Table of Contents

CBSE Sample Papers for Class 12 Economics Delhi – 2009

Time allowed : 3 hours Maximum marks 100

GENERAL INSTRUCTIONS

(i) All questions in both the sections are compulsory.

(ii) Marks for questions are indicated against each.

(iii) Questions No. 1-5 and 17-21 are very short-answer questions carrying 1 nick each. They are required to be answered in one sentence each.

(iv) Questions No. 6-10 and 22-26 are? short-answer questions carrying 3 marks each. Answers to them should normally not exceed 60 words each.

(v) Questions No. 11-13 and 27-29 are also short-answer questions carrying 4 marks each. Answers to them should normally not exceed 70 words each.

(vi) Questions No. 14-16 and 30-32 are long-answers questions carrying 6 marks each. Answers to them should normally not exceed 100 words each.

(vii) Answers should be brief and to the point and the above word limit should be adhered to as far as possible.

SET I

SECTION A

Question.1. Give two examples of Microeconomic studies.

Answer. The two examples of microeconomic studies are (i) study of relation between price and demand of goods and (ii) price determination.

Question.2. When is the demand of a commodity said to be inelastic?

Answer. Demand of a commodity is said to be inelastic when percentage change in quantity demanded is less than the percentage change in price i.e., e < 1.

Question.3. Define fixed cost.

Answer. Fixed costs are those which do not change with the change in the level of output.

TFC – TC – TVC.

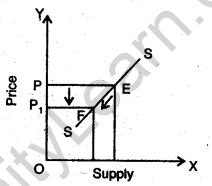

Question.4. What causes a downward movement along a supply curve?

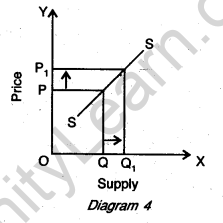

Answer. A downward movement along a supply curve, indicating contraction of supply, is caused due to fall in the price of a commodity other factors affecting the, supply remaining same/unchanged. See diagram.

Question.5. Define monopoly.

Answer. Monopoly refers to a market situation where there is a single seller selling a product which has no close substitutes

Question.6. Why does an economic problem arise? Explain.

Or

Explain the problem of ‘What to produce’.

Answer. Scarcity of resources having alternative uses in relation to unlimited wants gives rise to an economic problem.

There are three causes for an economic problem:

(i) Unlimited wants. Human wants are unlimited and differ in intensity.

(ii) Limited resources. Resources, generally Called factors of production, are scarce in relation to their need.

(iii) Alternative uses of resources. A resource can be used for many purposes. But it can be used for only one purpose at a time.

What to produce? This problem signifies what goods should be produced and in what quantities. This problem arises when due to scarcity of resources we cannot produce each and every thing which we want. Therefore, a decision has to be taken as to what goods should be produced and in what quantities. In short, we have to see whether we should produce consumer goods or producer goods or defence goods or all the goods in some quantity combination.

So, on the basis of importance of various goods, an economy has to decide which goods should be produced and in what quantities.

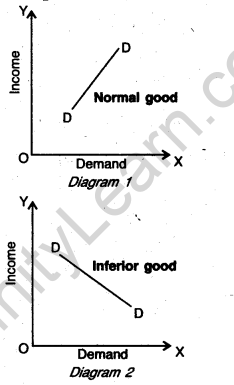

Question.7. Distinguish between a normal good and an inferior good. Give example in each case. 3

Answer. Normal Good

1. A normal good is one whose demand increases with an increase in the money income of the consumer.

2. Normal goods have positive income effect, e.g. if a consumer buys more of milk for his family as his income rises, then milk will be called a normal good as shown in Diagram 1.

Inferior Good

1. An inferior good is one whose demand falls with a rise in income of the consumer because he can now afford to buy a normal (superior) good as shown in Diagram 2.

2. Inferior goods have negative income effect; e.g. if a consumer reduces the consumption of toned milk when his income rises, then toned milk is an inferior good for that consumer, as shown in Diagram2.

Question.8. How is the price elasticity of demand of a commodity affected by the number of its substitutes? Explain.

Answer. When a commodity has a large number of close substitutes, its demand is usually very elastic. This is because a consumer can easily shift from one substitute to another in case of a change in price. If there are no substitutes of a good, the consumer has no option but to buy the given good, e.g. demand for cold drinks like Coca-Cola, Pepsi, etc. is highly elastic because of availability of close substitutes.

