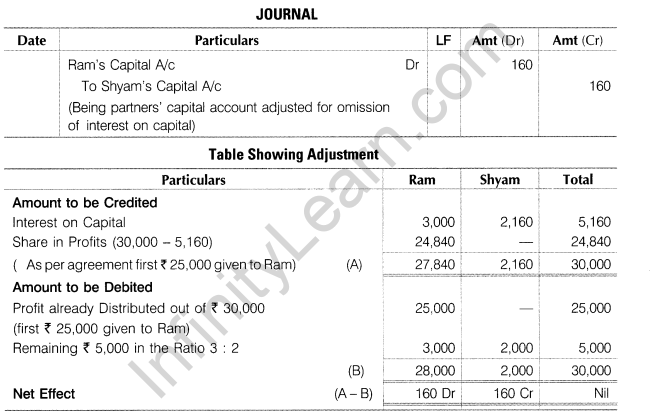

Ans.

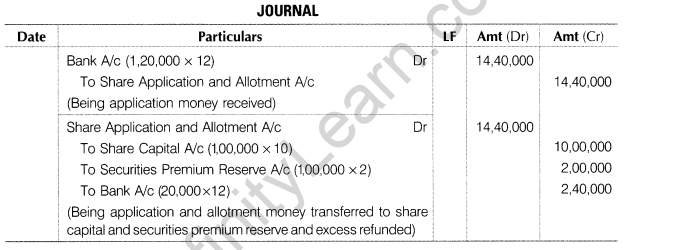

9.Shiva Ltd issued 1,00,000 equity shares of Rs 10,00,000 at Rs 2 premium, full amount called-up on application. 1,20,000 applications are received and shares are allotted on pro-rata basis. Money overpaid on application is refunded. Pass journal entries.

Ans.

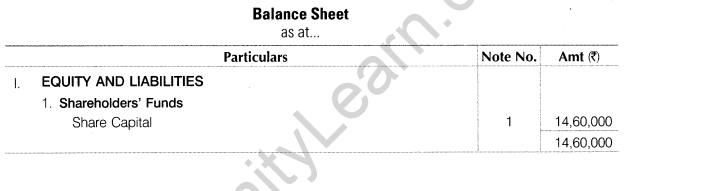

10.Arihant Ltd is registered with a capital of Rs 20,00,000 equity shares of Rs 10 each.1,50,000 equity shares were offered for subscription to public. Applications were received for 1,50,000 shares. All calls were made and amount was duly received except final call of Rs 2 on 20,000 shares. Show the share capital in the balance sheet of the company.

Ans.

11.Following is the balance sheet of Sanya, Upasna and Niti as at 31st December, 2014 who shared profits in the ratio of 2 : 1 : 1.

Sanya died on 31 March, 2015. Under the partnership agreement, the executor of Sanya was entitled to

(i)Amount standing to the credit of her capital account.

(ii)Interest on capital at the rate of 6% per annum.

(iii) Goodwill of the firm valued at Rs 15,000.

(iv)Her drawings upto the date of death Rs 5,000.

(v)Her share of profit upto the date of death, calculated on the basis of previous year’s profit which was Rs 12,000.

Pass necessary journal entries. What value is shown in the above problem?

Ans.

12.Karan and Pragya are partners in a firm sharing profits in the ratio of 2 : 3. The balance sheet of the firm as on 31st March, 2015 is given below

The partners decided to share profits in equal ratio with effect from 1st April, 2015. The following adjustments were agreed upon

(i)Land and building was valued at Rs 16,00,000 and machinery at Rs 16,40,000 and were to appear at revalued amounts in the balance sheet.

(ii)The goodwill of the firm was valued at Rs 80,000 but it was not to appear in books.

Pass the necessary journal entries to affect the above.

Ans.

13.A, B and C entered into partnership on 1st April, 2014 to share profit and losses in the ratio of 3 : 2 :1. A however, personally guaranteed that C’s share of profit after charging interest on capital @ 6% per annum would not be less than Rs 10,000 in any year as he needed this money for his children’s education. Their capitals were A Rs 3,00,000; B Rs 2,00,000 and C Rs 2,00,000. The profit for the year ended on 31st March, 2015 amount to Rs 78,000.

