Important Questions for CBSE Class 12 Accountancy Reconstitution of a partnership Firm

Any change in existing agreement of partnership amounts to reconstitution of a firm. As a result, the existing agreement comes to an end and a new agreement comes into existence and the firm continues.

1. Modes of Reconstitution of a Partnership Firm

Reconstitution of a firm can take place in any of the following ways

(i) Change in the profit sharing ratio of existing partners

(ii) Admission of a new partner.

(iii) Retirement of an existing partner.

(iv) Death of a partner.

2. Change in Profit Sharing Ratio Among the Existing Partners

When one or more partners acquire an interest in the business from another partner(s), it is said to be a change in the profit sharing ratio in a partnership firm. A change in the profit sharing ratio among the existing partners means it is a reconstitution of the firm without admission, retirement or death of a new partner(s).

The sacrifice made or gain received by a partner is calculated by deducting the new share from the old share of a partner.

3. Adjustments Required at the Time of Change in Profit Sharing Ratio

(i) Determination of Sacrificing Ratio and Gaining Ratio

New Profit Sharing Ratio It is the ratio in which the partners are to share profits/losses in future.

Sacrificing Ratio It is the ratio in which the partners have agreed to sacrifice their share of profit in favour of other partner or partners. This ratio is calculated by taking out the difference between old profit share and new profit share.

Gaining Ratio It is the ratio in which the partners have agreed to gain their share of profit from other partner(s). This ratio is calculated by taking out the difference between new profit share and old profit share.

![]()

(ii) Accounting Treatment of Goodwill

The entry to be passed for adjustment of goodwill, when there is a change in profit sharing ratio is

Gaining Partners’ Capital/Current A/c Dr [In gaining ratio]

To Sacrificing Partners’ Capital/Current A/c [In sacrificing ratio]

(Being the adjustment made for goodwill on change in profit sharing ratio)

Treatment of Existing Goodwill

Goodwill (if any) appearing in the books of the firm is written-off by debiting it to all partners’ capital accounts in their old profit sharing ratio and by crediting the goodwill account.

The entry is

All Partners’ Capital/Current A/c Dr [In old ratio]

To Goodwill A/c [With book value of goodwill]

(iii) Revaluation of Assets and Reassessment of Liabilities

(a) When Revised Values are to be Recorded in the Books of Accounts

An account titled ‘Revaluation account’ or ‘Profit and loss adjustment account’ is opened for revaluation of assets and reassessment of liabilities.

Format of Revaluation Account

(b) When Revised Values are not to be Recorded in the Books of Accounts

If partners decide to record the net effect of revaluation of assets and liabilities without affecting the old amount of assets and liabilities, a single adjusting entry ‘ involving the capital accounts of gaining partners and sacrificing partners is passed.

(iv) Accounting Treatment of Reserves, Accumulated Profits or Losses

(a) For Transfer of Reserves and Accumulated Profits

Reserve/Profit and Loss A/c Dr

Workmen’s Compensation Reserve A/c Dr

Investments Fluctuation Reserve A/c Dr

To All Partners’ Capital* (or Current)** A/c (Individually)

(b) For Transfer of Accumulated Losses

All Partners’ Capital* (or Current)** A/c (Individually) Dr

To Profit and Loss A/c

To Deferred Revenue Expenditure A/c

♦Capital- Under fluctuating capital method.

♦♦Current- Under fixed capital method.

Adjustment of Reserves and Accumulated Profits/Losses through Capital Accounts Only

A single adjusting entry involving the capital accounts of sacrificing and gaining partner is passed, when the partners decide to record net effect of reserves and accumulated profits/losses without affecting the old figures.

In Case of Profit

Gaining Partner’s Capital A/c Dr

To Sacrificing Partner’s Capital A/c

In Case of Loss

Sacrificing Partner’s Capital A/c Dr

To Gaining Partner’s Capital A/c

Previous Years Examination Questions

1 Mark Questions

1. Give the meaning of ‘reconstitution of a partnership firm’. (AllIndia; Delhi2014)

Ans Change in the existing agreement of partnership is considered as reconstitution of a partnership firm. Due to this, existing agreement comes to an end and the new agreement comes into existence and the firm continues.

2. State the ratio in which the partners share the accumulated profits when there is a change in the profit sharing ratio amongst existing partners. (All India 2013)

Ans. Accumulated profits are distributed in old profit sharing ratio, at the time of change in profit sharing ratio amongst the existing partners.

3.State the ratio in which the partners share profits or losses on revaluation of assets and liabilities, when there is a change in profit sharing ratio amongst existing partners. (Delhi 2013)

Ans. Revaluation profits or losses are distributed in old profit sharing ratio, at the time of change in profit sharing ratio amongst the existing partners.

4. State any two occasions on which a firm can be reconstituted.

(Delhi 2012,2008; All India 2011)

Ans. A firm can be reconstituted on the following occasions (Any two)

(i) When there is a change in the profit sharing ratio of existing partners.

(ii) When a new partner is admitted.

(iii) When an existing partner retires.

(iv) When an existing partner dies.

5. Why are ‘reserves and surplus’ distributed at the time of reconstitution of the firm? (Delhi, All India 2010)

Ans. At the time of reconstitution of the firm, reserves and surplus should be transferred to old partners’ capital/current accounts in their old profit sharing ratio because the new partner is not entitled to any share in such undistributed profits or losses as these are earned/accrued by the old partners.

4 Marks Question

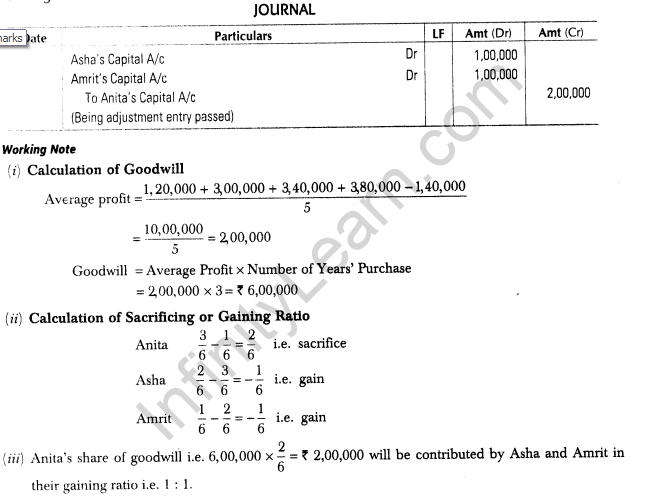

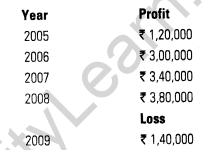

6. Anita, Asha and Amrit are partners sharing profits in the ratio of 3:2:1 respectively From 1st January, 2010, they decided to share profits in the ratio of 1:1:1. The partnership deed provided that in the event of any change in profit sharing ratio, the goodwill should be valued at three years’ purchase of the average of five years’ profits. The profits and losses of the preceding five years are

Showing the working clearly, give the necessary journal entry to record the above

change