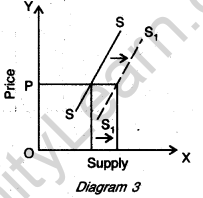

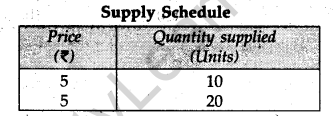

Question.9. Explain the meaning of ‘increase in supply’ and ‘increase in quantity supplied’ with the help of a schedule.

Answer. Increase in supply occurs when quantity supplied increases at the existing price due to factors other than the price of the commodity. It can be explained with the help of the following .schedule and Diagram 3.

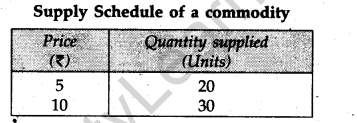

As per the above schedule, initially the quantity supplied is 10 units at a price of Rs. 5 per unit. Due to other factors, like technological improvement or reduction in input prices, quantity supplied increases to 20 units at the same price. This is known as increase in supply. Increase in quantity supplied occurs when quantity supplied increases due to increase in the commodity’s own price. This can be explained with the help of the following supply schedule and Diagram 4.

According to the above schedule, 20 units of the commodity are supplied at a price of Rs. 5 per unit But the quantity supplied increases to 30 units when price of the commodity increases to ? 10 per unit. This extension of supply occurs when price increases from Rs. 5 to Rs. 10 per unit as shown in Diagram 4.

Question.10. Why is. a firm under Perfect Competition a price-taker? Explain.

Answer. Perfect Competition is a market situation in which a large number of firms produce homogeneous goods and sell them at a uniform price.

The share of each seller in the total market supply is so small that no single seller can influence the price. Hence it has no option but to sell the product at the price determined by the industry (determined by interaction of market demand and supply). It is because of this that each firm is said to be a price taker in perfect competition.

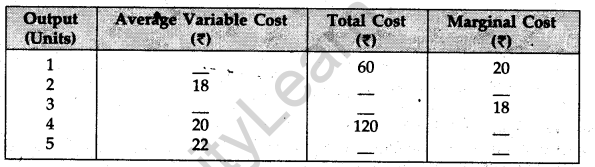

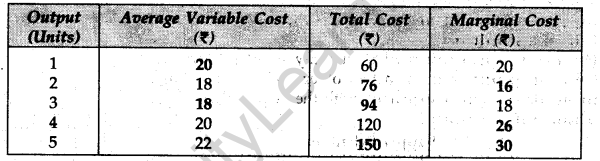

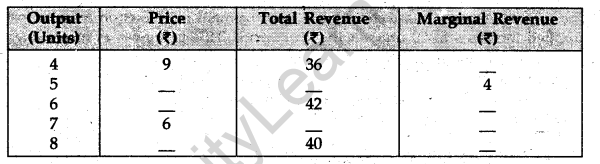

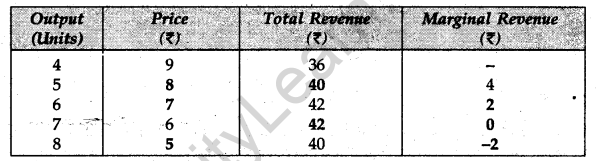

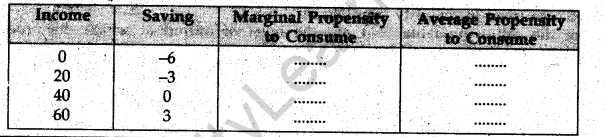

Question.11. Complete the following table:

Answer.

(or)

Complete the following table:

Answer.

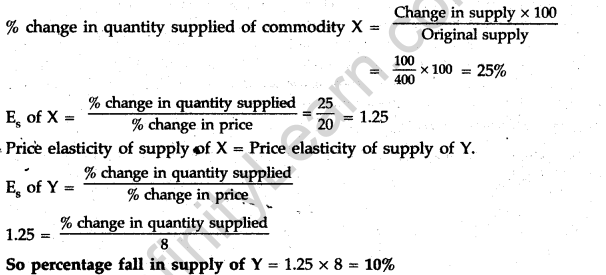

Question.12. Commodities X and Y have eqval price elasticity of supply. The supply of X rises from 400 units to 500 units due to a 20 peir cent rise in its price. Calculate the percentage fall supply of Y if its price falls by 8 percent.

Answer.