Show the profit and loss appropriation account and also identify the value highlighted.

Ans.

14.R, S and T who were sharing profits and losses in the ratio of 3:1:1 respectively decided to dissolve the firm. From the information given below, complete the realisation account, partners’ capital account and bank account.

Ans.

15.Journalise the following transaction when the whole amount is payable on application

(i)12% debentures issued at Rs 100 repayable at Rs 110.

(ii)12% debentures issued at Rs 110 repayable at Rs 120.

(iii) 12% debentures issued at Rs 96 and redeemable at Rs 100.

Note Face value of the debentures is Rs 100.

Ans.

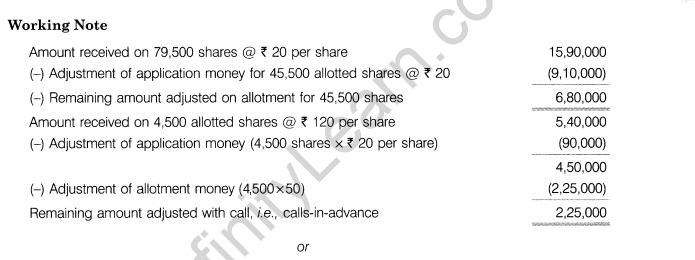

16.On 1st June, 2015, Kartik Ltd offered for subscription 50,000 equity shares of Rs 100 each at a premium of Rs 20 per share payable as given below On application Rs 20 per share; on allotment (including premium) t50 per share and two months after allotment Rs 50 per share.

Applications were received for 84,000 shares. On 1st July, 2015, the Directors proceed to allot shares proportionately. Of these, application for 4,500 shares were accompanied with full amount and hence were accepted in full and the balance allotment was made on pro-rata basis. Excess amount paid by applicants was utilised towards allotment and call money due from them.

One of the applicants to whom 300 shares were allotted proportionately, failed to pay the call money. His shares were forfeited on 30th November, 2015 and subsequently issued @ Rs 130 per share.

Record entries relating to these transactions in the journal of the company.

or

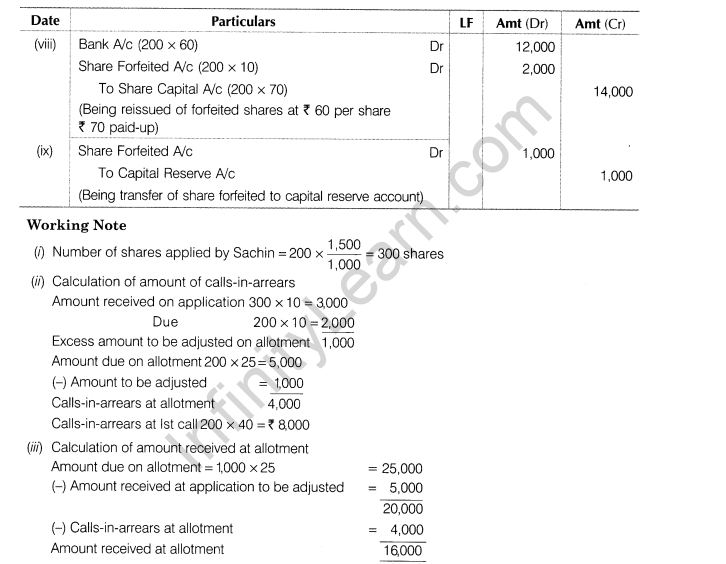

Jatin Ltd has been registered with an authorised capital of Rs 2,00,000 divided into 2,000 shares of Rs 100 each of which 1,000 shares were offered for public subscription at a premium of Rs 5 per share payable as under

On application Rs 10; on allotment Rs 25 (including premium); on first call 40 and on final call 30.

Applications were received for 1,800 shares of which applications for 300 shares were rejected outright, the rest of the applications were allotted 1,000 shares on pro-rata basis. Excess application money was transferred to allotment.

All the money were duly received except from Sachin, a holder of 200 shares, who failed to pay allotment and first call money. His shares were later on forfeited and reissued to Shyam at Rs 60 per share Rs 70 paid-up, final call has not been made. Record necessary journal entries.

Ans.

