Table of Contents

Money and Banking Important Questions for class 12 economics Barter System and Money

1. Barter System: It is a system of exchange, where goods are exchange for goods, also known as c-c economy. Where c stands for commodity.

2.Drawbacks of Barter System of Exchange

(i) Lack of double coincidence of wants (ii) Lack of common measures of value

(iii) Lack of store of value (iv) Lack of standard for deferred payments

(v) Lack of divisibility

3. Evolution of Money: Money finds its origin to facilitate the need of exchange. Earlier under barter system, people were dependend on each other to satisty their wants. Barter system had many problems in itself. Money is the most useful and necessary invention to overcome the drawbacks of barter system.

4. Money It is defined as a thing that is commonly accepted as a medium of exchange. It is an intermediate good which is acceptable to both the parties i.e. buyer and seller.

5. Definition of Money

(i) Legal definition of money According to this definition, money is anything which has the legal power to act as a medium of exchange and to discharge debt.

(ii) Functional definition of money According to this definition, money is anything that is generally accepted as a means of an exchange and at the same time, acts as a measure and as a store of value.

6. Forms of Money

(i) Fiat money: The money issued by the legal authority of an economy, such as coins and currency notes are termed as fiat money.

(ii) Fiduciary money :The form of money which is backed by the trust between the two parties i.e. payer and payee, is termed as fiduciary money e.g. cheques issued by one party to another, promissory notes, etc.

(iii) Full bodied money: The money in terms of coins whose commodity value is equal to the monetary value, is termed as full bodied money.

(iv)Credit money : It refer to that money of which money value is more than commodity value.

7. Functions of Money

(i) Primary Functions of Money

(a) Medium of exchange

(b) Common unit of account or unit of account

(ii) Secondary Functions of Money

(a) Store of value

(b) Transfer of value

(c) Standard of deferred payments

8. Demand for Money: It is referred to as liquidity preference of an individuals, i.e. the choice of holding the money in liquid form (cash) or to earn interest rate or for precaution purpose. (People generally holds money for three purposes (according to keynes)

(i) Transactive purpose

(ii) Speculation purpose (for investment)

(iii) Precautionary purpose (for unforseen circumstances)

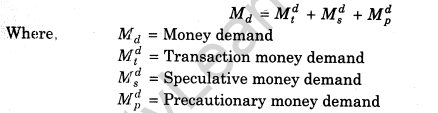

9. Aggregate Money Demand: The total demand for money in an economy is composed of transaction demand, speculative demand and precautionary demand. Transaction ‘ demand is directly proportional to GDP and price level, whereas the speculative demand is inversely related to the market rate of interest. The Aggregate Money Demand in an economy is, therefore, written as

10. Concept of Supply of Money: The total stock of money in circulation among the public at a particular point of time is called money supply.

11. Indian Monetary System: In India, currency notes and coins are used for monetary transaction. Currency notes are issued by the Reserve Bank of India (RBI), which is monetary authority in India. However, coins are issued by the Govermment of India.

12. Compo nents of Money Supply

(i) Currency held by public/people

(ii) Demand deposits of banks

(iii) Time deposits of banks

(iv) Savings account deposits

(v) Time and savings deposits with post offices

(vi) Other deposits of the RBI

(vii) National Savings Certificates (NSCs)

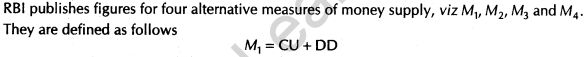

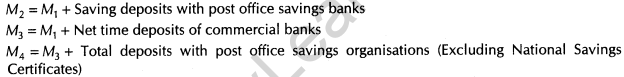

13.Measures of Money Supply in India

Previous Years Examination Questions

1 Mark Questions

1. State the components of money supply. (Delhi 2013,2010)

or

What is included in money supply? (Delhi 2011c)

or

Name the two components of money supply. (All India 2010)

Ans. The following are included in money supply:

(i) Currency notes held by public

(ii) Demand deposits of commercial banks

2. Define money supply. (Delhi 2011,2010c)

Ans. The total stock of money in circulation among the public at a particular point of time is called money supply.

3. Define money. (All India 2011)

or

Give the meaning of money. (All India 2010)

Ans. Money is defined as a thing or object that is commonly accepted as a medium of exchange. It is an intermediate good which is acceptable to both the parties i.e. buyers and sellers.

3 Marks Questions

4. Explain the significance of the unit of account function of money. (All India 2014)

Ans. Money serves as a unit of value or common measure of value in terms of which the value of all goods and services are measured. This helps in measuring the exchange values of commodities. The prices of all the goods and services can be fixed in terms of money and the problem of expressing of the value of each commodity in terms of quantities of other goods can be avoided. This function of money makes it possible to keep business accounts. It would not be possible to keep business account unless all business transaction are expressed in terms of money.

5. Explain the significance of the store of value function of money.

(Delhi 2014,2012; Compartment 2014)

Ans. Significance of store of value as a function of money are:

(i) The money is an asset that retains value over time provided price remains constant. The public stores their wealth in the form of money.

(ii) People can hold wealth in the form of money as it has general acceptability.

(iii) It promotes capital formation by the way of new investment.

6. Explain the standard of deferred payment function of money. (All India 2014,2012)

Ans. Money simplifies the mechanism of deferred payments by a great deal. Deferred payments means future payment. When we take a loan from somebody, we not only pay the principal amount but also the interest amount. Under barter system of exchange, it was very difficult to make such transactions. As money maintains a standard value over a period of time provided price remains constant deferred payments can be easily done.

7. Explain the store of value as function of money. (Foreign 2014; All India 2009)

Ans. Money is an asset that retains its value over time. People store their wealth in the form of money. Money overcomes the problem of storing perishable item under barter system of exchange. With money, people hold liquidity and value in a much more convenient manner.