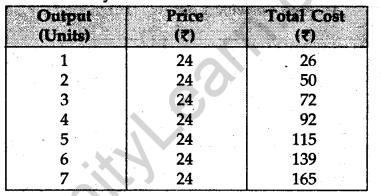

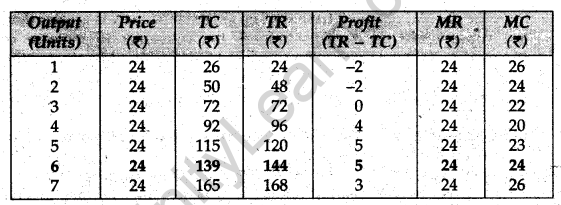

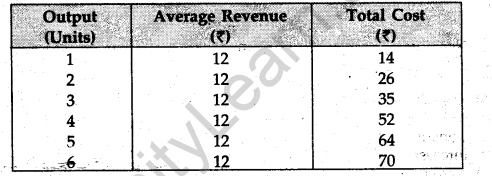

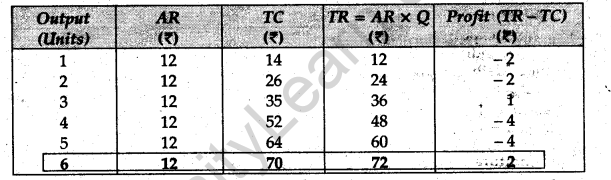

Question.13. From the following schedule find out the level of output at which the producer is equilibrium. Give reasons for your answer.

Answer.

The producer is in equilibrium at 6th unit of output. This is because at this level of output his profit is maximum. Also at this level his

MR = MC – 24.

Question.14. Explain the causes of a rightward shift in demand curve of a commodity of an individual consumer .

Answer. The main reasons of rightward shift in demand curve of a commodity are:

1. Increase in income of buyers of normal good. With increase in income of the consumer, the demand curve for normal good shifts to the right.

2. Fall in iricome in case of inferior good. Fall in income of a consumer may shift the demand curve of an inferior good to the right.

3. Rise in price of substitute goods. In case of substitute goods, demand tor a commodity rises with rise in price of its substitute commodity.

4. Fall in price of a complementary good. In case of complementary goods, demand for the commodity rises with a fall in the price of the complementary commodity.

5. Favourable taste and preference for a commodity. If consumer’s tastes and preferences change in favour of a commodity, the demand for the commodity rises shifting the demand curve towards right.

(or)

Explain the conditions of consumer’s equilibrium in case of (i) single commodity and (ii) two commodities. Use utility approach.

AM. A consumer is in a state of? equilibrium when he spends his given income on tire purchase of a commodity (or combination of goods) in such a way that gives him maximum satisfaction.

(i) Consumer’s equilibrium in case of a single commodity is attained when MU= Price

This implies that a consumer makes purchases only upto the point where utility of the last unit is equal to the price of that unit. This is the stage when he maximises his gains. If he moves beyond this stage and purchases more units of the commodity/ then MU will fall (Law of diminishing marginal utility) and will become less than the price paid for it. Here marginal utility means marginal utility of ?

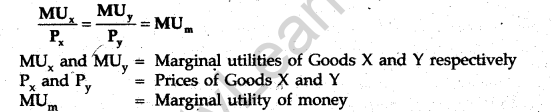

(ii) In case of two commodities, consumer attains equilibrium when:

This implies that a consumer attains equilibrium (maximum satisfaction) when the marginal utility obtained from the last rupee spent on both the goods becomes equal. This is also known as the Law of Equi-Marginal Utility.

Suppose the MU obtained from the last rupee spent on X is greater than the MU of the last rupee spent on Y. This induces the consumer to increase consumption of commodity X. Due to operation of Law of Diminishing Marginal Utility \({ MU }_{ x }\) will fall ,

and \({ MU }_{ x }\) will rise till finally \( \frac { { MU }_{ x } }{ { P }_{ x } }\) will become equal to \( \frac { { MU }_{ y } }{ { P }_{ y } }\) . When they are equal, the consumer gets the same MU per rupee and has no reason to further re-allocate his income on the two goods.

Question.15. Giving reasons, state whether the following statements are true or false:

(i) When there are diminishing returns to a factor, total product always decreases.

(ii) Total product will increase only when marginal product increases.

(iii) When marginal revenue is zero, average revenue will be constant.

Answer. (i) False. Because diminishing returns to a factor implies a situation where marginal product is falling. A fall in MP implies that TP should be increasing though at a diminishing rate. Total Product will increase till Marginal Product remains positive.

(ii) False. Total Product will also increase when Marginal Product decreases though at a diminishing rate.

(iii) False. Marginal Revenue (MR) will be zero only when Total Revenue (TR) is constant- This implies that Average Revenue (AR) will fall as output increases.