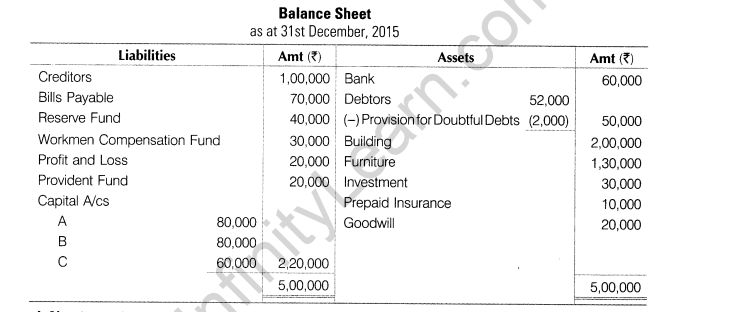

17.A, B and C are partners with profit sharing ratio of 2 : 2 : Their balance sheet is given below:

Adjustments

(i) D comes as a new partner and brings proportionate capital and goodwill,

(ii) New ratio is 3 : 3 : 2 : 2.

(iii) Goodwill of the firm is Rs 50,000.

(iv) Prepaid insurance no more required.

(v)Provision for doubtful debts is to be increased to Rs 5,000.

(vi)Investment is valued at Rs 20,000 and is taken over by A.

(vii)Furniture valued at Rs 1,00,000.

(viii) Building valued at 120%.

Prepare necessary accounts and balance sheet.

or

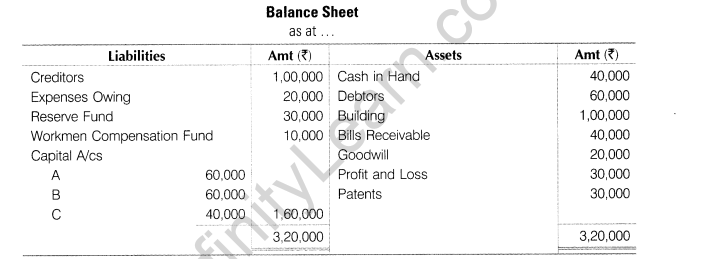

A, B and C are partners with ratio 5:3:2

Adjustments

(i)A takes retirement.

(ii)New ratio of B and C is 1 : 1 and goodwill of the firm is valued at ? 60,000.

(iii)Expenses owing increase by 10,000.

(iv)Creditors increased to Rs 1,05,000.

(v)Rs 10,000 bills receivable dishonoured and are not recoverable.

(vi)Patents are now value less.

(vii)Rs 20,000 unrecorded investment brought into books.

(viii) Rs 10,000 paid to A in cash and balance is transferred to his loan account. Prepare necessary accounts and balance sheet.

Ans.

Part B

(Financial Statements Analysis)

18.The accountant of DLF Finance Ltd, a company engaged in providing loans and investing into shares has shown dividend received on shares as an investing activity. Is the treatment correct?

Ans. No, as the company is engaged in the business of providing loans and also investing in shares, any income arising from these activities should be shown under operating activity.

19.What are cash equivalents?

Ans. Cash equivalents are short-term highly liquid investments that are readily convertible into the known amount of cash and which are subject to an insignificant risk of change in value.

20.(i)State the major headings on the liability side of the balance sheet according to Schedule III of the Companies Act, 2013.

(ii)State any one limitation of Analysis of financial Statements.

Ans.(i) (a)Shareholders’ funds.

(b)Share application money pending allotment.

(c)Non-current liabilities.

(d)Current liabilities.

(ii) Limitation of analysis of financial statements It ignores price level changes.

21. PQR Ltd is into the business of manufacturing tyres. Honesty and hard work are the two pillars on which the business has been built. It has a good turnover and profits. Encouraged by huge profits, it decided to give the workers bonus equal to two months salary.

Following is the comparative statement of profit and loss of PQR Ltd for the years ended 31st March, 2014 and 2015.

(i)Calculate net profit ratio for the years ending 31st March 2014 and 2015.

(ii)Identify the value which PQR Ltd wants to communicate to the society.

Ans.

22.Following is the statement of profit and loss of Ronak Ltd for the year ended 31st March, 2015 and the balance sheet of the company as at that date

Ans.

23.From the following balance sheet of Vikas Ltd as on 31st March, 2014 and 2015, prepare a cash flow statement.

Ans.