8. Explain the significance of medium of exchange function of money. (Delhi 2014)

or

Explain the medium of exchange function of money. (All India 2013; Delhi 2009c)

Ans. The primary function of money is, acting as a medium of exchange between two parties involved in a transaction. It avoids the practical problems of wastage of time and resources, involved in the barter system of an exchange and it improves the transactional efficiency. It also promotes allocational efficiency in the trade and production of goods and services. Hence, it can be said that money was Seprated the acts of sales and purchases.

9. Explain the problem of double coincidence of wants faced under barter system. How has money solved it? (Delhi 2013)

Ans. Double coincidence of wants :Barter system can only work, when both the persons are ready to exchange each other’s goods i.e. person A should have the good person B wanted and vice-versa. But Usually this type of double coincidence is rare, especially in modern times.

Money eliminates double coincidence of wants: In modern times, the buyer exchanges goods for money, the seller exchanges goods for money due to common measure of value function of money, It facilitates an exchanges of goods and services and helps in carrying on trade smoothly.

10. Explain the evolution of money. (All India 2008)

Ans. Money find its origin to facilitate the need of exchange. Earlier under barter system people were dependend on each other to satisfy their wants. Barter system had many problems in itself. Money has over all those problems and hence, accepted as a medium of exchange. Money has also over come the problem of double coincidence of wants and lack of common measure of value.

4 Marks Questions

11. Define money supply and explain its components. (Foreign 2014)

Ans. The total stock of money in circulation among the public at a particular point of time is called money supply. Money supply, like money demand, is a stock variable.

Where, CU is currency (notes plus coins) held by the public and DD is net demand deposits held by commercial banks. The word ‘net’ implies that only deposits of the public held by the banks are to be included in money supply. The interbank deposits, which a commercial banks, are not to be regarded as part of money supply.

12. How does money overcome the problems of barter system? Explain briefly. (All India 2011)

Ans. Money overcomes the problem of barter system by replacing the C-C economy with monetary economy

(i) In a barter system, there was a problem of double coincidence of wants. It is very difficult to match the expectations of two different individuals. Thus, money was envolved to overcome the problem of coincidence of wants. As it is very difficult to find two person having goods needed by the other person in the barter system of exchange.

(ii) When there was no money, it was difficult to give common unit of value to measure goods or commodities but when money is evoluted, it gives a common unit of amount to every goods and commodities.

(iii) Money facilitates the contractual and future payments i.e. deferred payments which, were very difficult at the time of barter system.

(iv) Money is also a legal tender which has a general acceptance which was not the case under barter system.

13. State four functions of money. Explain any one of them. (Delhi 2009)

Ans. Following are the four functions of money:

(i) It acts as a medium of exchange.

(ii) It is a common unit of account.

(iii) Money acts as a store of value.

(iv) It is a standard of deferred payment.

Money as a medium of exchange: The primary function of money is, acting as a medium of exchange between two parties involved in a transaction. It avoids the practical problems of wastage of time and resources, involved in the barter system of an exchange and it improves the transactional efficiency. It also promotes allocational efficiency in the trade and production of goods and services. Hence, it can be said that money was Seprated the acts of sales and purchases.

14. Explain any two functions of money. (Delhi 2009; All India 2008)

Ans. (i) Standard of deferred payment: Money simplifies the mechanism of deferred payments by a great deal. Deferred payments means future payment. When we take a loan from somebody, we not only pay the principal amount but also the interest amount. Under barter system of exchange, it was very difficult to make such transactions. As money maintains a standard value over a period of time provided price remains constant deferred payments can be easily done.

(ii) Store of value: Money is an asset that retains its value over time. People store their wealth in the form of money. Money overcomes the problem of storing perishable item under barter system of exchange. With money, people hold liquidity and value in a much more convenient manner.

15. Describe the evolution of money. (All India 2009)

Ans.Evolution of money: Money find its origin to facilitate the need of exchange. Earlier under barter system people were dependend on each other to satisfy their wants. Barter system had many problems in itself. Money has over all those problems and hence, accepted as a medium of exchange. Money has also over come the problem of double coincidence of wants and lack of common measure of value.

There are mainly six stages of evolution of money, that are as follow:

(i) Use of animals such as cow, sheep for exchange.

(ii) Use of commodities such as rice, wheat, cotton for exchange.

(iii) Use of metals such as gold, silver, brass for exchange.

(iv) Use of currency notes and coins.

(v) Use of cheques, drafts, bill of exchange, bonds, etc as money. ‘

(vi) Use of credit and debits cards for exchange.

16. State the functions of money. (Delhi 2008C)

Ans. The following are the functions of money

(i) Unit of account: Money acts as a common denominator in terms of which the value of all the commodities are expressed. The price and value of a commodity is quoted in terms of money. This function of money helps to compare the value of commodities and calculate the rate of exchange between two goods or services.

(ii) Medium of exchange :The primary function of money is, acting as a medium of exchange between two parties involved in a transaction. It avoids the practical problems of wastage of time and resources, involved in the barter system of an exchange and it improves the transactional efficiency. It also promotes allocational efficiency in the trade and production of goods and services. Hence, it can be said that money was Seprated the acts of sales and purchases.

(iii) Standard of deferred payments: Money simplifies the mechanism of deferred payments by a great deal. Deferred payments means future payment. When we take a loan from somebody, we not only pay the principal amount but also the interest amount. Under barter system of exchange, it was very difficult to make such transactions. As money maintains a standard value over a period of time provided price remains constant deferred payments can be easily done.

(iv) Store of value: Money is an asset that retains its value over time. People store their wealth in the form of money. Money overcomes the problem of storing perishable item under barter system of exchange. With money, people hold liquidity and value in a much more convenient manner.