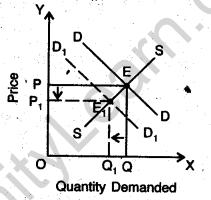

Question.16. With the help of a diagram, explain the effect of “decrease”’ in demand of a commodity on its equilibrium price and quantity.

Answer. Equilibrium price of a good is the price at which the market supply of the good equals the market deihand for that good.

The effect of decrease in demand for a commodity on its equilibrium price and quantity is explained with the help of the following Diagram:

Decrease in demand shifts the demand curve from DD to \({ D }_{ 1 }\) \({ D }_{ 1 }\) towards left. E is the original equilibrium point where OP is the equilibrium price and OQ is the equilibrium quantity. After the shift in the demand curve, the new demand curve (\({ D }_{ 1 }\)\({ D }_{ 1 }\)) intersects tire original supply curve (SS) at -point Er which is the new equilibrium. At \({ E }_{ 1 }\), the -equilibriumprice is OPa and equilibrium quantity is \({ OQ }_{ 1 }\) Thus, both equilibrium price and equilibrium quantity will fall when there is a decrease in demand.

For Blind Candidates only in lieu of Q. No. 16

Define equilibrium price. How is it affected by a “decrease” in demand of a commodity?

Answer. Same as for Q. 16.

Section B

Question.17. Why is repayment of loan a capital expenditure?

Answer. Loan is a liability. Its repayment is a capital expenditure because it reduces the liability of the : government. .

Question.18. What is meant by excess demand in Macroeconomics?

Answer. Excess Demand refers to a situation when Aggregate Demand (AD) is more than Aggregate Supply (AS) at the full employment level in an economy.

Question.19. What can be the minimum value of investment multiplier?

Answer. The minimum value of investment multiplier can be one.

Question.20. Define bank rate.

Answer. It is the rate at which the Central Bank gives credit to commercial banks.

Question.21. Define involuntary unemployment.

Answer. It is a situation in which people are able and willing to work at the existing wage rate but are unable to find work.

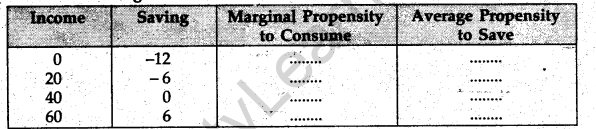

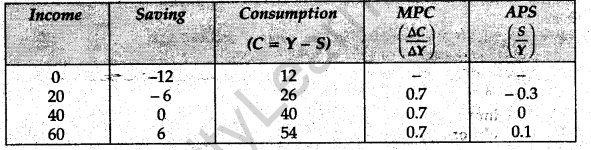

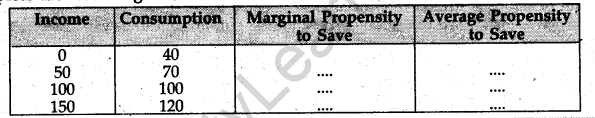

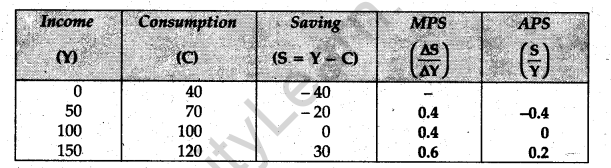

Question.22. Complete the following table:

Answer.

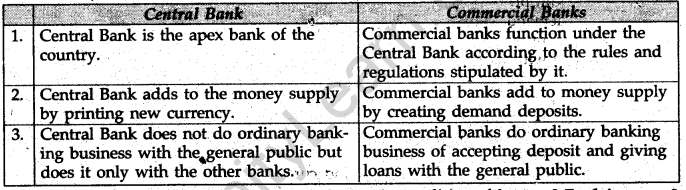

Question.23. State any three points of distinction between Central Bank and Commercial Banks.

Answer.

Question.24. How can a government budget help in reducing inequalities of income? Explain.

Answer. Government can achieve this aim bj^fakifig two fiscal policy steps. It can raise and impose taxes on income of rich and on the goods consumed by them thereby reducing their disposable income. The government can also increase subsidies and free services to the poor like education, medical treatment etc.

In this way, income inequalities can be, reduced.

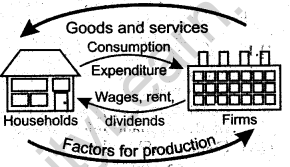

Question.25. Explain the circular flow of income.

Answer. The flow of production, income generation and expenditure involving different sectors of the economy in the form of wages, rent and dividends, is known as circular flow of income (see diagram).

Production gives rise to income (factor incomes), which in turn gives rise to demand for goods and services. This demand leads to expenditure by households on goods and services produced. In this way income generated by production units reaches bade to production units and makes the circular flow complete.

Or

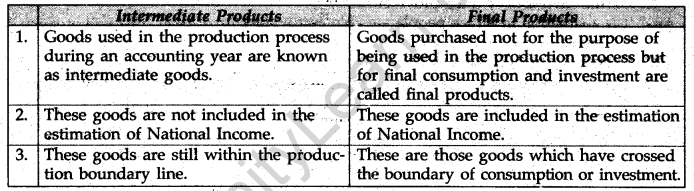

Distinguish between intermediate products and final products. Give examples.

Answer.

Question.26. List the items of the current account of balance of payments account. Also define ‘balance of trade’.

Answer. The items which are recorded in the current account are:

(i) Export and import of goods (visible items).

(ii) Export and import of sendees (invisible items).

(iii) Unilateral receipts and payments.

Balance of Trade refers to the difference in the value of imports and exports of visible items only.

BOT = Export of visible items – Import of visible items

Question.27. Explain the meaning and two merits of fixed foreign exchange rate.

Answer. Fixed Foreign Exchange Rate refers to the exchange or conversion rate as decided by die government. It has the following two merits:

(i) Elimination of Risk: There is a certain degree of risk involved for the exporter in the process of trade if there is a time lag between the delivery of goods and services and the receipt of payment. Fixed exchange rate eliminates this element of risk.

(ii) Mobility of Capital: Because of the uncertainty involved in the system of flexible exchange rates, investors often hesitate to invest in foreign countries. A system of fixed exchange rate facilitates movement of capital withiri countries eliminating this uncertainty.

Or

Explain two sources each of demand and supply of foreign exchange.

Answer. Two sources of demand of foreign exchange are:

• for importing goods and services. –

• for making investments abroad in financial and physical assets.

Two sources of supply of foreign exchange are:

• from transfer payments in the form of gifts, donations, cash remittances by family, etc.

• from exporting goods and services.

Question.28. State the four functions of money. Explain any one pf them.

Answer. Four functions of money are as follows:

(i) Money serves as a medium of exchange.

(ii) Money serves as a store of value.

(iii) Money is a standard of deferred payment.

(iv) Money serves as a unit of account.

Money as a store of value: People save a part of their earnings for use in future. Money fulfils this need of the people. People can store surplus purchasing power for future use. This means that one can hold orte’s earnings until the time one wants to spend it. This is facilitated by the fact that money comes in convenient denominations and is easily portable.

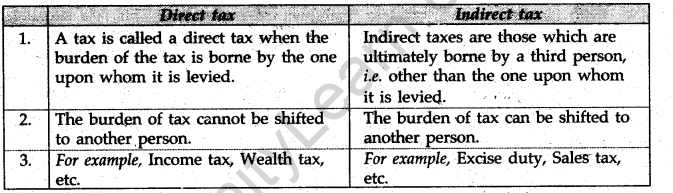

Question.29. Distinguish between:

(i) Direct tax and indirect tax

(ii) Revenue deficit and fiscal deficit.

Answer.(i)

(ii) Revenue deficit: It refers to the excess of the government’s total revenue expenditure over its total revenue receipts.

Revenue deficit = Total revenue expenditure – Total revenue receipts

Fiscal deficit: Fiscal deficit in a government budget refers to the excess of total

expenditure over the sum of revenue receipts and non-debt capital receipts.

Fiscal deficit = Total expenditure – (Revenue receipts + Capital receipts excluding borrowings)

Question.30. How will you treat the following while estimating domestic factor incotne of India? Give reasons for your answer.

(i) Remittances from non-resident Indians to their families in India.

(ii) Rent paid by the embassy of Japan in India to a resident Indian.

(iii) Profits earned by branches of foreign bank in India.

Answer. (i) These are transfer payments and are not to be included in the estimation of domestic factor income of India.

(ii) Since the Japan Embassy in India is not a part of the Indian domestic territory, therefore, it will not be included in the domestic factor income of India.

(iii) These will be included in the domestic income because the branches of the foreign bank are within the domestic territory of India.

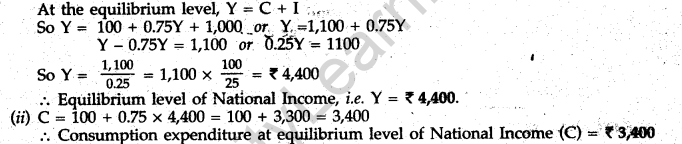

Question.31. Given consumption function C = 100 + 0.75 Y (where C = Consumption expenditure and Y = National Income) and investment expenditure = Rs. 1,000, calculate:

(i) Equilibrium level of National Income.

(ii) Consumption expenditure at equilibrium level of National Income.

Answer. (i) Given: C = 100 + 0.75Y, I = Investment expenditure=Rs. 1,000.

Or

What changes will take place to bring an economy in equilibrium, if:

(i) planned savings are greater than planned investment, and

(ii) planned savings are less than planned investment.

Answer. (i) When planned savings are greater than planned investment: It is a situation when aggregate demand is less than aggregate supply, i.e., there is a situation of deficient : demand in the economy.

Since the buyers are buying less than what is expected, the stock of inventories starts increasing.

As a result, the producers cut back on production thereby reducing employment and income levels.

The downward trend continues till AD and AS once again become equal bringing the ; economy back to equilibrium.

(ii) Planned savings are less than planned investment: This is a situation of excess

demand, wherein aggregate demand (AD) is more than aggregate supply (AS).

In this situation the inventories start falling as the investment demand of business firms is more than the planned savings.

To bring the economy back to equilibrium level, producers will have to increase production raising the employment and income level.

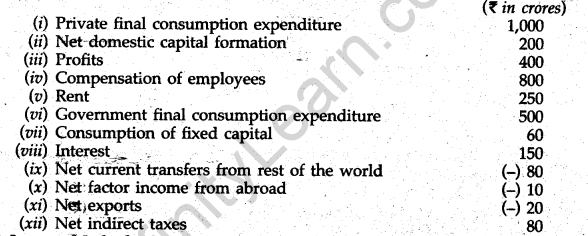

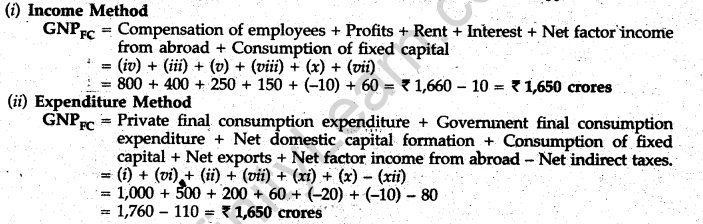

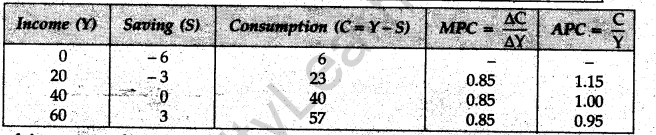

Question.32. Calculate “gross national product at factor cost” from the following data by (i) income method, and (ii) expenditure method.

Answer.

SET II

Note : Except for the following questions, all the remaining questions have been asked in Set I.

SECTION A

Question.1. Give the meaning of opportunity cost

Answer. Opportunity cost is the value of the next best alternative foregone by choosing one alternative rather than the other.

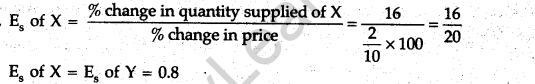

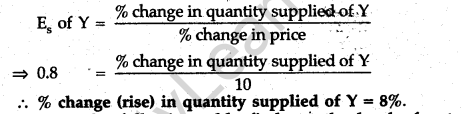

Question.11. The price elasticity of supply of commodity X and Y are equal. The price of X falls from Rs. 10 to Rs. 8 per unit and its quantity supplied falls by 16 per cent The price of Y rises by 10 percent Calculate the percentage increase in its supply.

Answer.

Question.13. From the following table find out the -level of output at which die producer is in equilibrium. Give reasons for your answer.

Answer.

The producer will be in equilibrium at the 6* unit of output. This is because he earns the maximum profit (TR – TC); which is Rs. 2 at this unit of output.

Question.15. Giving reasons, state whether the following statements are true or false:

(i)Increase in total pro chi ct always indicates that there are increasing returns to a factor.

(ii) Marginal revenue is always the price at which the last unit of a commodity is sold,

(iii) When there are diminishing returns to a factor, marginal and total product both

always fall.

Answer. (i) False. Total Product (TP) can also increase when there are decreasing returns to a factor (though at a diminishing rate) so long as Marginal Product (MP) is positive.

(ii) False. Marginal Revenue (MR) can be the price of the last unit sold but only in case of perfect competition. However, this is not always the case. In fact MR can work out to zero or negative also while that is never the case with price.

(iii) False. In case of diminishing returns to a factor only Marginal Product (MP) tends to fall. Total Product (TP) can rise so long as Marginal Product (MP) is positive.

SECTION B

Question.18. Define Deflationary Gap.

Answer. The deficiency in the aggregate demand at full employment is deflationary gap.

Question.19. If investment multiplier is 1, what will be the value of marginal propensity to consume?

Answer. Given, investment multiplier, K=1

K=\(\frac { 1 }{ 1-MPC } \) K=1..(given)

1=\(\frac { 1 }{ 1-MPC } \) or 1-MPC=1 or MPC=1-1=0.

MPC will be equal to 0, when (K) investment multiplier is 1.

Question.22. Complete the following table:

Answer.

Question.28. Explain any two functions of money.

Answer. The two functions of money are:

(i) Medium of exchange: Money as a medium of exchange’means money as a means of payment for exchange of goods and services. This solves the problem of double coincidence of wants inherent in the barter system of trade. This function of money facilitates trade.

(ii) Unit of account: This is also called as the measure of value function. Money as a unit of account means it works as a standard unit for quoting prices. It makes money a medium of comparing prices of goods and services.

Question.30. How will you treat the following while estimating National Income of India? Give reasons for your answer.

(i) Salaries received If Indian residents working in Russian Embassy in India.

(ii) Profits earned by an Indian bank from its branches: abroad.

(in) Entertainment tax received by the government.

Answer. (i) It will be included in the-estimation of National Income because it is factor income from abroad.

(ii) This will also be included in the estimation of National Income because it is a part of factor income from abroad.

(iii) National Income is calculated at factor cost while entertainment tax is an indirect tax. Therefore, it will not be included in the estimation of National Income.

Question.31. Calculate “gross national product at factor cost” from the following data by (i) income method, and (ii) expenditure method:

Answer. (i) Income Method

GNPFC = Profits + Compensation of employees + Rent + Interest + Consumption of fixed capital + Net factor income from abroad

= (iii) + (iv ) +(v) + (viii) + (vii) + (x)

= 400 + 800 + 250 + 150 + 60 + (-10)

= 1660, – 10 = Rs. 1650 Crores

(ii) Expenditure Method

GNPFC = Private final consumption expenditure + Government final consumption expenditure + Net domestic capital formation + Consumption of fixed capital + Net exports + Net factor incorfie from abroad – Net indirect taxes = (i) + (vi) + (ii) + (vii) + (xi) + (x) – (xii)

= 1,000 + 500 + 200 + 60 + (-20)+ (-10)-80

= 1760 – 110 = Rs. 1650 Crores

SET III

Note: Except for the following questions, all the remaining questions have been asked in Set I and – Set II.

SECTION A

Question.3. Give the meaning of micro-economics.

Answer. Micro-economics is a study of individual economic units Such as firms, households, industries etc. to make economic decisions.

Question.15. Explain the causes of a leftward shift in demand curve of a commodity.

Answer. Main causes of a leftward shift in demand (decrease in demand) are:

(i)Income of the consumer: With decrease-in income of the consumer, the demand curve for a normal good shifts to the left.

(ii) Tastes and preferences: Unfavourable change in the taste and preference of the

commodity decreases its demand and leads to a leftward shift in the demand curve.

(iii) Fall in price of substitute goods: Demand for a commodity falls (and demand curve shifts towards left), when the price of its substitute commodity falls.

(iv) Rise in price of complementary goods: In case of complementary goods, demand for the commodity falls with a rise in the price of its complementary commodity.

Or

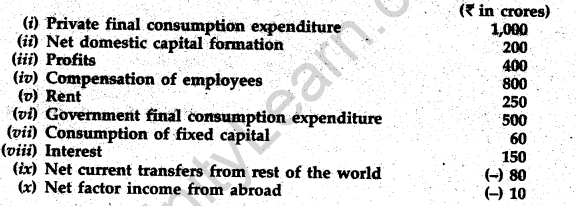

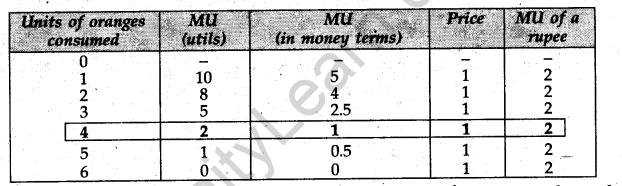

Explain consumer’s equilibrium in case of a single commodity with the help of a utility schedule.

Answer. Consumer’s equilibrium in case of a single commodity is attained when Marginal Utility in r money terms is equal to price, i.e., MU (money terms) = Price

\(\frac { MU of a product }{ MU of a rupee }\)= Price of the product

MU of a rupee is the extra utility when an additional rupee is spent on other available goods r in general.

It is assumed that a rational consumer will purchase a good only if the benefit derived in the form of utility is greater than or at least is equal to its price.

The above mentioned condition of consumer’s equilibrium can be explained with the help of an example.

Example: The following schedule shows the MU of a consumer derived from consumption

of successive orange. Suppose the price of an orange is Rs. 1 per piece and the MU of a rupee is 2 utils. Consumer equilibrium in case of a single good:

As per the above schedule, the consumer will attain equilibrium at the 4th unit because the purchase of the 4th unit of orange gives him utility worth Rs. 1(2/2) which is equal to the price of an orange (Rs. 1). He will not buy the 5th unit because MU in money terms (0.5) is less than its price (Rs. 1).

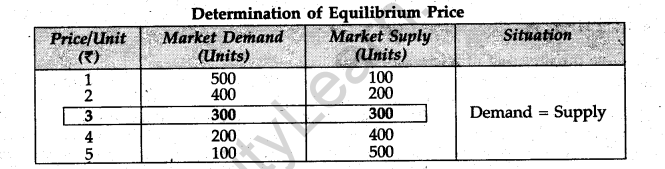

Question.16. How is equilibrium price of a commodity determined? Explain with the help of a demand and supply schedule.

Answer. Equilibrium price of a good is the price at which the market supply of the good equals the market demand for that good. By market supply, we mean the sum total of supply by all the producers of a good taken together. Whereas market demand refers to the sum total of demand by all the consumers of that good taken together.

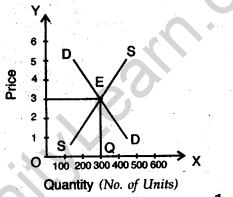

This can be better explained with the help of the following schedule and Diagram.

In, the above table, equilibrium price is Rs. 3 per unit and equilibrium quantity is 300 units. At any other price, market demand and market supply are not equal.

The equilibrium attained from demand and supply in case of perfect competition is represented in the given Diagram. Equilibrium price is OP which is determined by the intersection of demand and supply curves at point E. At that point equilibrium quantity is OQ.

SECTION B

Question.17. Define a Government Budget.

Answer. Budget is a statement made by the Government showing the estimated receipts and expenditure during the period of the financial year.

Question.19. Give the meaning of autonomous consumption.

Answer. Consumption at zero level of income is called autonomous consumption. Autonomous consumption expenditure is not affected by change in income.

Question.22.Complete the following table:

Answer.

Question.30. How will you treat the following while estimating National Income of India? Give reasons for your answer.

(i) Salaries paid to Russians working in Indian Embassy in Russia.

(ii) Profits earned by an Indian company from its branch inSingapore.

(iii) Capital gains to Indian residents from sale of shares of a foreign company.

Answer. (i) It is not included while estimating National Income because it is a part of factor income paid abroad.

(ii) It is included while estimating National Income because it is a factor income from abroad.

(iii) It is not included in National Income of India because it is a financial transaction – corresponding to which there is no flow of goods and services in the economy.

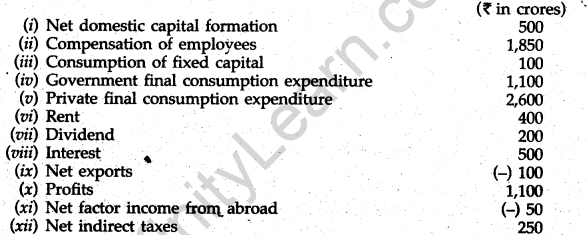

Question.31. From the following data, calculate gross national product at factor cost by (i) income method and (ii) expenditure method.

Answer.(i)By Income Method

\(\frac { GNP }{ FC }\)= Compensation of employees + Rent + Interest + Profits + Net factor income from abroad + Depreciation (Consumption of fixed capital)

= (ii) + (vi) + (viii) + (x) + (xi) + (iii)

= 1,850 + 400 + 500 + 1,100 + (-50) + 100 = 3,950 – 50 = Rs. 3,900 Crores

(ii) By Expenditure Method

\(\frac { GNP }{ FC }\) = Government final consumption expenditure + Private final consumption expenditure + Net domestic capital formation + Consumption of fixed capital + Net exports + Net factor income from abroad – Net indirect taxes. = (iv) + (v) + (i) + (iii) + (ix) + (xi) – (xii)

= 1,100 + 2,600 + 500 + 100 + (-100) + (-50) – 250 = 4,300 – 400 = Rs. 3,900 Crores